Technical analysis by SadarExplore about Symbol PAXG: Buy recommendation (7/16/2025)

SadarExplore

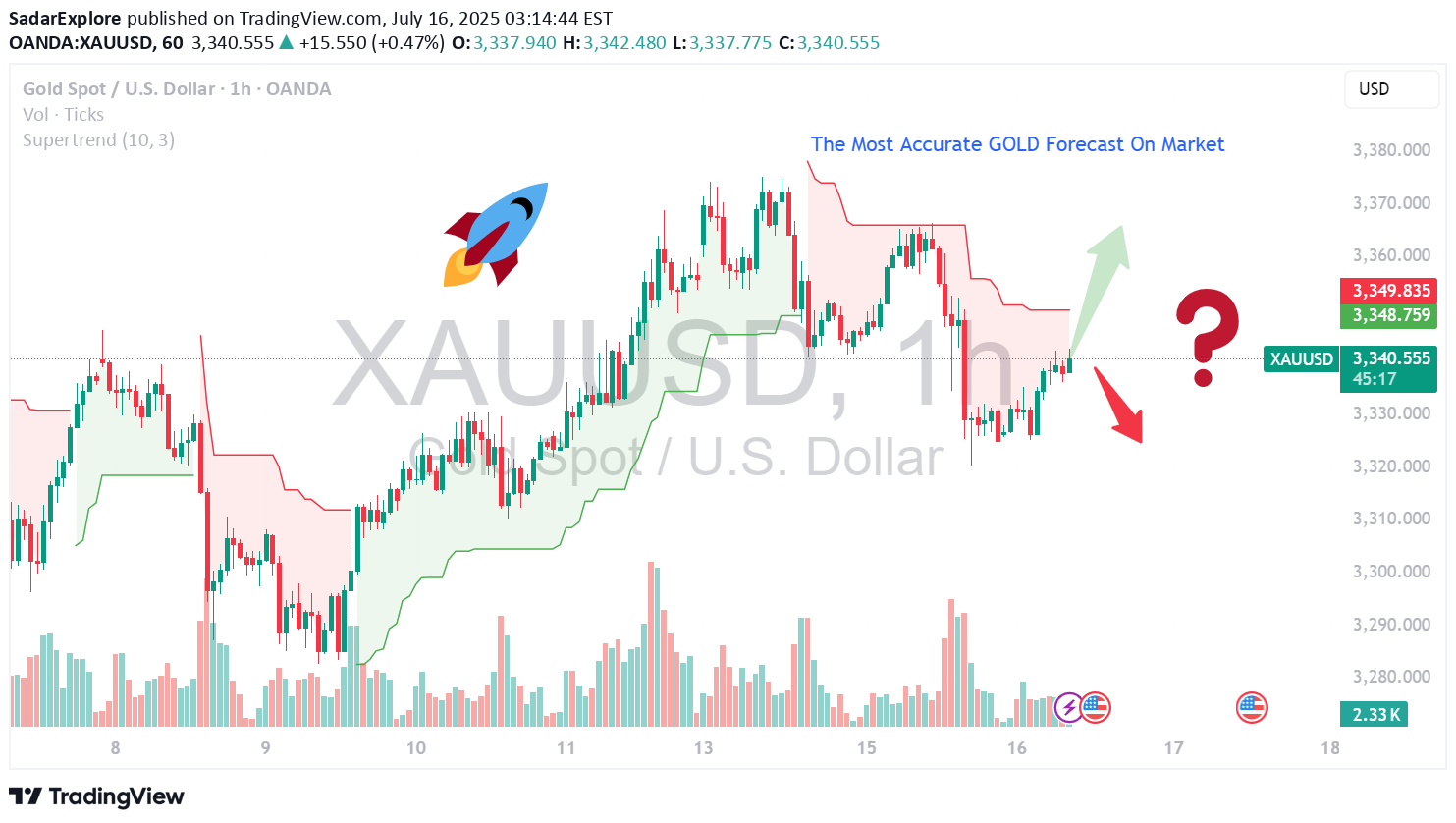

MOST ACCURATE XAUUSD GOLD FORECAST ANALYSIS MARKET

Current Setup & Technical Outlook Consolidation & Pennant Formation: Gold is building a bullish pennant and trading above its 50‑day MA — a classic continuation pattern suggesting a breakout toward new highs if momentum resumes . Key Levels: Support: $3,330–3,340 — confirmed by multiple technical sources . Resistance/Breakout Zone: $3,360–3,375 — clearing this could trigger a rally toward $3,400+ . Upside Targets: $3,390, then possibly $3,500–$3,535 per weekly forecast . Alternate Bearish Scenario: A failure around the 0.618 Fibonacci resistance (~$3,374) and overbought RSI could spark a pullback to $3,356 or lower . --- 🧠 Fundamental Drivers Inflation & U.S. Macro Data: Market awaits June CPI/PPI and Fed commentary — cooler inflation could boost gold via dovish expectations, while hotter data may strengthen the USD and weigh on bullion . Geopolitical & Safe-Haven Demand: Trade tensions (e.g., tariffs) are keeping gold elevated near $3,350–$3,360 . Central Bank & Real Yields Watch: Continued gold purchases and lower real rates are supportive, although mid-term easing in risks (like global trade) could curb momentum .gold move up soon stay tuned with our analysisare you happy with our analysis guys finally done