Technical analysis by GoldFxMinds about Symbol PAXG on 7/5/2025

GoldFxMinds

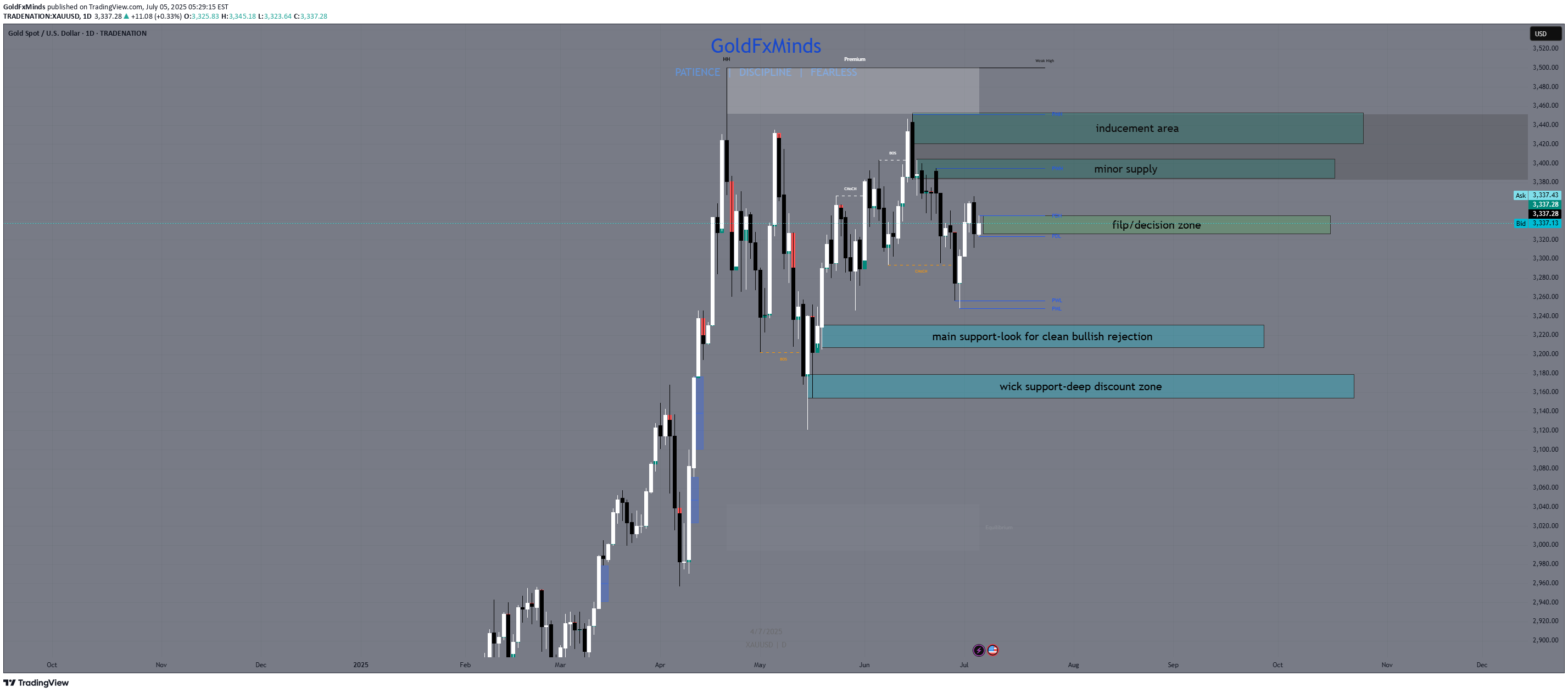

👋 Hey traders, welcome to the fresh week! After the Friday selloff, gold is approaching a key inflection point. Let’s break down what’s happening on the Daily chart and how to approach it with clarity — no guessing, just precision.Stay focused. The real opportunity is always in how you prepare.🌍 Macro + SentimentMarket remains sensitive to yield shifts and broader risk sentiment (BRICS summit also continues)Price remains elevated in premium territory after months of vertical flow — but structure is finally showing re-accumulation or re-distribution?📈 Daily BiasNeutral to bearish until the 3330–3344 zone fully flips cleanly as supportStructure shows lower highs, strong wick rejections in premium zones, and a need for confirmation🧠 What the chart tells us:Price is compressing between a D1 FVG (below) and unfilled premium OB (above)Friday’s low wicked into a small imbalance — but was not a clean tap into the main OBRSI is midrange, EMAs are flat, and momentum is indecisiveWe're either gearing up for a bullish FVG reclaim or prepping for a deeper drop into discount⚠️ Key Zones to Watch🔵 Support Zones (Buy Zones)3230–3208→ D1 Fair Value Gap + unmitigated bullish OB + discount pricing→ Valid only with clean bullish rejection. High interest for sniper entries if price returns.3170–3154→ Untapped daily OB + historical support wick + aligns with deeper discount zone→ Stronger bounce zone if 3230 fails. Confluence with fib retracement & RSI likely oversold here.🔴 Supply Zones (Sell Zones)3420–3450→ Premium FVG + D1 OB combo + previous bearish rejection wick→ High probability inducement area. Valid only if price fails to hold 3344 flip.3388–3402→ Minor supply + internal structure break level→ Short-term reaction area. Lower conviction but watch for rejection if price overextends.🟡 Decision / Flip Zone3327–3344→ Former support now turned resistance→ If this zone flips bullish and holds, bias shifts to continuation. If rejection occurs, confirms retracement deeper into discount.✅ ConclusionThe market is entering a decision week — no rush. Let the chart guide you.Clarity comes not from prediction, but preparation. This chart isn’t hindsight — it’s a live framework.✨ Final ThoughtIf this chart feels clear, that’s because it was built with intention — not after the move, but before it happens.The difference between noise and precision is structure.And we don’t guess — we prepare.🚀 If you appreciate detailed, real-time structure like this, hit follow and join the traders who value clean execution over hype.💬 Drop your bias below — bullish or bearish this week?📢 Disclosure: I use Trade Nation's broker feed on TradingView and I'm part of their influencer program.📉 This is educational content and not financial advice.