15.12.2025 tarihinde sembol METAX hakkında Teknik GlobalWolfStreet analizi

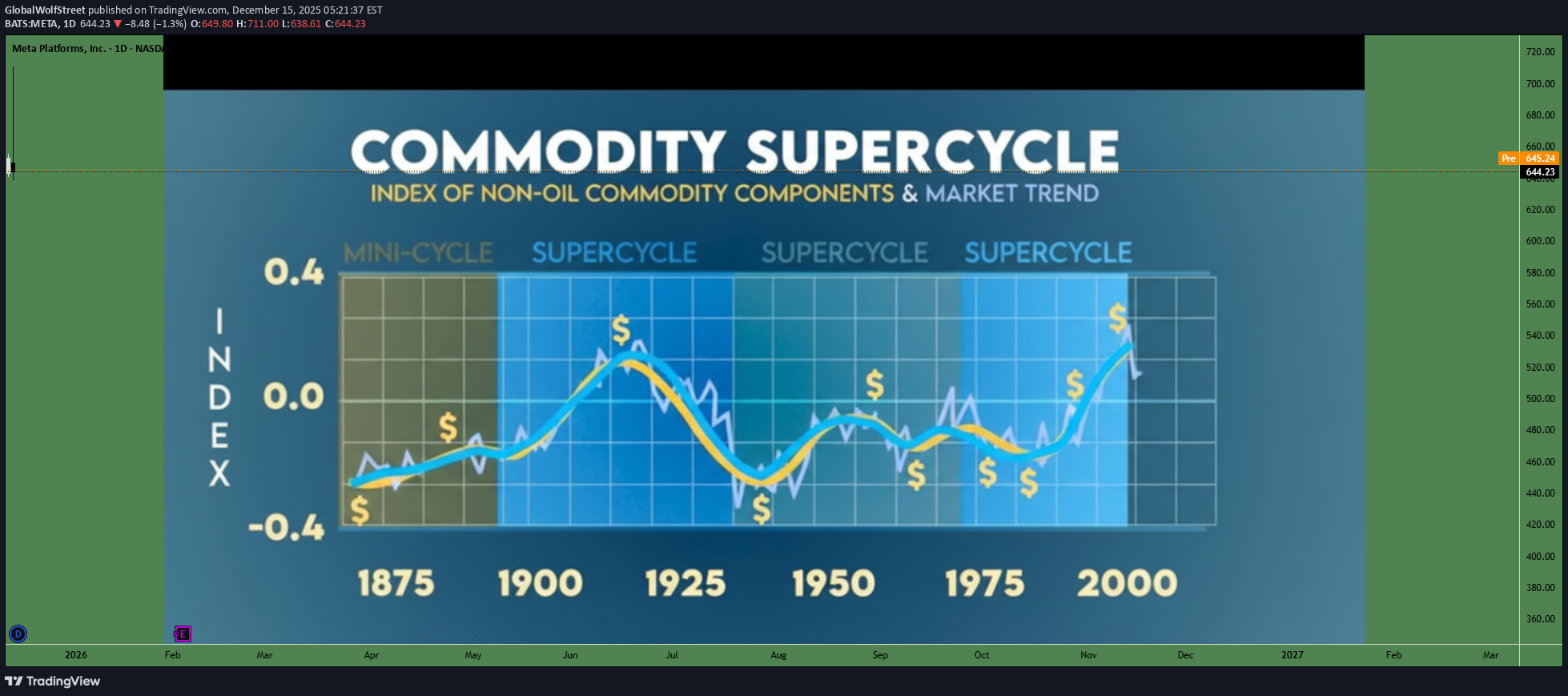

Commodity Super Cycle

Understanding the Long-Term Boom and Bust of Global Resources A commodity super cycle refers to a prolonged period—often lasting a decade or more—during which commodity prices rise significantly above their long-term average, driven by strong and sustained demand growth. Unlike short-term commodity rallies caused by temporary supply disruptions or speculative activity, a super cycle is structural in nature. It is usually powered by major global economic transformations such as industrialization, urbanization, technological shifts, demographic changes, or large-scale infrastructure development. Historically, commodity super cycles have played a crucial role in shaping global economies, influencing inflation, trade balances, corporate profits, and investment flows. Understanding the dynamics of a commodity super cycle helps investors, policymakers, businesses, and traders prepare for both opportunities and risks across commodities such as metals, energy, agriculture, and industrial raw materials. Origins and Concept of a Commodity Super Cycle The concept of a commodity super cycle gained prominence through the work of economists who observed long-term price trends across commodities. They noticed that commodity prices tend to move in extended waves rather than random patterns. These cycles typically consist of four phases: early recovery, expansion, peak, and decline. Super cycles are not driven by speculation alone. They emerge when demand consistently outpaces supply for many years. Since commodity production requires heavy capital investment and long lead times—mines, oil fields, pipelines, and farms cannot be expanded overnight—supply often struggles to respond quickly, pushing prices higher for extended periods. Key Drivers of a Commodity Super Cycle Rapid Economic Growth and Industrialization One of the strongest drivers of a super cycle is rapid economic growth in large economies. For example, the industrialization of the United States in the early 20th century and China’s economic expansion from the early 2000s created massive demand for steel, copper, coal, oil, and cement. Urbanization increases consumption of metals, energy, and construction materials on an unprecedented scale. Infrastructure and Urban Development Large infrastructure programs—roads, railways, ports, power plants, housing, and smart cities—require enormous quantities of commodities. When governments invest heavily in infrastructure over long periods, it creates sustained demand that supports a super cycle. Demographic Shifts and Population Growth Growing populations and rising middle classes increase demand for food, energy, housing, transportation, and consumer goods. Agricultural commodities, energy products, and industrial metals all benefit from these structural changes. Technological and Energy Transitions New technologies can trigger commodity demand shocks. The current global shift toward renewable energy, electric vehicles, and decarbonization has increased demand for lithium, copper, nickel, cobalt, and rare earth elements. Such transitions can spark new commodity super cycles focused on “green” or strategic metals. Supply Constraints and Underinvestment Commodity markets are cyclical, and long periods of low prices often lead to underinvestment. When demand later accelerates, limited supply capacity causes prices to surge. Environmental regulations, geopolitical tensions, and resource depletion further constrain supply, amplifying the cycle. Historical Examples of Commodity Super