ATOM

Cosmos

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

SwallowAcademySıralama: 30699 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 27.11.2025 |

Cosmos Fiyat Grafiği

سود Üç Ay :

خلاصه سیگنالهای Cosmos

سیگنالهای Cosmos

filtre

Mesajı şuna göre sırala

Tüccar Türü

timeframe

SpartaBTC

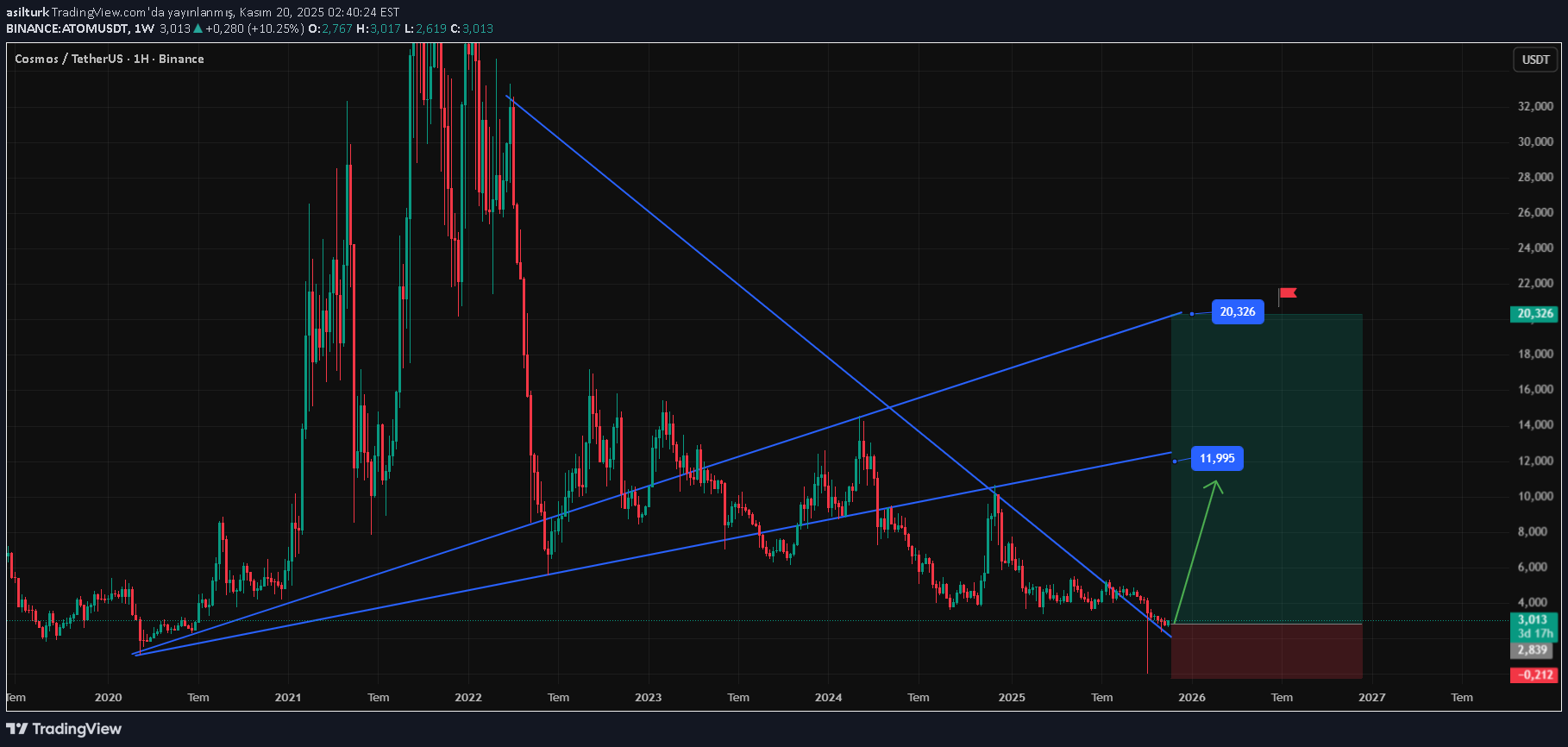

ATOM - COSMOS. Main Trend 12 2025

Logaritma. Ana trendi görselleştirmek için 1 aylık zaman dilimi. Fiyat, 2021 super hype dalgasının dağıtım bölgesinde, aşağı yönlü bir ikincil trend kanalında yer alıyor. hype öldü, ancak genel piyasa perspektifinden bakıldığında anlamlı olduğunda yeniden canlanma olasılığı oldukça yüksek. Bu yüzden yıllar sonra bu fikri yayınlıyorum + sana başka bir şey göstereceğim. 1 aylık zaman dilimi 3 günlük zaman dilimi. Birikim bölgelerinde korkuyu artışlarla satın alın, satış bölgelerinde ise neşeyi artışlarla satın. Piyasadakiler de dahil olmak üzere herhangi bir satın alma, birincil eğilim ve potansiyeli (hatta ikincil) açısından kabul edilebilir ve çok ucuzdur. Varlık çeşitlendirme risklerini de yönetirseniz (hype'te veya listelerde ölmek üzere olan "okul çocuğu şeker ambalajları" veya "umut vaat eden hurdalar" satın almaktan kaçının, bunlar aynı şeydir) ve her satın alımdan sonra, ihtiyaç duyulan yerde (trend hareketlerinin kısa vadeli kırılmaları, dağıtım ticareti) ve ihtiyaç duyulmadığı yerde (kapitülasyon, net bir sonucu olan geri dönüş bölgeleri) bir stop-loss uygulamak yerine giriş/çıkış miktarlarını yönetirseniz, ancak kitap bunun zorunlu olduğunu söylüyor (likidite) borsalar ve büyük piyasa katılımcıları tarafından toplanan algoritmalar, çoğunluğun klonlanmış eylemleri yoluyla). O zaman zaman içinde huzuru ve kârı, yani spekülatif "Zen" deneyimini yaşayacaksınız. 1) Zeka seviyeniz. 2) Ticaret planı. 