CORE

Core

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Core

سود 3 Months :

سیگنالهای Core

Filter

Sort messages by

Trader Type

Time Frame

AliferCrypto

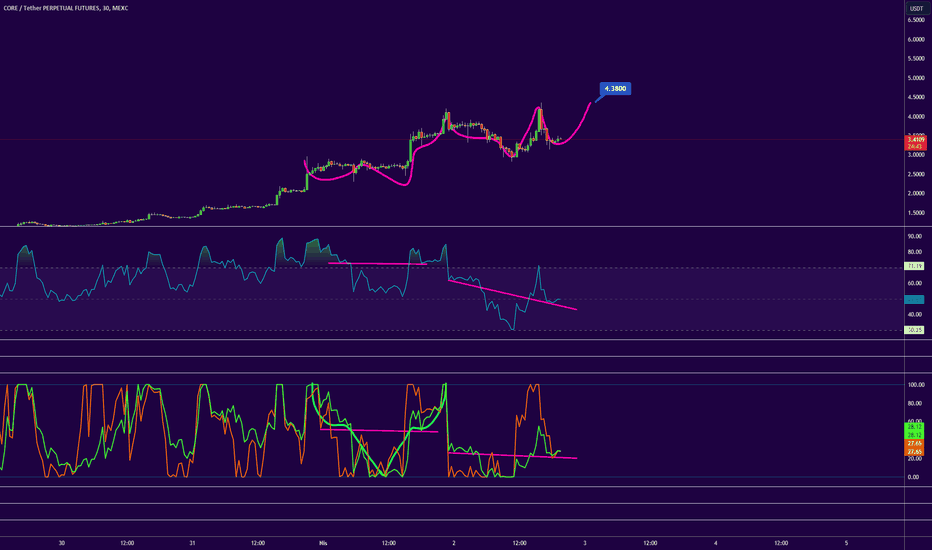

CORE Rectangle Breakout

COREUSDT appears to be breaking out of a 2 1/2 months long rectangle, and is currently challenging the 100-day EMA. Confirmation: Daily close above $0.58 Invalidation: Break back below the rectangle resistance Target: Previous support at $0.77 (resistance reinforced by 200-day EMA)Breakout confirmed. Watch for a retest of the resistance as support for a potential additional entry opportunity.Resistance retest as support is in, and it offered a very good R/R entry. Here's a 1H chart zoom-in.CORE target reached.

Salad2020

CoreUSDT 4H

Technical Analysis of Core Cryptocurrency It appears that the classic falling wedge pattern in Core cryptocurrency has been broken. This breakout has been followed by a pullback to the broken level, which could indicate a continuation of the bullish trend. If the price manages to hold above the support level, the likelihood of further upward movement increases. However, setting a stop-loss is crucial to minimize risks in case the trend reverses.

Tradeshoots

COER ONE MORE PUMP

Analysis Update: Daily Timeframe After a strong upward movement, we've seen a correction on the daily timeframe. I now anticipate a continuation of the upward trend and the achievement of our target. I will be entering another trade from these levels. Stay tuned and trade wisely!

TheCoinRepublic

CORE Price

The Daily chart of CORE token signifies a short term bullish reversal and the technicals are revealing that bulls are likely to trigger a potential up move ahead.

M2it2M

$CORE :: Indicate SELL & BUY LEVELS

Core (CORE) is built as an L1 blockchain that is compatible with Ethereum Virtual Machine (EVM), therefore it can run Ethereum smart contracts and decentralized applications (dApps). The Core network is powered by the “Satoshi Plus” consensus mechanism, which secures the network through a combination of delegated Bitcoin's mining hash and delegated Proof-of-Stake (DPoS). The protocol is backed by its native token, CORE.

hungryCheetah14960

sell posishion

Falling position according to the points indicated in the image. The support floor has been broken and we will be sellers until the next supportA second profit limit is available. The loss limit also changed.

btcimportantMoth24910

$CORE spot trade

CORE currently in a very tight range. A big move might be coming.Hopefully Bitcoin remains bullish for the upward move to take place.

CryptoNoan

$CORE $CORE BULLISH LONG

COREUSDT Perpetual Contract Analysis Current Price: 1.9092 USDT Key Levels: Support: 1.4677 USDT Resistance: 2.8918 USDT Trade Setup: Entry: Break above 1.90 USDT (descending trend line) Take Profit: Partial and LTPR Stop Loss: Below 1.4677 USDT Strategy: Enter on a break above the descending trend line with volume. Use a trailing stop loss along the ascending trend line. This setup suggests a potential bullish breakout with significant upside. Use a trailing stop loss to manage risk

tobo çalışmaya çalışıyor

Do not trust this product of imagination. It is not a recommendation.

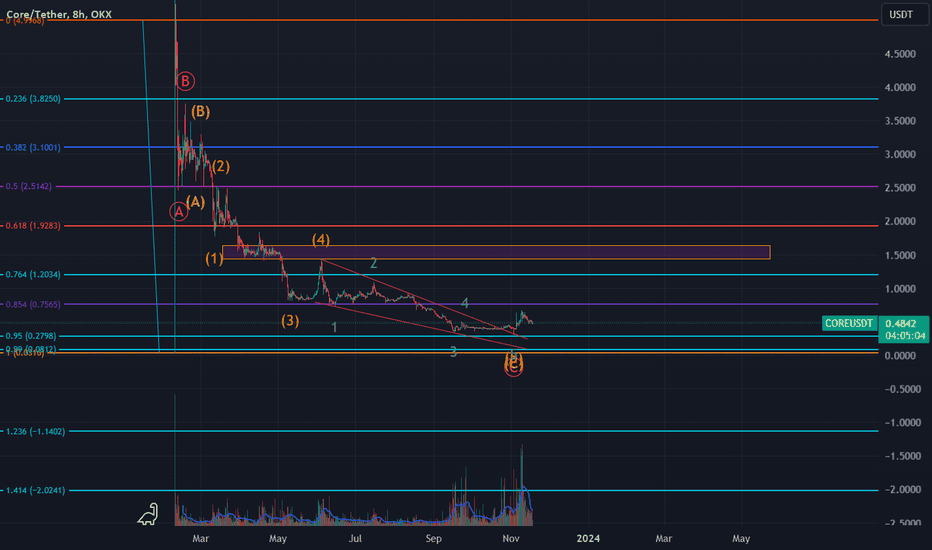

COREUSDT grand plan for the end off pre-bull phase

Analysis using Fibonacci Retracement has already marked .95-.99 Analysis using Elliot Wave Theory (Classic) as written in chart, it all aligned with, even the ending diagonal. Next step: - Retesting the 4th Wave of the correction wave in Wave C from ABC as strong resistance for now - Retrace between .78 - 99 of the wick COREUSDT had before, maybe even 50% of the wick (not Fibonacci Retracement, but measured precisely 50% of the wick)Target reached, closing my position @ 1.51 this morning. longing from @ 0.39-0.4

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.