TFUEL

Theta Fuel

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

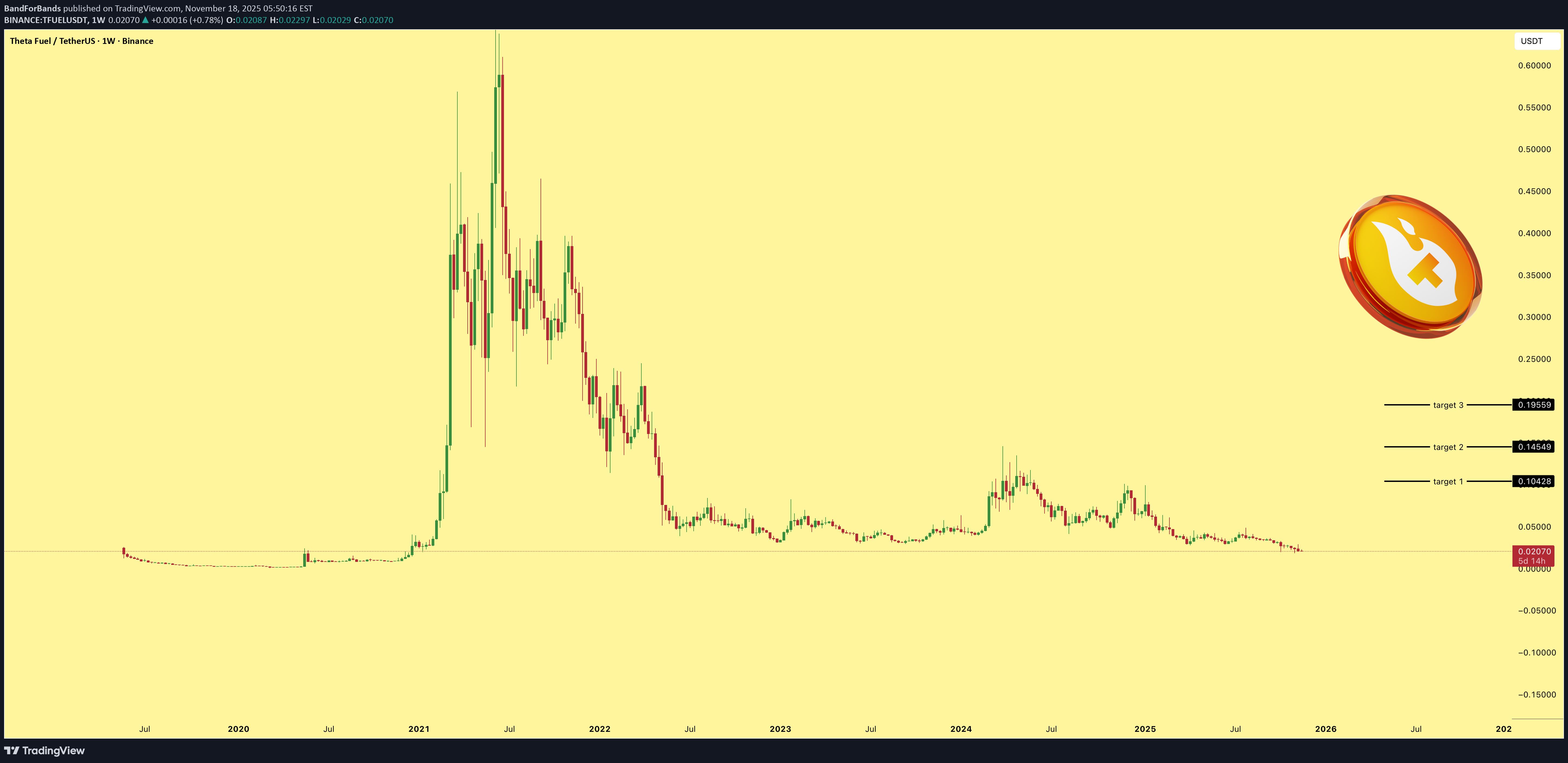

Price Chart of Theta Fuel

سود 3 Months :

سیگنالهای Theta Fuel

Filter

Sort messages by

Trader Type

Time Frame

CryptoWithJames

تحلیل فنی TFUEL: سیگنال صعودی قوی در الگوی گُوِه نزولی (امکان رشد 60 درصدی)

#TFUEL UPDATE TFUEL Technical Setup Pattern: Falling Wedge Pattern Current Price: $0.041 Target Price: $0.065 Target % Gain: 60.00% Technical Analysis: TFUEL is showing a breakout from a falling wedge pattern on the 1D chart, signaling bullish potential. The price has moved above the wedge’s resistance trendline, indicating a shift in momentum. If buying pressure continues, TFUEL is positioned to move toward the projected target zone, supported by improving structure and early bullish reaction. Time Frame: 1D Risk Management Tip: Always use proper risk management.

Bithereum_io

آینده TFUEL: آیا این کوین از الگوی گُوِه نزولی میجهد؟ (اهداف صعودی بزرگ)

#TFUEL is moving inside a falling wedge pattern on the daily chart and is currently facing the daily SMA50. Volume has increased, and the probability of a breakout above the wedge resistance is high. If that happens, the potential upside targets are: 🎯 $0.02682 🎯 $0.03071 🎯 $0.03385 🎯 $0.03698 🎯 $0.04146 🎯 $0.04715 ⚠️ Always remember to protect your capital with a proper stop-loss and disciplined risk management.

