JUV

Juventus Fan Token

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Juventus Fan Token

سود 3 Months :

سیگنالهای Juventus Fan Token

Filter

Sort messages by

Trader Type

Time Frame

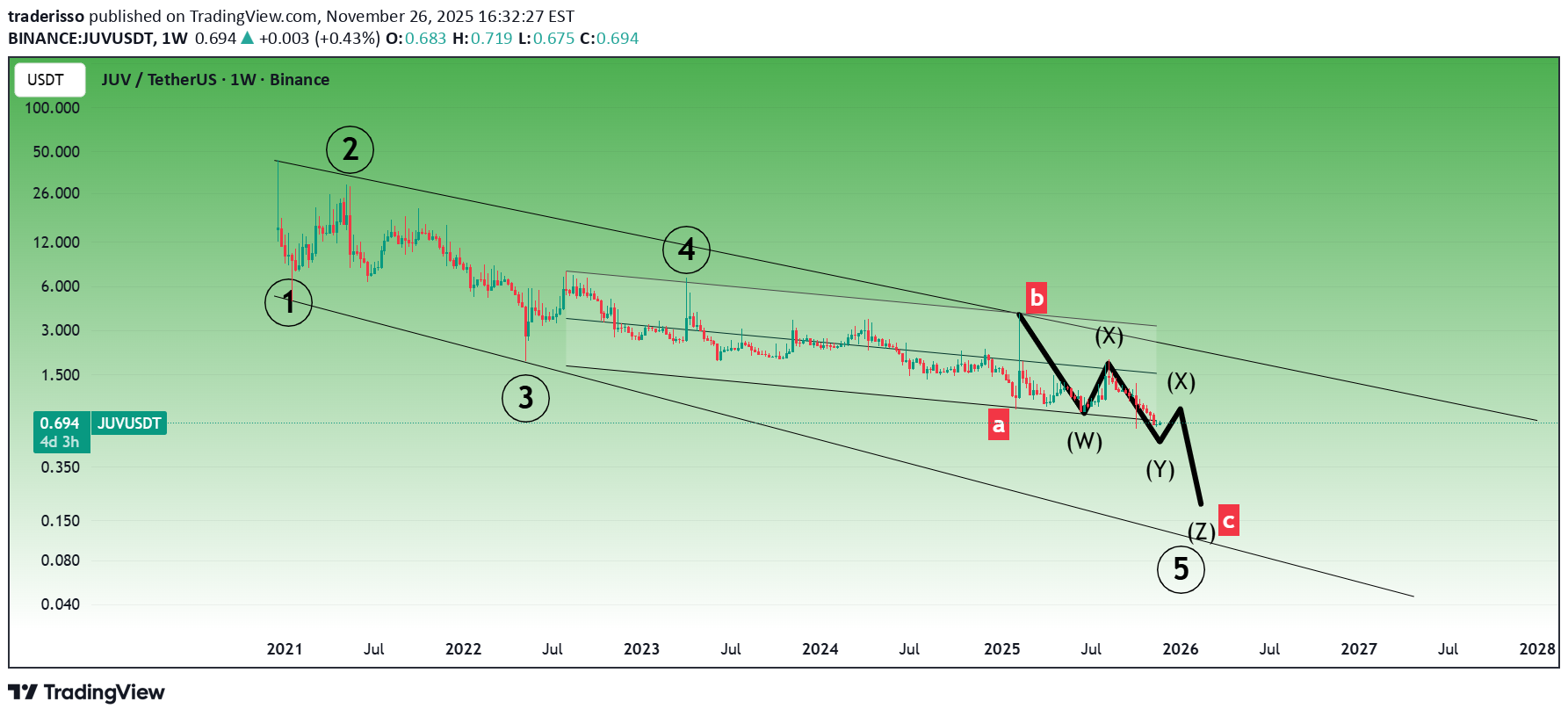

traderisso

نقشه راه توکن فان یوونتوس: تحلیل موجها و عوامل کلیدی قیمت

There is a possibility that the correction will deepen, but the 5th wave may be much shorter than I expected. Analyzes can be misleading for coins with very low supply. My aim is always for educational purposes. The most important element in price movements is always the supply and demand balance. * The purpose of my graphic drawings is purely educational. * What i write here is not an investment advice. Please do your own research before investing in any asset. * Never take my personal opinions as investment advice, you may lose your money.

Alpha-GoldFX

JUVUSDT Forming Falling Wedge

JUVUSDT is currently forming a falling wedge pattern, which is widely recognized as a bullish reversal signal in technical analysis. This setup shows that the price is compressing downward with lower highs and lower lows, but with decreasing selling momentum. When combined with strong trading volume, the probability of a bullish breakout increases significantly, giving this coin the potential for a 60% to 70%+ upside move. The wedge structure indicates that sellers are gradually losing strength while buyers are preparing for an entry. Once JUVUSDT breaks through its key resistance level, momentum traders and long-term investors could step in aggressively, fueling a rapid rally. Historically, this type of breakout has triggered strong surges across various crypto pairs, making this pattern particularly important to watch. Investor interest in this project has also been building, which strengthens the bullish case. Market sentiment and strong accumulation support the idea that JUVUSDT could soon shift direction and open up new growth opportunities. With favorable technicals and rising engagement, this pair is becoming more attractive to traders searching for high-probability setups. ✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

