ENJ

Enjin Coin

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Enjin Coin

سود 3 Months :

سیگنالهای Enjin Coin

Filter

Sort messages by

Trader Type

Time Frame

iMoneyTeam

ENJ Buy/Long Signal (4H)

ENJ has formed a bullish CH (Change of Character) on the chart. Higher lows are continuously being printed, and at the top of the chart we have a CP pullback/drop. If the price holds the two entry points that we marked on the chart, it can move upward and attack the higher zones. We have two entry points, which should be entered using a DCA approach. It is expected that the liquidity pools above the chart will be swept soon. Do not enter the position without capital management and stop setting Comment if you have any questions thank youAfter hitting the entry points, it pumped over 13% and the first target was reached

Alpha-GoldFX

ENJUSDT Forming Falling Wedge

ENJUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 90% to 100% once the price breaks above the wedge resistance. This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching ENJUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal. Investors’ growing interest in ENJUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates. ✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is your opinion about this Coin?) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

CryptoWithJames

ENJUSDT UPDATE

ENJ UPDATE ENJ Technical Setup Pattern: Falling Wedge Pattern Current Price: Target Price: Target % Gain: 110520% Technical Analysis: ENJ is breaking out of a falling wedge pattern on the 1D chart, signaling bullish potential. The price has recently surged above the resistance trendline, supported by an increase in volume. The setup is validated as the price approaches key resistance areas. Time Frame: 1D Risk Management Tip: Always use proper risk management.

