Technical analysis by GoldFxMinds about Symbol PAXG on 7/5/2025

GoldFxMinds

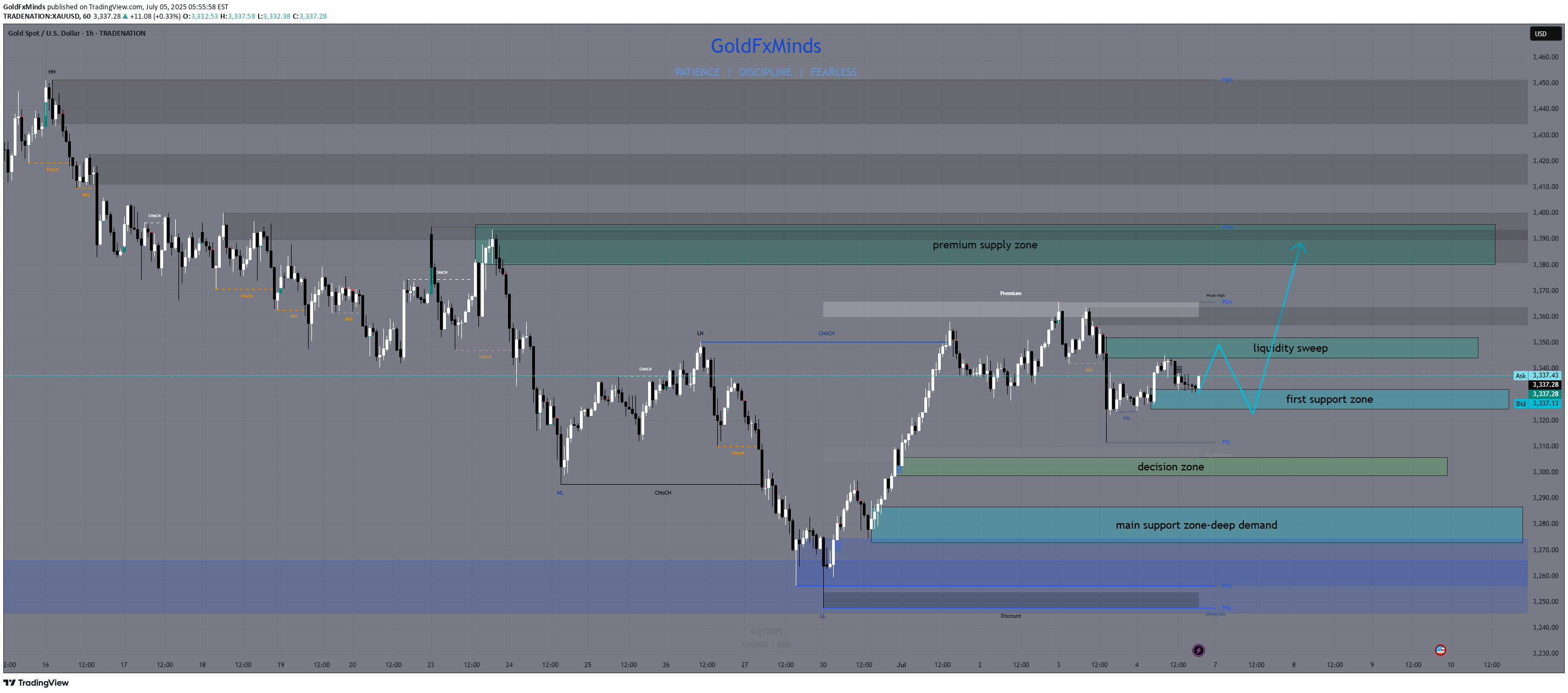

"Structure over noise. Patience is power. Welcome back to the battlefield."👋 Hey traders!After a low-volume week due to the US Independence Day holiday, we now re-enter the battlefield with structure tightening under major resistance — and with Fed commentary on the radar.No CPI. No NFP. But don't sleep on the setups — liquidity is quietly shifting.🧭 Here’s what we’ve got ahead:🔔 Key Events – July 8–12:🟡 Monday–Tuesday: BRICS Summit (geo/political exposure)🔵 Wednesday: FOMC Minutes – potential policy clues🔴 Thursday: Unemployment Claims + Fed speakers (Muserlian, Waller)⚪ Friday: Federal Budget BalanceWe’re likely entering a reactive environment — fueled by internal structure shifts, not major macro catalysts. Perfect for smart money setups.🧠 HTF Structure & Bias🔹 Daily Bias:Price remains capped under the key daily supply 3344–3351, which rejected cleanly before the holiday. Unless that flips into support, bias remains neutral to bearish.EMAs 5/21 are curling sideways. RSI is flattening, and structure shows fading momentum.🔹 H4 Bias:We’re consolidating below a CHoCH + LH series, inside premium territory. The rejection from 3344 was precise, and unless broken, pressure favors the downside.Price is rotating between the H4 EQ and the 3325–3332 intraday OB. Momentum is slowing — watch for re-accumulation or rejection depending on reaction at key zones.🔴 Supply Zones (Sell Scenarios)1. 3344 – 3351This is the Daily + H4 supply from last week. EMA alignment + FVG + liquidity sweep confluence.Perfect sniper rejection area if price trades up and stalls. Look for M15/M30 CHoCH confirmations.2. 3380 – 3394Untouched H1-H4 OB in premium. Not related to CPI/NFP — just pure inducement wick potential from above. If tapped after midweek liquidity push (e.g. FOMC Minutes), watch for overreaction entries.🟢 Demand Zones (Buy Scenarios)1. 3325 – 3332Last week’s discount reaction zone. H1 OB + internal CHoCH zone. If swept and protected by bullish PA (M15 BOS), this becomes the best R/R long back into 3344.Already tested Friday, but still holds weight for Monday.2. 3286 – 3272H4 OB + daily demand + RSI oversold zone.If we get a full breakdown early week, expect this area to act as a reaccumulation pocket for bulls — but only with confirmation.⚔️ Decision Zone – 3299 – 3305This is the weekly flip area.If bulls defend 3305 → bullish short-term bias returns.If 3299 fails → downside continues into 3280s.🧠 Summary & Gameplan🧷 No CPI. No NFP. That means cleaner technical moves — no fake news spikes, just pure structure.Expect Monday to be reactionary (post-holiday), and Wednesday–Thursday to bring intraday setups post-FOMC minutes.✅ If price is in premium, watch for bearish rejections at 3344/3380.✅ If price dips into discount, wait for confirmation longs at 3325 or 3286.✅ Stay patient in mid-range. Don’t force trades inside chop zones.