ACH

Alchemy Pay

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Alchemy Pay

سود 3 Months :

سیگنالهای Alchemy Pay

Filter

Sort messages by

Trader Type

Time Frame

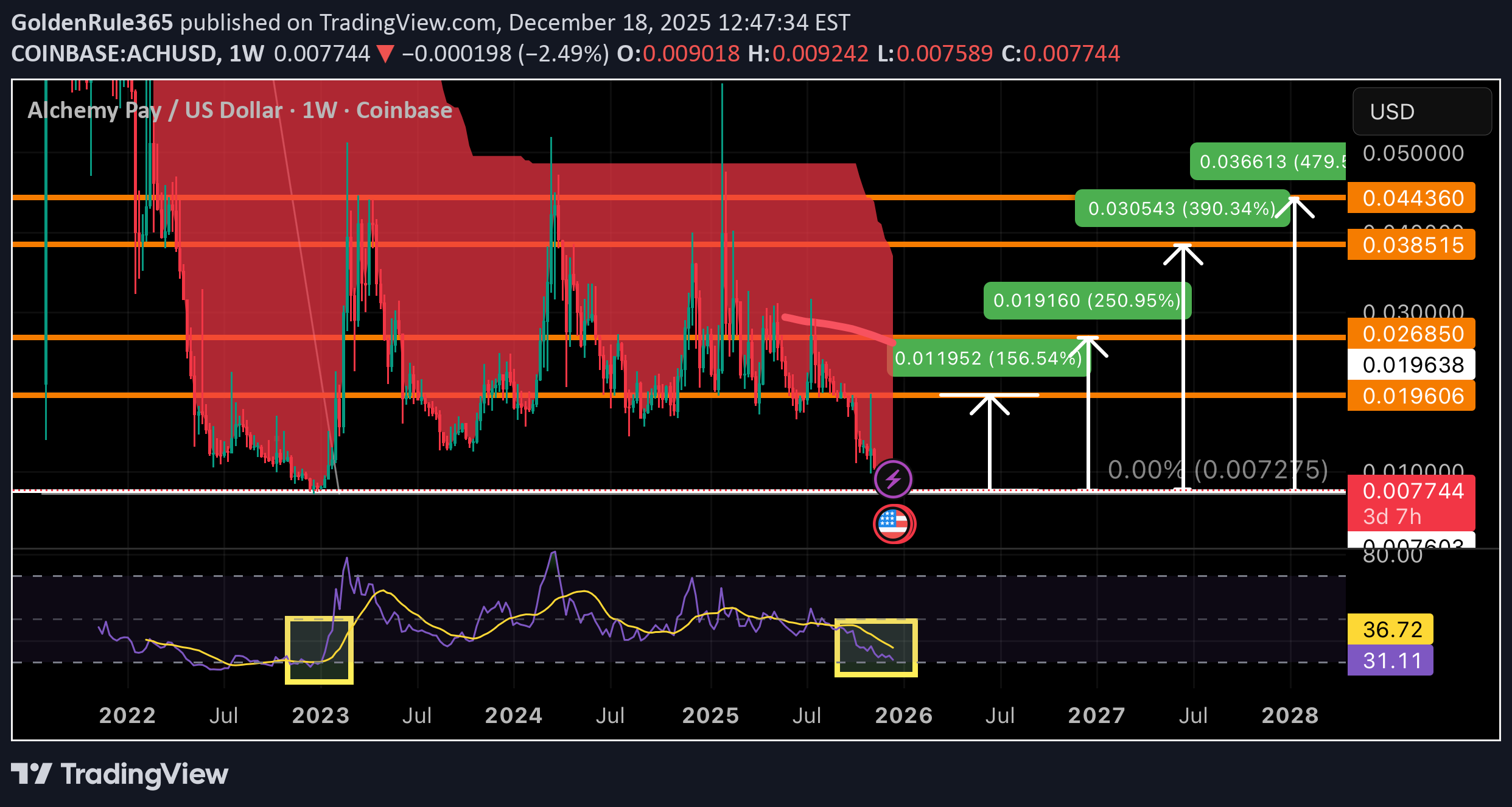

GoldenRule365

ACH - Looking prime for a bullish wave

Looking at RSI Weekly timeframe we see the same RSI range like it was back in January 2023 that produced a bullish wave with almost a 500% gain shortly after. I plotted 4 possible take profit zones for us. Alchemy Pay’s price trajectory hinges on executing its compliance-driven roadmap while navigating a cautious market. Short-term volatility is likely, but successful Alchemy Chain adoption or RWA traction could reverse the 60% annual decline. Watch the Q4 2025 blockchain launch: Will it catalyze transactional demand for ACH , or face scalability hurdles?

