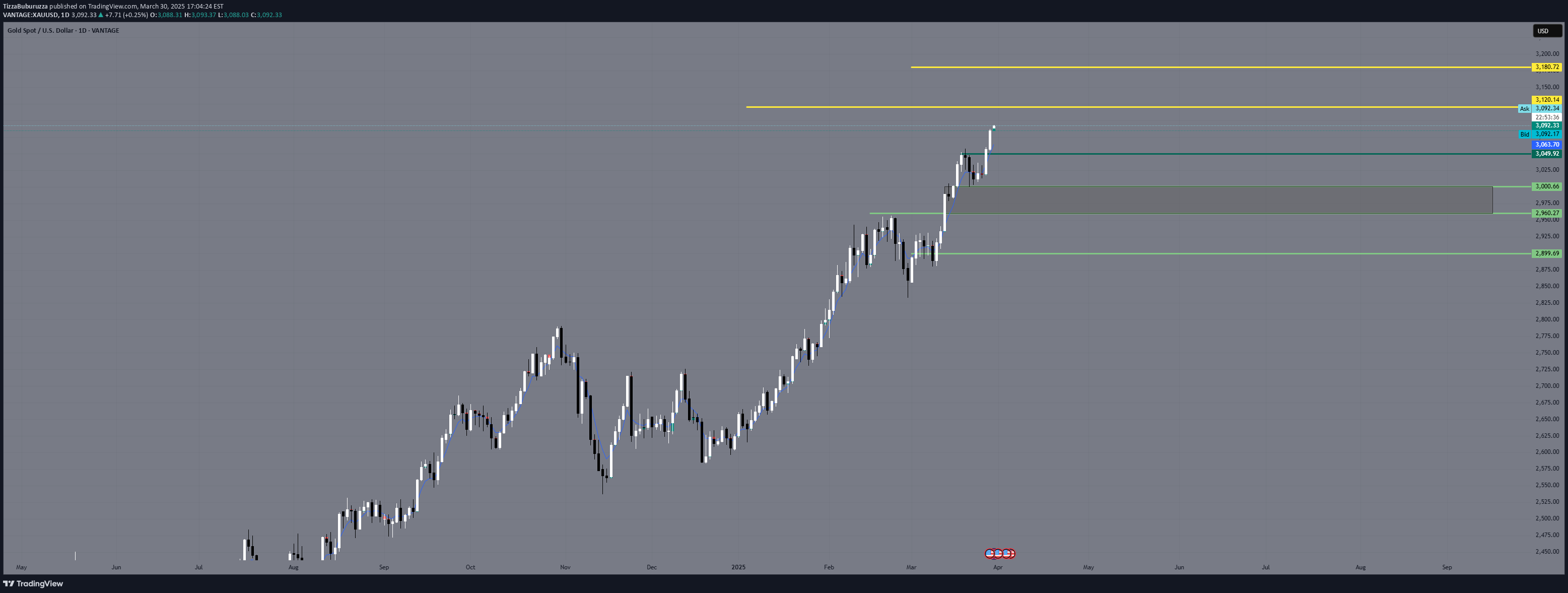

Technical analysis by TizzaBuburuzza about Symbol PAXG on 3/30/2025

XAUUSD Daily Trading Plan (1D Outlook)

🔍 1. Structure & Price ActionPrice broke out aggressively from previous consolidation (~2960–3000).Current impulse leg is strong, with very shallow pullbacks – trending conditions.Daily candles show sustained buying pressure, minimal upper wicks → buyers in control.📏 2. Key Levels (from your chart)📌 Upside Targets:🔸 3,120.14 – potential resistance / short-term TP🔸 3,180.72 – extended upside target if momentum holds🟩 Support Zones:✅ 3,049.38 – minor intraday support✅ 3,000.66 – recent breakout retest zone✅ 2,960.77 – clean demand zone / OB zone✅ 2,899.69 – last major demand / strong structure support🧠 3. SMC & Liquidity InsightsBuy-side liquidity has been cleared → clean runway toward psychological zones (3100–3200).FVG may exist between recent candles → shallow retracement into 3049 / 3000 possible.No active bearish OBs above → price remains in price discovery mode.📅 4. Daily Trade Scenarios✅ Scenario A: Bullish ContinuationHold above 3,049–3,060 → continuation toward:🎯 3,120🎯 3,180+Look for strong H4 bullish candles on retest of minor support.⚠️ Scenario B: Pullback to DemandReject from 3,100+ and drop toward:🔁 3,000 (retest previous high)🔁 2,960 (key OB / FVG zone)Watch for bullish reversal signals (engulfing, break of structure) for re-entry long.🟥 Scenario C: Deeper Reversal (Less Probable)Break below 2,899 could shift bias to neutral/short-term bearish.🧭 SummaryXAUUSD is in a strong trending phase with no major resistance above.Pullbacks into 3,049 / 3,000 / 2,960 are ideal areas to look for continuation longs.Focus remains on buy-the-dip setups as long as price holds above 2,899.