Technical analysis by pollux3000 about Symbol GLMR: Buy recommendation (3/25/2024)

pollux3000

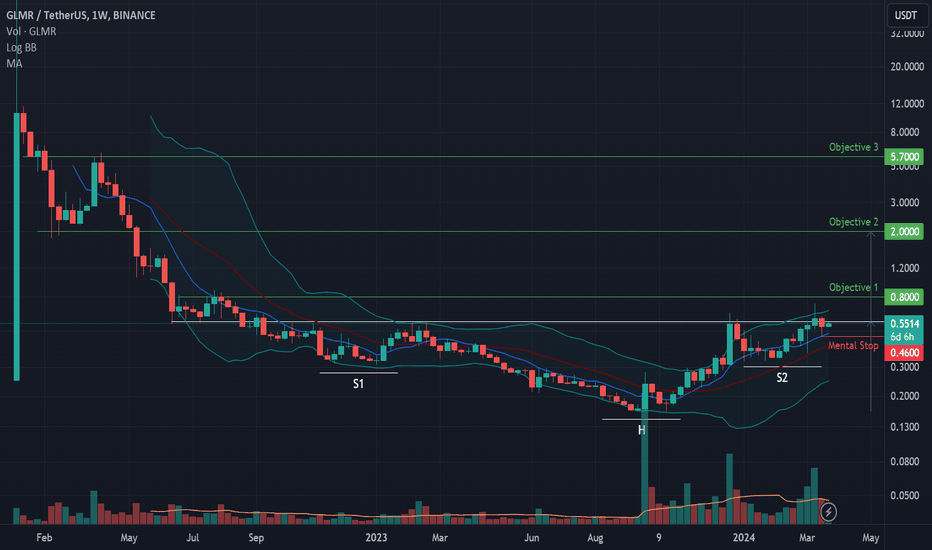

GLMR trade setup

Weekly: long term analysisAfter more than 95% deep correction during the bear market, GLMRUSDT is building a reversal Head&Shoulder on a weekly time frame. Volumes are increasing since the All Time Low corresponding to the Head of the pattern and is following perfectly the H&S psychological structure. Short term analysisThe inverted H&S pattern is attempting a breakout upward. If this breakout is confirmed, prices can start a strong upward move based on previous price action of GLMR. The latest higher low contracted the price’s volatility and offer us a good risk/reward setup.StrategyBuy signal will be given from a daily weekly close above the resistance line (neckline of the inverted H&S) around the 0.56$ mark.Objective 1: Next resistance line (with Risk/Reward =3) at 0.8$ ( +45%)Objective 2: Next resistance around corresponding to the H&S swing move target at the 2$ zone (+260%)Objective 3: Next resistance line at 5.7$ ( +900%)Invalidation Mental Stop: just below the recent daily swing low. This setup proposes a nice Risk RewardIf prices retrace to this stop level we will wait for the daily closing price then set a Stop loss ¼ or Risk below the weekly close price.Risk = Distance between Mental stop and entry point.Our mental stop was quickly touch then real stop was executed at 0.44$ on the 2nd of April. We are out of this trade with a controlled loss of 20%. Let's move on and focus on our next opportunities.