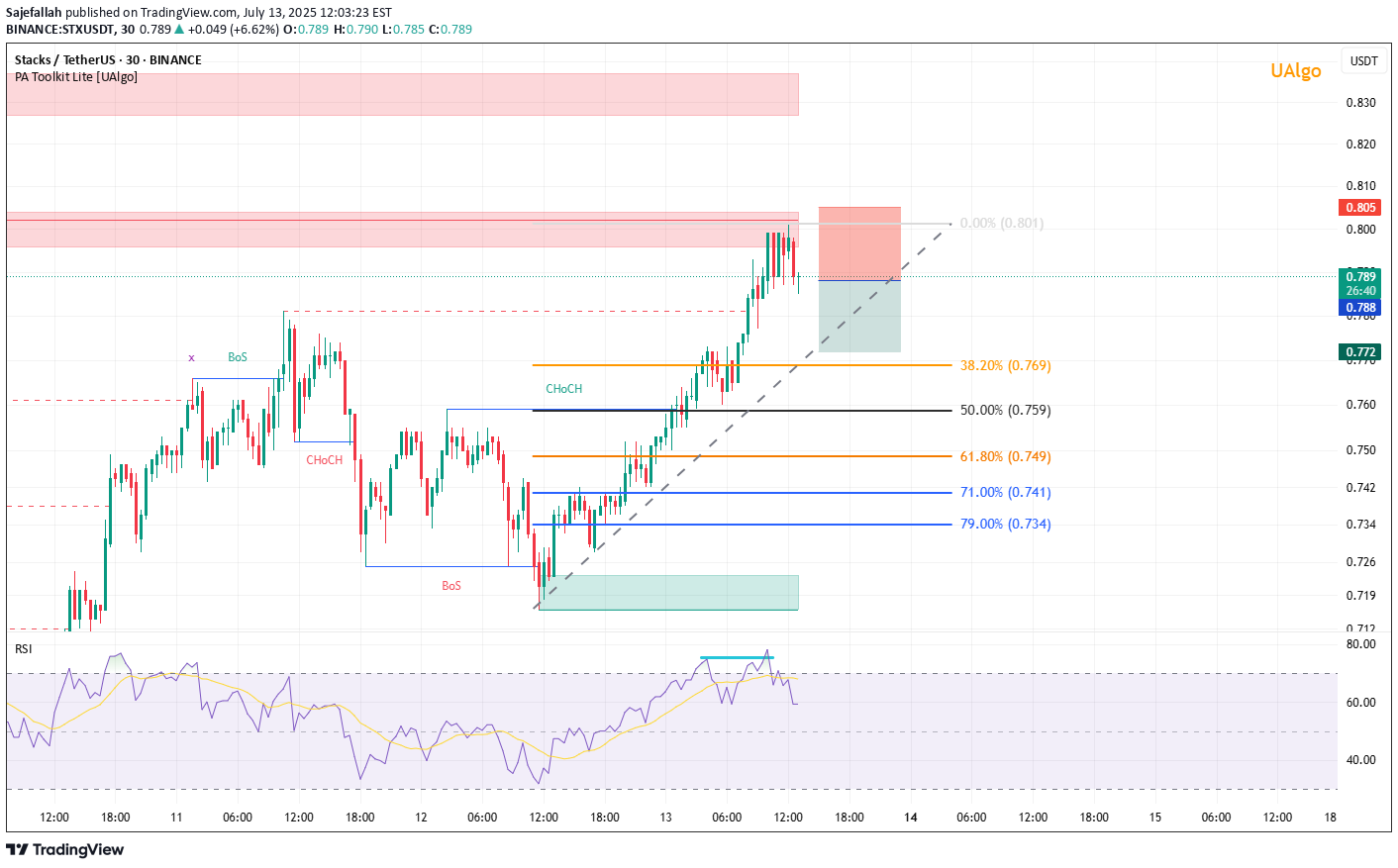

Technical analysis by Sajefallah about Symbol STX: Sell recommendation (7/13/2025)

Sajefallah

Analysis & Rationale: A high-probability short opportunity is forming on the STX/USDT 30-minute chart, primarily driven by a clear Bearish Divergence signal. While the price has registered a Higher High (HH), the Relative Strength Index (RSI) has failed to confirm this momentum, printing a Lower High (LH). This divergence indicates weakening buying pressure and a potential trend reversal or significant correction. The price is currently reacting to a key supply/resistance zone (red box), which coincides with the RSI exiting the overbought territory. This confluence of signals strengthens the case for a bearish move. Trade Setup: Asset: STX/USDT Timeframe: 30 Minutes Direction: Short / Sell Signal: Bearish Divergence Execution Plan: Entry Zone: Enter the short position near the current levels, within the supply zone (approximately $0.785 - $0.801). Stop Loss: Place the Stop Loss just above the recent swing high to protect against a setup invalidation (e.g., at $0.805 or slightly above). Take Profit Targets: Targets are based on the Fibonacci Retracement levels drawn from the previous swing low to the current high. TP1: $0.769 (38.2% Fib. level) TP2: $0.759 (50.0% Fib. level) TP3: $0.749 (61.8% Fib. level) Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves significant risk. Always conduct your own research and manage your risk appropriately.