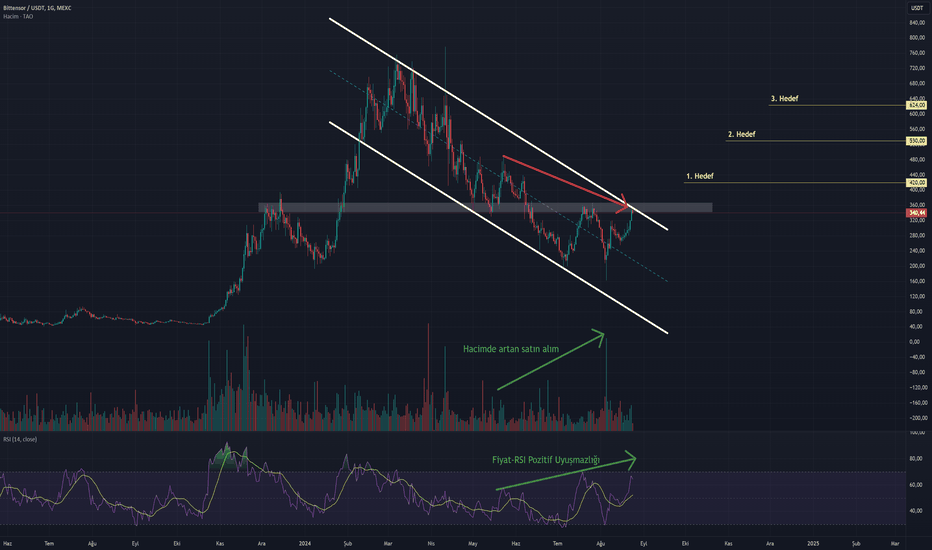

Technical analysis by gen1trade about Symbol TAO on 8/24/2024

gen1trade

In my previous analysis, I mentioned that Bittensor has an important place among the "decentralized artificial intelligence protocols" and is worth researching. When we look at the graph, three important points appear. Increased purchases in volume: The graph shows significant increase in the volume indicator. This may be a sign that the interest of buyers in the market increases and potentially supported the upward movement of the price. Price-RSI Positive dispute: Although it tends to decline in the price channel, we observe an upward movement in the RSI indicator. This positive dispute may be a harbinger that the current decrease trend is about to end. Fracture of the falling trend: I think that we can expect a movement to break the right price to the falling trend line seen on the graphic with volume and RSI information and to break this trend. Grayscale Decentralized AI Fund and Tao's future Decentralized AI Fund, which Grayscale founded about 1.5-2 months ago, is among the assets contained in Fund. Although this ratio seems to be low at the beginning, you can see that the ratio has increased a little more since the installation of this fund. I believe that TAO will gain more value over time in this fund. You can reach the Grayscale official document via the official website. In general, it is possible to say that TAO has an upward movement potential, considering both the technical indicators and the presence of the fund. Especially if the falling trend is broken, it is possible to see upward green candles upward. Conclusion: Based on this analysis, we have gone through a period that needs to be followed carefully in the TAO/USDT parity and if a possible falling trend breakage and rise trend starts, I think that the target levels I mentioned on the graph can be reached.