التحليل الفني ProjectSyndicate تحليل حول رمز PAXG: شراء (4/11/2025) مُقتَرَح

پیشبینی طلای ۲۰۲۶: آیا اصلاح فعلی فرصت خرید نهایی قبل از صعود است؟

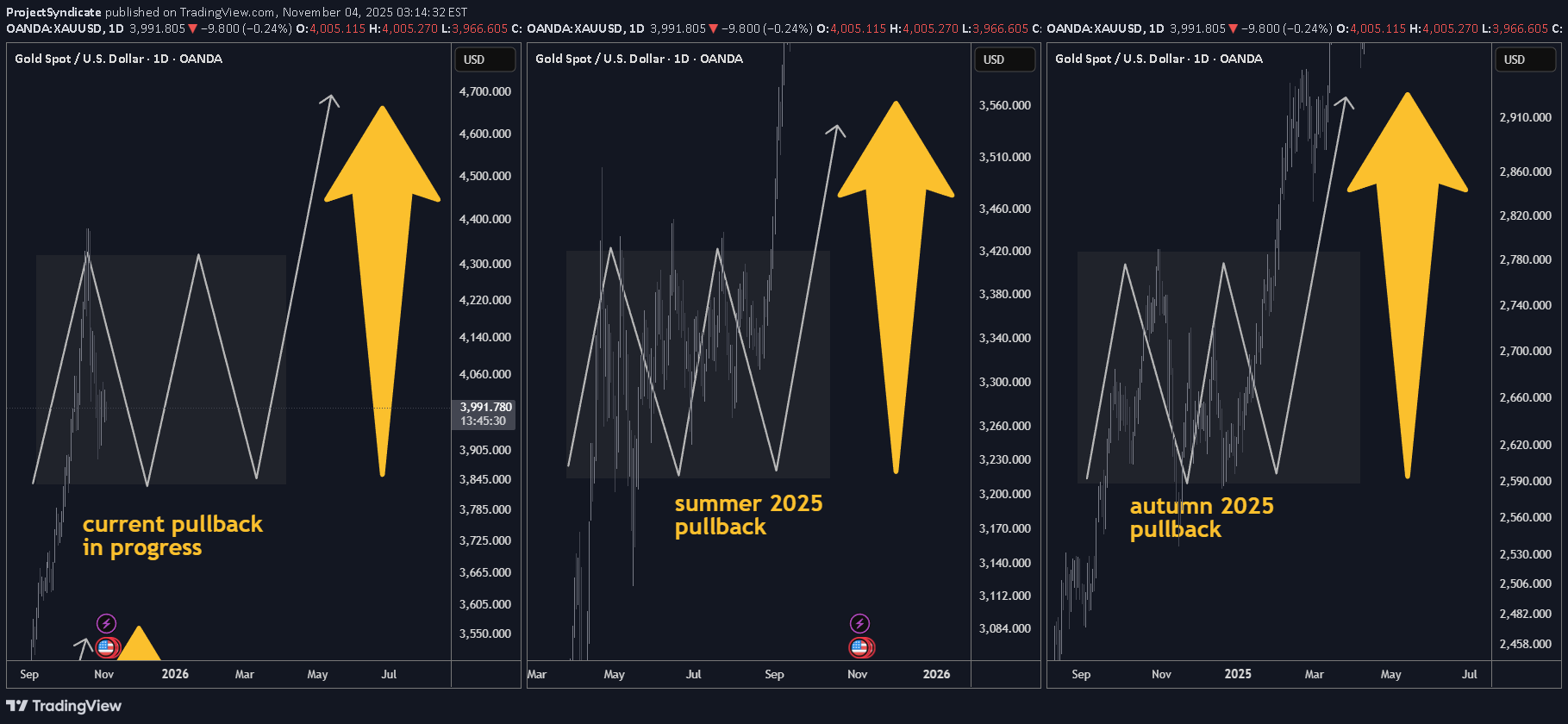

📌 Executive Summary •Base case (60%): The current pullback is a normal retracement within the primary bull trend. We expect consolidation through late Q4-2025 and potentially into January 2026, followed by a resumption of the uptrend in Q1/Q2-2026. •Drivers remain intact: Persistent central-bank accumulation, reserve-diversification dynamics, and episodic macro/geopolitical risk keep the structural bid under gold. •Positioning stance: Maintain core long exposure, add tactically on weakness into the $3.8k–$4.0k zone spot equivalent with tight risk controls, and ladder call spreads into Q2-2026. •Risk skew: Near-term pullback risk persists position shakeouts, macro data surprises. Structural bearish risks are low unless central-bank demand materially softens. ________________________________________ 🧭 Market Context & Recent Price Action •Gold printed successive record highs into mid-October; front-month futures traded above $4,170/oz before easing. Headlines framed the rally as policy and safe-haven led, with year-to-date gains exceptionally strong. •Central-bank demand continues to underpin the move: WGC and sell-side coverage highlight accelerating official-sector buying and diversification away from FX reserves; banks forecast higher prices into 2026. •The current setback aligns with prior bull-market pauses (e.g., Apr–Jul 2025 and Sep 2024–Dec 2024 pullbacks), consistent with the user-stated pattern of multi-month consolidations before trend resumption. What’s new in headlines late Oct–Nov 2025: •Pullback is “technical and temporary,” with buy-the-dip framing from UBS; next tactical target cited around $4,200. •Official-sector flows: Korea & Madagascar exploring reserve increases; PBoC extended buying streak into September. •WSJ coverage stresses gold’s role in erosion of trust in fiat/central banks and the reserve-diversification theme. ________________________________________ 🔑 Structural Bull Case 2025-2026 1.Official-Sector Accumulation: oMulti-year build in central-bank gold holdings (EM-led) as a sanctions-resilient reserve asset; this remains the single most important marginal buyer narrative. 2.Reserve Diversification & Financial Geopolitics: oEvidence that gold’s share of global reserves has risen while some institutions reassess currency composition. 3.Macro Volatility & Policy Trajectory: oPeriodic growth scares, policy pivots, and real-rate uncertainty sustain hedging demand. Street targets for late-2026 (e.g., ~$4,900 GS) anchor upside convexity. 4.Market Microstructure: oThin above prior highs and crowded shorts on pullbacks can fuel sharp upside re-accelerations when macro catalysts hit data, geopolitics, policy hints. ________________________________________ 📊 Technical Map Top-Down •Primary trend: Up. The sequence of higher highs/higher lows since 2024 remains intact; current move is a trend-within-trend consolidation. •Pullback anatomy: Prior bull pauses (Apr–Jul 2025; Sep–Dec 2024) lasted 2–4 months, with troughs forming on volatility compression and momentum washouts—a template for now. •Key tactical zones