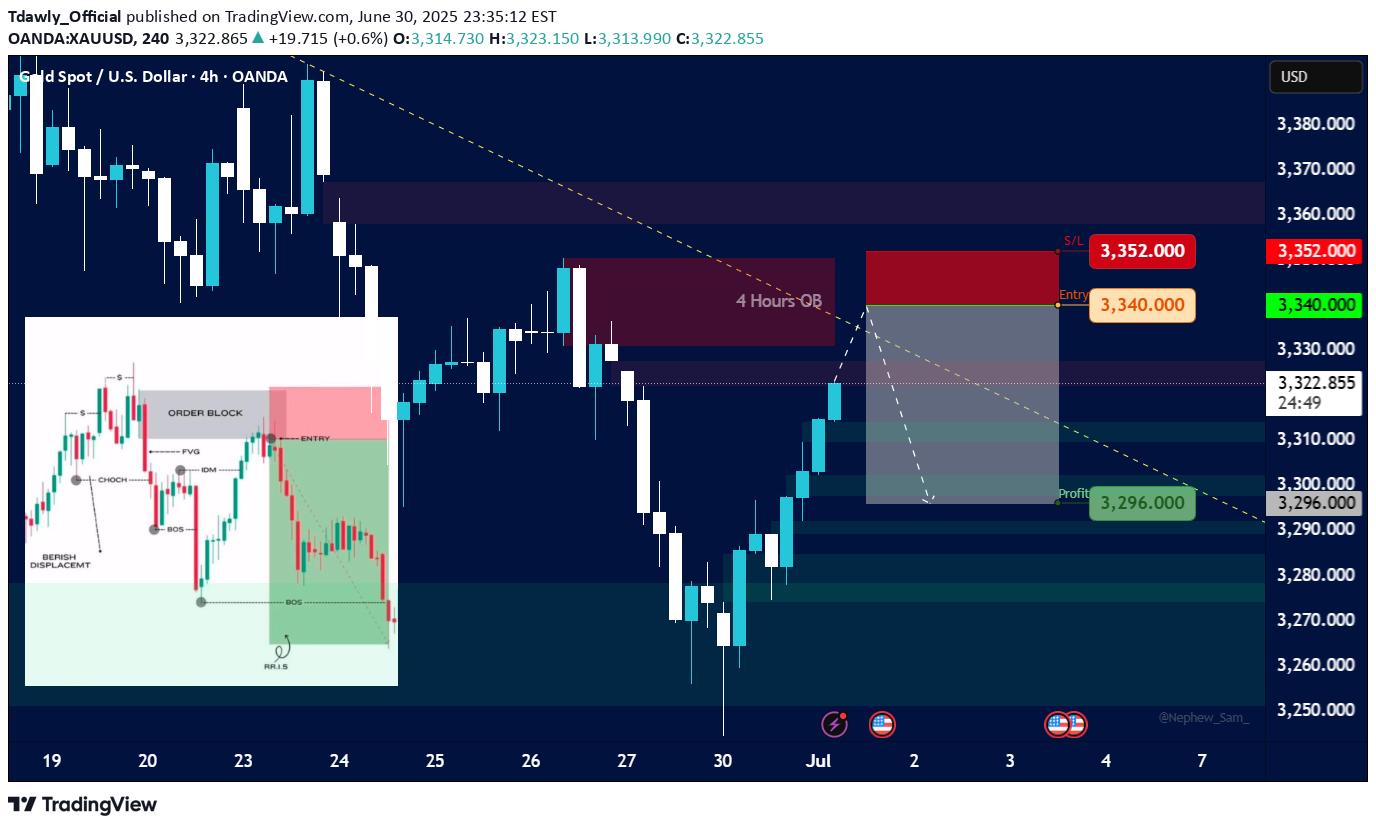

Technical analysis by Tdawly_Official about Symbol PAXG: Sell recommendation (7/1/2025)

Tdawly_Official

Here's an analysis based on the information presented in the image: Overall Market Structure (from a quick glance): Recent Price Action: The price has recently experienced a significant decline, followed by a bounce. Order Block (OB): There's a clearly marked "4 Hours OB" (Order Block) which is a key area of interest for potential resistance. Potential Trading Setup: Entry: The "Entry" price is set at 3,340.00. This entry point is within the bearish order block, suggesting a short (sell) position. Stop Loss (S/L): The "S/L" is placed at 3,352.00. This is above the high of the 4-hour order block, aiming to limit losses if the price moves against the short position and breaks above the resistance. Take Profit (Profit): The "Profit" target is set at 3,296.00. This target is significantly lower than the entry, aiming to capture a downward movement. Risk-Reward Ratio: Risk: The difference between the entry (3,340.00) and the stop loss (3,352.00) is 12 points. Reward: The difference between the entry (3,340.00) and the take profit (3,296.00) is 44 points. Ratio: This implies a risk-reward ratio of approximately 1:3.67 (44 / 12), which is generally considered favorable. Key Technical Concepts Illustrated (from the inset image): The smaller inset image on the left illustrates concepts commonly used in Smart Money Concepts (SMC) or Institutional Order Flow (IOF) trading: Order Block (OB): A price range where significant institutional buying or selling occurred, often leading to price reversals. The red box indicates a bearish order block. Entry: The point at which a trade is entered. FVG (Fair Value Gap) / Imbalance: An area on the chart where price moved quickly in one direction, leaving an "inefficiency" or gap that price often retests. CHoCH (Change of Character): An early sign of a potential trend reversal, indicating a shift in market sentiment. BOS (Break of Structure): When price breaks a significant high (for a bullish trend) or low (for a bearish trend), confirming the continuation or reversal of a trend. The multiple "BOS" labels suggest a series of lower lows, confirming a bearish trend. BERISH DISPLACEMENT: Implies strong bearish momentum leading to lower prices. PRLII S: This specific acronym is not universally recognized but could refer to a specific pattern or setup within the trader's methodology, possibly related to liquidity or price action. Conclusion/Potential Interpretation: The chart suggests a bearish outlook for XAUUSD, with the trader looking to short Gold at the retest of a 4-hour bearish order block. The setup has a favorable risk-reward ratio. The concepts in the inset image provide a theoretical framework for why this particular entry and targets might be chosen, based on institutional trading principles. The current price is at 3,322.285 at 08:33:38 +04, which is below the proposed entry, suggesting this might be a setup that the trader is waiting to happen or a retrospective analysis of a potential trade idea.