Technical analysis by GoldFxMinds about Symbol PAXG: Sell recommendation (7/15/2025)

GoldFxMinds

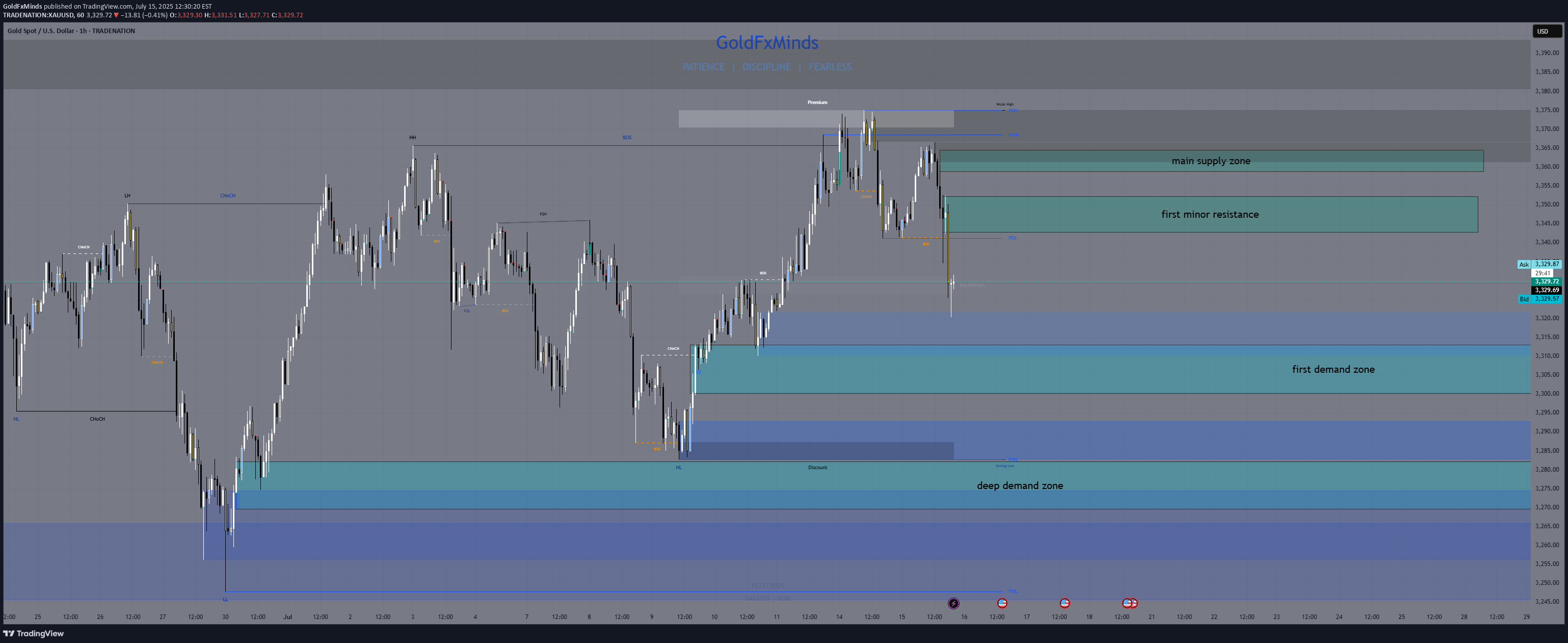

Post-CPI Flip Zone Battle Hello dear traders 💛 Today has been one of those heavy CPI days — full of volatility, sweeps, and doubt. But if we read it structurally and stop chasing candles, everything makes sense. Let’s break it all down step by step, clearly and human-like. Current Price: 3330 Bias: Short-term bearish, reactive bounce underway Focus Zone: 3319–3320 liquidity sweep + key decision structure unfolding 🔹 Macro Context: CPI came in slightly hot year-over-year (2.7% vs 2.6%) while monthly stayed in-line at 0.3%. That gave the dollar a short-lived boost, and gold reacted exactly how institutions love to play it — sweeping liquidity under 3320, then pausing. Not falling, not flying. Just... thinking. That reaction matters. Why? Because it shows us indecision. It tells us that gold isn’t ready to break down fully yet, and every aggressive move today was part of a calculated shakeout. 🔹 Daily Structure: Gold is still stuck below the premium supply zone of 3356–3380. Every attempt to rally there for the past few weeks has failed — including today. The discount demand area between 3280–3240 is still intact and untouched. So what does this mean? We are in a macro-range, and price is simply rotating between key structural edges. 🔹 H4 View: The rejection from CPI at 3355–3365 created a micro CHoCH, signaling the bullish leg is now broken. After the 3345 fail, price dropped to 3320 — but it hasn’t tapped the full H4 demand at 3310–3300. H4 EMAs are tilting down, showing pressure. This isn’t a breakout. It’s a correction inside a larger range. 🔸 Key H4 Supply Zones: 3345–3355: liquidity reaction during CPI 3365–3375: untested OB + remaining buy-side liquidity 🔸 Key H4 Demand Zones: 3310–3300: mitigation zone from the CHoCH 3282–3270: deep discount and bullish continuation zone if current fails Structure-wise: We are in a correction, not a clean uptrend. That’s why every bullish attempt fails unless confirmed. 🔹 H1 Real Structure This is where things got tricky today. Price formed a bullish BOS back on July 14, when we first pushed into 3370. That was the start of the bullish leg. But today, we revisited the origin of that BOS, right near 3320. This is a sensitive zone. If it holds → it’s still a retracement. If it breaks → we lose the bullish structure and shift full bearish. So far, price touched 3320, bounced weakly, but has not printed a bullish BOS again. 