spot-equiv.: o$3,800–$4,000: First reload area prior breakout shelf / 50–61.8% of the last leg. o$4,200–$4,250: First resistance / re-acceleration trigger retests of breakdown pivots. o$4,350–$4,400: High congestion; decisive weekly close above here re-opens ATH extension. ________________________________________ 🗓️ Scenario Pathing Q4-2025 → Q2-2026 •Base Case 60% — “Consolidate then resume”: oSideways-to-lower into late Q4/Jan 2026 as positioning resets; range $3.8k–$4.2k. oBreakout resumption in Q1/Q2-2026 as macro and official flows re-assert. •Bullish Extension 25% — “Shallow dip, quick reclaim”: oSofter real yields / risk flare trigger swift recapture of $4.2k–$4.4k and new highs earlier in Q1-2026. oCatalysts: heavier central-bank prints, geopolitical shock, or earlier policy-easing rhetoric. •Bear-Risk 15% — “Deeper flush, trend intact”: oHawkish macro surprise or forced deleveraging drives $3.6k–$3.7k probes; structure holds unless official-sector demand meaningfully fades ________________________________________ 🧪 What to Watch High-Signal Indicators •Official-Sector Data: Monthly updates from WGC, IMF COFER clues, and PBoC reserve disclosures. Continuation of EM purchases = green light for the bull. •Rates & Liquidity: Real-rate direction and dollar liquidity conditions around data and policy communications. •Microstructure: CFTC positioning inflections, ETF out/in-flows a lagging but useful confirmation when they finally turn. •Asia Physical/Policy: China/Japan retail and wholesale dynamics; policy/tax headlines can create short-term volatility. ________________________________________ 🎯 Strategy & Implementation 1) Core: •Maintain strategic long allocation consistent with mandate e.g., 3–5% risk budget; avoid pro-cyclical reductions during orderly pullbacks. 2) Tactical Adds •Scale-in buy program within $3.8k–$4.0k •Optionality: Buy Q2-2026 call spreads (e.g., 4.2/4.8) on dips; fund via selling Q1-2026 downside put spreads around $3.6k–$3.7k where comfortable with assignment. 3) Risk Controls 🛡️: •Hard-stop any tactical adds on weekly close < ~$3.6k or if credible evidence emerges of official-sector demand reversal.🥇 Base Case: Normal pullback inside primary bull trend — consolidation likely till Jan ’26, rally resumes Q1/Q2 ’26. 💰 Drivers Intact: Central-bank buying, reserve diversification, & macro/geopolitical hedging sustain long-term bid. 🏦 CB Demand: PBoC, Korea, Madagascar add reserves; official-sector flows remain the key pillar. 📉 Current Pullback: Mirroring Apr–Jul ’25 & Sep–Dec ’24 pauses — 2-4 month digestion phase. 🪙 Tech Zones: Buy zone $3.8k–$4.0k | Resistance $4.2k | ATH trigger $4.35k–$4.4k. 📊 Scenario Path: 60% → Consolidate → Resume bull 25% → Quick reclaim > $4.2k 15% → Deeper flush $3.6k–$3.7k (trend intact). 🔔 Watch: WGC/PBoC data, real-rate trends, CFTC & ETF flows, Asia policy headlines. 🎯 Strategy: Maintain core long (3-5% risk); scale-in $3.8–$4.0k; add Q2-26 call spreads 4.2/4.8; hedge via Q1-26 put spreads. 🛡️ Risk Control: Cut if < $3.6k or CB demand fades — otherwise, stay gold & buy the dip.🎁Please hit the like button and 🎁Leave a comment to support our team!let me know your thoughts on the above in the comments section 🔥🏧🚀Gold Bull Market Outlook And Targets: 5000 USD/7500 USD