BandForBands

Bithereum_io

آیا TFUEL آماده جهش بزرگ است؟ تحلیل الگوی گوه نزولی و اهداف قیمتی انفجاری!

#TFUEL is moving inside a falling wedge pattern on the daily chart. In case of a breakout above the daily SMA50 and the wedge resistance, the potential targets are: 🎯 $0.03175 🎯 $0.03601 🎯 $0.03945 🎯 $0.04290 🎯 $0.04780 🎯 $0.05404 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

CryptoNuclear

TFUEL/USDT – Critical Multi-Year Demand Zone Test!

🔎 Overview TFUEL is now at a make-or-break moment. After its explosive rally and peak in 2021, the price has been under heavy selling pressure, consistently forming lower highs. Yet, since 2022, TFUEL has repeatedly found support at a multi-year demand zone (0.022 – 0.033), which is once again being tested. This zone represents the last stronghold for buyers before the market risks sliding into a deeper bearish phase. Historically, every touch of this area has sparked notable buying reactions, making it a potential strategic accumulation zone for smart money. --- 🏹 Bullish Scenario If the demand zone holds firm: 1. Expect a valid bounce from 0.022 – 0.033 with a bullish weekly candle or strong lower wick rejection. 2. First target: 0.049 (minor resistance) → the key gateway to a recovery structure. 3. A confirmed breakout above 0.049 → opens the path to 0.0736 and 0.112, signaling a potential mid-term trend reversal. 4. Further breakouts above 0.14 – 0.21 → would mark a full macro reversal, with upside potential toward 0.397 – 0.59. 📈 In short: all bullish outcomes depend on a confirmed reaction from this critical demand zone. --- 🐻 Bearish Scenario If selling pressure overwhelms demand: 1. A weekly close below 0.022 would be a strong signal of breakdown. 2. Next downside targets: 0.0145 – 0.0117 (historical lows). 3. Such a move could trigger a capitulation phase, with the market searching for a new bottom. 📉 In short: if the last stronghold breaks, the downtrend accelerates. --- 🧩 Market Structure & Psychology TFUEL has been in a multi-year consolidation with sellers dominating (lower highs) while buyers consistently defend the demand zone. This creates a classic psychological battle: accumulation by strong hands (institutions/whales) vs distribution by impatient retail traders. A bounce could trigger a sharp rally as shorts and weak hands get trapped. On the other hand, a breakdown could spark panic selling and mass capitulation. --- 🎯 Conclusion TFUEL is now at its most critical zone since 2021. Bullish case: bounce from demand zone → 0.049 → 0.0736 → 0.112. Bearish case: breakdown <0.022 → 0.0145 → 0.0117. Weekly timeframe signals are significant here, as they will likely define TFUEL’s mid- to long-term direction. --- #TFUEL #ThetaFuel #CryptoAnalysis #Altcoins #SupportResistance #WeeklyChart #CryptoTA #LongTermView

Crypto_alphabit

#TFUEL (SPOT)

TFUELUSDT #TFUEL/ USDT Entry (0.0380 - 0.0415) SL 4H close below 0.037 T1 0.056 T2 0.075 _______________________________________________________ Golden Advices. ******************** * collect the coin slowly in the entry range. * Please calculate your losses before the entry. * Do not enter any trade you find it not suitable for you. * No FOMO - No Rush , it is a long journey.

MasterAnanda

Theta Fuel Whale Mistake Bullish Signal Revealed

Look at this... The charts reveal everything always before the event takes place.This happened yesterday on KuCoin, TFUELUSDT grew 185% but all the gains were removed.The peak happened at 0.09500. This means one thing and one thing only, there is no longer any resistance all the way up to that price. All the sell orders that were placed have been filled. This means that once the market turns bullish, this pair will move straight up. That's the proof, right there, yesterday's candle.This signal can be read in many different ways but they are all bullish, so, what will you do?Theta Fuel is going up. You read about it here first.Thanks a lot for your continued support.I am keeping it simple; simple is best.Namaste.

CryptoNuclear

MohamedSewid

TFUEL: A Possible Corrective Rise

#TFUEL is a token in the THETA coin ecosystem. It had a magnificent run back in 2020 - 2021. After that, it had a huge decline till late 2023 that was followed by a complex corrective pattern. Currently, it sits near a record local low that presents some short to mid term bullish expectation. Holding above $0.0277 is a stop-loss to a rewarding potential corrective bullish rise. #ThetaFuel

CryptoWithJames

TFUELUSDT UPDATE

TFUEL/USDT Technical SetupPattern: Falling Wedge BreakoutCurrent Price: $0.03465Target Price: $0.045, $0.065Target % Gain: ~30% to ~87%Technical Analysis: TFUEL has broken out of a long-term falling wedge on the daily chart. The breakout is supported by a strong bullish candle and increasing momentum, indicating a potential upside move.Time Frame: 1DRisk Management Tip: Always use proper risk management.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.