ABT

Arcblock

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Arcblock

سود 3 Months :

سیگنالهای Arcblock

Filter

Sort messages by

Trader Type

Time Frame

miljedtothemoon

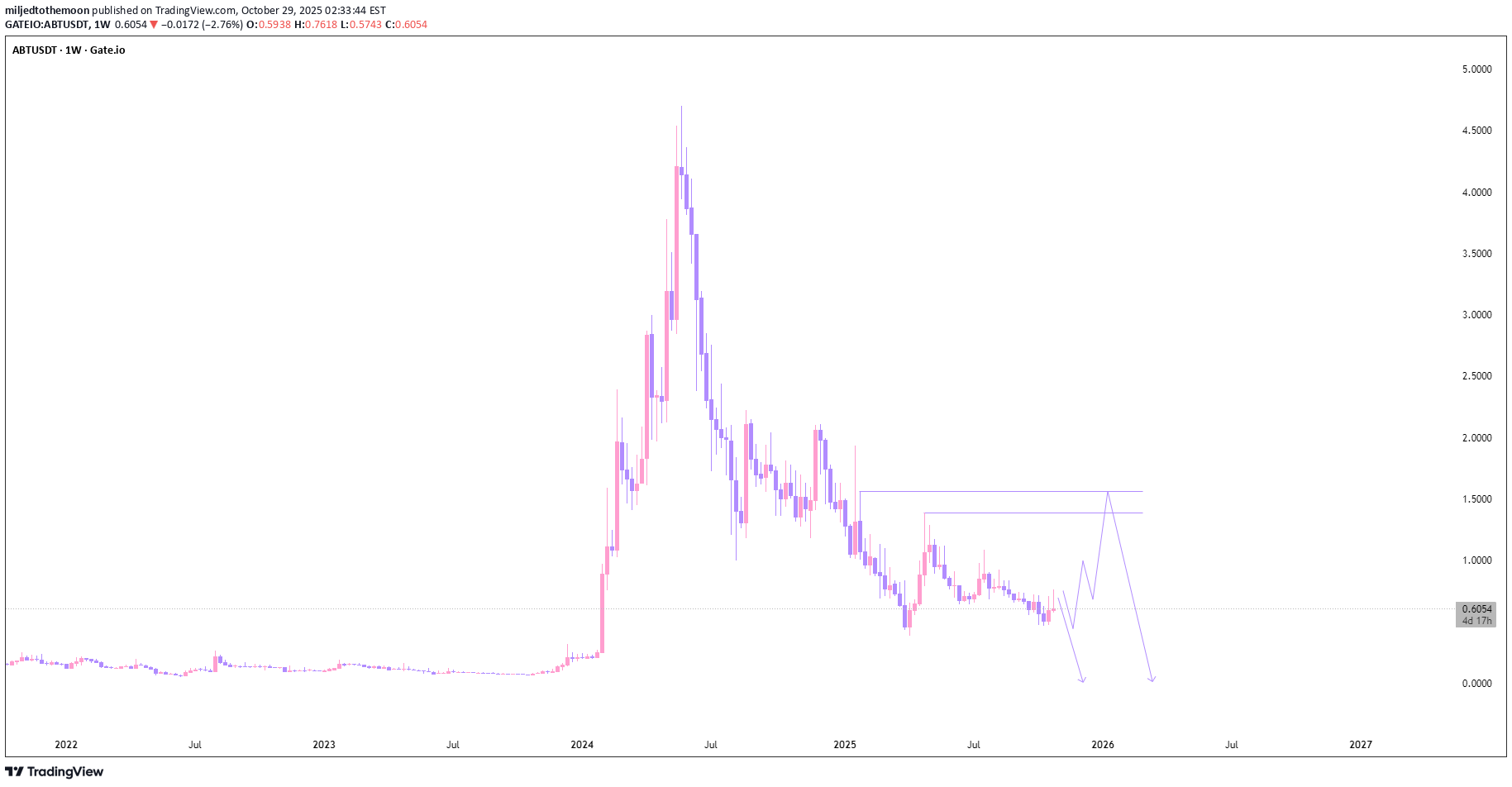

تحلیل ABT/USDT: ورود احتمالی شورت با هدف ۰.۰۵۳۰ در بازار خرسی!

The market structure remains bearish, with the token historically losing significant value during downturns and showing limited signs of recovery. A potential short setup could emerge following a manipulated upside move, with optimal short entries near resistance and profit targets around the $0.0530 level.

humzahTX

DrDovetail

ABT can potentially 4x in value reading up from the wedge its in

The smaller pink dotted measured move line is for the inv h&s pattern its formed inside the wedge with the top trendline of the wedge doubling as the invh&s pattern’s neckline. Hitting that smaller target is more or less a 2x from current price action. If we hit the full falling wedge target that’s a 4x from where it is currently. *not financial advice*

faisal_qaisy5

ABT is about to explode - watch out for the breakout

Currently consolidating, last year same time went up +100%. Watch out for the upcoming breakout which I expect it to be in the net two to three days. Happy hunting

cautiousRock3150

ABT round 2 about to start

Yes look at round one at the bottom. Are we to repeat this pattern? Most likely. ABT couldn’t even back test the old high. Far too bullish! The RSI bottomed out on the weekly time frame and created huge amounts of bullish divergence. See you at $19 plus in the future.

chitowntrader23

Is the bullish reversal signal finally here for $ABT ?

The 34 EMA (yellow line) has proven to be a very effective indicator for when we see bullish opportunties with ABT. As you can you see we have been respecting a Bearish channel for quite sometime, with a recent break out from the channel and attemps to change course. Time will tell.....Truth be told, I got shook out of about half position due to stop loss/s set (as to ensure profit taking on the way down). I did not see quite the recovery happening this quickly, so if we continue to climb, I will be salty, while also happy =)

MyLife2Saucy

ABT token to surpass 22 dollars?

After the parabolic run early 2024 the price came to a halt and started it's retrace and started bleeding slowly back to a dollar. Does this token have more gifts for it's holders? A small community was able to understand the tech and get in early in the cents region and reaped the rewards. Most may have missed the first wave, don't miss the second one...

DClayton

DAVID9039

SWFTC / CTXC

Mega accumulation/darvas boxes SWFTC/USD 4W CTXC/USD 4W MED/USD 2W ABT/USD 4W

chitowntrader23

ABT needs some BUYERS

We are continuing in this downward price channel, staying below my typical indicators that would tell me to go long. We are below both the 89 and 34 EMA, so until we can touch those and move beyond with some volume, it doesn't look good for upside. However, sideways action isn't bad either, which could indicate accumulation. Time will tell. I am still long.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.