IMX

Immutable

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

MohamedSewidRank: 31953 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 11/25/2025 |

Price Chart of Immutable

سود 3 Months :

سیگنالهای Immutable

Filter

Sort messages by

Trader Type

Time Frame

MohamedSewid

فرصت صعودی بزرگ IMX: آیا این آلت کوین گیمینگ به اوج بازمیگردد؟

#IMX is a leading alt-coin in the gaming sector. After nearly two years of decline and a recent ATL, it shows potential for a comeback after forming a historical zigzag pattern. Passing $0.96 is a key bullish confirmation to building strength for a reversal #Immutable

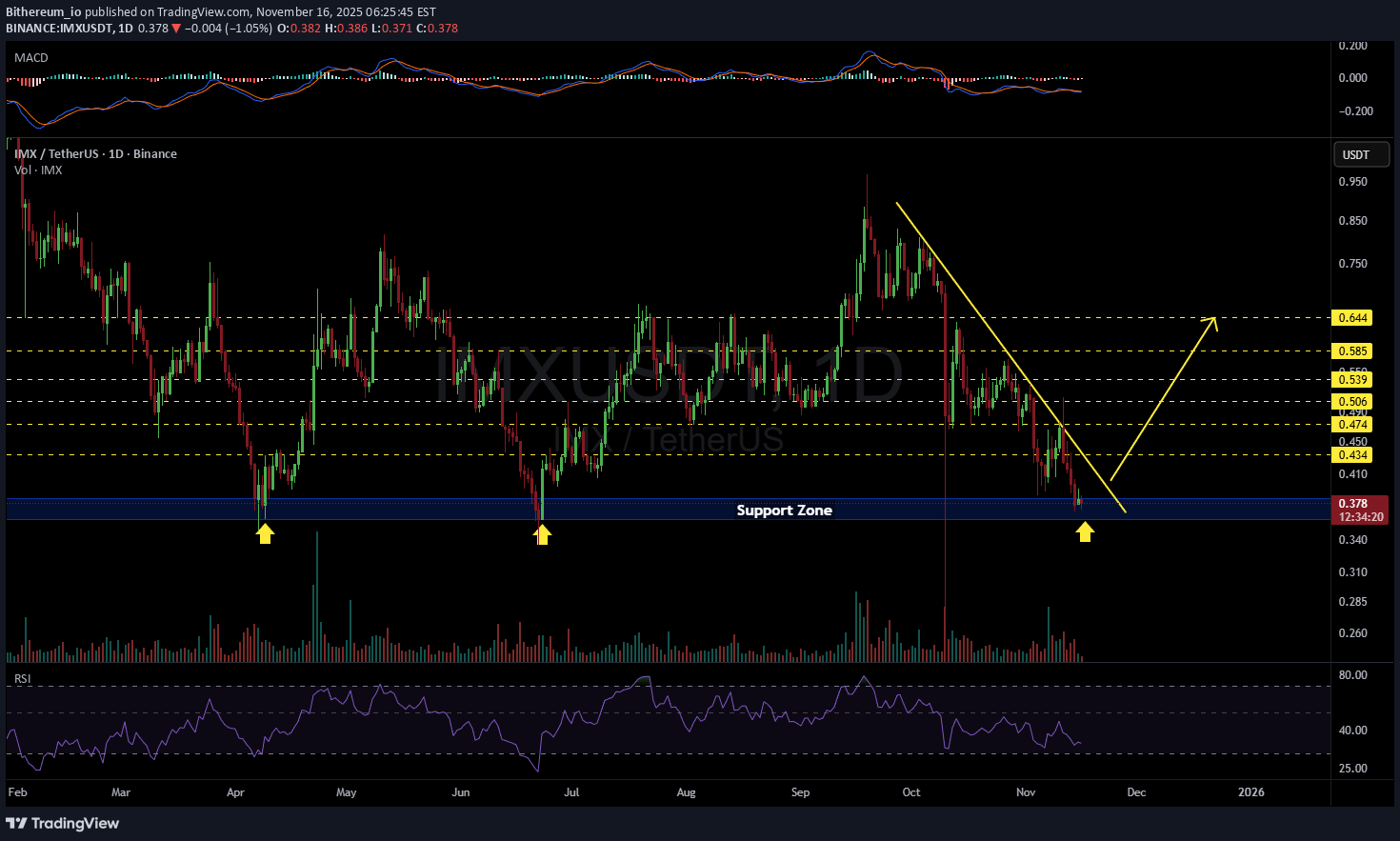

Bithereum_io

تحلیل تکنیکال IMX/USDT: آماده جهش به سمت اهداف قیمتی جدید؟

#IMX has settled on the support zone once again. It appears that a triple bottom formation is developing. If we get a successful bounce from the support zone with increased volume, we can expect the following upside targets: 🎯 $0.434 🎯 $0.474 🎯 $0.506 🎯 $0.539 🎯 $0.585 🎯 $0.644 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

shirkhanian_javad

تحلیل تکنیکال ایمکس (IMX/USDT): سطوح کلیدی حمایت و مقاومت در نمودار مثلثی!

