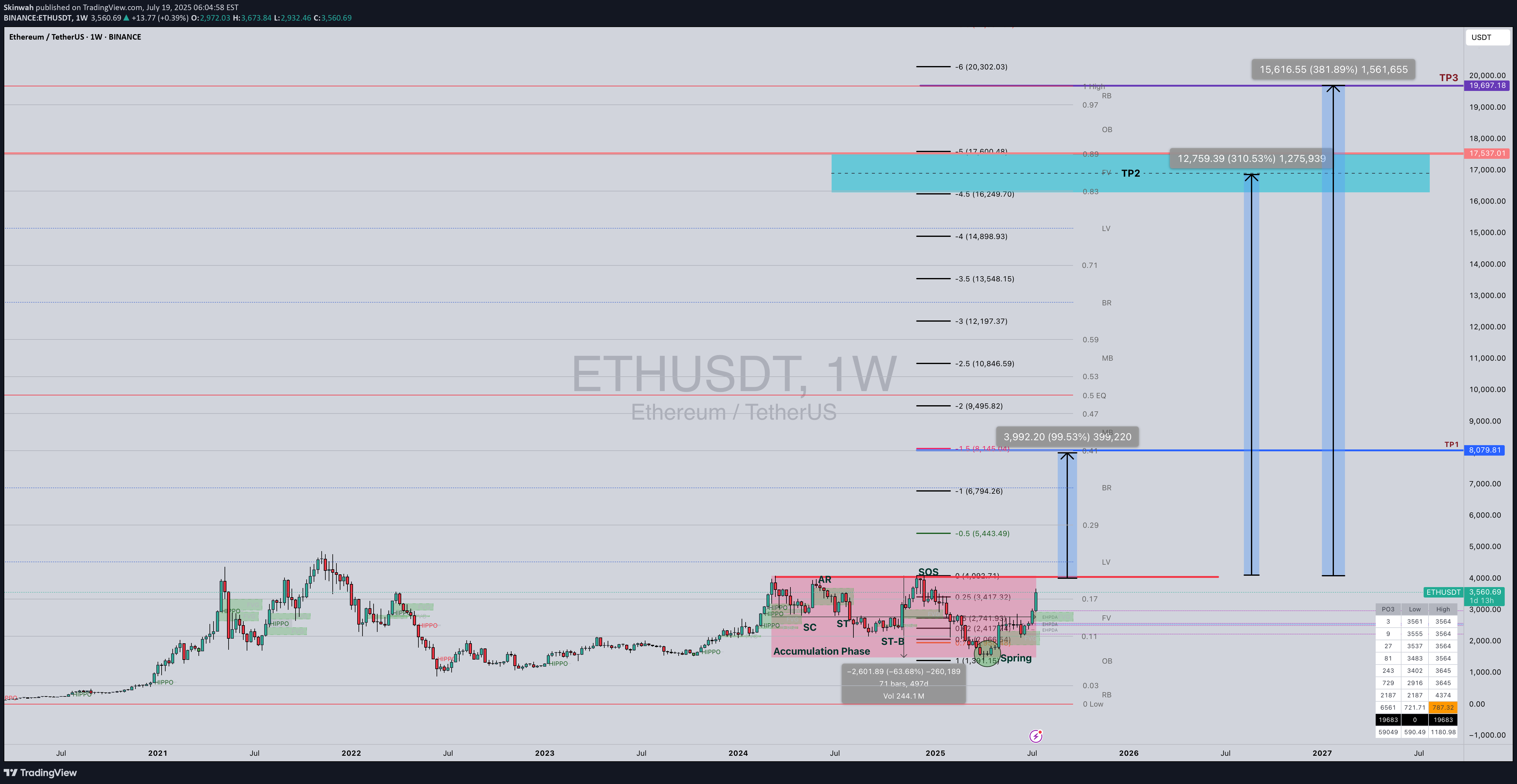

Technical analysis by Skinwah about Symbol ETH: Buy recommendation (7/19/2025)

Skinwah

Lord MEDZ ETH Trading Setup

For Personal Journaling – Not Financial Advice Asset: Ethereum (ETH) Analysis Techniques Used: Wyckoff Accumulation Phase ICT Fibonacci Extension Goldbach Projection Model Thesis: Based on confluence from Wyckoff schematic interpretation, ICT fib extension zones, and mathematical projection via Goldbach logic, Ethereum (ETH) appears poised for a significant upward move. Accumulation signals suggest smart money positioning, with price respecting historical support levels and consolidating in a reaccumulation range. The Fibonacci extensions and Goldbach theory projection align on the following bullish targets: Projected Take Profit Zones (TPs): TP1: $8,000 – First extension target post-breakout. TP2: $17,000 – Macro-level expansion target in line with Wyckoff Phase E markup. TP3: $19,700 – Final speculative cycle top target (Goldbach-based projection). Narrative & Confluence: Wyckoff Accumulation: ETH has shown signs of a spring and test, followed by higher lows and supply absorption. ICT Fib Extension: Expansion zones line up with 8000 as TP1, consistent with ICT’s market maker models. Goldbach Theory: Historical symmetry and prime pair modeling projects extreme but technically plausible TP2 and TP3 ranges. Notes: This thesis is part of Lord MEDZ's personal trading journal and is not to be taken as financial advice. Cryptocurrency markets are highly volatile. All readers should do their own research and only invest what they can afford to lose. Trade safe. Protect capital. Stay sharp. Lord MEDZ🙏 Thank You 🙏 Massive thanks to everyone who’s shown support—whether through likes, shares, sponsorships, or thoughtful comments. Your engagement keeps me motivated to stay consistent in this journey. I'm truly grateful for the community that's forming around these insights. Let’s continue learning, growing, and navigating these markets together. Much love and respect. 💙 — Lord MEDZ