Technical analysis by David_financial_analyst about Symbol PAXG on 6/3/2025

David_financial_analyst

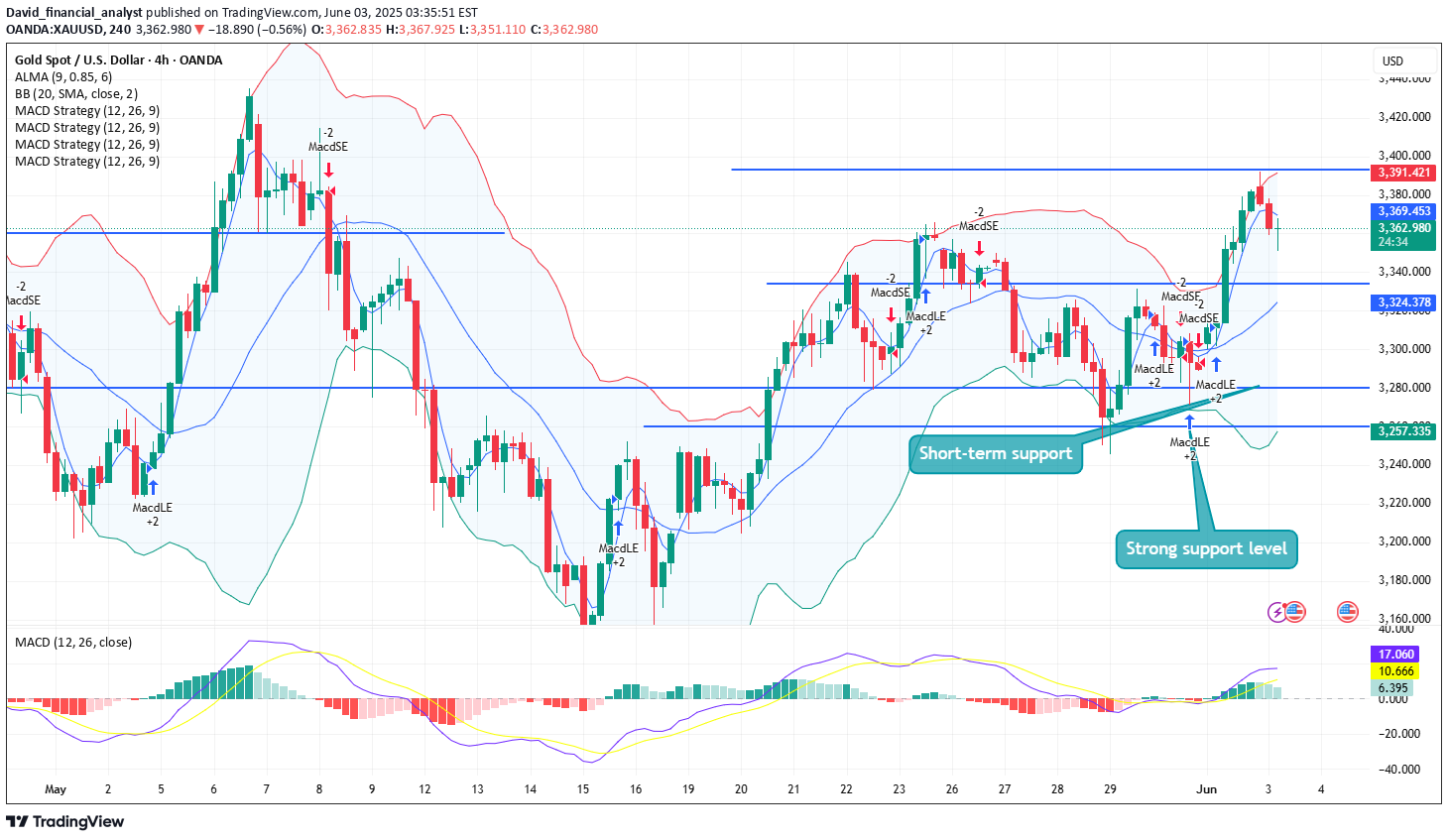

Risk aversion heats up, pushing gold prices to test pressure

Gold prices (XAU/USD) retreated slightly during the Asian trading session on Tuesday, mainly due to the dollar's modest rebound from a six-week low and the recovery in risk sentiment. The overnight rise in risk assets weakened safe-haven demand, prompting some gold bulls to take profits.However, the market remains vigilant about the global situation. The continued expansion of the US fiscal deficit, the escalation of trade tensions between Asian powers and the United States, and the failure of the second round of peace talks between Ukraine and Russia have kept the market's risk aversion supportive of gold.Last weekend, US President Trump accused Asian powers of violating the preliminary tariff agreement and announced an increase in steel import tariffs from 25% to 50%. The US government also asked countries to submit their best trade proposals by July 8, showing that its position on tariffs is getting tougher.In addition, the Fed's policy expectations also provide important support for gold prices. Despite the short-term rebound in the US dollar, the market still expects the Fed to make at least two 25 basis point interest rate cuts in 2025. Comments from several Fed officials this week indicate that if the trend of inflation retreat continues and policy uncertainty is resolved, the timing of interest rate cuts may be brought forward.Fed Governor Waller said that even if the new tariffs may temporarily push up price pressure, there is still a possibility of interest rate cuts this year; Chicago Fed President Goolsbee pointed out that there is room for interest rates to fall in the next 12-18 months.After breaking through the $3324-3326 area, gold prices continued to rise and broke through the key resistance area of $3355. At present, this position has turned into support. If the short-term adjustment does not fall below this area, it will be regarded as a confirmation process of stepping back. The lower support is at $3324 and $3300 respectively. After breaking through, it may test the $3286-3285 level.In terms of upper resistance, if the gold price breaks through the $3400 integer mark, it will open up space for upward movement, with the target looking at the $3430-3432 area. If the momentum continues, it is expected to challenge the historical high set in April again and hit the important psychological level of $3500.Editor's opinion:The current market is in a tug-of-war between the short-term recovery of the US dollar and the medium- and long-term safe-haven demand, but multiple fundamental factors are still bullish for gold, especially the rising geopolitical risks and trade concerns, the Fed's dovish expectations, and the background of US fiscal instability.Gold prices are expected to resume their upward trend after falling back to support near $3,355. Pay attention to the guidance of the non-agricultural data to be released on Friday on the US dollar and gold. XAUUSD XAUUSD GOLD XAUUSD GOLD XAUUSD