the price of this cruptocurrency is in a triangle support and resistance are clearly visible in the chart

Hyperwave_Mauritius

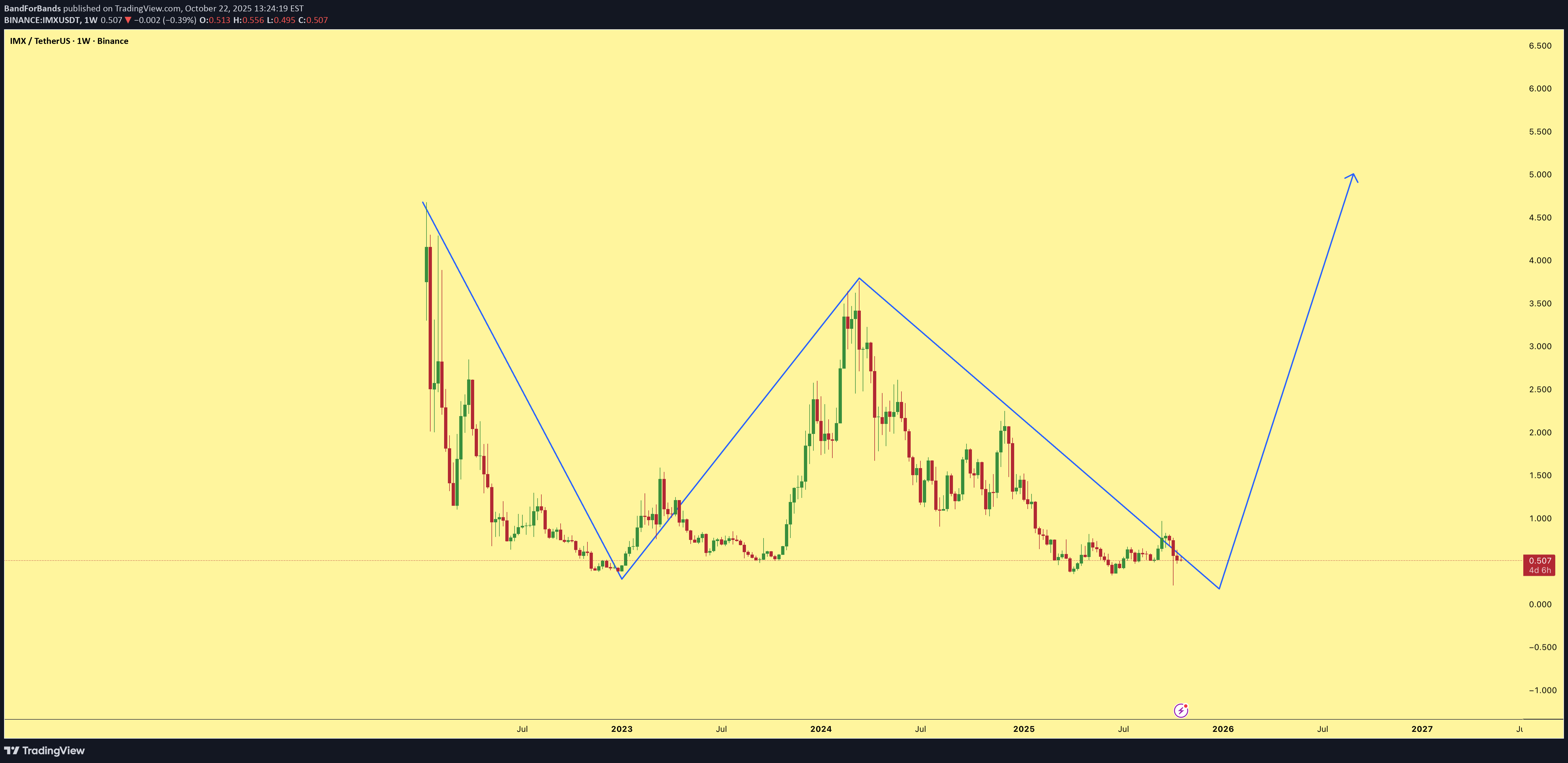

چرا باید «IMX» را همین حالا به سبد داراییهای خود اضافه کنید؟ (تحلیل نمودار خیرهکننده)

IMX is the type of Assets that must be in your portfolio. Not financial advice. But this chart looks very well readybuying in heavy on imx this weekendi am still going to hold my bags of IMX however based on trend and patterns. i do believe the cycle will shift towards LTC before going to imx most likely first quarter of 2026.

miljedtothemoon

پیشبینی قیمت IMXUSDT: حرکت بعدی در محدوده 0.50 و اهداف صعودی/نزولی کلیدی

Price is consolidating around the 0.50 zone, with a bullish breakout above 0.55 potentially targeting 0.68, while a rejection from this area may trigger a bearish continuation toward 0.47 and 0.42. Sideways movement between 0.47–0.55 would signal indecision and further consolidation. Always plan and manage your trades according to your risk tolerance and strategy.

