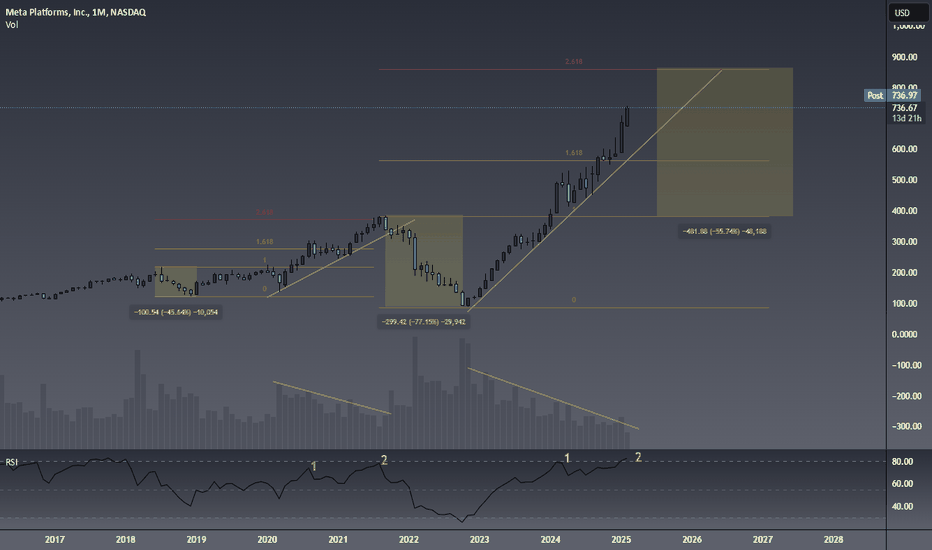

Technical analysis by ChazzyFreshh about Symbol METAX on 2/15/2025

ChazzyFreshh

Was just having a little fun before bed and brainstorming on the META chart. Our darling as of late. I love trying to find similarities and patterns between macro swings and cycles. Human psychology and business cycles have a way of repeating themselves pretty often. As they say, history doesn't repeat, but it rhymes. This recent melt up reminds a lot of the price action META saw in 2021-2022. RSI overbought both times, currently approaching the 2.618 fib when connecting them to major high and low points. Decreasing volume on the moves up. There's a lot of other data to support a bear market may be on the horizon: Weak housing data/stocks (I do see some outlier stocks in the housing sector). The yield curve un-inversion which typically precedes major bear markets 6-12 months after un-inversion. The dollar seems to want to keep going higher. However it has shown a lot of weakness here lately which could help fuel the rest of the bull market. The unwinding of the Japanese Yen carry trade has seemed to play a big factor in U.S equities as of late. Every time the BOJ hikes interest rates, a lot of U.S. equities see pretty sizable bearish volatility shortly after. Being the darling that META has become, once this trend line breaks it will be a signal that everyone should be taking note of in my opinion. I think the risk of a bear market increases dramatically. Maybe we get a shallow or 2022 style bear market next year and continue to make one last lag into new highs in 2027. Here are some ideas that could support that theory: China seems to be coming out of a depression-style bear market and is beginning to inject liquidity into their economy. This could help give U.S. equities a little more juice to run higher for longer chips could make a major comeback and fuel SPY/QQQ higher for longer. Names like Google, Tesla and Amazon can continue to show strength and we could see a rotation into them. Maybe we get some more significant quantum breakthroughs with the help of AI. These are things to keep in mind, but I think the probabilities of this this bull market we've enjoyed since 2008 is A LOT closer to the end than the beginning. I base most of my sentiment off the 18.6 year real estate/land cycle theory that I have been following since 2022. I also give a lot of credibility to U.S. yield curve un-inversions sending shockwaves through the global economic system. What do you guys and gals think?