18.12.2025 tarihinde sembol METAX hakkında Teknik The-Thief analizi

The-Thief

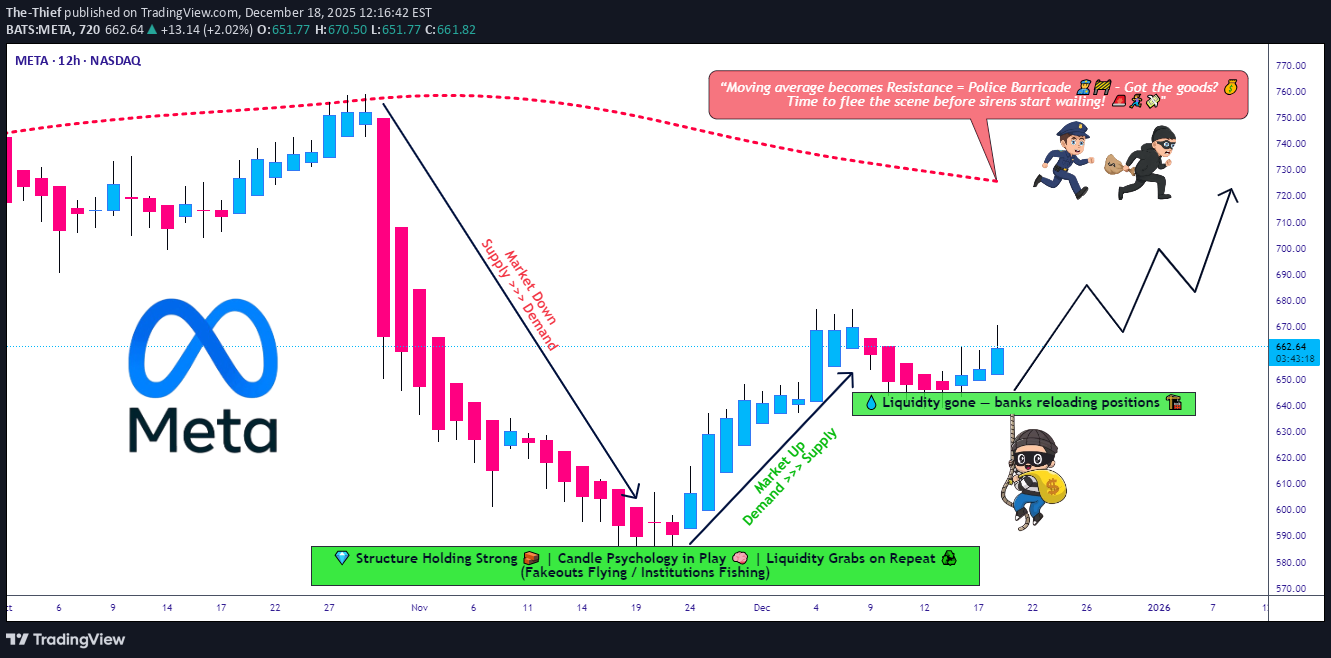

META Momentum Builds! Bullish Swing Trade Roadmap

🚀 META: The Layered Entry Swing Play - AI Momentum Revival 📈 Executive Summary 💼 META Platforms sits at a pivotal technical juncture where institutional AI capex demand collides with short-term profit-taking. This swing trade targets the $720 resistance breach using a disciplined layered entry methodology — perfect for risk-managed traders seeking 3-5% upside with controlled downside. 📊 Trade Setup | Master Plan Asset: 🔵 META (NASDAQ) | Meta Platforms, Inc. Timeframe: Swing Trade (4-6 weeks) Bias: 🟢 BULLISH (Support Zone Recovery) Risk Appetite: Moderate to Aggressive 🎯 Entry Strategy | The Intelligent Layering System Rather than chasing a single entry price, we employ a pyramiding buy-in method across key support zones. This reduces emotional trading and improves risk-reward at scale. Multi-Layer Entry Points (Buy in Tranches): Layer 1 (Initial Position): $638.50 — 2% account risk Layer 2 (Dip Catch): $630.00 — 2% account risk Layer 3 (Strength Reload): $650.00 — 2% account risk Layer 4 (Breakout Confirmation): $660.00 — 1.5% account risk Total Allocation: ~7.5% per full setup (adjust per your risk tolerance) Rationale: Layering avoids the emotional cost of "missing" an entry and distributes your execution cost—professional traders call this dollar-cost averaging on entries. 🛑 Stop Loss | Discipline Wins Wars Hard Stop: $610.00 Reasoning: Below this level, the daily chart's support at the 200-EMA fails. Loss = ~4-5% from average entry ($645), which is reasonable swing risk. ⚠️ DISCLAIMER: This stop-loss level is MY analysis only. You remain fully responsible for your risk. Consider your account size, leverage, and emotional tolerance before committing capital. Never risk more than 2% per trade. 🎪 Target Strategy | Know When to Take Profits Primary Target (Resistance Police Force): 📍 $720.00 Why $720 Matters: 328-Period SMA (4-hour chart) typically acts as resistance during consolidated ranges Overbought Territory Signal: RSI creeping above 70 = profit-taking zone Technical Trap Warning: Large sellers often cluster here after gaps up Psychological Level: Round numbers ($720) trigger algorithmic selling Escape Plan: When price approaches $720, take 50% off the table to lock profits. Let remaining 50% run with a trailing stop at +3% below entry. ⚠️ DISCLAIMER: This target is NOT guaranteed. META could face: regulatory headwinds, macro rate shock, or competitor moves. You decide your exit—never marry a target. Protect your capital first. 