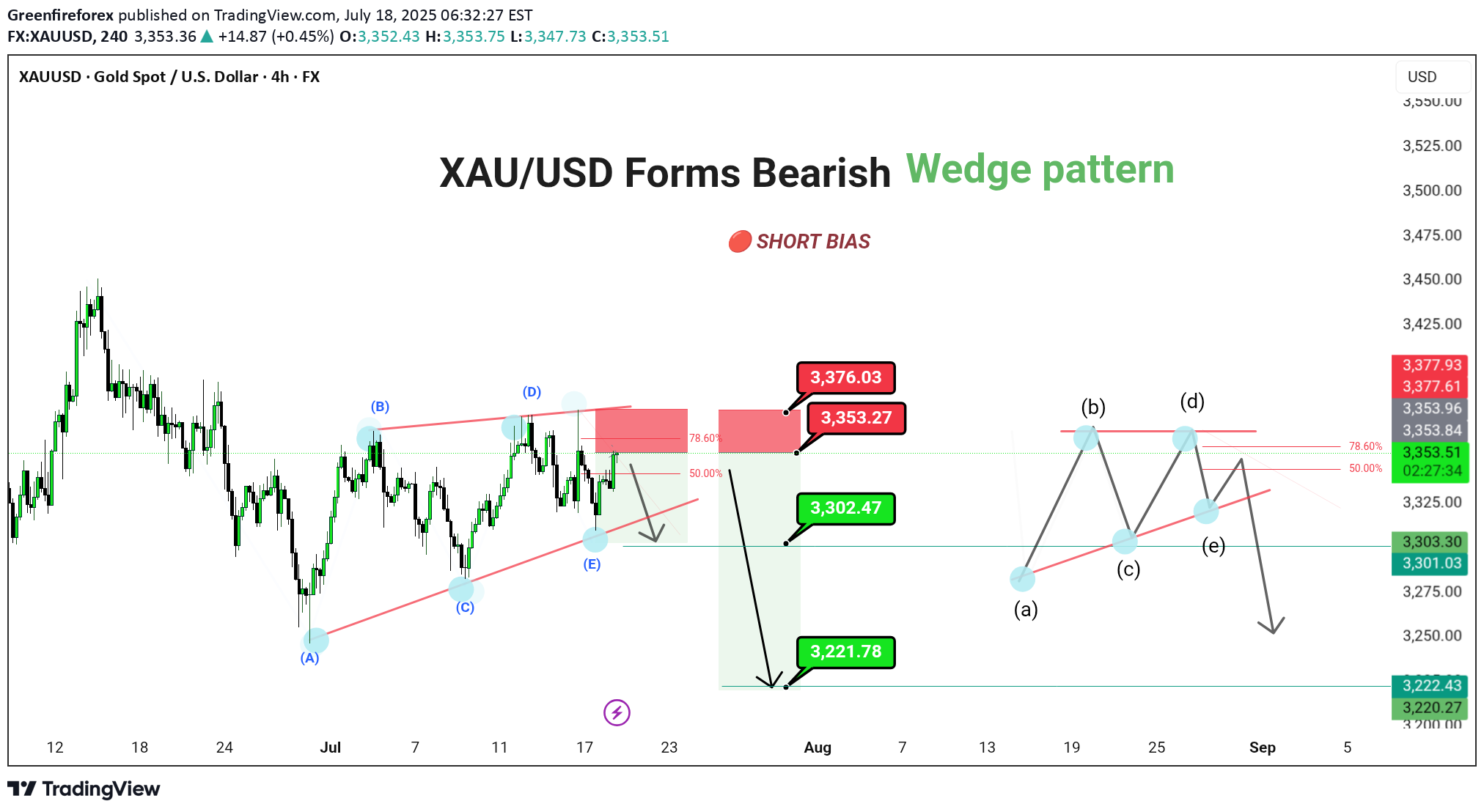

Technical analysis by Greenfireforex about Symbol PAXG: Sell recommendation (7/18/2025)

XAU/USD (4H) | FX | Gold Spot vs US Dollar 🔴 SHORT BIAS 📅 Updated: July 18 --- 🔍 Description Gold is trading within a bearish contracting triangle, suggesting a continuation move to the downside after the recent corrective bounce. Price is currently approaching the key 3,371–3,376 resistance zone, which aligns with the 78.6% Fibonacci retracement and upper triangle boundary. This resistance confluence could mark the termination of the (E) wave of the triangle, paving the way for a larger downward thrust. A confirmed break below 3,302 would open the door toward 3,221 as the next major target. The structure also leaves room for a minor internal triangle (a)-(b)-(c)-(d)-(e) pattern within the broader range, reinforcing the bearish setup. --- 📊 Technical Structure (4H) ✅ Bearish contracting triangle: (A)-(B)-(C)-(D)-(E) ✅ 78.6% Fibonacci + supply zone = ideal rejection point ✅ Internal triangle projection aligns with lower support test 📌 Downside Targets Target 1: 3,302.47 Target 2: 3,221.78 🔻 Invalidation: Above 3,376.03 --- 📈 Market Outlook Macro View: Rising real yields and cooling inflation reduce gold’s appeal Fed Watch: Hawkish tone supports USD, weighing on XAU Technical View: Structure favors downside break from triangle formation --- ⚠️ Risks to Bias Break and daily close above 3,376.03 invalidates triangle structure Sudden risk-off sentiment or dovish Fed shift could boost gold demand Sharp reversal in dollar strength --- 🧭 Summary: Bearish Breakout Setup Forming XAU/USD is completing a bearish triangle structure, with price sitting just below resistance. A rejection from the 3,371–3,376 zone can trigger a breakout lower, first toward 3,302, then extending to 3,221. As always, confirmation and tight risk control are key. ---