sembol PAXG hakkında analiz Teknik Xayah_trading: Satın al (18 saat önce) önerilir

Xayah_trading

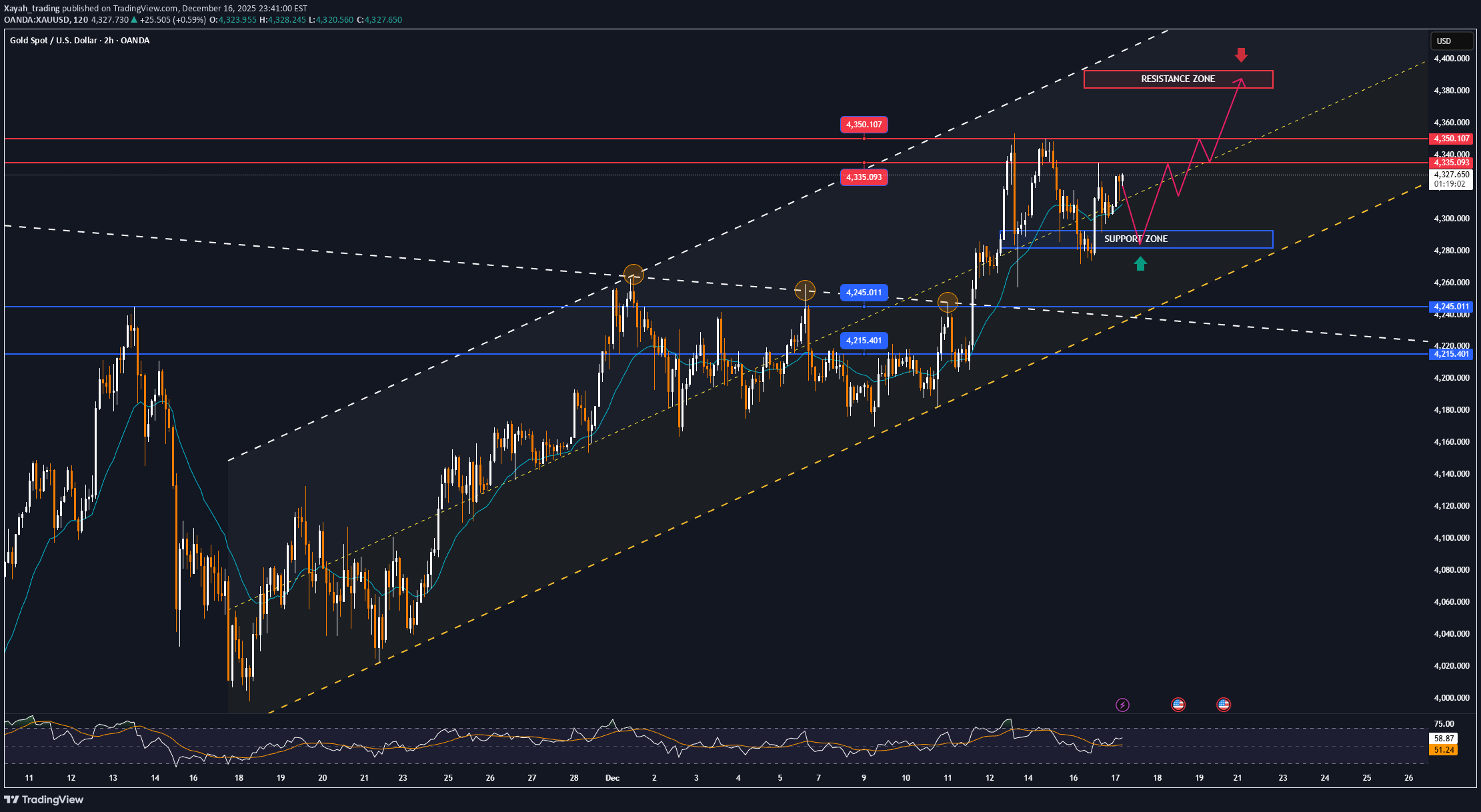

GOLD surges after US jobs data, policy uncertainty

XAUUSD made a sudden surge during the Asian session on December 17, jumping nearly USD 25 within just a few hours, reaching the 4,327 USD/ounce area before cooling off and consolidating around 4,320 USD/ounce. This was not a “clean” trend-driven rally, but rather a fast market reaction to a series of inconsistent economic signals coming from the US. This move followed the previous session’s strong volatility, when gold prices reversed multiple times after the Nonfarm Payrolls report. The initial reaction was a sharp rally, consistent with gold’s typical response to weak labor data. However, just minutes later, the market reversed as investors took a closer look at the broader picture: labor conditions were not excessively weak, consumer spending remained resilient, and the Fed had no urgent reason to ease aggressively. Labor data weak on the surface, firm at the core The US Bureau of Labor Statistics reported that nonfarm payrolls increased by 64,000 in November, beating expectations, while the unemployment rate rose to 4.6%, the highest level since 2021. This created a “misaligned” data set: jobs are still being added, but the quality of the labor market is beginning to deteriorate. This very contradiction drove sharp volatility in gold. Initially, the market reacted to the headline: higher unemployment implies the Fed may need to turn more dovish. But once flows calmed, a bigger question emerged: does the Fed really need to ease quickly when consumer spending remains solid? As a result, expectations for rate cuts in early 2026 remain relatively low, around 25%, indicating that the market is not yet ready to make a strong bet on an aggressive easing cycle. Monetary policy pulls gold between two opposing forces Last week, the Fed cut rates by 25 basis points, but the accompanying message remained highly cautious. Interest rate futures currently price in only two modest cuts in 2026, rather than a decisive easing cycle. In this context, gold — a non-yielding asset — is in a sensitive position: Benefiting from economic risks, noisy data, and policy uncertainty. But constrained by the reality that real rates have not fallen deeply enough to build a sustainable upside foundation. This explains why gold can rally very quickly in the short term, yet is equally prone to sharp corrections shortly afterward. The broader backdrop: inflation, consumption, and geopolitics US retail sales data for October were largely flat, showing that consumers are still holding up despite pressure from high prices and the impact of tariffs. This makes it difficult for the Fed to turn more accommodative and is another reason why gold remains stuck in a choppy trading