Technical analysis by ADSV11 about Symbol BTC: Sell recommendation (7/28/2024)

ADSV11

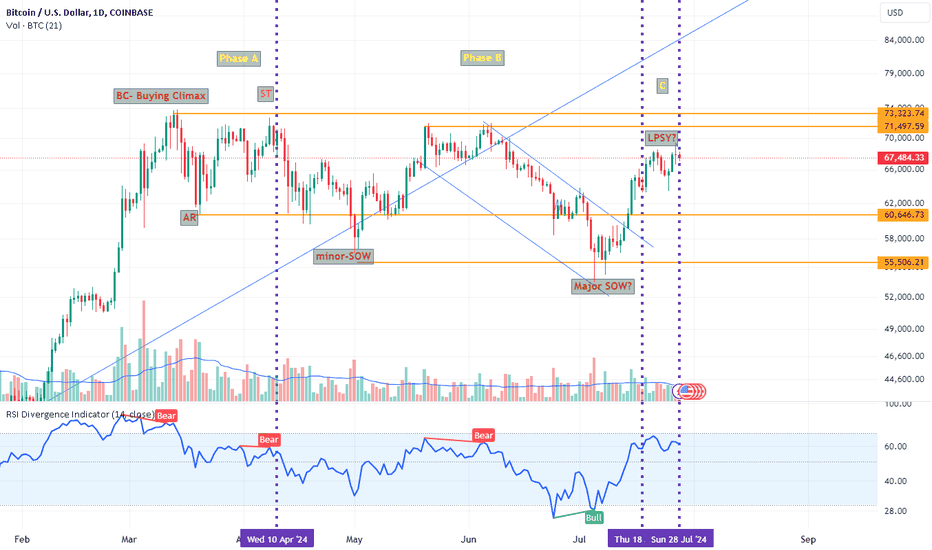

I've been tracking Bitcoin's recent movements, and I believe we're seeing a classic Wyckoff distribution pattern play out. Key Levels and Phases Phase A (Buying Climax - BC): We saw a significant buying climax, where the price reached a peak in the upper $70,000s. An Automatic Reaction (AR) followed, pulling back to around the mid $60,000s. Phase B: During this phase, the price oscillated between the mid $60,000s and the upper $70,000s, forming a series of Secondary Tests (ST) and minor Signs of Weakness (SOW). Notice the increased volatility and volume spikes, typical in this phase. Phase C: We might be in Phase C, where a potential Last Point of Supply (LPSY) is forming. The recent rally failed to break the resistance in the low $70,000s, indicating potential weakness. Diminishing Volume: The recent rally to the low $70,000s saw diminishing volume, hinting at a lack of buying interest. Bearish Signals Major SOW? The price broke below the minor SOW level (mid $50,000s) and bounced back, possibly confirming a major SOW. RSI Divergence: The RSI is showing bearish divergence with multiple bear signals since March. Trading Strategy Short Position: If the price fails to break above the low $70,000s again and shows bearish signs, consider entering a short position. Target the previous support levels around the mid $60,000s and mid $50,000s. Stop Loss: Place your stop loss just above the low $70,000s to manage risk. Remember, always do your own research and trade responsibly. Happy trading!More volumeincrease volume