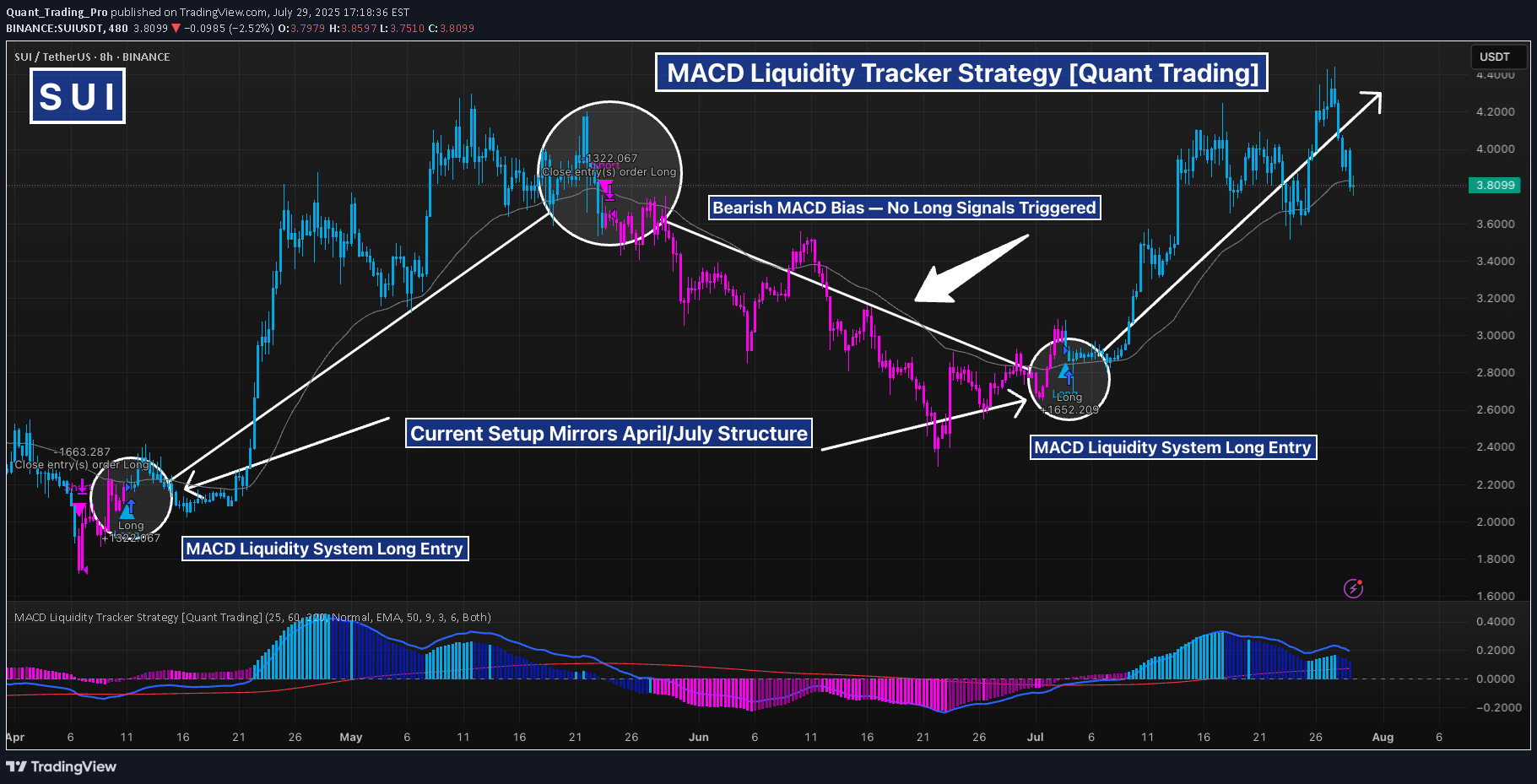

Technical analysis by Quant_Trading_Pro about Symbol SUI: Buy recommendation (7/29/2025)

The MACD Liquidity Tracker Strategy continues to deliver precise trend entries and exits on SUI, with another textbook setup potentially forming. The system has already caught two clean long cycles since April — each triggered after MACD histogram reversal and confirmed trend structure. What stands out is how well the system avoids chop: during the magenta (bear-biased) zone from May to early July, no long entries were triggered despite volatile bounces. This highlights the strategy’s strength — it filters noise and only fires when true momentum aligns with structural breakout zones. We're now in what could be the early stages of a third bullish cycle. The latest long entry (circled) followed a deep reset in both price and MACD, similar to April and July before the last rallies. Price has now cleared its EMA filter and is attempting to hold above $3.80–4.00. MACD histogram shows early signs of momentum rebuilding, and if price holds this level, there’s potential for continuation toward $4.80+. If momentum fades here, a retest of $3.50 remains possible before any further upside. 📊 Strategy Settings Used: – MACD: 25 / 60 / 220 – EMA Filters: 50 & 9 (Normal Mode) – Entry Logic: MACD momentum + trend alignment – Visual Bias: Blue = Bullish, Magenta = Bearish ⚠️ Key to this system is patience — waiting for full signal alignment instead of anticipating. So far, this strategy has rewarded discipline with high-conviction moves.