Technical analysis by Mihai_Iacob about Symbol PAXG on 7/17/2025

Mihai_Iacob

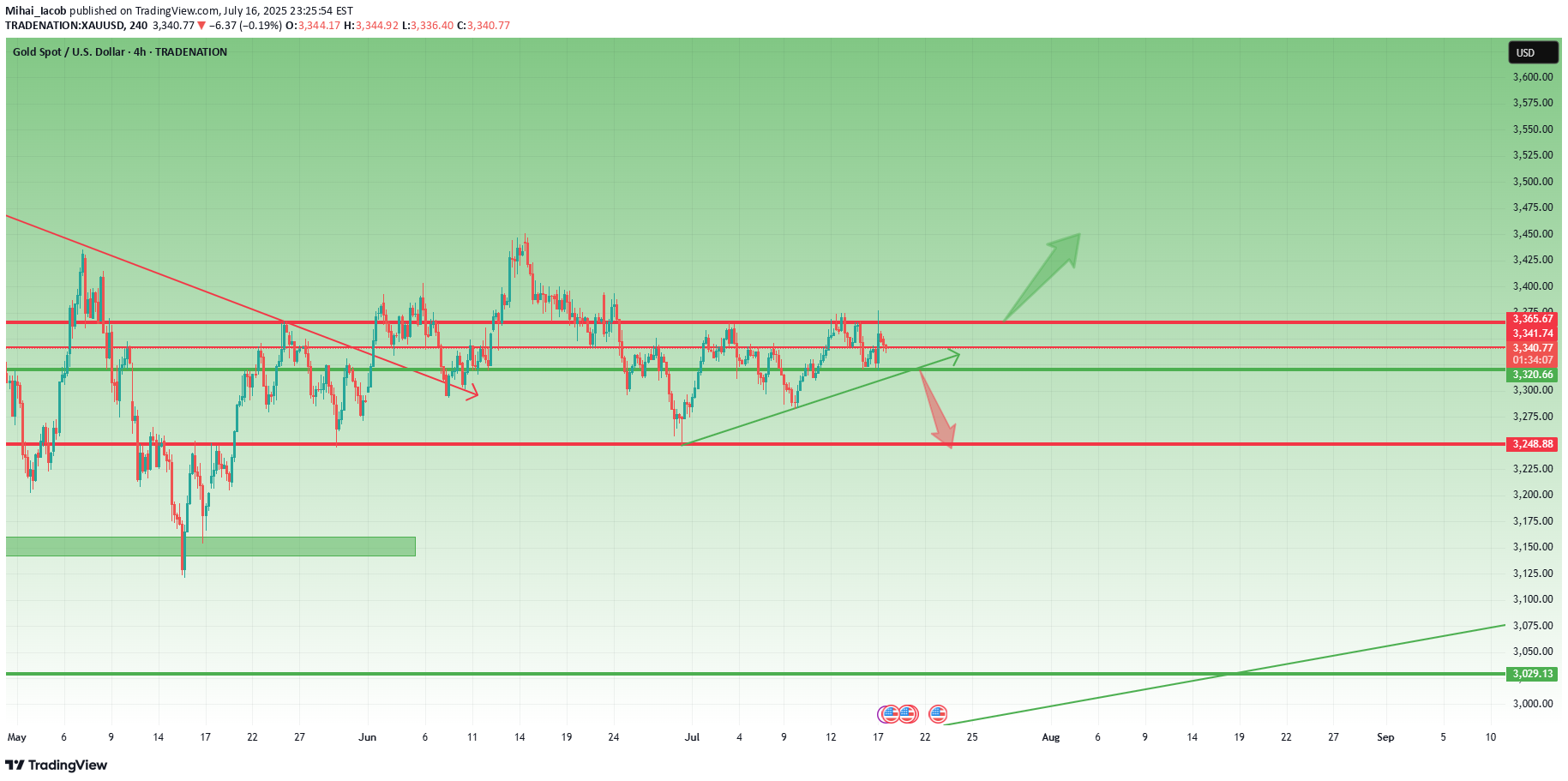

📉 Quick recap: As you know, I've been bullish on Gold. However, as explained in yesterday’s analysis, I started to approach this view with more caution. Unfortunately, I closed my long position at break even… before the rally to the 3375 resistance. That’s trading. 📌 What now? Despite missing that move, the market is beginning to offer more clarity. There are now two key levels that will likely define the next major swing: ________________________________________ 🔹 1. Resistance at 3375 – Top of the Range / Triangle Breakout Zone •This level marks the upper boundary of the recent range •It’s also the resistance of a developing ascending triangle •A clean breakout above 3375 would confirm the pattern and could trigger a strong upside acceleration •Target: 3450 zone, with potential for more if momentum kicks in (approx. 1000 pips higher) ➡️ This is the obvious bullish scenario – in line with the broader trend and classical technical setup. ________________________________________ 🔻 2. Support at 3320 – The Less Obvious, but Classic Gold •3320 is now a confluence support area •Technically, a break below here is less probable – but Gold has a habit of doing the unexpected •If 3320 breaks, bears could look for a first leg to 3280 (approx. 400 pips), and very probably 3250 (around 700 pips drop) ➡️ This bearish scenario is not the base case, but it must not be ignored. Sometimes the trap is in the obvious. ________________________________________ 🧭 Trading Plan: For now, I’m out of the market, patiently waiting for confirmation. I’ll trade the breakout – whichever side gives the signal first. ________________________________________ 📌 Conclusion: Gold is coiling for a larger move. The levels are clear: 3375 and 3320 are the doors. One of them will open. Until then, we wait and prepare. 🚀 Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.In this morning’s analysis, I outlined two potential scenarios for Gold. While the bearish scenario wasn't the base case, I mentioned that Gold has a "talent" for fooling traders, and this might just be one of those moments. ➡️ This bearish scenario is not the primary expectation, but it must not be ignored. Sometimes, the real trap lies in what seems too obvious. With price currently around 3315, we're starting to see signs that support the idea of a deeper correction. Stay cautious — and always prepared.