Technical analysis by BrankoPetruci about Symbol BTC on 7/20/2024

BrankoPetruci

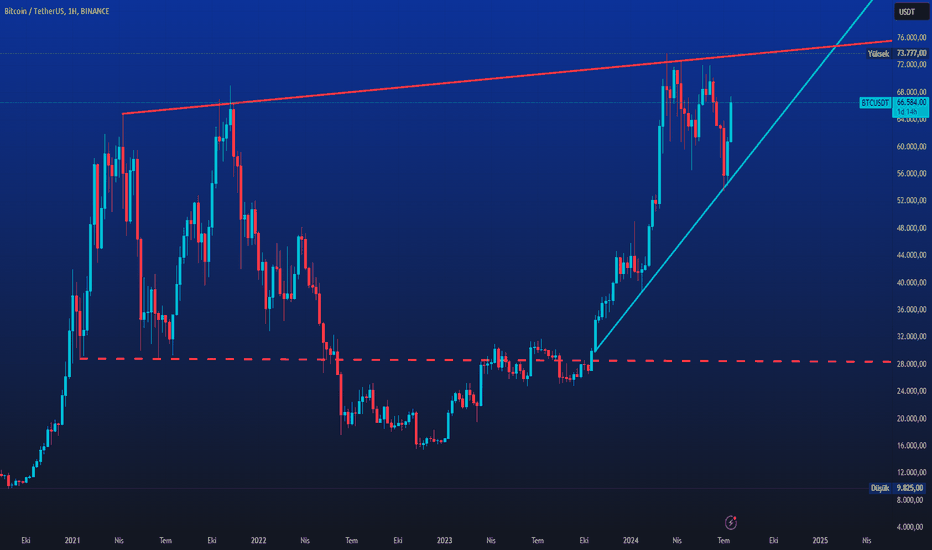

Bitcoin Saç Baş Yoldurdu-Küpleri de Doldurdu

Bitcoin 54 thousand support from the support of the 73 thousand summit towards an attack. Let's see if his breath is enough. Such an expectation is in the market with the wind of the #Ethereum ETF process, which is expected to be approved and started to be processed. However, we will see if MMs will allow it. In the meantime, 5 spot Ethereum ETF will begin to be traded at the Chicago Board Opions Exchange on July 23 following the final legal approval. -21shares Core Ethereum ETF, -Fidelity Ethereum Fund, -Invesco Galaxy Ethereum ETF, -Vaneck Ethereum ETF, -Franklin Ethereum These ETFs, including ETF, were enabled with SEC Approved rule amendments. Exporting funds plan to temporarily waive or reduce wages to gain market share. A good step for receivables from ETFs. Analysts expect the new ETF to draw a net entrance of billions of dollars to Ethereum in the months following the launch of the new ETFs. The price bar descended to the main trend support according to the weekly graph at Cointlegraph🚨bitcoin! 🔹56K and 52K Fibo sequential support levels. For a new rise trend, the rise trend that starts from April 2021 has to exceed the resistance of the bit brother. This seems difficult for now. 🔸 On May 5, it gave a good opportunity and we gathered the lice from the 48-50 k range. Therefore, it can be a time where investors in the position should protect their positions with the right risk management, and the traders should take gradual profits. The whole world is in particular to an interest rate cut from the USA. Will there be an effect? Certainly! 🔹 However, there is no appropriate environment-economic welfare and risk appetite for the bull rally that makes rockets with the "Flying-Caid-Caid-20x". We have been beaten badly about both disease and economic turbulences and wars. If you need to use it in place. ⚡️ In such an environment, you have no judgment-detection of the Martavals. What is valid during this period is the basic information and techniques that you have developed with your own strategies that you have learned both protecting your portfolio and making risk management! Patiently continue to progress with small steps ... I recommend you to read the psychological cycle of markets: