Technical analysis by David_Perk about Symbol PAXG on 7/8/2025

David_Perk

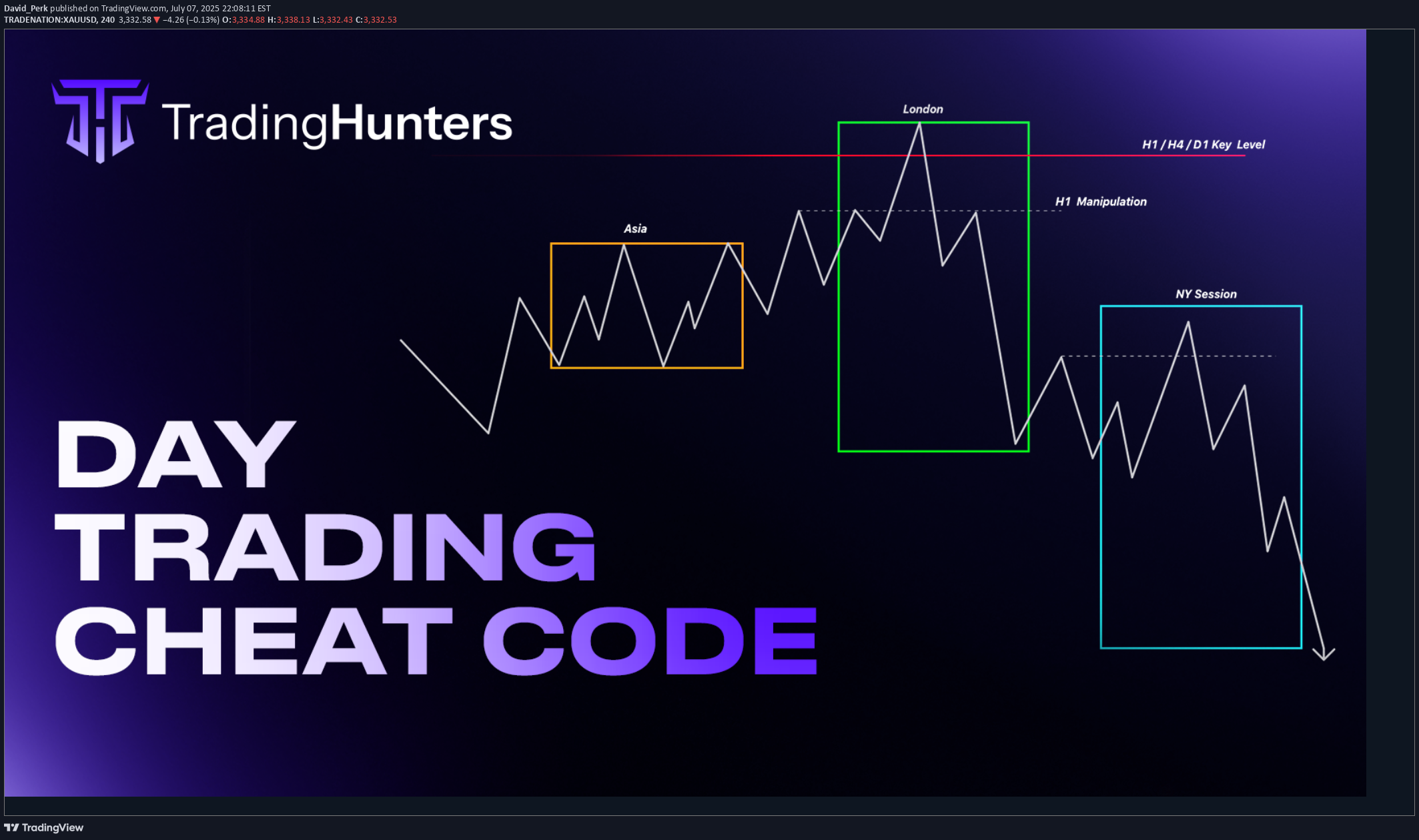

Hey whats up traders, in reveal cheat code for day trading by using session profiles. It's powerful concept. If correctly applied with HTF trend it will allows you to join running train path the right time.Dont forget to follow me. I release such articles every Monday.🧠 What Are Session Profiles?A session profile describes the typical price structure and narrative during a market session — from open → high/low → close.In Forex, we focus on:•Asian Session•London Session•New York SessionEach session can act as either a reversal or continuation of the previous session(s).📈 Why They WorkMarkets are engineered to:•Run stops (above highs or below lows)•Fill inefficiencies (fair value gaps or imbalances)CLS prefer to move price during specific times — the active hours around session opens. This is where liquidity is high and slippage is minimal, making it ideal for executing large orders.So, session profiles help us map out when and where these manipulations are most likely to happen.✅ Why You Should Use ThemSession profiles help you:•Avoid low-probability trades in dead sessions•Focus on high-probability narratives•Anchor your execution models to contextBut remember: they are not an entry model. You still need:•A higher timeframe bias•A mechanical entry model•A system for risk and trade management🔁 How to Use Session ProfilesUse the previous session(s) to anticipate the next one.•For London session → analyze the Asian session•For New York session → analyze Asian + London sessionsYou’re looking for:1.Manipulations into key levels2.Displacement (price moves away strongly)3.Change in order flow (e.g. OB,on M5 ,15 or H1)4.Remaining liquidity targets (draw on liquidity)📊 Session Profile Types with Chart Logic1. 🔄 London Continuation ProfileConditions:•Asia session already made a manipulation into a key level•Price displaced away from that level•CIOD / OB on M15 or H1 before London openExample:•EURUSD H1: Asia runs stops above H1 high into a fair value gap (key level)•Displacement confirms intent•At London open, price retraces into M15 premium (PD array) and continues in the same directionInvalidation: the manipulation high/low from Asia sessionNarrative: Asia did the manipulation → London does the continuation.2. 