iMoneyTeam

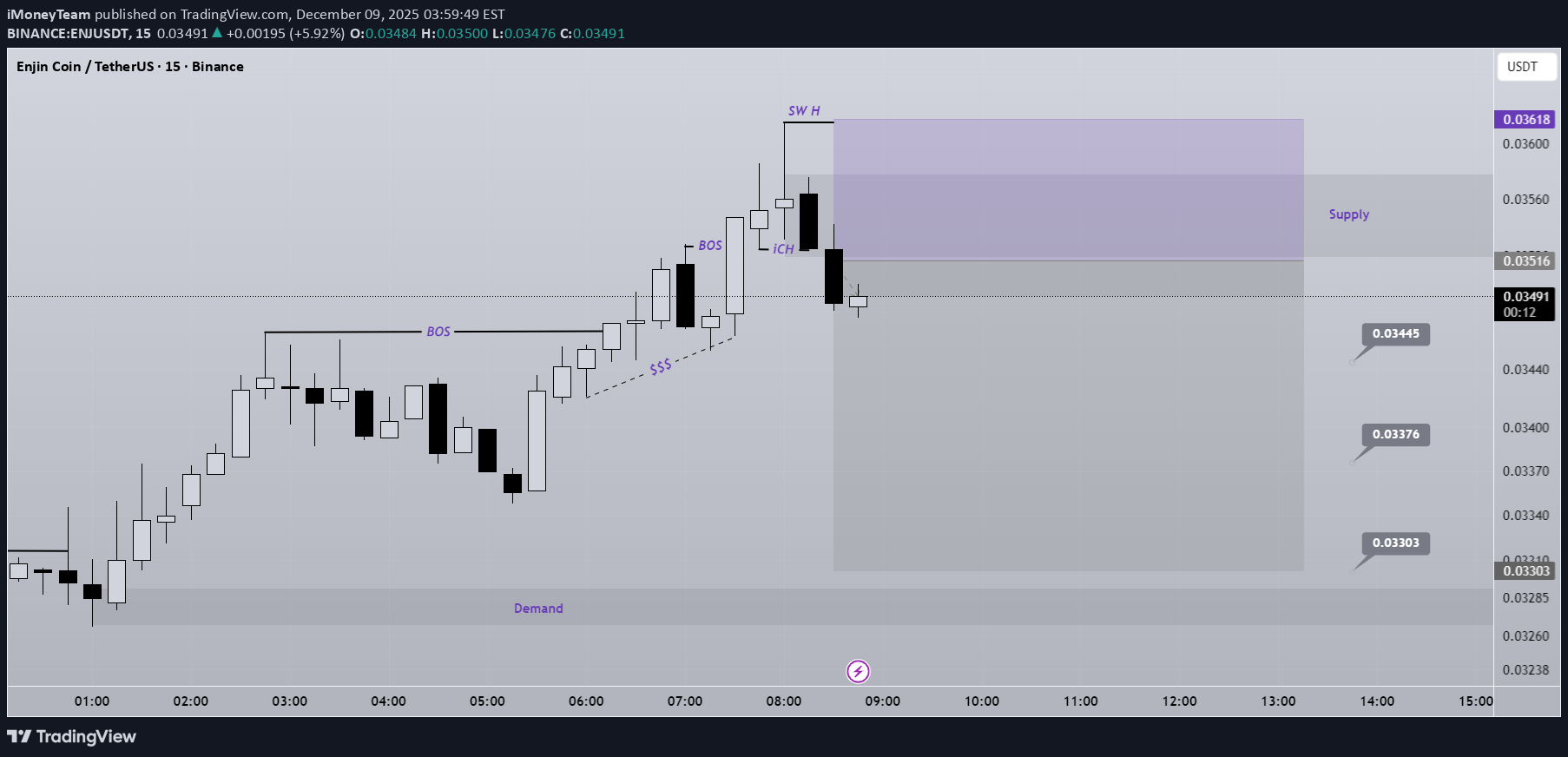

ENJ Sell/Short Signal (15M)

It seems the market is waiting for the FED news on October 10. That’s why market volatility has decreased, and we are forced to trade on lower timeframes. The stop loss, entry zone, and targets are marked on the chart. If you enter this position earlier, the risk-to-reward ratio will be lost. If price returns to the entry zone, we can enter the trade. Please note that if the final target is hit and then price comes back to the entry zone, we will not enter again. Do not enter the position without capital management and stop setting Comment if you have any questions thank youConsidering that the previous setup was stopped out with a 2% stop loss, the next setup we are looking for on ENJ is as follows: Entry zone: 0.0355 – 0.0422 Targets: 0.03449 – 0.03001 – 0.02521 Stop loss: 0.04480

iMoneyTeam

ENJ Sell/Short Setup (15M)

It seems the market is waiting for the FED news on October 10. That’s why market volatility has decreased, and we are forced to trade on lower timeframes. The stop loss, entry zone, and targets are marked on the chart. If you enter this position earlier, the risk-to-reward ratio will be lost. If price returns to the entry zone, we can enter the trade. Please note that if the final target is hit and then price comes back to the entry zone, we will not enter again. Do not enter the position without capital management and stop setting Comment if you have any questions thank you

asilturk

تحلیل تکنیکال و پیشبینی قیمت ENJ: آیا این ارز دیجیتال آماده جهش است؟

ENJ is currently trading at $0.033 price band. ENJ is the native cryptocurrency of the Enjin Ecosystem, a popular gaming and virtual world platform. ENJ's core mission is to create an infrastructure layer that enables in-game items, virtual assets and NFTs (Non-Fungible Tokens) to have real value. The main difference that separates ENJ from other cryptocurrencies and game projects is that NFTs must be backed with ENJ. Its market value is $65 million, there are 1.91 billion units in actual circulation, and it continues to be traded at the $0.03 (cent) band, which was the price it was offered in 2017. The platform concentration value is above 3, so it is necessary to pay attention to harsh and sudden movements and liquidity. Although the comparative chart BTC shows that the recovery has not started yet, we observe that the recovery has started and the trend formation has occurred in the ETH based chart. If there is a significant increase in volume, it may test new price targets. Sequential targets are indicated in the chart. I wish you pleasant spending.

salah_al_bahi

حقیقت بازارهای مالی: تفاوت فارکس و کریپتو، نقدینگی پنهان و آینده بورس!

