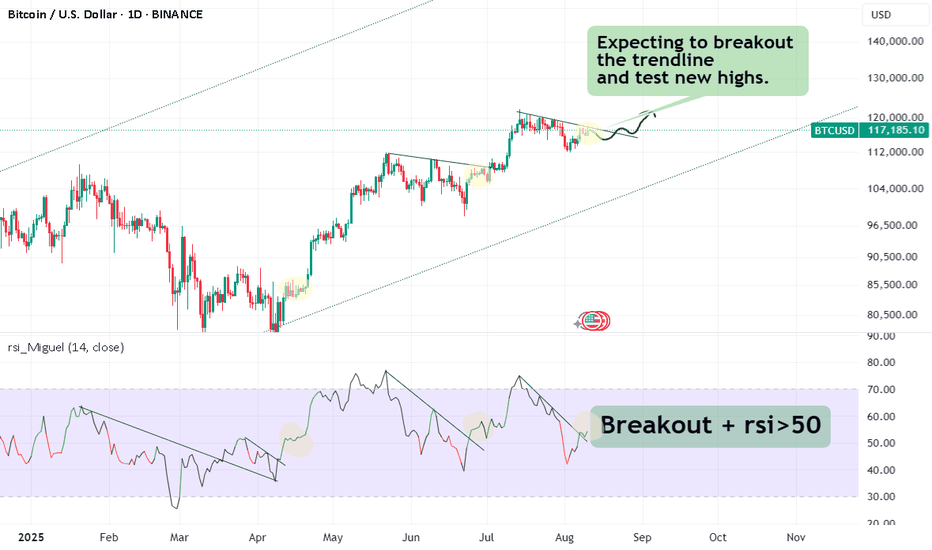

Technical analysis by MiguelFTCurado about Symbol BTC on 8/10/2025

MiguelFTCurado

Think of RSI like a car’s speedometer: The speed (RSI) changes b

"Think of RSI like a car’s speedometer: The speed (RSI) changes before the position (price) changes direction." 1. What RSI actually is? RSI (Relative Strength Index) is just a math transformation of price data. It measures the ratio of recent upward moves to downward moves over a period (often 14 candles) and compresses it into a 0–100 scale. 2. Why RSI sometimes “moves first” This isn’t magic — it’s because RSI is sensitive to the speed and size of recent price changes, not just direction. - If price is still going up but at a slower pace, RSI can already start turning down. - If price is falling more gently than before, RSI can start curling up before price actually reverses. 3. Why traders care about RSI reversals? - If RSI starts turning down from an overbought level while price is still climbing, it can be an early warning of a possible price top. - Same for the opposite: RSI turning up from oversold while price still dips can signal an upcoming bounce. 4. RSI above or below 50 50 on the RSI is the “momentum neutral” line. - When RSI is above 50, recent gains outweigh recent losses → momentum is bullish. - When RSI is below 50, recent losses outweigh recent gains → momentum is bearish. 5. The “delay” you see The delay is more about your eyes than the math: - RSI smooths recent price moves (average gains/losses), so it reacts slightly ahead to changes in momentum. - Price must actually reverse for you to “see” it, but RSI reflects that change in momentum first. - Think of RSI like a car’s speedometer: The speed (RSI) changes before the position (price) changes direction. 6. How to deal with noise* in RSI? Use higher timeframes (1D, 1W, 1M) to confirm signals from small charts. *Noise in trading = small, random price movements that don’t reflect the bigger trend. On a 1-minute or 5-minute chart, there’s a lot of this — caused by scalpers, bots, spreads, liquidity gaps, and normal market “chatter.”Feel free to comment or ask something 🤑