LTO

LTO Network

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of LTO Network

سود 3 Months :

سیگنالهای LTO Network

Filter

Sort messages by

Trader Type

Time Frame

Zorroreny

LTO - capitulation dump before strong push up?

LTO lost support at 0.05$ and did massive dump. This looks now like completed impulse to downside with significant capitulation dip. We are oversold and when looking similar structure on lower timeframes we see that bounce up was usually very strong (push to fibb 0.786-0.886 range) so I am expecting similar action also now - bounce and strong push to test 0.25-0.50$ range.

Danyal_mdb

LTOUSDT

Expecting trend will reverse from here.BuyStop order and SL are mention on the chart

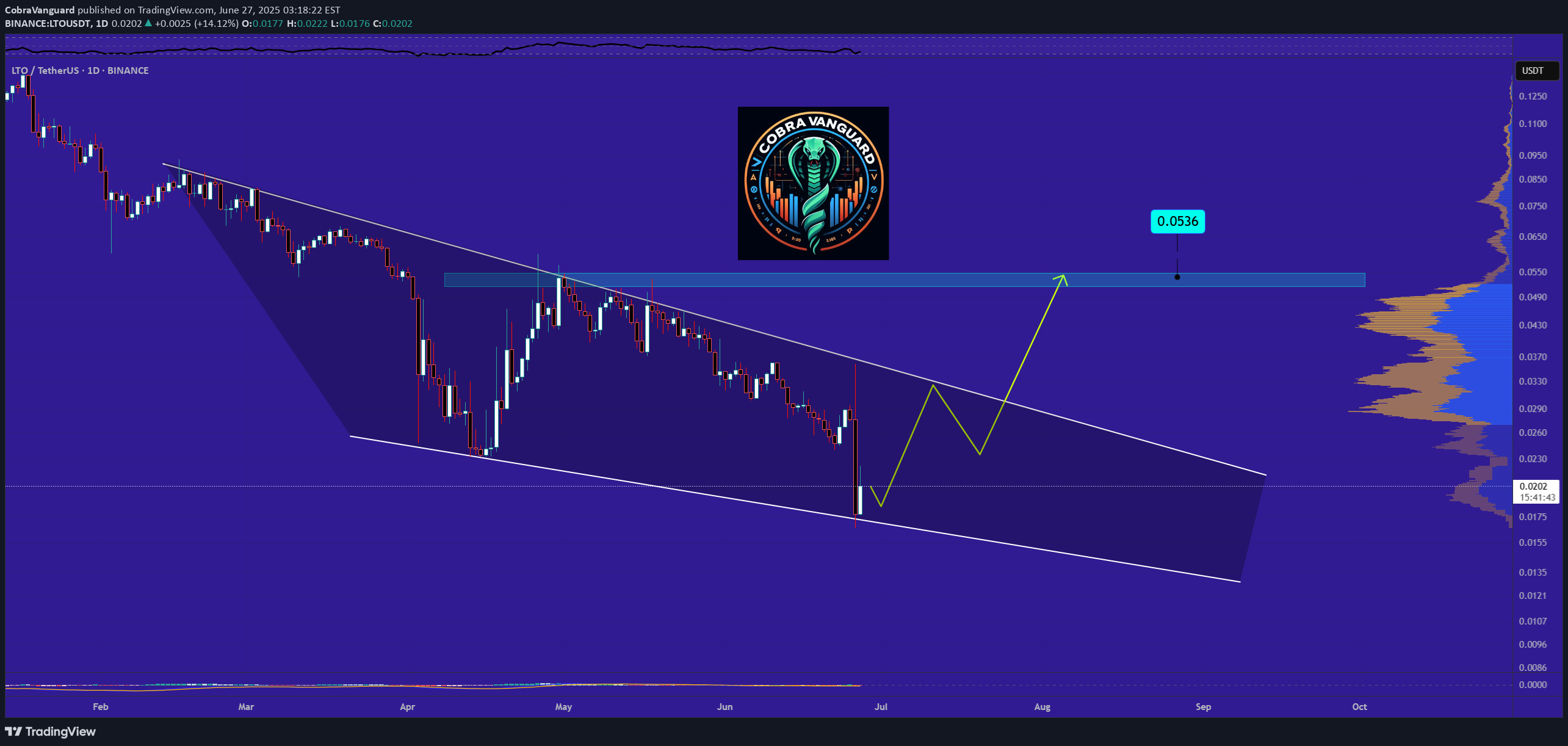

CobraVanguard

LTO Analysis - What Shall we Expect !!!

If the price can break through this Wedge's resistance, I expect it to reach $0.05 in a short time.Stay Awesome , CobraVanguard

CryptoNuclear

MyCryptoParadise

Is #LTO Ready for an Explosive Move or Another Trap Ahead?

Yello Paradisers! Are you watching how #LTO is quietly tightening within a triangle while the rest of the market looks away? This might just be the last moment of silence for #LTONetwork:💎#LTOUSDT is currently consolidating within a clean symmetrical triangle, wedged tightly between a descending resistance and an ascending support trendline. This pattern has already seen multiple touches on both edges, suggesting price is nearing the point of decision.💎What makes this formation more compelling is how #LTOUSD is holding just above the immediate support at the $0.0371 zone and 20EMA is also acting as support. This area has acted as a launchpad twice already, keeping bullish hopes alive. Price is once again pressing against the upper boundary of the triangle, increasing the odds of a breakout on the next attempt.💎If bulls manage to push above the descending resistance and we see a confirmed breakout with strong volume, the first upside target sits at $0.0533, which is a key short-term resistance level. From there, momentum could carry the price toward $0.0598, where a strong historical resistance lies based on the volume profile.💎However, the bullish structure is clearly invalidated on a break below $0.0321. Any decisive move under this support zone would shift the short-term outlook in favor of the bears, potentially opening a path toward lower support.Discipline, patience, robust strategies, and trading tactics are the only ways you can make it long-term in this market.MyCryptoParadiseiFeel the success🌴

CryptoNuclear

LTOUSDT 1D Analysis

Rockybullcrypto

LTO Long at breakout

Buy gradually from here or wait for breaking through this resistance line with a short-term target of at least 10%+.

Bithereum_io

LTOUSDT 1D

#LTO is moving inside a descending broadening wedge pattern on the daily chart. Consider buying it here and near the support level of $0.0401.In case of a breakout above the pattern resistance and the Ichimoku cloud, the targets are:🎯 $0.0574🎯 $0.0744🎯 $0.1060🎯 $0.1316⚠️ Use a tight stop-loss.

CryptoWithJames

LTOUSDT UPDATE

Pattern: Falling Wedge BreakoutCurrent Price: \$0.0465Target Price: \$0.105,Target % Gain: 130.59%Technical Analysis: LTO has broken out of a long-term falling wedge pattern on the 1D chart, suggesting bullish momentum. Volume has increased post-breakout, confirming strength. A move toward \$0.105 is likely.Time Frame: 1DRisk Management Tip: Always use proper risk management.

TheSignalyst

LTO - Its Logo Says It All...

Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.📚 After breaking above the $0.03 structure marked in blue, LTO has shifted its momentum from bearish to bullish.It is currently in a correction phase, but as long as the $0.03 support holds, we’ll be eyeing trend-following long setups to catch the next impulsive wave upward.📈🎯 Short-term target: $0.05🎯 Mid-term target: $0.10🎯 Long-term target: $0.50📚 Always follow your trading plan regarding entry, risk management, and trade management.Good luck!All Strategies Are Good; If Managed Properly!~Rich

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.