Conclusion: Manipulation exists whether in the Forex or Crypto market It also became clear that the liquidity in crypto is not real, and what is known as supply and demand is unrealistic talk My fear is that it does not apply to the stock market As for the market goals specifically for alternative currencies, there are two theories. If according to the divine rule, the Soviets will be satisfied with simple goals. If not, we will reach our real goals

CryptoNuclear

ENJ/USDT — At Demand Zone, Could This Be the Next Major Rebound?

📊 Overview: Enjin Coin (ENJ) is now sitting at one of the most crucial levels in its history. Price is consolidating within the 0.045 – 0.070 USDT demand zone, the very same area that once served as the launchpad for the massive 2020–2021 rally. After years of decline since its 2021 peak, ENJ is once again retesting this key zone. The big question: Will this mark the beginning of a new accumulation phase and bullish cycle, or will we see a breakdown into new lows? --- Structure & Chart Pattern 📉 Primary Trend: Multi-year downtrend since the 2021 ATH (lower highs & lower lows). 📌 Critical Zone: 0.045 – 0.070 USDT demand zone (highlighted in yellow), historically strong support. 📈 Key Resistance Levels: 0.095 – 0.11 – 0.132 – 0.21 – 0.36 → potential upside targets if a rebound occurs. 📉 Extreme Support: 0.0322 → the all-time low, in case of breakdown. --- Bullish Scenario (Potential Rebound / Accumulation) 1. Price holds above 0.045 – 0.070 USDT → confirming demand is active. 2. A breakout above 0.095 – 0.11 USDT → would be the first signal of a medium-term trend reversal. 3. Bullish upside targets: 🎯 0.132 (minor resistance) 🎯 0.2099 (key swing high) 🎯 0.3623 (strong bullish confirmation) 4. With strong momentum, further expansion could push price towards 0.679 – 0.91 USDT, which were major distribution zones in the past. In short, this area offers a potential “discounted entry” if the bullish scenario plays out. --- Bearish Scenario (Continuation of Downtrend) 1. Weekly close below 0.045 → failure of the demand zone. 2. Next downside target: 0.0322 (historical low). 3. A breakdown here strengthens the continuation bearish structure, possibly leading to prolonged sideways movement at low levels before any recovery attempt. --- Conclusion & Key Notes ENJ is now at a golden demand zone that will decide the long-term direction. Aggressive traders may consider scaling in small positions in this zone with a tight stop below 0.045. Conservative traders may prefer waiting for a confirmed breakout above 0.095 – 0.11 before entering larger positions. Risk/Reward looks attractive here, but remember: the macro trend is still bearish, so risk management is crucial. --- "Markets often give second chances at historical levels. ENJ is back to the same area where its last major rally began in 2020. Will history repeat itself with a new bullish cycle, or will we witness fresh lows? This is where patience and risk management make all the difference." --- #ENJ #ENJUSDT #EnjinCoin #CryptoAnalysis #CryptoTrading #Altcoins #SupportResistance #CryptoRebound #CryptoBearish #CryptoBullish #AccumulationZone

yoruk_efe

ENJ, enjcoin

Friends, how are you, I haven't shared it for a while. On the other side there are more users, at least those who follow here are more active and open to learning. The summit of this coin is close to $ 5, I can't say they've seen them, I don't think most coins will renew the summit, this is my own opinion. At least, I believe that this kind of coins that have fallen too much can do if the expected bull comes. Nevertheless, everyone should take their own risk and act accordingly. According to the interaction here, I can continue to share new coins and stocks here. Abundant gains.

Crypto_alphabit

ENJ (SPOT)

ENJUSDT #ENJ/ USDT Entry range (0.0650- 0.0700) SL 1D close below 0.062 T1 0.0810 T2 0.0970 T3 0.1350 **** This coin has a great targets , but this is only the beginning **** _______________________________________________________ Golden Advices. ******************** * collect the coin slowly in the entry range. * Please calculate your losses before the entry. * Do not enter any trade you find it not suitable for you. * No FOMO - No Rush , it is a long journey.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.