Technical analysis by GoldFxMinds about Symbol PAXG on 7/13/2025

GoldFxMinds

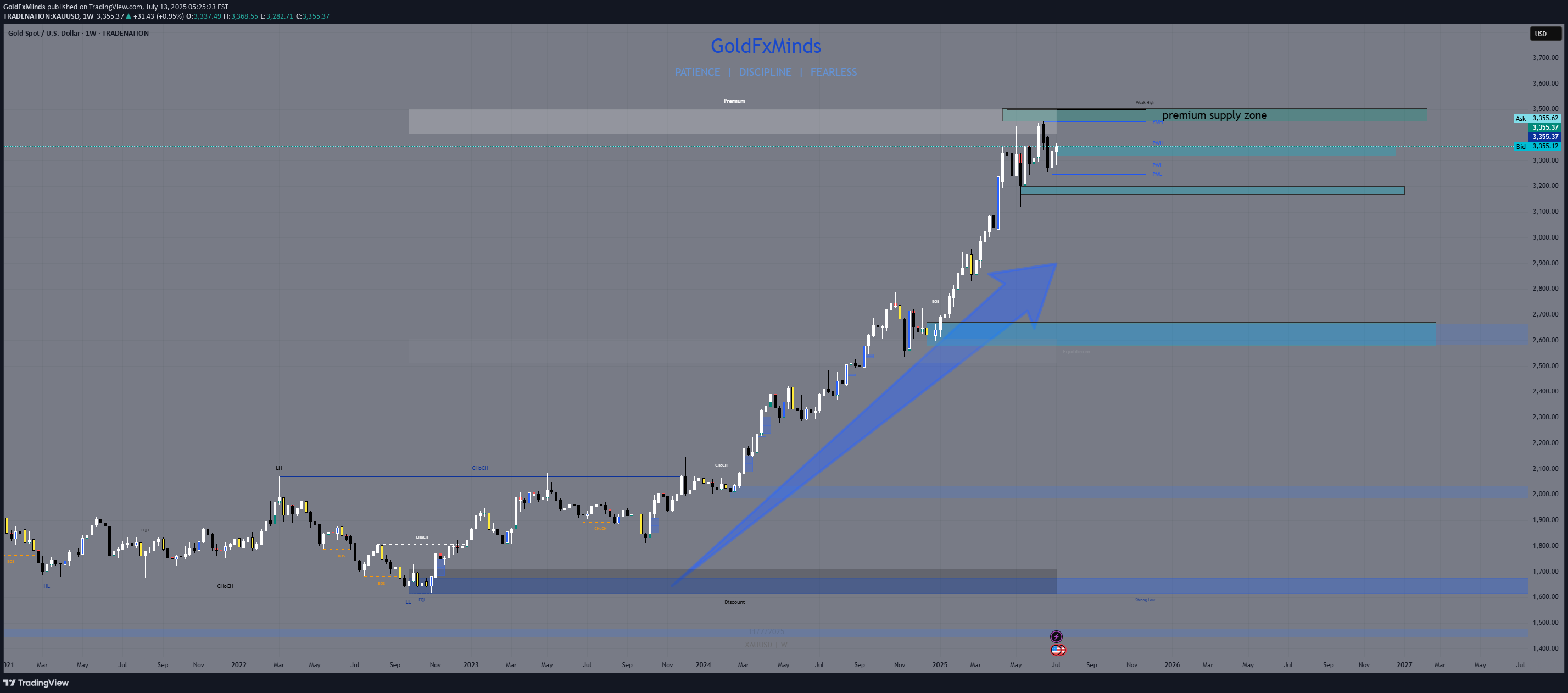

Hey team — we're entering a decisive week on gold as macro tensions heat up and price dances inside a key premium range. Let’s dive into what the chart is telling us. 🔸 HTF Bias: Weekly Structure Breakdown Bias: Bullish with exhaustion signs Current candle: Bearish rejection forming after last week's lower high inside the premium range Trend: Still bullish overall, but stalling inside a distribution-like pattern Weekly structure: Confirmed CHoCH in early 2023 launched the bullish leg Break of structure toward Higher High (HH) continues but weak high was created near 3500 We’re currently inside a weekly premium range, rejecting the upper quadrant 🔸 Key Weekly Confluences: Zone Type Price Level Confluences 🔼 Resistance 3490–3500 Weak High + Premium zone + FVG + RSI divergence 🔼 Upper Range 3450–3470 Historical imbalance fill + EMA5 overextension 🔽 Support 3355–3320 Weekly OB + Discount side of premium leg + FVG 🔽 Deep Support 3200–3170 Last strong demand + BOS origin + RSI oversold risk zone Fibonacci Range: 3500 = top of the bullish extension; 50% retracement sits around 3250 RSI (Weekly): Starting to curve down from overbought territory — watch for structure cracks EMAs (5/21/50): Strong upside lock remains but a flattening 5EMA hints short-term slow-down 🗓 Macro + News Context: This week is loaded with high-impact U.S. data and a parade of FOMC speakers: Core CPI (Monday) and Retail Sales (Thursday) = critical for short-term inflation outlook FOMC members speaking throughout the week = high chance of volatility spikes Pre-G20 positioning (Friday–Saturday) could lead to risk-off flows or safety bids on gold Watch Crude Oil Inventories and Building Permits for risk sentiment impact The combination of CPI, retail sales, and continuous Fed commentary could cause abrupt sentiment swings — especially if inflation surprises to the upside again. ⚠️ What to Watch This Week: Any weekly close above 3470 = potential sweep into weak high (3500) Failure to hold 3355 zone = opens the door to revisit the deeper OB around 3200 Look for a lower high inside premium to confirm bearish weekly intent — otherwise we remain bullish Any bounce from 3320 must show strong volume + FVG reaction to confirm continuation ✅ Final Notes: This week is all about patience. We’re in a premium exhaustion phase, and with heavy macro catalysts on the table, gold is primed for a decisive breakout — up or down. Stay flexible. Let price show its hand around the major zones. We’ll refine sniper entries on H4 and H1 once the weekly opens fully. — 📌 If this breakdown helped, hit 🚀🚀🚀 follow GoldFxMinds 🔔 for daily updates as this structure develops and drop a comment: Will gold sweep 3500 or collapse toward 3200? 👇 📢 Disclosure: This analysis is based on the Trade Nation TradingView feed. I’m part of their Influencer Program and receive a monthly fee. ⚠️ Educational content only — not financial advice.