Ren_MomentumTrader

@t_Ren_MomentumTrader

تریدر چه نمادی را توصیه به خرید کرده؟

سابقه خرید

تخمین بازدهی ماه به ماه تریدر

پیام های تریدر

فیلتر

نوع پیام

Ren_MomentumTrader

تحلیل ZEN/USDT: راز سطوح کلیدی و مومنتوم در استراتژی جدید LMT

Key Level Zone: 8.650 - 9.050 LMT v2.0 detected. The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align. Introducing LMT (Levels & Momentum Trading) - Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL. - While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones. - That insight led to the evolution of HMT into LMT – Levels & Momentum Trading. Why the Change? (From HMT to LMT) Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by: - Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork. - Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup. - Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively. - Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets. Whenever I share a signal, it’s because: - A high‐probability key level has been identified on a higher timeframe. - Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent. - The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry. ***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved. Important Note: The Role of Key Levels - Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer. - Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance. My Trading Rules (Unchanged) Risk Management - Maximum risk per trade: 2.5% - Leverage: 5x Exit Strategy / Profit Taking - Sell at least 70% on the 3rd wave up (LTF Wave 5). - Typically sell 50% during a high‐volume spike. - Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R. - Exit at breakeven if momentum fades or divergence appears. The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement. If you find this signal/analysis meaningful, kindly like and share it. Thank you for your support~ Sharing this with love! From HMT to LMT: A Brief Version History HM Signal : Date: 17/08/2023 - Early concept identifying high momentum pullbacks within strong uptrends - Triggered after a prior wave up with rising volume and momentum - Focused on healthy retracements into support for optimal reward-to-risk setups HMT v1.0: Date: 18/10/2024 - Initial release of the High Momentum Trading framework - Combined multi-timeframe trend, volume, and momentum analysis. - Focused on identifying strong trending moves high momentum HMT v2.0: Date: 17/12/2024 - Major update to the Momentum indicator - Reduced false signals from inaccurate momentum detection - New screener with improved accuracy and fewer signals HMT v3.0: Date: 23/12/2024 - Added liquidity factor to enhance trend continuation - Improved potential for momentum-based plays - Increased winning probability by reducing entries during peaks HMT v3.1: Date: 31/12/2024 - Enhanced entry confirmation for improved reward-to-risk ratios HMT v4.0: Date: 05/01/2025 - Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling HMT v4.1: Date: 06/01/2025 - Enhanced take-profit (TP) target by incorporating market structure analysis HMT v5 : Date: 23/01/2025 - Refined wave analysis for trending conditions - Incorporated lower timeframe (LTF) momentum to strengthen trend reliability - Re-aligned and re-balanced entry conditions for improved accuracy HMT v6 : Date : 15/02/2025 - Integrated strong accumulation activity into in-depth wave analysis HMT v7 : Date : 20/03/2025 - Refined wave analysis along with accumulation and market sentiment HMT v8 : Date : 16/04/2025 - Fully restructured strategy logic HMT v8.1 : Date : 18/04/2025 - Refined Take Profit (TP) logic to be more conservative for improved win consistency LMT v1.0 : Date : 06/06/2025 - Rebranded to emphasize key levels + momentum as the core framework LMT v2.0 Date: 11/06/2025 - Fully restructured lower timeframe (LTF) momentum logic

Ren_MomentumTrader

سیگنال BB/USDT: راز موفقیت در سطوح کلیدی (LMT v2.0)

Key Level Zone: 0.17500 - 0.18500 LMT v2.0 detected. The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align. Introducing LMT (Levels & Momentum Trading) - Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL. - While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones. - That insight led to the evolution of HMT into LMT – Levels & Momentum Trading. Why the Change? (From HMT to LMT) Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by: - Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork. - Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup. - Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively. - Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets. Whenever I share a signal, it’s because: - A high‐probability key level has been identified on a higher timeframe. - Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent. - The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry. ***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved. Important Note: The Role of Key Levels - Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer. - Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance. My Trading Rules (Unchanged) Risk Management - Maximum risk per trade: 2.5% - Leverage: 5x Exit Strategy / Profit Taking - Sell at least 70% on the 3rd wave up (LTF Wave 5). - Typically sell 50% during a high‐volume spike. - Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R. - Exit at breakeven if momentum fades or divergence appears. The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement. If you find this signal/analysis meaningful, kindly like and share it. Thank you for your support~ Sharing this with love! From HMT to LMT: A Brief Version History HM Signal : Date: 17/08/2023 - Early concept identifying high momentum pullbacks within strong uptrends - Triggered after a prior wave up with rising volume and momentum - Focused on healthy retracements into support for optimal reward-to-risk setups HMT v1.0: Date: 18/10/2024 - Initial release of the High Momentum Trading framework - Combined multi-timeframe trend, volume, and momentum analysis. - Focused on identifying strong trending moves high momentum HMT v2.0: Date: 17/12/2024 - Major update to the Momentum indicator - Reduced false signals from inaccurate momentum detection - New screener with improved accuracy and fewer signals HMT v3.0: Date: 23/12/2024 - Added liquidity factor to enhance trend continuation - Improved potential for momentum-based plays - Increased winning probability by reducing entries during peaks HMT v3.1: Date: 31/12/2024 - Enhanced entry confirmation for improved reward-to-risk ratios HMT v4.0: Date: 05/01/2025 - Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling HMT v4.1: Date: 06/01/2025 - Enhanced take-profit (TP) target by incorporating market structure analysis HMT v5 : Date: 23/01/2025 - Refined wave analysis for trending conditions - Incorporated lower timeframe (LTF) momentum to strengthen trend reliability - Re-aligned and re-balanced entry conditions for improved accuracy HMT v6 : Date : 15/02/2025 - Integrated strong accumulation activity into in-depth wave analysis HMT v7 : Date : 20/03/2025 - Refined wave analysis along with accumulation and market sentiment HMT v8 : Date : 16/04/2025 - Fully restructured strategy logic HMT v8.1 : Date : 18/04/2025 - Refined Take Profit (TP) logic to be more conservative for improved win consistency LMT v1.0 : Date : 06/06/2025 - Rebranded to emphasize key levels + momentum as the core framework LMT v2.0 Date: 11/06/2025 - Fully restructured lower timeframe (LTF) momentum logic