3) Risk kontrolü. Bu, disiplin (olgunluk, deneyim) ve ilk nokta ile güçlü bir şekilde ilişkilidir. Yukarıdaki üç noktadan herhangi birine sahip değilseniz (biri olmadan diğeri işe yaramaz), o zaman yatırım yapmaktan ve ticaret yapmaktan vazgeçin, çünkü her zaman zayıf bir oyuncu olacaksınız ve kısa süreli kazançlar (kazalar veya size "yemlendirilmek") önemli olmayacaktır. Sonuçta uzun vadede duygusal yıkım ve pişmanlıktan başka bir şey yaşamayacaksınız. Bu, para ve sorumlulukla ilgili her türlü faaliyet için geçerlidir. Risk her zaman sizin tarafınızdan gerekçelendirilmeli ve kontrol edilmelidir. Bu vakıfların temelidir. Eğer durum böyle değilse, kil temel üzerine spekülatif bir ev inşa ediyor ve sadece fiyatını tahmin etmeye çalışıyorsunuz demektir. Er ya da geç çökecek ve ne kadar geç olursa o kadar acı verici olacaktır. 🧠 Yalnızca daha anlayışlı olanlar için kişisel gelişime yönelik bilgiler. Kimsenin buna ihtiyacı yok çünkü var olmayan bir şeyi icat edeceksiniz. Para kazanmak için standart TA mantığı + risk yönetimi yeterlidir. Algoritmanın "seviyeleri" (mantıklı olan destek/direnç bölgesi seviyeleriyle örtüşür), tamamı bir mıknatıs kullanılarak ve tam olarak sayısal değerlere dayalı olarak ayarlanır (herkesin bunu anlamasına gerek yok; bu bir bonus, daha fazlası değil). İşleri basit tutmak için özellikle yalnızca geniş bir zaman dilimi (ay) ve önemli trend yön bölgelerini kullandım. Anlasanız da anlamasanız da, bunu zaten birçok kez gösterdim. Bazı mıknatıs seviyeleri mum çubuklarını (düşük ve yüksek) temel alırken, diğerleri trend yönünü (linear) temel alır. Parantez içinde belirttim. Fiyatın yıllar sonra gösterdiği gibi (trend gelişimi), planlandığı gibi (trend yönü ve kilit alanlar), yani hepsi "Aladdin'in karesi" gibi "var olmayan" bir AI algoritması tarafından yaratıldı. Ah, evet. Bu bir komplo teorisi... Açın gözlerinizi... Piyasalar sermaye tarafından rasyonaliteye göre, eylemlerine göre (düşük seviyeden satın almak haber dehşeti yaratır, yüksekten satmak haber coşkusu yaratır) yönlendirilir ve bu da kâra eşittir. Bunda hükümetlerin, özellikle de "küresel demokrasinin" hükümetlerinin büyük rolü var.

