Technical analysis by efafinans about Symbol BTC on 6/17/2022

efafinans

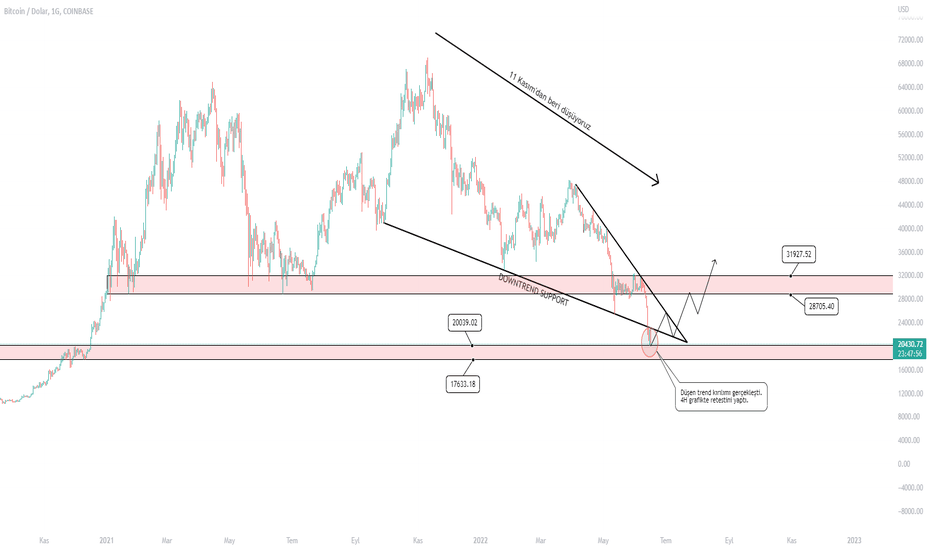

The Bitcoin decision, which was priced in line with the 0.75 basis point interest rate decision, increased to 22.8k levels after the decision was taken in line with expectations, but there was selling pressure in the markets due to increasing concerns after the press statement made by FED Chairman Powell. As global inflation increases, the risk in the markets will continue to increase. Last night, the FED said that they will continue to increase interest rates but may reduce interest rates in 2024. This shows that the risk for the markets will continue. When we look at Bitcoin, there is serious movement in large wallets. While some buy and withdraw to cold wallets, others continue to send BTC to stock exchanges. This is an indication that investors are indecisive. When we look at Bitcoin's technical appearance, it has broken down the decline that came from September 29 and has been tested 3 times in total. It is currently at the top of the 20k-17k support band. If the price enters the band range, it may consolidate in this area for a long time. There is no indication for an increase at the moment. Unless important data comes, the increases will be limited. It seems too early for a reaction to the decline, but if it gets a reaction from this area, the 25.6k level will be our target, then we will expect a decline to the 21.5k level again as indicated in the chart. In order for the current trend to be broken, it needs to rise above the 28.7k-31.9k band. Unless it falls again, I will expect 17.6k. Since the bottoms are at the bottoms, the effect of the decline in BTC has also decreased somewhat. There are a few projects I like in altcoins. I will prepare a basket from this area and start collecting goods slowly... It has reached the area we expected, if you ask my opinion after this, I expect a pullback from here or from the 20.9k level again. If it exceeds these levels, 21.4k-22.8k will be the next possible pullback zones. BTC's new pricing is the 23k-19k band. I think it will ebb and flow in this band range for a long time. For now, above 23k is expensive, below 19k is cheap. If it exceeds 23k, it may show an increase to 27k-28.2k. As I mentioned in the analysis, we cannot say that the downtrend is over unless it exceeds 31.9k...