Ren_MomentumTrader

TWT/USDT

Key Level Zone: 1.1250 - 1.1550 LMT v2.0 detected. The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align. Introducing LMT (Levels & Momentum Trading) - Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL. - While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones. - That insight led to the evolution of HMT into LMT – Levels & Momentum Trading. Why the Change? (From HMT to LMT) Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by: - Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork. - Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup. - Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively. - Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets. Whenever I share a signal, it’s because: - A high‐probability key level has been identified on a higher timeframe. - Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent. - The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry. ***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved. Important Note: The Role of Key Levels - Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer. - Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance. My Trading Rules (Unchanged) Risk Management - Maximum risk per trade: 2.5% - Leverage: 5x Exit Strategy / Profit Taking - Sell at least 70% on the 3rd wave up (LTF Wave 5). - Typically sell 50% during a high‐volume spike. - Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R. - Exit at breakeven if momentum fades or divergence appears. The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement. If you find this signal/analysis meaningful, kindly like and share it. Thank you for your support~ Sharing this with love! From HMT to LMT: A Brief Version History HM Signal : Date: 17/08/2023 - Early concept identifying high momentum pullbacks within strong uptrends - Triggered after a prior wave up with rising volume and momentum - Focused on healthy retracements into support for optimal reward-to-risk setups HMT v1.0: Date: 18/10/2024 - Initial release of the High Momentum Trading framework - Combined multi-timeframe trend, volume, and momentum analysis. - Focused on identifying strong trending moves high momentum HMT v2.0: Date: 17/12/2024 - Major update to the Momentum indicator - Reduced false signals from inaccurate momentum detection - New screener with improved accuracy and fewer signals HMT v3.0: Date: 23/12/2024 - Added liquidity factor to enhance trend continuation - Improved potential for momentum-based plays - Increased winning probability by reducing entries during peaks HMT v3.1: Date: 31/12/2024 - Enhanced entry confirmation for improved reward-to-risk ratios HMT v4.0: Date: 05/01/2025 - Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling HMT v4.1: Date: 06/01/2025 - Enhanced take-profit (TP) target by incorporating market structure analysis HMT v5 : Date: 23/01/2025 - Refined wave analysis for trending conditions - Incorporated lower timeframe (LTF) momentum to strengthen trend reliability - Re-aligned and re-balanced entry conditions for improved accuracy HMT v6 : Date : 15/02/2025 - Integrated strong accumulation activity into in-depth wave analysis HMT v7 : Date : 20/03/2025 - Refined wave analysis along with accumulation and market sentiment HMT v8 : Date : 16/04/2025 - Fully restructured strategy logic HMT v8.1 : Date : 18/04/2025 - Refined Take Profit (TP) logic to be more conservative for improved win consistency LMT v1.0 : Date : 06/06/2025 - Rebranded to emphasize key levels + momentum as the core framework LMT v2.0 Date: 11/06/2025 - Fully restructured lower timeframe (LTF) momentum logic

Ren_MomentumTrader

SOON/USDT

Key Level Zone: 0.33500 - 0.34000 LMT v2.0 detected. The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align. Introducing LMT (Levels & Momentum Trading) - Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL. - While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones. - That insight led to the evolution of HMT into LMT – Levels & Momentum Trading. Why the Change? (From HMT to LMT) Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by: - Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork. - Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup. - Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively. - Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets. Whenever I share a signal, it’s because: - A high‐probability key level has been identified on a higher timeframe. - Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent. - The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry. ***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved. Important Note: The Role of Key Levels - Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer. - Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance. My Trading Rules (Unchanged) Risk Management - Maximum risk per trade: 2.5% - Leverage: 5x Exit Strategy / Profit Taking - Sell at least 70% on the 3rd wave up (LTF Wave 5). - Typically sell 50% during a high‐volume spike. - Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R. - Exit at breakeven if momentum fades or divergence appears. The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement. If you find this signal/analysis meaningful, kindly like and share it. Thank you for your support~ Sharing this with love! From HMT to LMT: A Brief Version History HM Signal : Date: 17/08/2023 - Early concept identifying high momentum pullbacks within strong uptrends - Triggered after a prior wave up with rising volume and momentum - Focused on healthy retracements into support for optimal reward-to-risk setups HMT v1.0: Date: 18/10/2024 - Initial release of the High Momentum Trading framework - Combined multi-timeframe trend, volume, and momentum analysis. - Focused on identifying strong trending moves high momentum HMT v2.0: Date: 17/12/2024 - Major update to the Momentum indicator - Reduced false signals from inaccurate momentum detection - New screener with improved accuracy and fewer signals HMT v3.0: Date: 23/12/2024 - Added liquidity factor to enhance trend continuation - Improved potential for momentum-based plays - Increased winning probability by reducing entries during peaks HMT v3.1: Date: 31/12/2024 - Enhanced entry confirmation for improved reward-to-risk ratios HMT v4.0: Date: 05/01/2025 - Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling HMT v4.1: Date: 06/01/2025 - Enhanced take-profit (TP) target by incorporating market structure analysis HMT v5 : Date: 23/01/2025 - Refined wave analysis for trending conditions - Incorporated lower timeframe (LTF) momentum to strengthen trend reliability - Re-aligned and re-balanced entry conditions for improved accuracy HMT v6 : Date : 15/02/2025 - Integrated strong accumulation activity into in-depth wave analysis HMT v7 : Date : 20/03/2025 - Refined wave analysis along with accumulation and market sentiment HMT v8 : Date : 16/04/2025 - Fully restructured strategy logic HMT v8.1 : Date : 18/04/2025 - Refined Take Profit (TP) logic to be more conservative for improved win consistency LMT v1.0 : Date : 06/06/2025 - Rebranded to emphasize key levels + momentum as the core framework LMT v2.0 Date: 11/06/2025 - Fully restructured lower timeframe (LTF) momentum logic