environment. In the coming days, attention will shift to CPI, jobless claims, and the PCE index. These are not merely economic data points, but key puzzle pieces that will determine whether the low-rate narrative — the long-term foundation for gold — is truly being reinforced. Personal perspective This rally is not a confirmation of a new uptrend, but rather a reminder that the gold market is trading in a high-noise environment, where each data release can be interpreted in multiple ways. Gold is currently reflecting uncertainty in global monetary policy rather than a clear growth story. In such a context, large price swings are not the exception — they are the new normal. Technical analysis and suggestions XAUUSD The dominant trend for gold remains upward, but it is entering the most sensitive phase of the cycle. On the daily chart, gold prices maintain a structure of higher highs and higher lows, moving steadily within an upward price channel since Q3 2025. However, the $4,320 – $4,335/ounce range is becoming a short-term distribution zone, where buying pressure is no longer as dominant as during the previous acceleration phase. Prices have approached this area several times but have yet to form a decisive breakout, reflecting the cautious sentiment of large investors. In terms of momentum, the RSI has moved out of the overbought state but has not yet formed a clear bearish divergence, indicating that the uptrend has not been broken, but is entering a consolidation phase, a technical correction. The current corrections are more of a "cooling" phase than a trend reversal. Conditions for opening a new uptrend cycle: The closing price clearly above 4,330 – 4,350 USD, accompanied by increased volume and volatility. The RSI returns to the region above 65 and remains stable, confirming the return of buying momentum. When these conditions converge, gold could enter a new sustained uptrend, with a medium-term target extending to the $4,450-$4,600/ounce range, corresponding to the upper boundary of the expanding uptrend channel. Risk of correction to watch: Losing the support zone of $4,245 – $4,215 (Fibonacci 0.236 and the nearest consolidation bottom) will trigger stronger profit-taking pressure. In a negative scenario, gold could retreat further to the $4,050 – $3,970 zone, which could be the convergence of the medium-term moving average and the equilibrium zone of the current uptrend. Cautious Scenario – Trading on Corrections If the price clearly fails at $4,330 – $4,350 and short-term weakness signals appear, consider short-term technical selling. Target: $4,245 → $4,200, with small volume, adhering strictly to discipline as the overall trend remains upward. SELL XAUUSD PRICE 4392 - 4390⚡️ ↠↠ Stop Loss 4396 →Take Profit 1 4384 ↨ →Take Profit 2 4378 BUY XAUUSD PRICE 4288 - 4290⚡️ ↠↠ Stop Loss 4284 →Take Profit 1 4296 ↨ →Take Profit 2 4302