🔁 London Reversal ProfileConditions:•Asia session consolidates near a higher timeframe key level•London open initiates the manipulation into the key level•Displacement + M15 BOS after manipulationExample:•GBPUSD H1: Asia consolidates under daily FVG•London opens, price runs Asia high into that FVG•M15 breaks down → clean short setup•Target: higher timeframe draw on liquidity (e.g., previous day low)Invalidation: the London session high (manipulation point)Narrative: London performs the manipulation → price reverses.3. 🔄 New York Continuation ProfileConditions:•Asia + London already created a clear manipulation and displacement•London has not reached the final draw on liquidity•London is not overextended (e.g., <70 pips move)•New York opens with structure intact for continuationExample:•EURUSD H1: London makes a reversal from a key level and displaces lower•Draw on liquidity (e.g., previous day low) still untouched•NY opens and continues the sell-off, retracing briefly into M15 imbalance before expanding lowerInvalidation: manipulation level from LondonNarrative: London set the direction → NY finishes the move.4. 🔁 New York Reversal ProfileConditions:•No clear London profile (no key level touched, no strong CHoCH)•NY opens and manipulates into a key level (e.g., daily OB, FVG)•Clear M15 or H1 CHoCH or BOS confirming reversal•Asia + London lows still intact (liquidity available below)Example:•EURUSD H1: No strong setup in London•NY opens, price spikes into daily OB and takes out London highs•M15 structure shifts → sell targeting London + Asia lowsInvalidation: NY session manipulation highNarrative: London was noise → NY takes control and reverses.🔁 Visual Structure Flow Before applying any session profile, confirm:1.High-probability trading conditions (e.g., key level proximity, market open, liquidity available, Red News)2.Bias in place (HTF (D1 and Weekly direction must be known)Then:→ Check for valid session narrative→ Select the correct session profile→ Wait for the stop run of H1 / H4→ Is there enough room for the move to key level→ If we are still in first half of session you can enter. If its close the end of session skip it.→ Apply your entry and risk model.→ Dont be greedy look for 2:1 RR trade and get out.No Raid = No trade. if bearish - You always want enter above H1 I H4 candle after LTF CIODIf bullish - You always want to enter bellow H1/ H4 after LTF CIOD.Never sell low / Never buy High... wait for stop run of highs in down trend.