🧲 If this gave you real clarity — don’t just scroll on.Hit the ❤️ button, smash Follow, and tell us in the comments:👉 Which zone do you trust more — the 3325 reentry or the 3380 inducement trap?Let the gold tribe know 👇—📢 Disclosure:This analysis is based on the Trade Nation TradingView feed. I’m part of their Influencer Program and receive a monthly fee.⚠️ Educational content only — not financial advice.— GoldFxMinds 💛Patience | Discipline | Fearless Execution🧠 XAUUSD NY Session Update – July 7, 2025“Let the structure guide you. Not the noise.”👋 Hey traders, we’re back with the NY session flow after a volatile start in Asia and London. Price has reacted cleanly into the higher supply zone, and now we’re hovering near 3330–3340, just below the major HTF rejection block at 3344–3351.With no CPI or NFP this week, markets are dancing purely to liquidity and technical flows. Let’s break it down clearly:🌍 Macro & News Context (July 8–12)🔸 Monday–Tuesday: BRICS Summit → geopolitics may influence gold sentiment🔸 Wednesday: FOMC Minutes → internal policy sentiment shift🔸 Thursday: Unemployment Claims + Fed Speakers🔸 Friday: Budget Balance➡️ We’re in a data-light, reaction-heavy environment.Expect setups to depend more on structure and liquidity sweeps, not sudden news.🔎 HTF STRUCTURE & BIAS📌 Daily Bias:Still capped under 3344–3351 daily supply, where price rejected hard pre-holiday.EMAs 5/21 sideways, RSI softening → neutral to bearish unless 3351 breaks.Structure = LH + CHoCH → sellers still have control unless flipped.📌 H4 Bias:Price remains trapped between the H4 equilibrium and premium rejection.Still seeing LH formation → bearish pressure remains unless new HH forms.Rejection from 3344 still holds as valid HTF sell trigger.📌 H1 Update:Price tapped 3339 during NY open, stalling under first sell zone.Minor CHoCH on M15 forming — watch 3330 BOS for bearish confirmation.If rejected, we could revisit 3325–3330 first.⚔️ Real-Time Trade Scenarios🔻 SELL SCENARIOS1. 3344–3351 (LIVE zone)Daily + H4 supplyEMA alignment + liquidity sweep🔸 Entry only on M15/M30 CHoCH + BOS below 3330No confirmation = No short. Be disciplined.2. 3380–3394Untouched premium OBIf tapped, wait for a clean reaction → ideal late-week trap.🟢 BUY SCENARIOS1. 3325–3330H1 OB + CHoCH base + internal supportAlready tested earlier, but if price pulls back cleanly and holds, watch for M15 BOS → reentry long2. 3299–3305Weekly decision zoneIf bulls defend 3305 → structure flips bullishIf 3299 breaks → full retrace into 3286 or lower3. 3286–3272Daily demand + H4 OB + RSI confluenceOversold potential if full breakdown occursWait for bullish CHoCH → high-RR reaccumulation✅ Final Plan & Execution Flow🧷 Price is at premium → don’t force longs🧷 Watch for rejection at 3344 or fake sweep into 3380🧷 Only buy if 3325 or 3305 reacts with BOS + clean PA🧷 Ignore mid-range chop unless PA confirms directionStay tactical, not emotional. Let price confirm your logic.No confirmation = No trade. We don’t guess — we execute.—📌 If you found this helpful, hit 🚀🚀🚀, share with someone in your trading circle, and comment:👉 Are you stalking the 3344 short… or waiting for the 3305 long?Let the structure do the talking.—GoldFxMindsPatience | Discipline | Fearless Execution