Ren_MomentumTrader

FLM/USDT

Key Level Zone: 0.0320 - 0.0330 LMT v2.0 detected. The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align. Introducing LMT (Levels & Momentum Trading) - Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL. - While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones. - That insight led to the evolution of HMT into LMT – Levels & Momentum Trading. Why the Change? (From HMT to LMT) Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by: - Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork. - Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup. - Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively. - Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets. Whenever I share a signal, it’s because: - A high‐probability key level has been identified on a higher timeframe. - Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent. - The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry. ***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved. Important Note: The Role of Key Levels - Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer. - Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance. My Trading Rules (Unchanged) Risk Management - Maximum risk per trade: 2.5% - Leverage: 5x Exit Strategy / Profit Taking - Sell at least 70% on the 3rd wave up (LTF Wave 5). - Typically sell 50% during a high‐volume spike. - Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R. - Exit at breakeven if momentum fades or divergence appears. The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement. If you find this signal/analysis meaningful, kindly like and share it. Thank you for your support~ Sharing this with love! From HMT to LMT: A Brief Version History HM Signal : Date: 17/08/2023 - Early concept identifying high momentum pullbacks within strong uptrends - Triggered after a prior wave up with rising volume and momentum - Focused on healthy retracements into support for optimal reward-to-risk setups HMT v1.0: Date: 18/10/2024 - Initial release of the High Momentum Trading framework - Combined multi-timeframe trend, volume, and momentum analysis. - Focused on identifying strong trending moves high momentum HMT v2.0: Date: 17/12/2024 - Major update to the Momentum indicator - Reduced false signals from inaccurate momentum detection - New screener with improved accuracy and fewer signals HMT v3.0: Date: 23/12/2024 - Added liquidity factor to enhance trend continuation - Improved potential for momentum-based plays - Increased winning probability by reducing entries during peaks HMT v3.1: Date: 31/12/2024 - Enhanced entry confirmation for improved reward-to-risk ratios HMT v4.0: Date: 05/01/2025 - Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling HMT v4.1: Date: 06/01/2025 - Enhanced take-profit (TP) target by incorporating market structure analysis HMT v5 : Date: 23/01/2025 - Refined wave analysis for trending conditions - Incorporated lower timeframe (LTF) momentum to strengthen trend reliability - Re-aligned and re-balanced entry conditions for improved accuracy HMT v6 : Date : 15/02/2025 - Integrated strong accumulation activity into in-depth wave analysis HMT v7 : Date : 20/03/2025 - Refined wave analysis along with accumulation and market sentiment HMT v8 : Date : 16/04/2025 - Fully restructured strategy logic HMT v8.1 : Date : 18/04/2025 - Refined Take Profit (TP) logic to be more conservative for improved win consistency LMT v1.0 : Date : 06/06/2025 - Rebranded to emphasize key levels + momentum as the core framework LMT v2.0 Date: 11/06/2025 - Fully restructured lower timeframe (LTF) momentum logic