📡 Related Pairs to Monitor (Correlation Watch) 🔗 1️⃣ GOOG (Google / Alphabet Inc.) — POSITIVE CORRELATION (+0.82) Key Insight: Both compete in AI advertising and data-center infrastructure. If GOOG rallies, META usually follows. Watch: GOOG breaks above $200 = risk-on sentiment for META. 2️⃣ TSLA (Tesla, Inc.) — MODERATE POSITIVE CORRELATION (+0.71) Key Insight: Both are "mega-cap AI/Tech bets." TSLA weakness can drag META down (flight to safety). Watch: TSLA support breaks = potential META correction into your layers. 3️⃣ AMZN (Amazon.com) — POSITIVE CORRELATION (+0.76) Key Insight: AWS AI infrastructure play; if AMZN capex concerns flare, META suffers (shared narrative). Watch: AMZN guidance = signal for META's data-center spend outlook. 4️⃣ SPY (S&P 500 ETF) — MODERATE CORRELATION (+0.68) Key Insight: Macro beta. Fed rate decisions move SPY; SPY moves all mega-caps. Watch: CPI data Dec 18, 2025 at 8:30 AM ET = critical catalyst. 5️⃣ VIX (Volatility Index) — NEGATIVE CORRELATION (-0.55) Key Insight: Rising VIX = fear. META can gap down on broad market panic. Watch: VIX above 20 = consider tightening your stop or waiting for another layer signal. 💡 Key Technical Confluences ✅ Why This Setup Works: Layered entries = you're never "too early" or paying too much 52-week range sits between $480–$796 (META has room to $720) 📈 Analyst consensus = "Strong Buy" with targets ~$832 median AI capex narrative = earnings growth driver into Q1 2026 Dividend pay date Dec 23 = pre-holiday consolidation likely ❌ Risks to Abort: Breaking below $610 = trade is invalid; exit immediately Regulatory shock (FTC enforcement) = gap down risk Macro CPI shock Dec 18 = volatility surge, potential liquidation Competitive loss to GOOG/AMZN AI = narrative reversal 📈 Risk Management Checklist Before you trade this setup: Do you understand layering reduces timing risk? ✅ Is your stop at $610 within your risk tolerance? ✅ Have you calculated max loss? (e.g., 7.5% × 2% per layer = ~$150 per $1000 risked) ✅ Is $720 target realistic in 4-6 weeks? (YES—analyst upside + technical confluence) ✅ Will you stick to your exit plan, or will greed override? ⚠️ (This is the real test!) 🎬 Action Plan | Execution Timeline Week 1 (Dec 18–22): Place Layer 1 & 2 buy orders. Watch CPI data (Dec 18, 8:30 AM ET). Week 2–3: Scale into Layers 3 & 4 on any dips. Monitor GOOG/AMZN correlation. Week 4–6: Approach $720; take 50% profit at resistance. Manage trailing stop on remainder. Exit Plan: TP hit = reduce risk. SL hit = accept loss, move on. No "hope trading." 📝 Disclaimer & Fun Caveat 🎭 This is a "playful but serious" swing-trade idea. It's designed for entertainment AND education—think of it as how a mischievous but disciplined trader (our "thief trader OG") approaches META with style, humor, and risk management. ✨ Closing Thought If you find value in this analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community! #META #SwingTrade #TechStocks #AITheme #LayeredEntry #TradingView #StockMarket #NASDAQ #Bullish #MoneyManagement #RiskManagement #ProfitTaking #TechnicalAnalysis #StockAnalysis #TradeSetup #LongBias #2025Trading