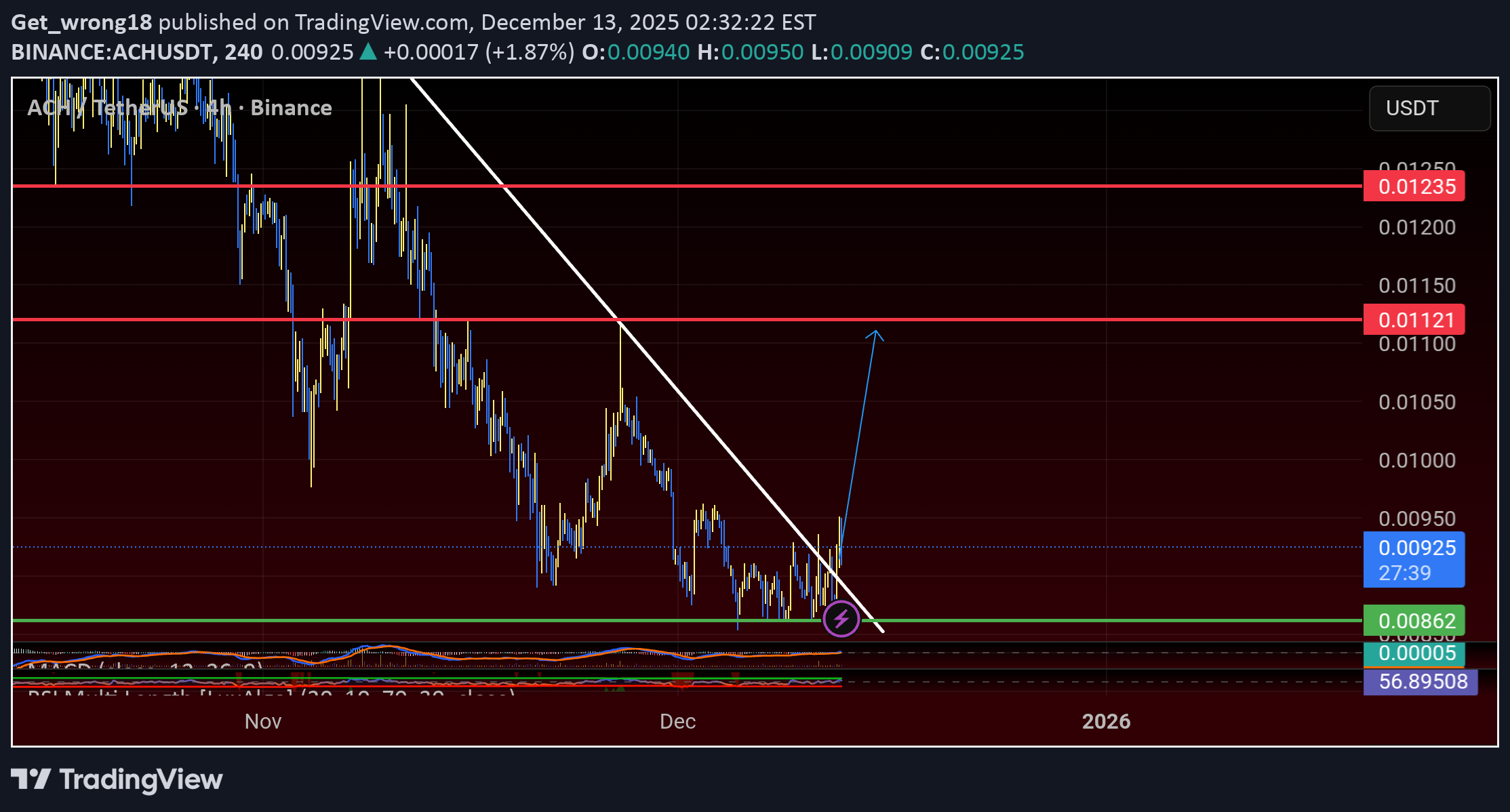

عبور بزرگ ACH: آیا قیمت به اوجهای جدید میرسد؟ (سطوح کلیدی حمایت و مقاومت)

Support around 0.0086 Resistance 0.0112 and 0.01235

SaykoCrypto

تحلیل هفتگی ACH/USDT: سطوح کلیدی و اهداف قیمتی در محدوده رنج!