Cycles Early 20th Century (1890s–1920s): Driven by industrialization in the US and Europe, fueling demand for coal, steel, and agricultural commodities. Post–World War II Boom (1945–1970s): Reconstruction of Europe and Japan, combined with population growth, led to strong commodity demand. China-Led Super Cycle (2000–2014): China’s rapid industrial growth and urbanization created one of the largest commodity booms in history, pushing prices of iron ore, copper, oil, and coal to record highs. Each cycle eventually ended as supply caught up, demand slowed, or economic conditions changed. Impact on Global Economies Commodity super cycles have profound macroeconomic effects: Inflation: Rising commodity prices increase production and transportation costs, often leading to higher consumer inflation. Exporters vs Importers: Commodity-exporting countries (such as Australia, Brazil, Russia, and Middle Eastern nations) benefit from improved trade balances and economic growth, while importing nations face higher costs. Currency Movements: Exporters’ currencies often strengthen during a super cycle, while importers may see currency pressure. Corporate Profits and Investment: Mining, energy, and commodity-linked companies experience higher revenues and profits, encouraging capital investment and mergers. Role of Financial Markets and Investors For investors, a commodity super cycle creates long-term opportunities across asset classes: Equities: Mining, energy, fertilizer, and infrastructure companies often outperform. Commodities and Futures: Direct exposure through futures, ETFs, and commodity indices becomes attractive. Inflation Hedges: Commodities are often used to hedge against inflation during super cycles. Emerging Markets: Resource-rich emerging economies tend to attract capital inflows. However, volatility remains high, and timing is critical, as late-cycle investments can suffer sharp corrections. Risks and Limitations of a Super Cycle Despite their long duration, commodity super cycles are not permanent. Risks include: Overcapacity: High prices encourage excessive supply expansion, eventually leading to oversupply. Technological Substitution: Innovation can reduce reliance on certain commodities, lowering demand. Economic Slowdowns: Recessions or financial crises can abruptly end demand growth. Policy and Environmental Constraints: Climate policies and regulations can both boost and restrict commodity demand, creating uncertainty. Investors and policymakers must recognize that every super cycle eventually peaks and reverses. Is the World Entering a New Commodity Super Cycle? Many analysts believe the global economy may be entering a new commodity super cycle driven by energy transition, infrastructure spending, supply chain reshoring, and geopolitical fragmentation. Metals critical for clean energy, food security concerns, and constrained fossil fuel investment are all contributing factors. However, whether this develops into a full super cycle depends on sustained global growth, policy consistency, and long-term demand trends. Conclusion A commodity super cycle represents a powerful and transformative phase in the global economy, marked by prolonged periods of rising commodity prices driven by structural demand shifts and supply constraints. These cycles reshape industries, influence inflation, alter trade dynamics, and create significant investment opportunities—while also carrying substantial risks. Understanding the causes, phases, and impacts of a commodity super cycle allows market participants to make informed decisions and better navigate the long-term ebb and flow of global commodity markets.