WaveRiders2

مقاومت جدید ATOM: آیا خروج از سقف قرمز ممکن است؟

🚨📊 ATOM Güncelleme ATOM ayrıca red 🔴'de yeni bir direnç bölgesi oluşturdu. Bu seviye artık güçlü bir tavan görevi görüyor. ve fiyatın bu red direncinin üzerine çıkması gerekiyor tekrar gerçek bir yükseliş momentumu göstermek için. Bu kopuş gerçekleşene kadar, Satıcılar kontrolü elinde tutuyor ve yükselişler sınırlı kalıyor.

CryptoYodaX

SwallowAcademy

کازموس (ATOM) آماده جهش: بهترین نقاط ورود برای سود کوتاهمدت و بلندمدت

ATOM, bu uzun aşağı yönlü sürecin ardından nihayet tersine dönme işaretleri gösteriyor ve bu tepkiyle birlikte zaten kısa vadeli bir ticaret fırsatı oluşuyor. Uzun vadeli kurulum için fikir aynı kalıyor, ancak SL daha yüksek zaman dilimindeki oyunlarda doğal olarak daha geniş olduğundan daha küçük bir kaldıraçla devam edeceğiz. Bu momentum devam ederse, alıcıların fiyatı EMA'ların yakınındaki doldurulmamış bölgelere geri itmeyi hedeflemesi gerekiyor; gerçek genişlemenin başlayabileceği yer burası. Bu geri dönüş devam ettiği sürece hem kısa vadeli hem de uzun vadeli işlemler geçerliliğini korur. Kırlangıç Akademisi

CryptoAnalystSignal

تحلیل ATOM/USDT: آیا موج صعودی جدید در راه است؟ (سطوح کلیدی و اهداف قیمت)

#ATOM Fiyat 1 saatlik zaman diliminde azalan bir kanalda hareket ediyor. Alt sınıra ulaştı ve üst sınırın yeniden test edilmesiyle birlikte bu sınırı aşmaya doğru ilerliyor. RSI göstergesinde alt sınıra yakın bir düşüş trendi var ve yukarı yönlü bir toparlanma bekleniyor. 2.40'ta yeşil renkte önemli bir destek bölgesi var. Fiyat bu bölgeden birçok kez sıçradı ve tekrar sıçrama yapması bekleniyor. 100 dönemlik hareketli ortalamanın üzerinde istikrara doğru bir eğilimimiz var ve ona yaklaşıyoruz, bu da yukarı doğru movement'i destekliyor. Giriş fiyatı: 2,51 İlk hedef: 2,58 İkinci hedef: 2,66 Üçüncü hedef: 2,75 Basit bir prensibi unutmayın: para yönetimi. Zararı durdur emrinizi yeşil renkteki destek bölgesinin altına yerleştirin. Sorularınız için lütfen yorum bırakın. Teşekkür ederim.