When the price moves into the range on the weekly chart, the targets will be the range middle band and range high point. The chart is for tracking purposes only. It does not contain investment advice!!

CryptoKrypto

آلتکوین ACH در آستانه انفجار قیمتی: آماده جهش ۳۰۰ درصدی و عبور از ۱ دلار؟

CryptoNuclear

ACH/USDT — Multi-Year Support Zone, Bounce or Breakdown?

🔎 Overview ACH/USDT is currently consolidating within a multi-year demand zone around ~0.01811 (highlighted in yellow). This level has acted as a strong support multiple times, producing significant reactions whenever price touched it. However, each bounce from this area has been weaker than the last, forming lower highs — a clear sign of persistent selling pressure. Structurally, this resembles a descending triangle, where sellers are consistently pushing from above while buyers defend the same support zone. This puts ACH at a critical crossroads: Will buyers defend the support again and trigger a strong rebound? Or will sellers finally break it down, opening the path toward new lows? --- 📌 Key Technical Levels Main demand zone (support): 0.01811 Next supports if breakdown: 0.01400 → 0.00950 → historical low 0.00720 Major resistances (bullish targets): 0.02263 0.02867 0.03441 0.04075 0.04500 0.05059 --- 📈 Bullish Scenario Trigger: Weekly close above 0.02263 or a confirmed breakout from the lower-high structure. Implication: Buyers successfully defend the multi-year demand zone and regain short-term control. Targets: 0.02867 → 0.03441 → 0.04075 → 0.05059 Note: A sustainable breakout will require strong buying volume; otherwise, it risks being another failed rally. --- 📉 Bearish Scenario Trigger: Weekly close below the 0.01811 demand zone. Implication: Descending triangle confirms to the downside, signaling potential mid-term breakdown. Targets: 0.01400 → 0.00950 → possibly retesting the historical low at 0.00720. Note: A breakdown here could trigger capitulation, since this zone has long been a critical stronghold for buyers. --- 📊 Pattern & Sentiment Dominant pattern: Descending Triangle (neutral-to-bearish bias). Short-term sentiment: Neutral, awaiting reaction at the demand zone. Mid-term sentiment: Bearish leaning, as repeated tests of support increase breakdown risk. Catalysts: A broader crypto market recovery (BTC/ETH rally) could fuel upside, while weak market conditions may accelerate a breakdown. --- 📌 Conclusion ACH/USDT is standing at a make-or-break zone. The multi-year support around 0.01811 is the last stronghold for buyers. A solid bounce could spark rallies toward 0.02867 and higher, but if the support breaks, a deep correction toward the historical lows near 0.00720 becomes likely. Strategy: Bullish traders: Wait for confirmed weekly breakout & retest. Bearish traders: Watch for a confirmed weekly breakdown below 0.01811. Neutral traders: Stay patient, as this zone may define ACH’s direction for the coming months. --- #ACHUSDT #ACH #AlchemyPay #Crypto #Altcoin #ChartAnalysis #TechnicalAnalysis #SupportResistance #DescendingTriangle #BreakoutOrBreakdown

CryptoKrypto

$ACH LAST OPPORTUNITY TO BUY AT THIS PRICE!

ACH Is consolidating before pumping up to $0.05 like it did the last 2 times. zoom out on my chart and you will see. Only this time, with the altcoins gearing up for a bull run and main net for ACH scheduled for Q2 2026, We are going to faintly break out of the MULTI YEAR CHANNEL! EASILY HEADED TO $0.20+ ACCUMULATE AS MUCH AS YOU CAN WHILE YOU HAVE TIME!!!!!

cryptodelightt

ACH/USDT

ACH/USDT TERM Long Analysis YTD graphics to myself stop net

citexco_trade

Bruno2244

BUYING

Disclaimer: All ideas shared here reflect my own market outlook. Trading always involves risk, and no setup is guaranteed. Markets move fast, and perspectives can change quickly — this post represents my current view at the time of publishing. Manage risk wisely and make decisions based on your own judgment. Wins and losses are both part of the process. What matters most is discipline, consistency, and risk control. Trade responsibly.

CryptoYodaX

ACHUSDT - SPOT SETUP

🚀SPOT - Alchemy @AlchemyPay Binance 🔥 Buy Zone: $0.02041 - $0.02051 🎯 TP1: $0.02142 | TP2: $0.02169 | TP3: $0.0226 Always DYOR before this...

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.