Ren_MomentumTrader

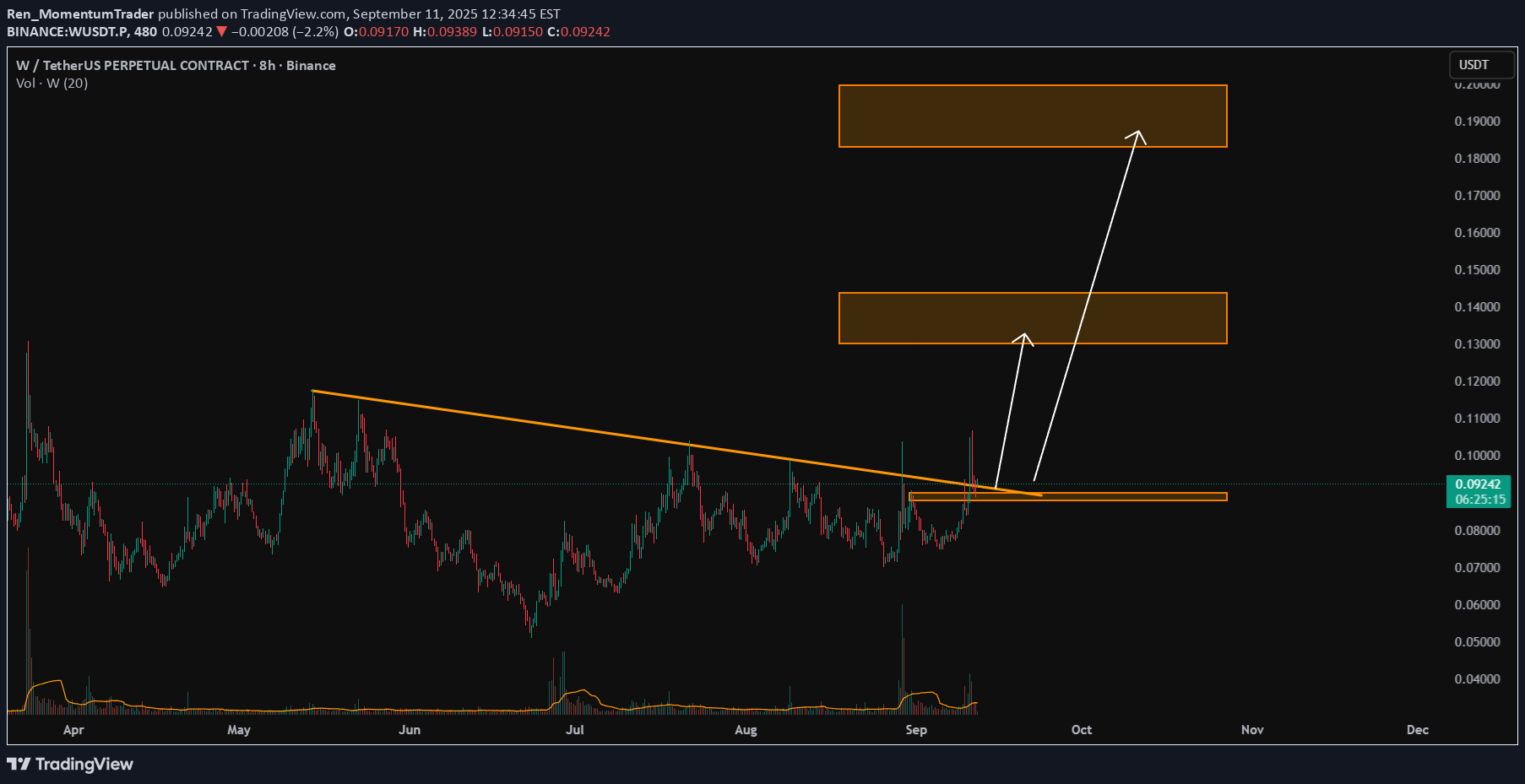

W/USDT

ناحیه سطح کلیدی: 0.08800 - 0.09000 LMT v2.0 شناسایی شد. به نظر می رسد تنظیمات امیدوار کننده است—قیمت قبلاً با افزایش حجم و مومنتوم، روند صعودی داشته و سپس این ناحیه را به طور تمیز دوباره آزمایش کرده است. اگر مومنتوم همچنان همسو باشد، این یک فرصت عالی با نسبت پاداش به ریسک است. معرفی LMT (معاملات سطوح و مومنتوم) - در طول 3 سال گذشته، رویکرد خود را برای تمرکز بیشتر بر مهمترین عنصر در هر معامله اصلاح کرده ام: سطح کلیدی. - در حالی که HMT (معاملات مومنتوم بالا) به من کمک زیادی کرد—ترکیب روند، مومنتوم، حجم و ساختار در چندین بازه زمانی—متوجه شدم که شناسایی مداوم و احترام به این مناطق حیاتی قیمت، چیزی است که واقعاً معاملات خوب را از معاملات عالی جدا می کند. - این بینش منجر به تکامل HMT به LMT – معاملات سطوح و مومنتوم شد. چرا تغییر؟ (از HMT به LMT) تغییر از معاملات مومنتوم بالا (HMT) به معاملات سطوح و مومنتوم (LMT) دقت، کنترل ریسک و اطمینان را با موارد زیر بهبود می بخشد: - نقاط ورود و توقف ضرر واضح تر: سطوح کلیدی تعریف شده برنامه ریزی برای نقاط ورود، توقف ضرر و اندازه موقعیت را آسان تر می کند—دیگر حدس و گمان وجود ندارد. - کیفیت سیگنال بهتر: اکنون مومنتوم همیشه در برابر یک منطقه حمایت یا مقاومت بررسی می شود—اگر همسو باشد، یک تنظیمات قوی تر است. - نسبت پاداش به ریسک بهبود یافته: تمام معاملات به سطوح کلیدی متصل هستند، که محاسبه و مدیریت موثر ریسک را آسان تر می کند. - اطمینان قوی تر: با نقاط ابطال واضح فراتر از سطوح کلیدی، اعتماد به برنامه و حفظ نظم و انضباط آسان تر است—حتی در بازارهای سخت. هر زمان که سیگنالی را به اشتراک می گذارم، به این دلیل است که: - یک سطح کلیدی با احتمال بالا در یک بازه زمانی بالاتر شناسایی شده است. - مومنتوم، ساختار بازار و حجم در بازه زمانی پایین تر نشان می دهد که ادامه یا معکوس شدن قریب الوقوع است. - نسبت پاداش به ریسک (بر اساس آن سطح کلیدی) مطابق با معیارهای من برای یک ورود منظم است. ***لطفاً توجه داشته باشید که انجام یک تجزیه و تحلیل جامع بر روی یک نمودار بازه زمانی واحد می تواند کاملاً چالش برانگیز و گاهی اوقات گیج کننده باشد. من از درک شما از تلاش های انجام شده قدردانی می کنم. نکته مهم: نقش سطوح کلیدی - نگه داشتن یک ناحیه سطح کلیدی: اگر قیمت به ناحیه سطح کلیدی احترام بگذارد، مومنتوم اغلب روند را در جهت مورد انتظار پیش می برد. این زمانی است که ما به دنبال ورود هستیم، با توقف ضرر درست فراتر از ناحیه با کمی حاشیه. - شکستن یک ناحیه سطح کلیدی: یک شکست قطعی سیگنال توقف ضرر احتمالی برای معامله گران روند است. برای معامله گران معکوس، این نشانه ای است برای در نظر گرفتن تغییر جهت—قیمت اغلب مناطق شکسته شده را به عنوان حمایت یا مقاومت جدید دوباره آزمایش می کند. قوانین معاملاتی من (بدون تغییر) مدیریت