tradecitypro

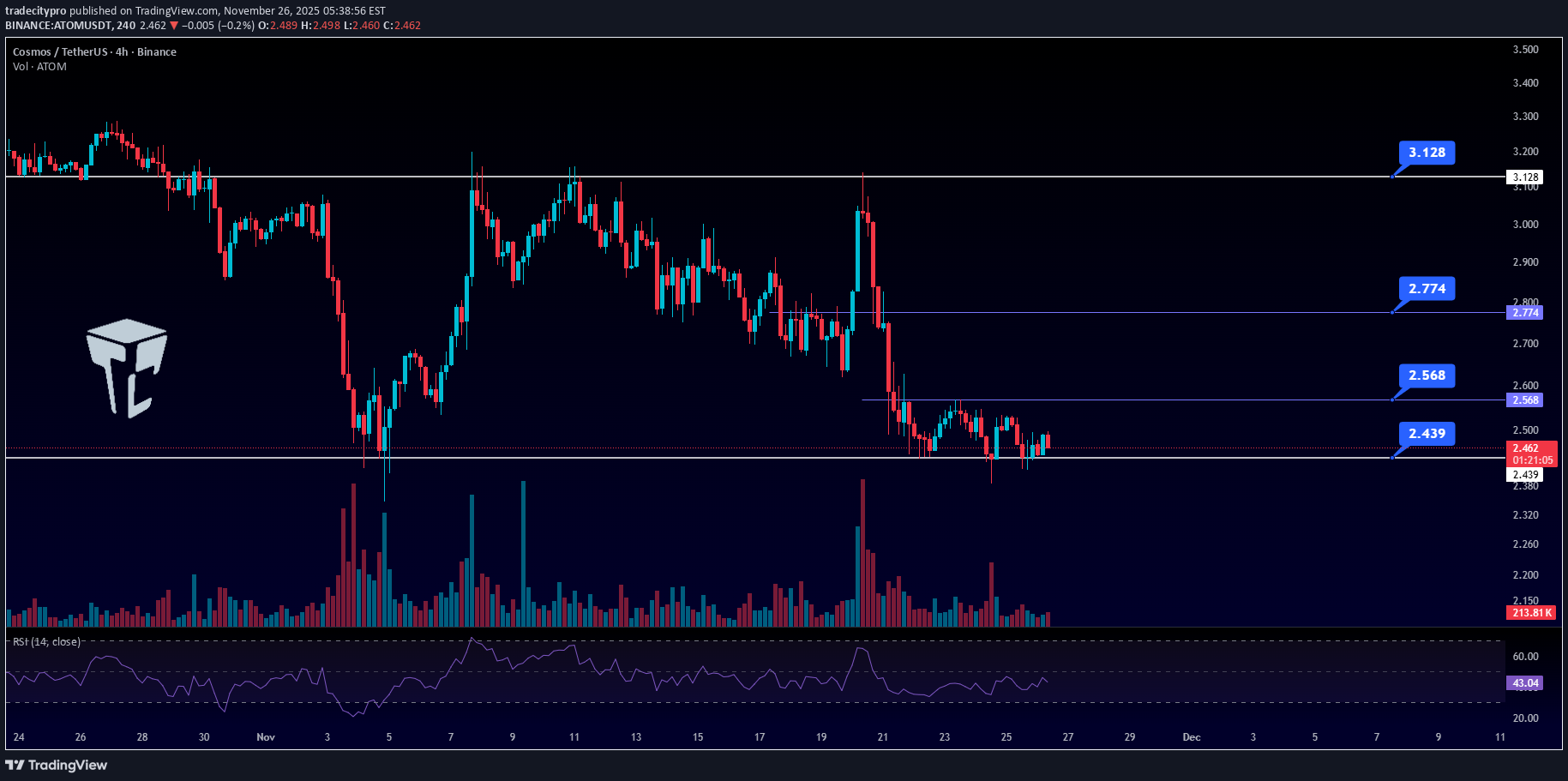

قیمت اتم (ATOM) در آستانه سقوط؟ حمایت حیاتی که نباید از دست برود!

👋 TradeCityPro'ya hoş geldiniz! Kripto piyasasındaki en eski kripto paralardan biri olan ve şu anda çok kritik bir destek seviyesinde, aslında son major destek bölgesinde bulunan ATOM'un analizine dalalım. 🌐 Bitcoin Genel Bakış Başlamadan önce, talebiniz üzerine Bitcoin analiz bölümünü özel bir günlük rapora taşıdığımızı bir kez daha hatırlatmama izin verin; böylece Bitcoin'in trendini, hakimiyetini ve genel piyasa duyarlılığını her gün daha derinlemesine analiz edebiliriz. Daha yüksek zaman dilimlerinde, piyasadaki son dönemdeki ağır düşüşler nedeniyle ATOM daha önce neredeyse 0 dolara kadar düştü, son derece dik bir düşüş yaşadı ve ardından uzun bir konsolidasyon aşamasına girdi. Şu anda fiyat bir kez daha aralığın en altına ulaştı; bu, uzun süredir saygı duyduğu temel destek bölgesi. 2.439 dolar civarındaki bu alan, ATOM’un son savunma hattı olarak değerlendirilebilir. 🔻 Kısa Pozisyon 2,439'un altındaki bir kırılma, kısa pozisyon için net bir tetikleyici sağlar. Ancak doğrulama, dökümün doğrulanması için hacimde bir artış gerektirir. 🔼 Uzun Pozisyon Güçlü düşüş yapısı nedeniyle uzun pozisyon almak şu anda tercih edilen bir seçenek değil. Ancak fiyat değişmeye devam ederse ve bu desteği korursa, 2,568'in üzerinde bir kırılma geçerli bir uzun kurulum sağlayabilir.

DEXWireNews

افزایش خیرهکننده ۱۱ درصدی قیمت کازماس (ATOM) همزمان با سقوط بازار!