BandForBands

TheirThereTheyre

تشکیل کف سهگانه در منطقه حمایتی: بهترین فرصت خرید در چارت روزانه!

Looks like a potential Triple Bottom (orange) on the Daily as well as consolidation on/near the support line (white). This area seems like a great buy zone. Not financial advice. https://www.tradingview.com/x/fkrwUDNR/

CryptoNuclear

IMX در کف قیمت تاریخی؛ آیا زمان انباشت است یا دام نهایی؟

After a prolonged downtrend since 2022, Immutable X (IMX) is once again testing the critical accumulation zone between 0.48 – 0.38 USDT — a price area that has repeatedly acted as a major turning point in the past. This yellow demand block now represents the last stronghold of buyers, where every dip has historically triggered strong rebounds marked by long lower wicks — a clear sign of buying absorption and smart money activity. For now, IMX remains trapped within a large consolidation range, capped by resistance around 0.75 USDT. Whether the price breaks out or breaks down from this range will likely determine IMX’s trajectory for the months ahead. --- Pattern & Structural Analysis Primary trend: Long-term bearish, but currently showing signs of potential base formation. Demand Zone (Yellow Block): 0.48 – 0.38 USDT, acting as the main accumulation area. Key Resistance: 0.75 USDT — a breakout above this level could mark the start of a trend reversal. Long Lower Wicks: Indicate liquidity sweeps and strong absorption by buyers. Market Structure: Sideways range — a transitional phase between distribution and potential accumulation. --- Bullish Scenario (Reversal Setup) A decisive close above 0.75 USDT, backed by increasing volume, would confirm the start of a new bullish phase. First upside target sits at 1.14 USDT, followed by 2.35 USDT — a major macro resistance zone. The structure would shift from range-bound to higher highs and higher lows, signaling clear bullish control. Confirmation trigger: Formation of a higher low above 0.65 after breakout — indicating sustainable momentum. --- Bearish Scenario (Breakdown from Accumulation Zone) If price closes below 0.38 USDT on the 6D timeframe, it would invalidate the current accumulation range. This breakdown could lead IMX to revisit 0.21 – 0.25 USDT, aligning with previous historical lows. Such a move would confirm a capitulation phase before any major reversal takes place. --- Psychological & Macro Perspective IMX is likely in its “disbelief zone” — the phase where the majority lose interest, yet smart money quietly begins accumulation. The reaction inside the 0.48 – 0.38 USDT demand zone will determine the next macro direction: either the beginning of a long-term reversal, or the final flush before true recovery. --- Conclusion The 0.48 – 0.38 USDT zone is a decisive battleground between bulls and bears. As long as IMX holds above this block, the reversal potential remains alive. A confirmed breakout above 0.75 USDT could trigger a multi-month rally. However, a breakdown below 0.38 would likely lead to another bearish leg toward 0.21 USDT. --- #IMX #ImmutableX #IMXUSDT #CryptoAnalysis #SmartMoney #TechnicalAnalysis #AccumulationZone #SwingTrade #CryptoTA #PriceAction

ULYSSESTRADER

تحلیل تکنیکال فوری: فرصت فروش (شورت) جذاب در IMX/USDT با ریسک به ریوارد عالی!

1. Chart Context Pair: IMX/USDT Timeframe: 1h Current Price: ≈ 0.551 USDT Market sentiment: Price recently failed to create new highs and is now retesting a resistance zone. 2. Trade Setup The highlighted red/green zone represents the short trade idea: Entry Zone: Around 0.551 USDT (current price at resistance). Stop Loss (SL): 0.578 USDT (top of the red box). If price goes above this, the short idea is invalidated. Take Profit (TP): 0.492 USDT (bottom of the green box). Targeting a drop back into support. 3. Risk/Reward Ratio Risk (SL distance): ~0.027 USDT Reward (TP distance): ~0.059 USDT R:R ratio ≈ 2.18:1 This is a favorable setup, offering more than 2x reward compared to risk. 4. Support & Resistance Resistance Zone: 0.55 – 0.57 (price rejected here earlier). Support Zone: Around 0.49 – 0.52 (highlighted in the green zone). The trader expects sellers to step in at resistance and push price back down toward support. ✅ In summary: This is a short position on IMX/USDT where the trader enters at ~0.55, places a stop loss at 0.578, and aims for 0.492. The risk/reward is strong (≈2:1), based on the idea that resistance will hold and price will drop back into the support zone.

Filnft

پیشبینی سقوط ایمکس به ۶۵ سنت: فرصت فروش فوری با ریسک کم!

Imx short to $0.65 Just opened Sl: 0.705 Time sensitive. Reason for trade: Downtrend + HTF correlationRepositioned imx shortAm now 1k in post ideas. I'll stop posting trade signals here.Trading-view mods be flagging my posts for spam or low quality. Mind you I don't benefit from sharing these post and when I mentioned X even though was part of plan it became an issue

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.