ریسک - حداکثر ریسک در هر معامله: 2.5٪ - اهرم: 5 برابر استراتژی خروج / برداشت سود - فروش حداقل 70٪ در موج سوم صعودی (موج 5 LTF). - معمولاً 50٪ در طول یک افزایش حجم بالا می فروشیم. - هنگامی که معامله به نسبت 1.5:1 R:R دست می یابد، توقف ضرر را به نقطه سر به سر منتقل کنید. - اگر مومنتوم محو شود یا واگرایی ظاهر شود، در نقطه سر به سر خارج شوید. بازار بسیار پویا و دائماً در حال تغییر است. سیگنال های LMT و سطوح سود هدف (TP) بر اساس قیمت و حرکت فعلی هستند، اما شرایط بازار می تواند فوراً تغییر کند، بنابراین بسیار مهم است که سازگار بمانید و بازار را دنبال کنید movement. اگر این سیگنال/تحلیل را معنادار می دانید، لطفاً آن را لایک و به اشتراک بگذارید. از حمایت شما سپاسگزارم~ با عشق به اشتراک می گذارم! از HMT به LMT: تاریخچه مختصر نسخه سیگنال HM: تاریخ: 17/08/2023 - مفهوم اولیه شناسایی عقب نشینی های مومنتوم بالا در روندهای صعودی قوی - پس از موج قبلی با افزایش حجم و مومنتوم فعال شد - متمرکز بر اصلاحات سالم به سمت حمایت برای تنظیمات بهینه پاداش به ریسک HMT v1.0: تاریخ: 18/10/2024 - انتشار اولیه چارچوب معاملات مومنتوم بالا - ترکیب تحلیل روند، حجم و مومنتوم چند بازه زمانی. - متمرکز بر شناسایی حرکات قوی روند با مومنتوم بالا HMT v2.0: تاریخ: 17/12/2024 - Major به روز رسانی نشانگر مومنتوم - کاهش سیگنال های نادرست ناشی از تشخیص نادرست مومنتوم - غربالگر جدید با دقت بهبود یافته و سیگنال های کمتر HMT v3.0: تاریخ: 23/12/2024 - افزودن عامل نقدینگی برای افزایش ادامه روند - بهبود پتانسیل برای بازی های مبتنی بر مومنتوم - افزایش احتمال برنده شدن با کاهش ورود در طول قله ها HMT v3.1: تاریخ: 31/12/2024 - تأیید ورود پیشرفته برای نسبت های پاداش به ریسک بهبود یافته HMT v4.0: تاریخ: 05/01/2025 - ترکیب فشار خرید و فروش در بازه های زمانی پایین تر برای افزایش احتمال حرکات روند در حین بهینه سازی زمان ورود و مقیاس بندی HMT v4.1: تاریخ: 06/01/2025 - هدف برداشت سود (TP) با گنجاندن تحلیل ساختار بازار افزایش یافت HMT v5: تاریخ: 23/01/2025 - تحلیل موج پالایش شده برای شرایط روند - ترکیب مومنتوم بازه زمانی پایین تر (LTF) برای تقویت قابلیت اطمینان روند - شرایط ورود مجدداً تنظیم و متعادل شده برای دقت بهبود یافته HMT v6: تاریخ: 15/02/2025 - ادغام فعالیت انباشت قوی در تحلیل موج عمیق HMT v7: تاریخ: 20/03/2025 - تحلیل موج پالایش شده همراه با انباشت و احساسات بازار HMT v8: تاریخ: 16/04/2025 - منطق استراتژی کاملاً بازسازی شده است HMT v8.1: تاریخ: 18/04/2025 - منطق برداشت سود (TP) پالایش شده است تا برای بهبود win سازگاری محافظه کارانه تر باشد LMT v1.0: تاریخ: 06/06/2025 - تغییر نام تجاری برای تأکید بر سطوح کلیدی + مومنتوم به عنوان core چارچوب LMT v2.0 تاریخ: 11/06/2025 - منطق مومنتوم بازه زمانی پایین تر (LTF) کاملاً بازسازی شده است

