GoldenRule365

@t_GoldenRule365

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

GoldenRule365

HBAR-Ready for a bullish rally back to $0.19, $0.24, $0.29

Looking at a daily timeframe the super trend indicator is showing bullish green. On this timeframe it rarely produces a fake out. You can see that the retest of its previous highs lines up with the POC. I have an alert set I suggest getting in now with a take profit at $0.19 there's another take profit at $0.24 and a very aggressive take profit would be at $0.29 MACD and RSI are flashing bullishness Best of luck on your trading journey to success.

GoldenRule365

ATH - Massive Breakout on the horizon

Look at the massive possible retest. Looking at one hour timeframe price action is above the 50 day moving average and 200 day moving average Daily RSI, MACD are bullish as well as micro time Frames for SuperTrend indicator. 1 vital factor is that during the entire recent decline, this is the first consolidation phase. Bouncing off $0.01000 support a strong level. IMO everything has a green light for blastoff! If you have been following along with our ATH positions, they have produced handsome ROI.

GoldenRule365

NKN - Currently consolidating

Price action finally fell out of the descending parallel channel now it's consolidating sideways highlighted by the yellow parallel channel looking for a bullish rally to retest the green line at $0.0420

GoldenRule365

MKR - Update: we are looking for a bullish reversal

Even though MKR broke out of the ascending parallel channel towards our goal of June 2026 for a macro retest I still think it has the potential to get back within that channel it just has to break this next resistance level at $2,286 I have an alert set at that price and when that triggers I will post a new update for us as soon as possible. Remember to always manage your trade set stop losses and take profits according to your personal risk assessment. Good luck on our journey to profits!

GoldenRule365

ATH Update: Zoom in shot showing price action above 50 MA

With the second image you can clearly see that the price action has moved above the 50 moving average which is the yellow line the red line would be the 200 moving average. Those are signals of bullish reversals. Last time we had a good movement it took about two months to hit our high target that was plotted. I've set two new targets for us one is more conservative one is back at the $0.03 mark. Remember to always manage your assets properly make sure you set your stop losses and take profits according to your level of risk assessment. Best of luck on our journey to profits!

GoldenRule365

GoldenRule365

MKR - Maker Update, RSI overbought

Historically when MKR taps this high RSI zone we get a pullback. Most likely back near $1,000 100% Fibonacci retest by June 2026 is looking less likely especially after falling out of the ascending channel.

GoldenRule365

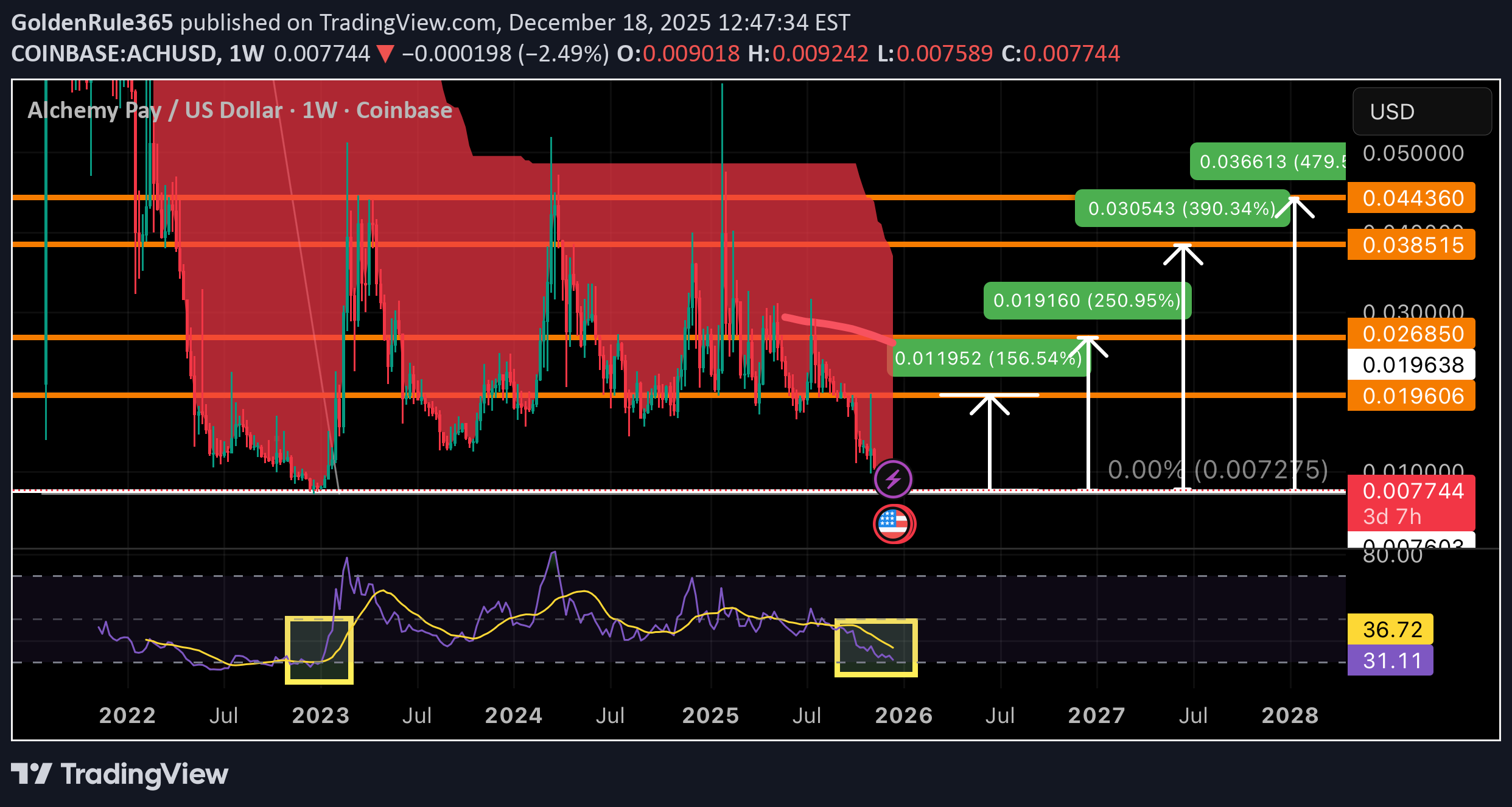

ACH - Looking prime for a bullish wave

Looking at RSI Weekly timeframe we see the same RSI range like it was back in January 2023 that produced a bullish wave with almost a 500% gain shortly after. I plotted 4 possible take profit zones for us. Alchemy Pay’s price trajectory hinges on executing its compliance-driven roadmap while navigating a cautious market. Short-term volatility is likely, but successful Alchemy Chain adoption or RWA traction could reverse the 60% annual decline. Watch the Q4 2025 blockchain launch: Will it catalyze transactional demand for ACH , or face scalability hurdles?

GoldenRule365

GoldenRule365

ATH - High Plotted target hit!

Thats over a 70% gain that took just barely 2 months of patiently waiting! Congratulations to all that followed!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.