CryptoWithJames

JUVUSDT UPDATE

#JUV UPDATE JUV Technical Setup Pattern: Bullish falling wedge breakout Current Price: $1.085 Target Price: $1.625 Target % Gain: 50.32% JUV is breaking out of a falling wedge pattern on the 1D timeframe. The breakout indicates bullish momentum with potential upside toward $1.625. Market structure favors continuation if buying pressure sustains. Always use proper risk management.

vipsy6

JUV 4H Trade Idea

Here is a trade idea for JUV on 4H TF. Expected RR is 1.78, which looks good. NFA. DYOR

CryptoWithJames

JUVUSDT UPDATE

\#JUV UPDATE JUV Technical Setup Pattern: Bullish Flag Current Price: \$1.566 Target Price: \$2.40 Target % Gain: 65.88% Technical Analysis: JUV is forming a bullish flag on the 1D chart after a strong impulsive move, consolidating within a tight range. Price has held above \$1.40 support with increasing bullish momentum, and a breakout above the flag resistance could trigger a sharp rally toward \$2.40. Time Frame: 1D Risk Management Tip: Always use proper risk management.

AltcoinPiooners

$JUV Bearish Divergence

JUVUSDT Trade Setup: Target 1: 1.446 (0.786 Fibonnaci Golden Zone). Target 2: 1.349 (0.618 Fibonnaci Golden Zone). Target 3: 1.280 (0.5 Fibonnaci Golden Zone). Target 4: 0.990 (0 Fibonnaci). DCA : 1.648 (1.135 Fibonacci) Stop Loss: 1.728 (1.272 Fibonacci). RSI Analysis: The RSI is showing a bearish divergence, suggesting potential bearish momentum. The current RSI is around 88.54, approaching oversold territory, so caution is advised.FROM Entry 1 +5.10% PROFIT FFROM DCA +9.59% PROFIT

Alpha-GoldFX

JUVUSDT Forming Bullish Momentum

JUVUSDT is showing signs of a strong recovery from its recent consolidation phase, with a clear bullish momentum starting to emerge. The price action has bounced confidently from a well-defined support zone, highlighted in the chart, and buyers have stepped in aggressively. This indicates strong market interest and could be the early stage of a new upward trend. The expected upside potential ranges from 30% to 40%+, supported by increasing volume and favorable sentiment. The token is now trading just above a key breakout zone, which has historically acted as resistance but is now turning into strong support. This shift in market structure is often a signal of a bullish reversal. Given the recent breakout attempt and minor pullback for retesting, the chart suggests JUVUSDT may be gearing up for a significant push toward the next resistance level. Technical indicators such as RSI and MACD also hint at further bullish continuation if current levels hold. Investor interest in JUV is steadily growing, with fundamentals and market sentiment aligning to support a short-to-mid-term rally. The project’s presence in the fan token sector, along with improving volume trends on major exchanges like Binance, reflects increasing confidence among traders and crypto investors. Traders keeping a close eye on potential breakout setups should not overlook JUVUSDT. The current technical setup offers a promising opportunity with a favorable risk-reward ratio, especially if the bullish momentum accelerates from here. ✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ABU-RAYAN

Descending Wedge Trend Breakou

As shown in the graph, a clear penetration of the fridged trend in strong quantities after penetration of a very important resistance It is expected to continue the upward trend to the goals shown

Qaisrani-Trades

JUV/USDT (4H) – Inverse Head and Shoulders Breakout Setup

JUV/USDT (4H) – Inverse Head and Shoulders Breakout SetupPattern: Inverse Head and Shoulders 👕Timeframe: 4-Hour ⏱️Pair: JUV/USDT 💱Published: June 12, 2025 📅---Technical Overview:JUV/USDT is developing a textbook inverse head and shoulders pattern, signaling a possible trend reversal. The left shoulder formed near 1.040, the head reached down to 0.980, and the right shoulder is forming again around 1.040. A descending neckline is being tested near 1.080. A confirmed breakout could open room for upside continuation 📈.---Potential Trade Setup:Bullish Scenario ✅Entry: On a confirmed 4H candle close above 1.080 with strong volumeTargets:* First target at 1.140 🎯* Second target at 1.180 🎯 Stop-loss: Below the right shoulder at 1.030 🛑Bearish Scenario ❌Invalidation: Failure to break the neckline followed by rejection at or below 1.080Confirmation: Breakdown below the rising trendline supporting the right shoulderTargets:* First target at 1.000 📉* Second target at 0.980 📉 Stop-loss (if shorting): Above neckline at 1.085 🛑---Risk Management ⚠️A false breakout or rejection from the neckline without volume confirmation could trap early bulls. If the price breaks below the right shoulder and trendline, bearish momentum may resume. Always wait for confirmation and use protective stops 📊.---Conclusion:JUV is testing a major technical pattern. A confirmed breakout can lead to strong gains, while failure may push the price back toward recent lows. Let the structure complete and act only on confirmed moves 🔍⏳.

Kapitalist01

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.