Ren_MomentumTrader

W/USDT

ناحیه سطح کلیدی: 0.08800 - 0.09000 LMT v2.0 شناسایی شد. به نظر می رسد تنظیمات امیدوارکننده است - قیمت قبلاً با افزایش حجم و شتاب به سمت بالا حرکت کرده و سپس این منطقه را به طور تمیز دوباره آزمایش کرده است. اگر شتاب همچنان همسو باشد، این یک فرصت عالی پاداش به ریسک را ارائه می دهد. معرفی LMT (معاملات سطوح و مومنتوم) - در طول 3 سال گذشته، رویکرد خود را اصلاح کرده ام تا بیشتر بر مهمترین عنصر در هر معامله تمرکز کنم: سطح کلیدی. - در حالی که HMT (معاملات مومنتوم بالا) به خوبی به من خدمت کرد - ترکیب روند، مومنتوم، حجم و ساختار در چندین بازه زمانی - متوجه شدم که شناسایی مداوم و احترام به این مناطق حیاتی قیمت، چیزی است که واقعاً معاملات خوب را از معاملات عالی جدا می کند. - این بینش منجر به تکامل HMT به LMT – معاملات سطوح و مومنتوم شد. چرا تغییر؟ (از HMT به LMT) تغییر از معاملات مومنتوم بالا (HMT) به معاملات سطوح و مومنتوم (LMT) دقت، کنترل ریسک و اعتماد را از طریق موارد زیر بهبود می بخشد: - ورودی ها و توقف های واضح تر: سطوح کلیدی تعریف شده برنامه ریزی ورودی ها، توقف ضررها و تعیین اندازه موقعیت را آسان تر می کند - دیگر حدس و گمان لازم نیست. - کیفیت سیگنال بهتر: مومنتوم اکنون همیشه در برابر یک منطقه حمایت یا مقاومت بررسی می شود - اگر همسو باشد، یک تنظیم قوی تر است. - بهبود پاداش به ریسک: همه معاملات به سطوح کلیدی متصل هستند، که محاسبه و مدیریت موثر ریسک را آسان تر می کند. - اعتماد قوی تر: با نقاط ابطال واضح فراتر از سطوح کلیدی، اعتماد به طرح و انضباط داشتن - حتی در بازارهای سخت - آسان تر است. هر زمان که سیگنالی را به اشتراک می گذارم، به این دلیل است که: - یک سطح کلیدی با احتمال بالا در یک بازه زمانی بالاتر شناسایی شده است. - مومنتوم، ساختار بازار و حجم در بازه زمانی پایین تر نشان می دهد که ادامه یا برگشت قریب الوقوع است. - پاداش به ریسک (بر اساس آن سطح کلیدی) معیارهای من را برای یک ورود منظم برآورده می کند. ***لطفاً توجه داشته باشید که انجام تجزیه و تحلیل جامع بر روی یک نمودار بازه زمانی واحد می تواند بسیار چالش برانگیز و گاهی اوقات گیج کننده باشد. از درک شما از تلاش های انجام شده قدردانی می کنم. نکته مهم: نقش سطوح کلیدی - نگه داشتن یک ناحیه سطح کلیدی: اگر قیمت به ناحیه سطح کلیدی احترام بگذارد، مومنتوم اغلب روند را در جهت مورد انتظار حمل می کند. این زمانی است که ما به دنبال ورود هستیم، با توقف ضرر که درست فراتر از منطقه با مقداری بافر قرار می گیرد. - شکستن یک ناحیه سطح کلیدی: یک شکست قطعی سیگنال توقف احتمالی برای معامله گران روند است. برای معامله گران برگشتی، این نشانه ای است برای در نظر گرفتن تغییر جهت - قیمت اغلب مناطق شکسته شده را به عنوان حمایت یا مقاومت جدید دوباره آزمایش می کند. قوانین معاملاتی من (بدون تغییر) مدیریت ریسک - حداکثر ریسک در هر معامله: 2.5٪ - اهرم: 5 برابر استراتژی خروج / برداشت سود - حداقل 70٪ را در موج سوم به سمت بالا بفروشید (موج 5 LTF). - به طور معمول 50٪ را در طول یک افزایش حجم بالا بفروشید. - هنگامی که معامله به R:R 1.5:1 رسید، توقف ضرر را به نقطه سر به سر منتقل کنید. - اگر مومنتوم محو شد یا واگرایی ظاهر شد، در نقطه سر به سر خارج شوید. بازار بسیار پویا و دائماً در حال تغییر است. سیگنال های LMT و سطوح سود هدف (TP) بر اساس قیمت و حرکت فعلی هستند، اما شرایط بازار می تواند فوراً تغییر کند، بنابراین بسیار مهم است که سازگار بمانید و از movement بازار پیروی کنید. اگر این سیگنال/تجزیه و تحلیل را معنادار می دانید، لطفاً آن را لایک و به اشتراک بگذارید. از حمایت شما سپاسگزارم~ با عشق این را به اشتراک می گذارم! از HMT به LMT: تاریخچه مختصر نسخه سیگنال HM : تاریخ: 17/08/2023 - مفهوم اولیه شناسایی عقب نشینی های مومنتوم بالا در روندهای صعودی قوی - پس از موج قبلی با افزایش حجم و مومنتوم فعال شد - تمرکز بر اصلاحات سالم به سمت حمایت برای تنظیمات بهینه پاداش به ریسک HMT v1.0: تاریخ: 18/10/2024 - انتشار اولیه چارچوب معاملات مومنتوم بالا - تجزیه و تحلیل روند، حجم و مومنتوم چند بازه زمانی را ترکیب کرد. - تمرکز بر شناسایی حرکات پرقدرت با مومنتوم بالا HMT v2.0: تاریخ: 17/12/2024 - Major به روز رسانی به اندیکاتور مومنتوم - سیگنال های نادرست ناشی از تشخیص نادرست مومنتوم را کاهش داد - غربالگر جدید با دقت بهبود یافته و سیگنال های کمتر HMT v3.0: تاریخ: 23/12/2024 - فاکتور نقدینگی را برای افزایش تداوم روند اضافه کرد - پتانسیل بهبود یافته برای بازی های مبتنی بر مومنتوم - احتمال برد را با کاهش ورودی ها در طول اوج ها افزایش داد HMT v3.1: تاریخ: 31/12/2024 - تأیید ورودی بهبود یافته برای نسبت های پاداش به ریسک بهبود یافته HMT v4.0: تاریخ: 05/01/2025 - فشار خرید و فروش را در بازه های زمانی پایین تر برای افزایش احتمال حرکات روند دار در عین بهینه سازی زمان ورود و مقیاس بندی گنجاند HMT v4.1: تاریخ: 06/01/2025 - هدف برداشت سود (TP) بهبود یافته با گنجاندن تجزیه و تحلیل ساختار بازار HMT v5 : تاریخ: 23/01/2025 - تجزیه و تحلیل موج پالایش شده برای شرایط روند دار - مومنتوم بازه زمانی پایین تر (LTF) را برای تقویت قابلیت اطمینان روند گنجاند - شرایط ورودی را برای دقت بهبود یافته دوباره تنظیم و متعادل کرد HMT v6 : تاریخ : 15/02/2025 - فعالیت انباشت قوی را در تجزیه و تحلیل عمیق موج ادغام کرد HMT v7 : تاریخ : 20/03/2025 - تجزیه و تحلیل موج پالایش شده همراه با انباشت و احساسات بازار HMT v8 : تاریخ : 16/04/2025 - منطق استراتژی کاملاً بازسازی شده است HMT v8.1 : تاریخ : 18/04/2025 - منطق برداشت سود (TP) پالایش شده تا برای بهبود win سازگاری محافظه کارانه تر باشد LMT v1.0 : تاریخ : 06/06/2025 - تغییر نام تجاری برای تأکید بر سطوح کلیدی + مومنتوم به عنوان core چارچوب LMT v2.0 تاریخ: 11/06/2025 - منطق مومنتوم بازه زمانی پایین تر (LTF) کاملاً بازسازی شده است