🔸 H1 Zones of Interest: Supply above: 3340–3345: micro reaction zone 3355–3365: CPI origin rejection 3370–3375: final inducement Demand below: 3310–3300: current flip test 3282–3270: if this breaks, bias flips bearish Right now, we are between zones. Price is undecided. RSI is oversold, yes — but that alone is never a reason to buy. We need structure. We need BOS. 🔻 So… What’s the Truth Right Now? ✅ If 3310–3300 holds and price builds BOS on M15 → a clean long opportunity develops ❌ If 3310 breaks, and we lose 3300, structure fully shifts and opens downside to 3280–3270 On the upside: Only look for rejections from 3355–3365 and 3370–3375 Anything inside 3325–3340 is noise. No structure, no clean RR. Final Thoughts: Today’s move was not random. It was a classic CPI trap: induce longs early, trap shorts late, and leave everyone confused in the middle. But we don’t trade confusion — we wait for structure to align with the zone. If M15 or H1 prints a BOS from demand, that’s your green light. If price collapses under 3300, flip your bias. The chart already told you it wants lower. No predictions. Just real reaction. — 📣 If you like clear and simple plans, please like, comment, and follow. Stay focused. Structure always wins. 📢 Disclosure: This analysis was created using TradingView charts through my Trade Nation broker integration. As part of Trade Nation’s partner program, I may receive compensation for educational content shared using their tools. — With clarity, GoldFxMinds🟡 XAUUSD Sniper Update – July 16, 2025 | GoldFxMinds Macro: 🔸 PPI came in soft, but gold remains heavy. Bears still in control below 3332. News didn’t flip the trend, just gave a temporary bounce. Key Sell Zones Above: 🔻 3325–3327 – First intraday supply. Quick scalp sells if price retraces here. 🔻 3330–3332 – H1 order block & major resistance. Look for sharp rejection or sweep. 🔻 3345–3350 – Top-of-day main supply. Only sell if we get a wild spike. Key Buy Zones Below: 🟢 3319–3316 – Discount demand zone. Only buy with strong bullish reaction (BOS or engulfing). 🟢 3312–3314 – Deep demand. Reactive scalps only, must see clear confirmation. 🟢 3303–3306 – Extreme demand, only for confirmed reversal. How to trade it: ⚡ Wait for price to hit these zones — no action in between! ⚡ Only take entries if there’s a clean rejection (sell) or real bullish signal (buy). ⚡ Ignore “dead zones” between 3321–3324 unless you see structure break. Momentum: Bearish bias. All pullbacks = sell opportunities until market proves otherwise. 🔥 If you want these levels and sniper plans every day, follow , like 🚀🚀🚀 and drop a comment if you caught the move! Stay focused, stay sharp, and never force a trade. __GoldFxMinds__