CTC

Creditcoin

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Creditcoin

سود 3 Months :

سیگنالهای Creditcoin

Filter

Sort messages by

Trader Type

Time Frame

AtresCryptoAcademy

CTCUSDT 1D Chart Analysis | Ascending Momentum Targets Major BO

CTCUSDT 1D Chart Analysis | Ascending Momentum Targets Major Breakout 🔍 Let’s break down CTC/USDT spot price action and map out the upward scenario as bullish momentum gains traction, with a focus on trendline support, volume dynamics, and key resistance levels. ⏳ 1-Day Overview CTC/USDT on the daily chart is carving out an ascending triangle formation, supported by a firm rising yellow trendline. Price is pressing against key horizontal resistance at $0.7950 as trading volume builds, hinting at buying interest ahead of a breakout move. 📈 Volume & Structure Insights - Steady volume expansion as price approaches the apex, confirming accumulation and bullish intent. - Strong base forming above the yellow ascending trendline, which has consistently held since April. - Immediate upside resistance stands at $0.7950; higher levels to target are $1.1511 and $1.4411 on a convincing breakout. 📊 Key Highlights: - Technical structure: Clear ascending triangle signals bullish continuation if resistance cracks. - Volume spike: Increasing volume supports the validity of the upward move. - Breakout scenario: If price closes above $0.7950, expect momentum to carry toward $1.1511 (next resistance), followed by $1.4411. - Price projection: Short-term retests are likely (see mapped path), but trend bias favors upside as long as the rising support holds. 🚨 Conclusion: CTC/USDT is poised for a breakout, with momentum and volume aligning for an upward move. Watch for a daily close above $0.7950 as the trigger—targets are $1.1511 and $1.4411. Volume acceleration and bullish structure reinforce the setup. Stay alert for invalidation if the ascending trendline fails to hold.

GoldsteinTheProfiletrader

Market makers keep unloading their holdings on CTC

CTC jumped into my eyes because of the OBV. It is going higher and higher on every pullback while maintaining lower highs in price. Looks like MMs keep dumping onto naive buyers that try to buy every "cheap bottom". This is absorption at it´s best. Seellers are really loding into longs at local highs. Price reclaimed the pmPOC but that alone isn´t bullish enough to me. Local 4 hr SFP is not really a sign of strength and we did not spend a lot of time here at the "new local higher high". We are here since roughly 10 hours. It is quick move that happened, here for a short time, already showing since of weakness, I am favoring downside. I would reevaluate if the 4 hr SFP high get´s broken but I probably wouldn´t change my mind into a bullish one, would rather look for another short opportunity. The SFP high stopped at the LVN of the relevant pmProfile. That´s not bullish. If bulls would be strong, they would slide through it and flip it into support / demand. The local uptrend also left many SPs below, which I would like to see filled at some point. This is not a strong foundation for endless upside. I want to be on the side of MMs dumping their **** on the buyers. Will see how this one will play out.

BCIRC

CTC/USDT-12H-Bingx

This is not a financial advice. Always do your own research and always put stoploss in your trade (SL) :) If you want more detailed info how to study and read charts or just need help with some coin, just write to me here a comment, i will try to answer to everybody... i can help you :) all for free, don't worry, BE HAPPY!

Enjoylifee

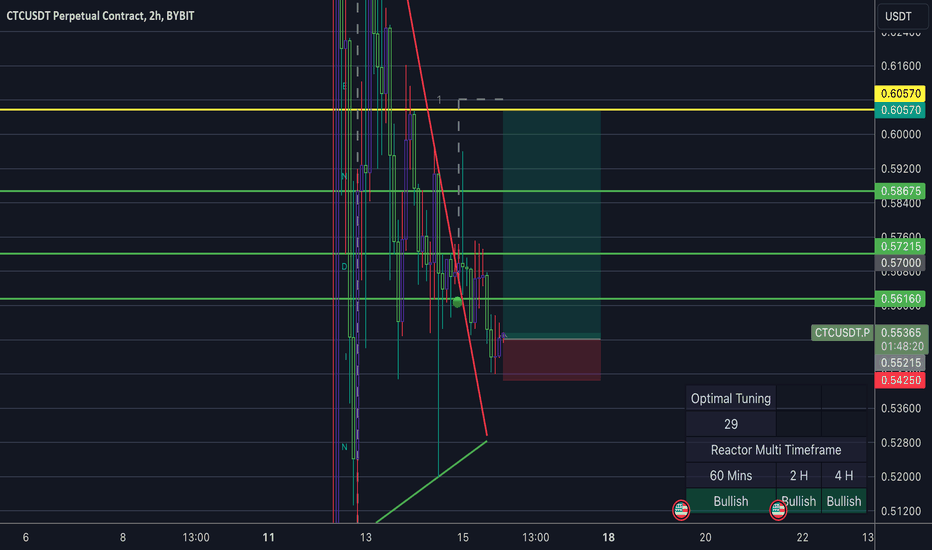

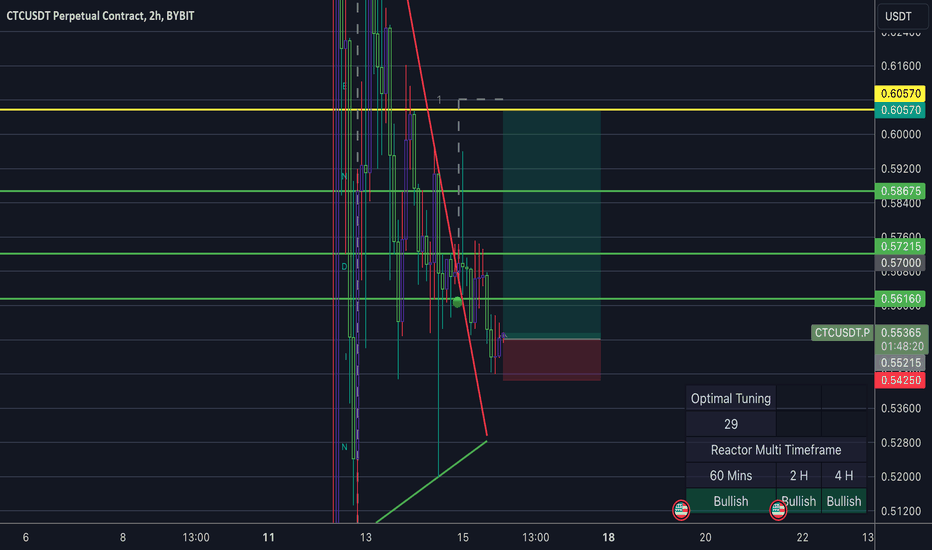

CTC/USDT LONG

Scalping CTC/USDT BIBYT WITH CLOSE STOP LOSS, AND HIGH PROFIT. Remember to take profit at lines, and move stop loss upwards to break even

Enjoylifee

CTC/USDT LONG

Scalping CTC/USDT BIBYT WITH CLOSE STOP LOSS, AND HIGH PROFIT. Remember to take profit at lines, and move stop loss upwards to break even

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.