Technical analysis by mytw0cents about Symbol SPYX: Buy recommendation (4/19/2025)

mytw0cents

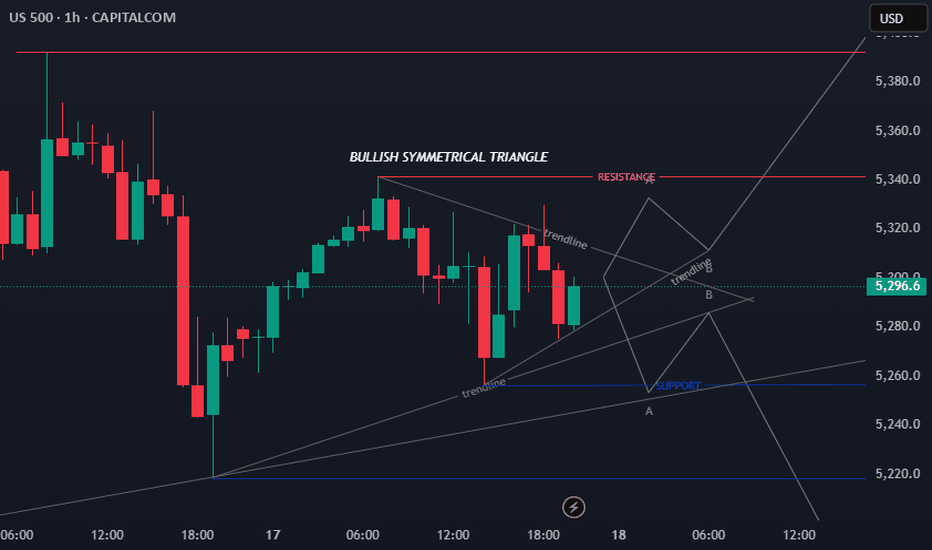

hi Fundamental view The **US500 index** dropped due to several key factors affecting the U.S. stock market: 📉 **Tech Stock Decline** – Technology stocks faced heavy pressure, especially after **Nvidia** plunged **6.9%** due to U.S. restrictions on AI chip exports to China. Other stocks like **AMD (-7.3%)** and **Micron Technology (-2.4%)** also fell. 💰 **Federal Reserve Uncertainty** – Remarks from **Fed Chair Jerome Powell** raised concerns in the market. Powell warned that new tariffs could trigger higher inflation and slow economic growth, making investors uncertain about interest rate policies. 🛍️ **Surge in Retail Sales** – Retail sales jumped **1.4%** in March as consumers rushed to buy before new tariffs took effect. This highlights economic uncertainty, pushing investors to sell their stocks. Overall, a mix of trade tensions, uncertain monetary policy, and a tech stock sell-off caused the **US500 index to drop 120.93 points (-2.24%)** on **April 16, 2025**. Technical view Yes, the **bullish symmetrical triangle** pattern is often a strong signal for upward price movement. When the price moves within this pattern, it usually indicates a **tightening volatility** before a **breakout**, which can present a good market entry opportunity. 🔍 **Breakout Confirmation** 1️⃣ Increased trading volume when price breaks above the **upper trendline**. 2️⃣ A closing candle above the **triangle resistance** for a valid signal. 3️⃣ Price targets can be measured using the pattern’s initial height as a projection. 📈 **Potential Price Movement** If the breakout happens, the price could surge toward the next **resistance level**. However, if the breakout fails and price moves below support, the pattern could turn **bearish**. Warren Buffett famously said, “Be greedy when others are fearful.” good luck **My trading strategy is not intended to be a signal. It's a process of learning about market structure and sharpening my trading my skills also for my trade journal** Thanks a lot for your support