Ren_MomentumTrader

PROM/USDT

Key Level Zone: 8.550 - 8.780 LMT v2.0 detected. The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align. Introducing LMT (Levels & Momentum Trading) - Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL. - While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones. - That insight led to the evolution of HMT into LMT – Levels & Momentum Trading. Why the Change? (From HMT to LMT) Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by: - Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork. - Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup. - Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively. - Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets. Whenever I share a signal, it’s because: - A high‐probability key level has been identified on a higher timeframe. - Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent. - The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry. ***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved. Important Note: The Role of Key Levels - Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer. - Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance. My Trading Rules (Unchanged) Risk Management - Maximum risk per trade: 2.5% - Leverage: 5x Exit Strategy / Profit Taking - Sell at least 70% on the 3rd wave up (LTF Wave 5). - Typically sell 50% during a high‐volume spike. - Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R. - Exit at breakeven if momentum fades or divergence appears. The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement. If you find this signal/analysis meaningful, kindly like and share it. Thank you for your support~ Sharing this with love! From HMT to LMT: A Brief Version History HM Signal : Date: 17/08/2023 - Early concept identifying high momentum pullbacks within strong uptrends - Triggered after a prior wave up with rising volume and momentum - Focused on healthy retracements into support for optimal reward-to-risk setups HMT v1.0: Date: 18/10/2024 - Initial release of the High Momentum Trading framework - Combined multi-timeframe trend, volume, and momentum analysis. - Focused on identifying strong trending moves high momentum HMT v2.0: Date: 17/12/2024 - Major update to the Momentum indicator - Reduced false signals from inaccurate momentum detection - New screener with improved accuracy and fewer signals HMT v3.0: Date: 23/12/2024 - Added liquidity factor to enhance trend continuation - Improved potential for momentum-based plays - Increased winning probability by reducing entries during peaks HMT v3.1: Date: 31/12/2024 - Enhanced entry confirmation for improved reward-to-risk ratios HMT v4.0: Date: 05/01/2025 - Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling HMT v4.1: Date: 06/01/2025 - Enhanced take-profit (TP) target by incorporating market structure analysis HMT v5 : Date: 23/01/2025 - Refined wave analysis for trending conditions - Incorporated lower timeframe (LTF) momentum to strengthen trend reliability - Re-aligned and re-balanced entry conditions for improved accuracy HMT v6 : Date : 15/02/2025 - Integrated strong accumulation activity into in-depth wave analysis HMT v7 : Date : 20/03/2025 - Refined wave analysis along with accumulation and market sentiment HMT v8 : Date : 16/04/2025 - Fully restructured strategy logic HMT v8.1 : Date : 18/04/2025 - Refined Take Profit (TP) logic to be more conservative for improved win consistency LMT v1.0 : Date : 06/06/2025 - Rebranded to emphasize key levels + momentum as the core framework LMT v2.0 Date: 11/06/2025 - Fully restructured lower timeframe (LTF) momentum logic

