Technical analysis by Khan_YIK about Symbol PAXG on 5/18/2025

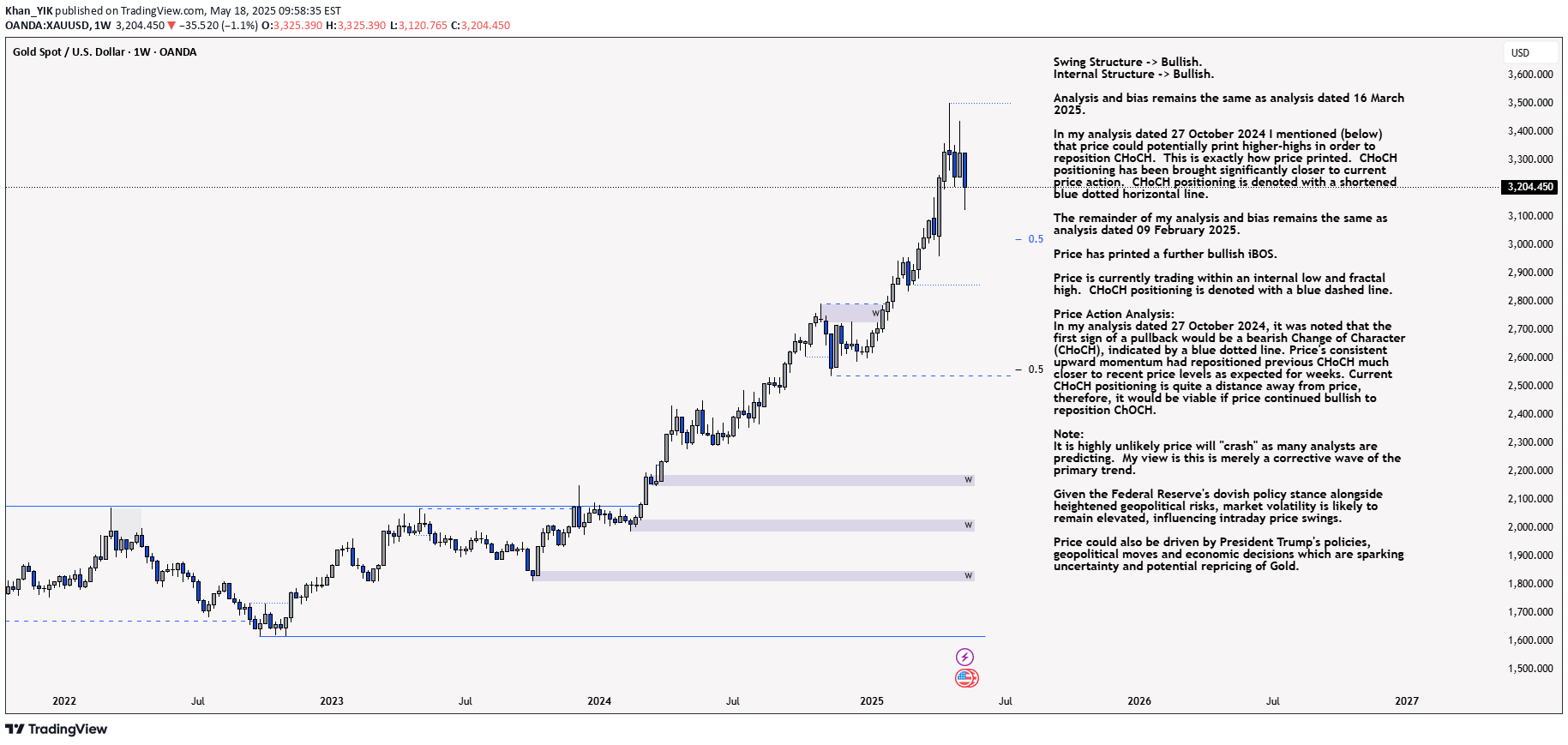

Weekly Analysis:Swing Structure -> Bullish.Internal Structure -> Bullish.Analysis and bias remains the same as analysis dated 16 March 2025.In my analysis dated 27 October 2024 I mentioned (below) that price could potentially print higher-highs in order to reposition CHoCH. This is exactly how price printed. CHoCH positioning has been brought significantly closer to current price action. CHoCH positioning is denoted with a shortened blue dotted horizontal line. The remainder of my analysis and bias remains the same as analysis dated 09 February 2025. Price has printed a further bullish iBOS.Price is currently trading within an internal low and fractal high. CHoCH positioning is denoted with a blue dashed line. Price Action Analysis:In my analysis dated 27 October 2024, it was noted that the first sign of a pullback would be a bearish Change of Character (CHoCH), indicated by a blue dotted line. Price's consistent upward momentum had repositioned previous CHoCH much closer to recent price levels as expected for weeks. Current CHoCH positioning is quite a distance away from price, therefore, it would be viable if price continued bullish to reposition ChOCH. Note:It is highly unlikely price will "crash" as many analysts are predicting. My view is this is merely a corrective wave of the primary trend. Given the Federal Reserve's dovish policy stance alongside heightened geopolitical risks, market volatility is likely to remain elevated, influencing intraday price swings.Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty and potential repricing of Gold.Weekly Chart: Daily Analysis: Swing -> Bullish.Internal -> Bullish.Analysis and Bias remains the same as Analysis dated 11 May 2025.Since my last weekly analysis price has finally printed a bearish CHoCH.This is the first indication, but not confirmation of bearish pullback phase initiation.Price is now trading within an established internal range. Price should now technically trade down to either discount of 50% internal EQ, or Daily demand zone before targeting weak internal high, priced at 3,500.200.Note:The Federal Reserve’s continued dovish stance, coupled with escalating geopolitical uncertainties, is expected to sustain elevated market volatility, influencing both intraday and broader trend developments.Additionally, price action may be further shaped by U.S. policy decisions, including measures enacted under President Trump. Shifts in geopolitical strategy and economic policymaking could introduce further uncertainty, contributing to the ongoing repricing dynamics within the gold market.Daily Chart: H4 Analysis: -> Swing: Bullish.-> Internal: Bullish.Analysis and bias remains the same as analysis dated 23 April 2025Price has now printed a bearish CHoCH according to my analysis yesterday.Price is now trading within an established internal range. Intraday Expectation: Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.Note:The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.H4 Chart: