IvanLabrie

@t_IvanLabrie

تریدر چه نمادی را توصیه به خرید کرده؟

سابقه خرید

تخمین بازدهی ماه به ماه تریدر

پیام های تریدر

فیلتر

نوع پیام

IvanLabrie

Hyperliquid bottom?

آقایان GN، تعطیلات به همه مبارک، من باید تنها مرد دیوانه ای باشم که امروز... 8 شب اینجا کار می کند. من میخواستم یک حماسه احتمالی در HYPE را مورد توجه شما قرار دهم، اخیراً یک سری کاتالیزورهای مثبت و یک سیگنال احساسات شاداب داشتیم: *تأیید کنندگان به سوزاندن HYPE انباشته شده در AF رأی دادند *هیچ خودی سکهای برای فروش در طول باز کردن قفل که موعد مقرر بود، نگرفت *ورود حاشیه پورتفولیو به Hyperliquid، کارایی سرمایه را به میزان قابل توجهی افزایش می دهد و حجم و کارمزدها را در پلتفرم افزایش می دهد. *بازارهای HIP-3 بسیار موفق و در حال رشد هستند * هیز، کلاهبردار ارشد سابق بیتمکس و قمارباز شیتکوین، به خود میبالید که تاپ را فروخته و از خرید آن امتناع میکند و میگفت با 20 دلار خرید کرد. و مهمتر از همه، ما به یک سطح فنی کلیدی بزرگ در نمودار هفتگی رسیدیم و روزانه در حال چرخش است، به طور بالقوه امروز یک سیگنال روند برای هدیه کریسمس به کار میرود. امروز مراقب افزایش قیمت بیش از 25.2375 دلار باشید، در صورت افزایش، معامله ادامه دارد. اگر نه، همچنان این توکن را تماشا کنید زیرا احتمالاً روند نزولی را در این محدوده soon معکوس کرد. با آرزوی موفقیت به سلامتی، ایوان لابری. سیگنال روند امروز تایید شد. من می توانم بگویم پایین با اعتماد به نفس بالا است.

IvanLabrie

IvanLabrie

IvanLabrie

IvanLabrie

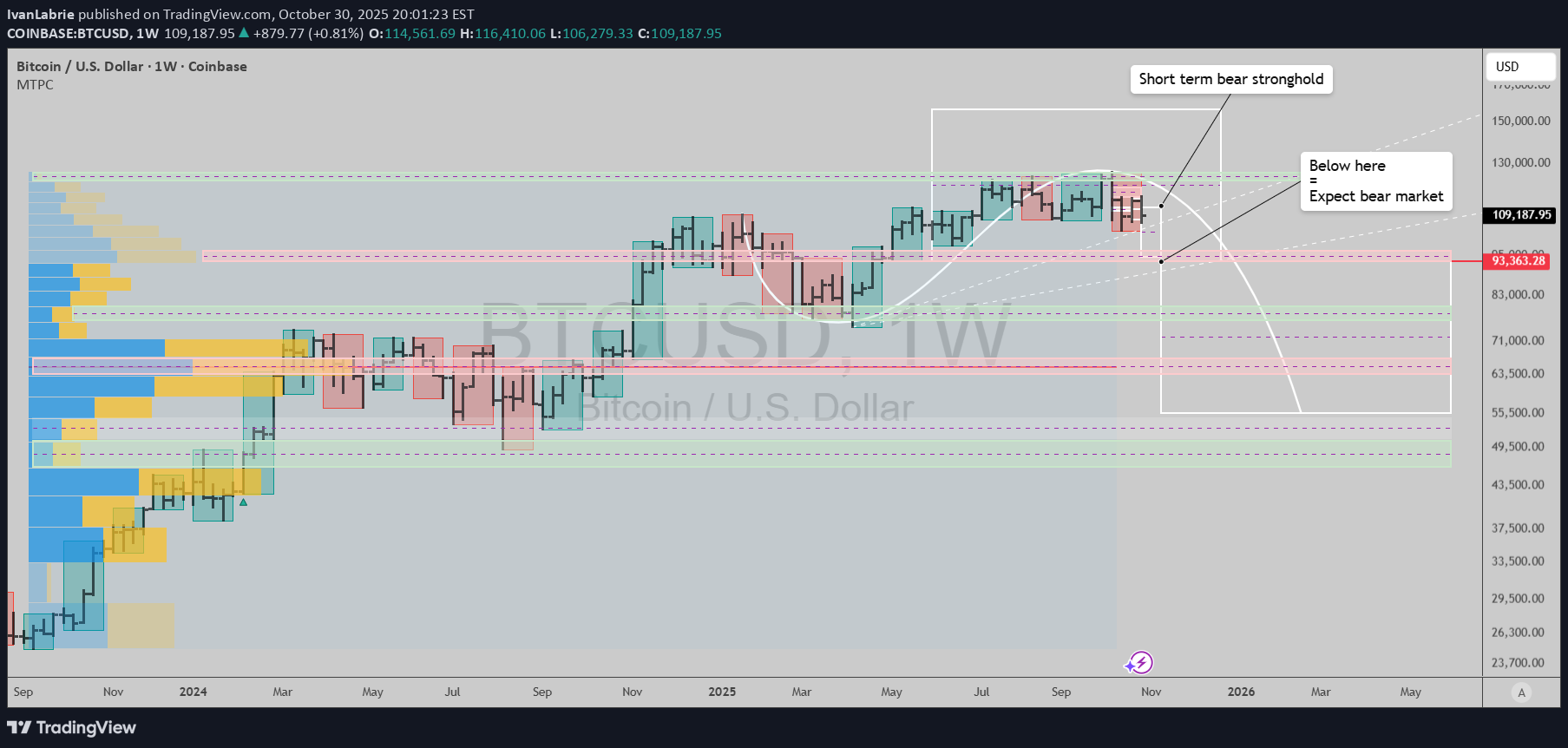

احتمال سقوط بیتکوین تا ۵۶ هزار دلار؛ آیا روند نزولی آغاز شده است؟

آقایان GN، سطوح کلیدی نمودار را رعایت کنید: خرسها در کوتاهمدت کنترل میشوند، اگر قیمت از اینجا کاهش یابد، میتواند به راحتی منطقه 93-94 هزار دلاری را تا زمانی که کمتر از 112 هزار دلار باشد، نشان دهد، بدهد یا بگیرد. اگر چنین باشد، کاهش قیمت به 56 هزار دلار تا اواسط سال 2026 به یک احتمال متمایز تبدیل می شود. من اقدامات احتیاطی لازم را انجام داده ام تا بتوانم از چنین سناریویی جان سالم به در ببرم، در حالی که در صورت شروع ناگهانی روند صعودی همچنان محافظت می شود. ضربدری انگشتان! به سلامتی، Ivan Labrie.1 اولین پشتیبانی بزرگ در 80k تا کنون انجام شده است...من از اینجا به بعد DCA را در بلندمدت کریپتوهای با اعتقاد بالا انجام داد.

IvanLabrie

IvanLabrie

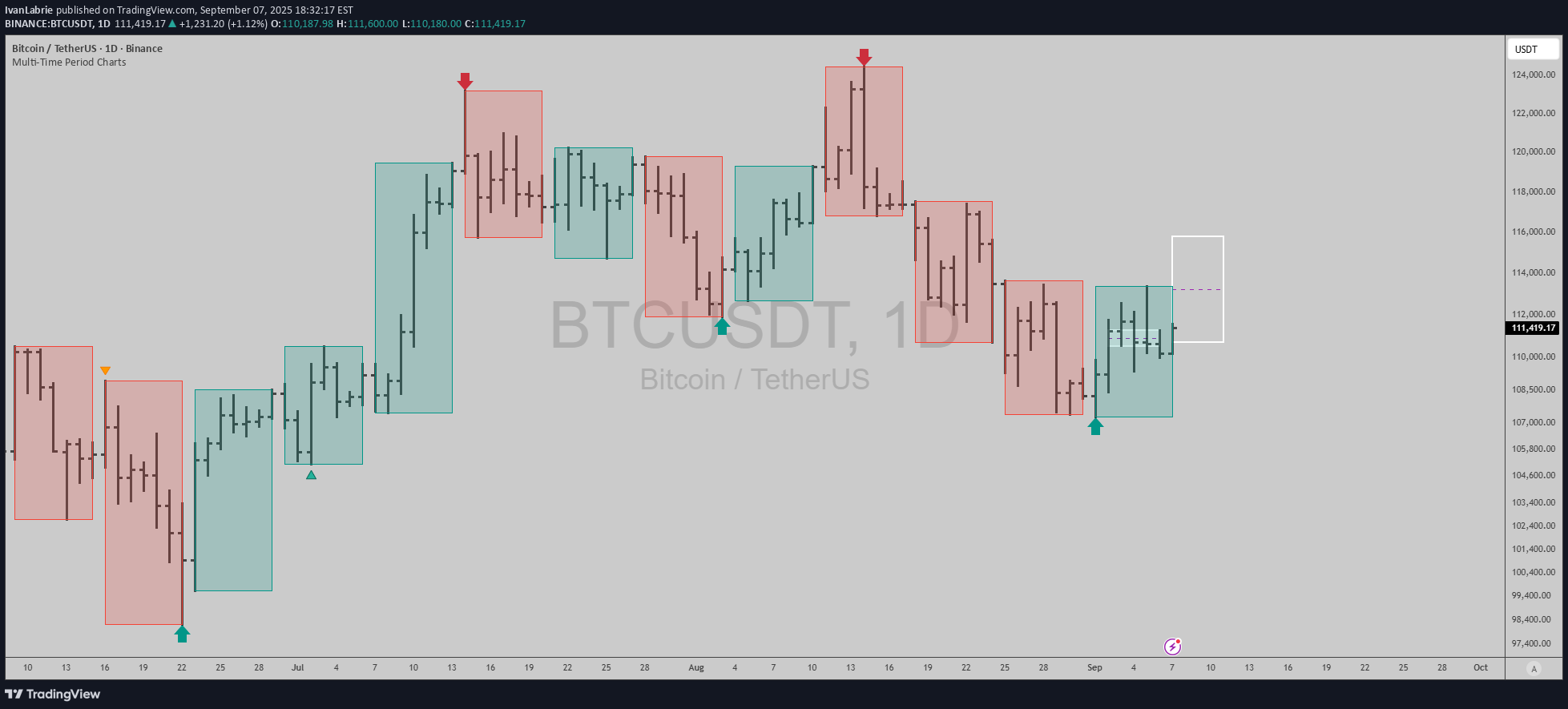

BTCUSD: Correction is over with high probability...

بازه زمانی روزانه در حال چشمک زدن به سیگنال خرید است ، احتمالاً نشان می دهد که تصحیح در رمزنگاری با شانس 60 ٪+ به پایان رسیده است. بهترین شانس! به سلامتی ، ایوان لابری.

IvanLabrie

$AAPL: +57% in 2 years or less

روند بلند مدت این سه ماهه را تأیید می کند ، کاتالیزور خوب با رویدادهایی که یک هفته پیش پس از آخرین گزارش درآمدها اتفاق افتاد: تیم کوک یک جلسه rare را برگزار کرد که همه دست را به کارکنان گفت: انقلاب AI "به همان اندازه بزرگ یا بزرگتر" از اینترنت ، تلفن های هوشمند ، محاسبات ابری و برنامه ها است. "اپل باید این کار را انجام دهد. اپل این کار را کرد. این نوع ما برای گرفتن است". سابقه تاریخی سیگنال های روند سه ماهه را در نمودار بررسی کنید ، هر یک از آنها لعنتی یکی از آنها کار کرده است. بهترین شانس! به سلامتی ، ایوان لابری.

IvanLabrie

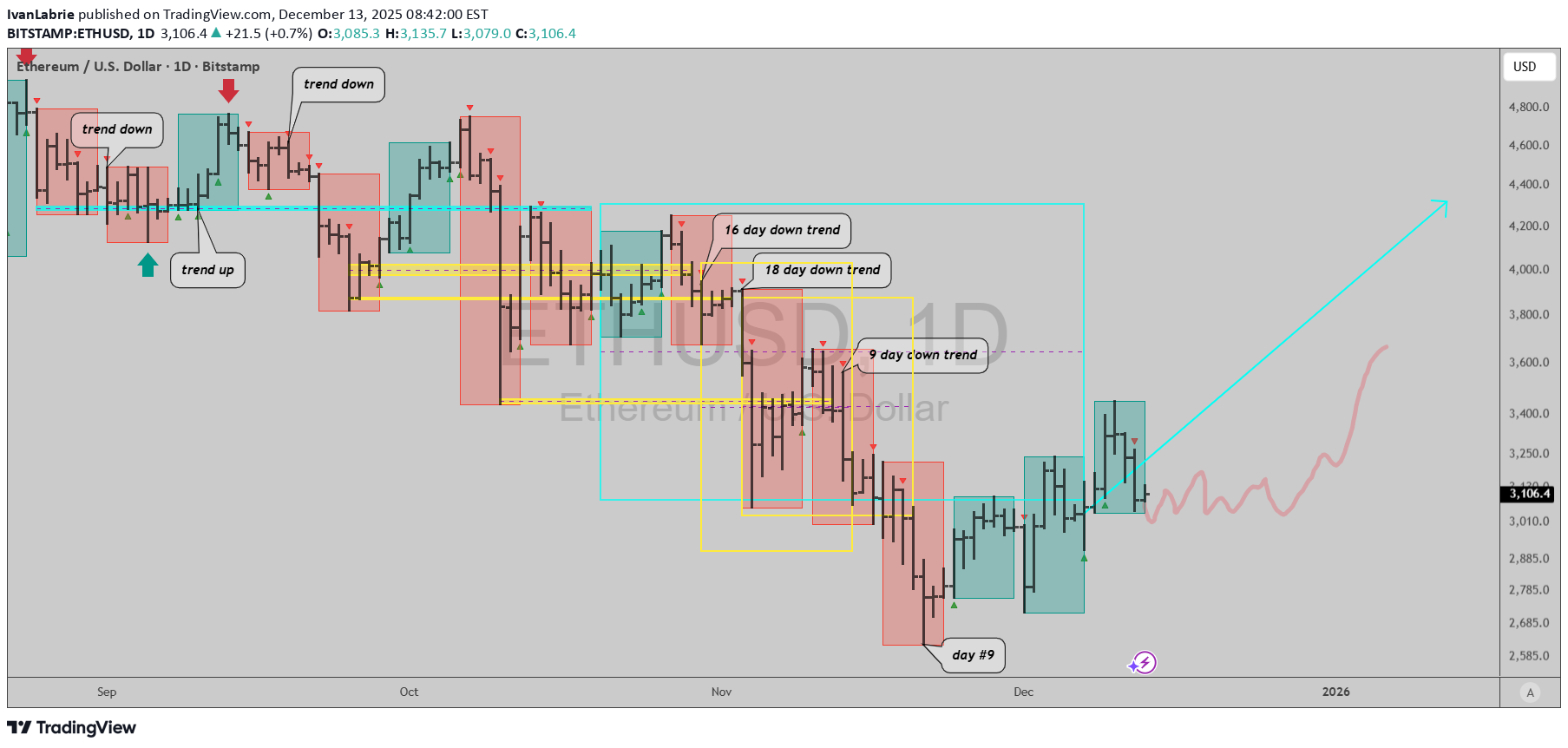

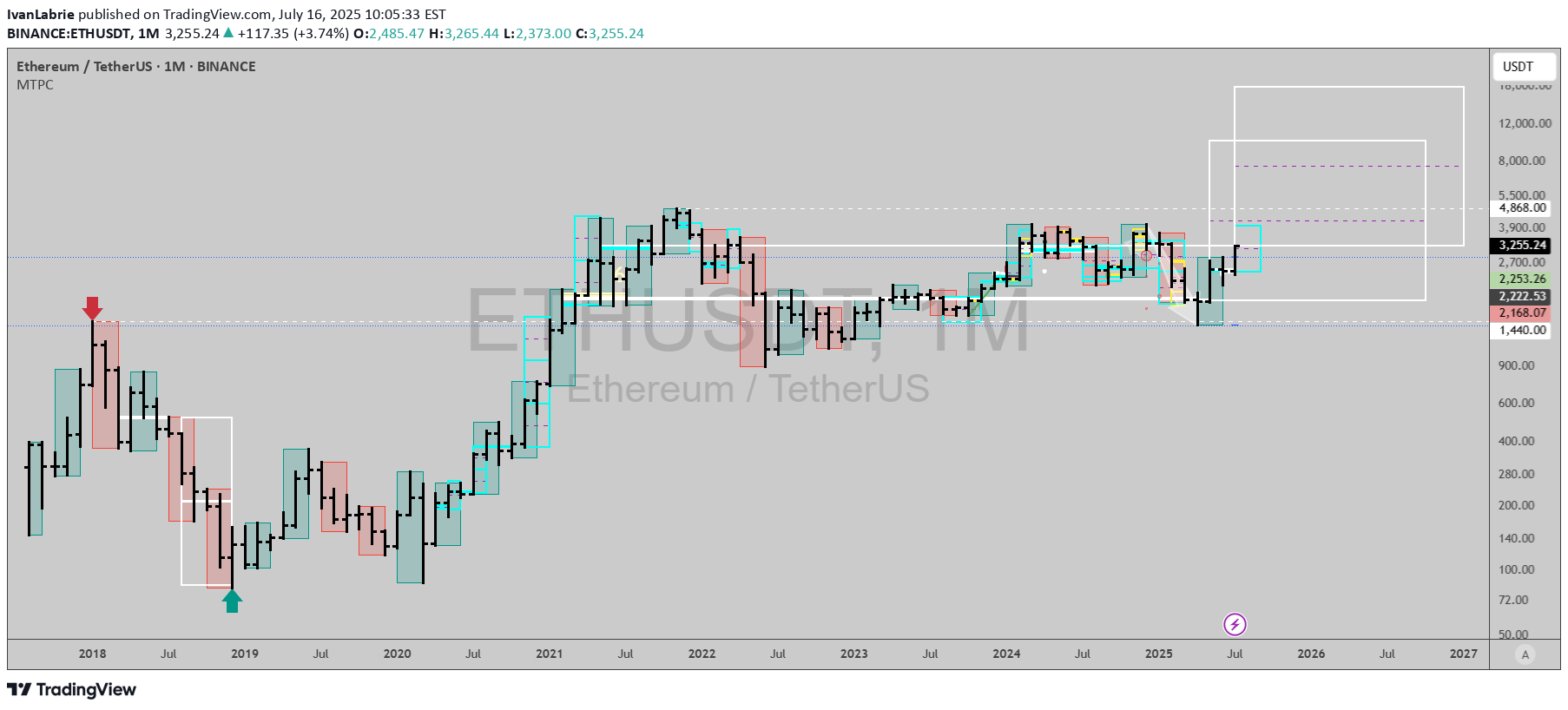

$ETHUSD: Long term trend and cup and handle pattern...

Ethereum بالاخره خیلی به شکستن و رسیدن به بالاترین سطح 52 هفتهای جدید نزدیک شده است. این حرکت پس از یک الگوی پایهسازی طولانیمدت رخ میدهد که شبیه یک الگوی فنجان و دسته کلاسیک است. سیگنالهای Timemode قبلاً در مورد صعودی بودن آن به ما هشدار داده بودند، زیرا روندهای روزانه، هفتگی، ماهانه و اکنون فصلی از ماه آوریل امسال به ترتیب صعودی شدهاند. اگر در حاشیه هستید یا موقعیت فروش دارید، به گاوها بپیوندید و هر چه زودتر وارد موقعیت خرید شوید. ریسک، کاهش به زیر 1715 دلار برای الگوهای بلندمدت در حال اجرا است، اهداف پیشبینی شده در بلندمدت از 10 هزار تا 95 هزار دلار متغیر است. همانطور که احتمالاً میدانید، اصول اساسی از یک روند صعودی عظیم حمایت میکنند، زیرا تعداد تراکنشهای ETH به بالاترین حد خود میرسد، موسسات برای به دست آوردن ETH بیشتر به صورت روزانه رقابت میکنند، جریان سرمایه ETF به طور پیوسته صعودی است و مقررات برای رشد دیفای از طریق استیبل کوینها و پذیرش RWA مطلوب شده است، همچنین پتانسیل برای نوآوریهای جدید دیفای و یا افزایش محبوبیت موارد موجود با استفاده گسترده وجود دارد. دیفای Ethereum اکنون به اندازه کافی امن و محکم است و میتواند از پس توان عملیاتی مورد نیاز برآید، و چرخها برای یک حرکت تماشایی از اینجا به بعد در حال حرکت هستند. با آرزوی موفقیت! با احترام، ایوان لابری. *فراموش کردم صندوقهای بازنشستگی 401(k) را ذکر کنم، بیش از 30 میلیارد دلار تقاضای دیگر نیز در راه است.

IvanLabrie

$ETHUSDT: Time at mode trend signal

سیگنال نمودار ماهانه به من یک هدف ۱۷۹۷۵ دلار ایالات متحده آمریکا برای هر کوین ویتالیک میدهد 🎯، ظرف ۱۹ ماه آینده... فکر نمیکنم خیلیها بتوانند این را درک کنند، اما این کاملاً ممکن و اکنون محتمل است. (تعداد کمی از گاویها و کسانی که صعودی هستند، هدف ۱۰ هزار را ذکر میکنند، اما هیچ چیز به این اندازه بالا نیست). با آرزوی بهترینها! ارادتمند، ایوان لابری.

سلب مسئولیت

هر محتوا و مطالب مندرج در سایت و کانالهای رسمی ارتباطی سهمتو، جمعبندی نظرات و تحلیلهای شخصی و غیر تعهد آور بوده و هیچگونه توصیهای مبنی بر خرید، فروش، ورود و یا خروج از بازارهای مالی نمی باشد. همچنین کلیه اخبار و تحلیلهای مندرج در سایت و کانالها، صرفا بازنشر اطلاعات از منابع رسمی و غیر رسمی داخلی و خارجی است و بدیهی است استفاده کنندگان محتوای مذکور، مسئول پیگیری و حصول اطمینان از اصالت و درستی مطالب هستند. از این رو ضمن سلب مسئولیت اعلام میدارد مسئولیت هرنوع تصمیم گیری و اقدام و سود و زیان احتمالی در بازار سرمایه و ارز دیجیتال، با شخص معامله گر است.