Ren_MomentumTrader

CFX/USDT

Key Level Zone: 0.1970 - 0.2040 LMT v2.0 detected. The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align. Introducing LMT (Levels & Momentum Trading) - Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL. - While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones. - That insight led to the evolution of HMT into LMT – Levels & Momentum Trading. Why the Change? (From HMT to LMT) Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by: - Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork. - Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup. - Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively. - Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets. Whenever I share a signal, it’s because: - A high‐probability key level has been identified on a higher timeframe. - Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent. - The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry. ***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved. Important Note: The Role of Key Levels - Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer. - Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance. My Trading Rules (Unchanged) Risk Management - Maximum risk per trade: 2.5% - Leverage: 5x Exit Strategy / Profit Taking - Sell at least 70% on the 3rd wave up (LTF Wave 5). - Typically sell 50% during a high‐volume spike. - Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R. - Exit at breakeven if momentum fades or divergence appears. The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement. If you find this signal/analysis meaningful, kindly like and share it. Thank you for your support~ Sharing this with love! From HMT to LMT: A Brief Version History HM Signal : Date: 17/08/2023 - Early concept identifying high momentum pullbacks within strong uptrends - Triggered after a prior wave up with rising volume and momentum - Focused on healthy retracements into support for optimal reward-to-risk setups HMT v1.0: Date: 18/10/2024 - Initial release of the High Momentum Trading framework - Combined multi-timeframe trend, volume, and momentum analysis. - Focused on identifying strong trending moves high momentum HMT v2.0: Date: 17/12/2024 - Major update to the Momentum indicator - Reduced false signals from inaccurate momentum detection - New screener with improved accuracy and fewer signals HMT v3.0: Date: 23/12/2024 - Added liquidity factor to enhance trend continuation - Improved potential for momentum-based plays - Increased winning probability by reducing entries during peaks HMT v3.1: Date: 31/12/2024 - Enhanced entry confirmation for improved reward-to-risk ratios HMT v4.0: Date: 05/01/2025 - Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling HMT v4.1: Date: 06/01/2025 - Enhanced take-profit (TP) target by incorporating market structure analysis HMT v5 : Date: 23/01/2025 - Refined wave analysis for trending conditions - Incorporated lower timeframe (LTF) momentum to strengthen trend reliability - Re-aligned and re-balanced entry conditions for improved accuracy HMT v6 : Date : 15/02/2025 - Integrated strong accumulation activity into in-depth wave analysis HMT v7 : Date : 20/03/2025 - Refined wave analysis along with accumulation and market sentiment HMT v8 : Date : 16/04/2025 - Fully restructured strategy logic HMT v8.1 : Date : 18/04/2025 - Refined Take Profit (TP) logic to be more conservative for improved win consistency LMT v1.0 : Date : 06/06/2025 - Rebranded to emphasize key levels + momentum as the core framework LMT v2.0 Date: 11/06/2025 - Fully restructured lower timeframe (LTF) momentum logic

Ren_MomentumTrader

OG/USDT

Key Level Zone: 5.250 - 5.340 LMT v2.0 detected. The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align. Introducing LMT (Levels & Momentum Trading) - Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL. - While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones. - That insight led to the evolution of HMT into LMT – Levels & Momentum Trading. Why the Change? (From HMT to LMT) Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by: - Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork. - Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup. - Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively. - Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets. Whenever I share a signal, it’s because: - A high‐probability key level has been identified on a higher timeframe. - Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent. - The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry. ***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved. Important Note: The Role of Key Levels - Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer. - Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance. My Trading Rules (Unchanged) Risk Management - Maximum risk per trade: 2.5% - Leverage: 5x Exit Strategy / Profit Taking - Sell at least 70% on the 3rd wave up (LTF Wave 5). - Typically sell 50% during a high‐volume spike. - Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R. - Exit at breakeven if momentum fades or divergence appears. The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement. If you find this signal/analysis meaningful, kindly like and share it. Thank you for your support~ Sharing this with love! From HMT to LMT: A Brief Version History HM Signal : Date: 17/08/2023 - Early concept identifying high momentum pullbacks within strong uptrends - Triggered after a prior wave up with rising volume and momentum - Focused on healthy retracements into support for optimal reward-to-risk setups HMT v1.0: Date: 18/10/2024 - Initial release of the High Momentum Trading framework - Combined multi-timeframe trend, volume, and momentum analysis. - Focused on identifying strong trending moves high momentum HMT v2.0: Date: 17/12/2024 - Major update to the Momentum indicator - Reduced false signals from inaccurate momentum detection - New screener with improved accuracy and fewer signals HMT v3.0: Date: 23/12/2024 - Added liquidity factor to enhance trend continuation - Improved potential for momentum-based plays - Increased winning probability by reducing entries during peaks HMT v3.1: Date: 31/12/2024 - Enhanced entry confirmation for improved reward-to-risk ratios HMT v4.0: Date: 05/01/2025 - Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling HMT v4.1: Date: 06/01/2025 - Enhanced take-profit (TP) target by incorporating market structure analysis HMT v5 : Date: 23/01/2025 - Refined wave analysis for trending conditions - Incorporated lower timeframe (LTF) momentum to strengthen trend reliability - Re-aligned and re-balanced entry conditions for improved accuracy HMT v6 : Date : 15/02/2025 - Integrated strong accumulation activity into in-depth wave analysis HMT v7 : Date : 20/03/2025 - Refined wave analysis along with accumulation and market sentiment HMT v8 : Date : 16/04/2025 - Fully restructured strategy logic HMT v8.1 : Date : 18/04/2025 - Refined Take Profit (TP) logic to be more conservative for improved win consistency LMT v1.0 : Date : 06/06/2025 - Rebranded to emphasize key levels + momentum as the core framework LMT v2.0 Date: 11/06/2025 - Fully restructured lower timeframe (LTF) momentum logic

سلب مسئولیت

هر محتوا و مطالب مندرج در سایت و کانالهای رسمی ارتباطی سهمتو، جمعبندی نظرات و تحلیلهای شخصی و غیر تعهد آور بوده و هیچگونه توصیهای مبنی بر خرید، فروش، ورود و یا خروج از بازارهای مالی نمی باشد. همچنین کلیه اخبار و تحلیلهای مندرج در سایت و کانالها، صرفا بازنشر اطلاعات از منابع رسمی و غیر رسمی داخلی و خارجی است و بدیهی است استفاده کنندگان محتوای مذکور، مسئول پیگیری و حصول اطمینان از اصالت و درستی مطالب هستند. از این رو ضمن سلب مسئولیت اعلام میدارد مسئولیت هرنوع تصمیم گیری و اقدام و سود و زیان احتمالی در بازار سرمایه و ارز دیجیتال، با شخص معامله گر است.