Fiyatı ( ATOM ) Ethereum'in 2900$ bölgesine düştüğü piyasadaki kanlı yükselişe rağmen bugün %11 arttı ve BTC 80 bin dolarlık bölgeye. ATOM RSI 53'te sıkı simetrik bir üçgen şeklinde daraltılmış durumda. Altcoin üçgenin tavanını 5 dolar direncine kadar kırarsa varlık 40 dolarlık direnci görecek. Başka bir haberde, Güney Kore'nin önde gelen borsası Bithumb, ATOM işlemlerini etkileyen önemli bir geçici askıya alma işlemini duyurdu. 10 Kasım 09:00 UTC'den itibaren platform, önemli bir ağ yükseltmesini kolaylaştırmak için tüm ATOM para yatırma ve çekme işlemlerini geçici olarak durduracak. Bu proaktif önlem, Cosmos ekosisteminin güvenli ve verimli bir şekilde gelişmeye devam etmesini sağlar. Cosmos (ATOM) Nedir? Özetle, Cosmos kendisini blockchain endüstrisinin karşılaştığı "en zor sorunlardan" bazılarını çözen bir proje olarak tanıtıyor. Bağlantılı blockchainlerden oluşan bir ekosistem sunarak, Bitcoin tarafından kullanılanlar gibi "yavaş, pahalı, ölçeklenemeyen ve çevreye zararlı" iş kanıtı protokollerine karşı bir panzehir sunmayı amaçlıyor. Cosmos Fiyat Data Cosmos bugünkü fiyatı $3,04 USD ve 24 saatlik $189,904,725 USD işlem hacmine sahiptir. Cosmos son 24 saatte %10,03 arttı. Mevcut CoinMarketCap sıralaması 1.457.333.330 USD piyasa değeriyle 52. sırada yer alıyor. 478,764,540 ATOM jetonluk dolaşım arzına sahiptir.

AmanSumanTrader

سیگنال فروش فوری ATOM: آماده ریزش به زیر 2.70! (استراتژی کوتاه مدت)

Yeni Ticaret Kurulumu: ATOM-USDT KISA Giriş: 3.034 veya CMP Hedef: TP1: 2,934, TP2: 2,834, TP3: 2,734, TP4: 2,634 Zararı Durdur: 3.205 Kaldıraç: 1X Teknik Analiz: ATOM şu anda güçlü bir satış baskısıyla karşı karşıya ve direnç alıyor. 4 saatlik zaman diliminde RSI 80'in üzerinde, bu da aşırı alım koşullarına işaret ediyor. Yani geri çekilme ihtimali yüksek.

asilturk

پیشبینی هیجانانگیز: آیا ATOM از اصلاح خارج میشود و صعود میکند؟

ATOM (cosmos) an itibari ile 3$ fiyat bandında hareket eden kripto için 47Milyon $ hacim gerçekleşmektedir. Cosmos için küçük bir hacim ama haftalık grafikte düzeltmenin tamamlandığını söyleye biliriz. ATOM/ETH çiftine baktığımızda kademeli olarak toparlanmanın başladığını görüyoruz.Ve güölü bir trend BTC karşılaştırmasında ise güçlü bir trend söz konusu değil fakat ETH ağırlıklı hacmin çalışacağını öngörüyor ve önümüzdeki günlerde düşen piyasadan pozitif ayrışabilir kanaatindeyim. Keyifli harcamalar dilerim.

CryptoYodaX

سیگنال انفجاری ATOM: آیا وقت خرید این ارز است؟ (اهداف ۳.۲ دلاری)

Sorumluluk Reddi

Sahmeto'nun web sitesinde ve resmi iletişim kanallarında yer alan herhangi bir içerik ve materyal, kişisel görüşlerin ve analizlerin bir derlemesidir ve bağlayıcı değildir. Borsa ve kripto para piyasasına alım, satım, giriş veya çıkış için herhangi bir tavsiye oluşturmazlar. Ayrıca, web sitesinde ve kanallarda yer alan tüm haberler ve analizler, yalnızca resmi ve gayri resmi yerli ve yabancı kaynaklardan yeniden yayınlanan bilgilerdir ve söz konusu içeriğin kullanıcılarının materyallerin orijinalliğini ve doğruluğunu takip etmekten ve sağlamaktan sorumlu olduğu açıktır. Bu nedenle, sorumluluk reddedilirken, sermaye piyasası ve kripto para piyasasındaki herhangi bir karar verme, eylem ve olası kar ve zarar sorumluluğunun yatırımcıya ait olduğu beyan edilir.