ARrowofTime

@t_ARrowofTime

تریدر چه نمادی را توصیه به خرید کرده؟

سابقه خرید

تخمین بازدهی ماه به ماه تریدر

پیام های تریدر

فیلتر

نوع سیگنال

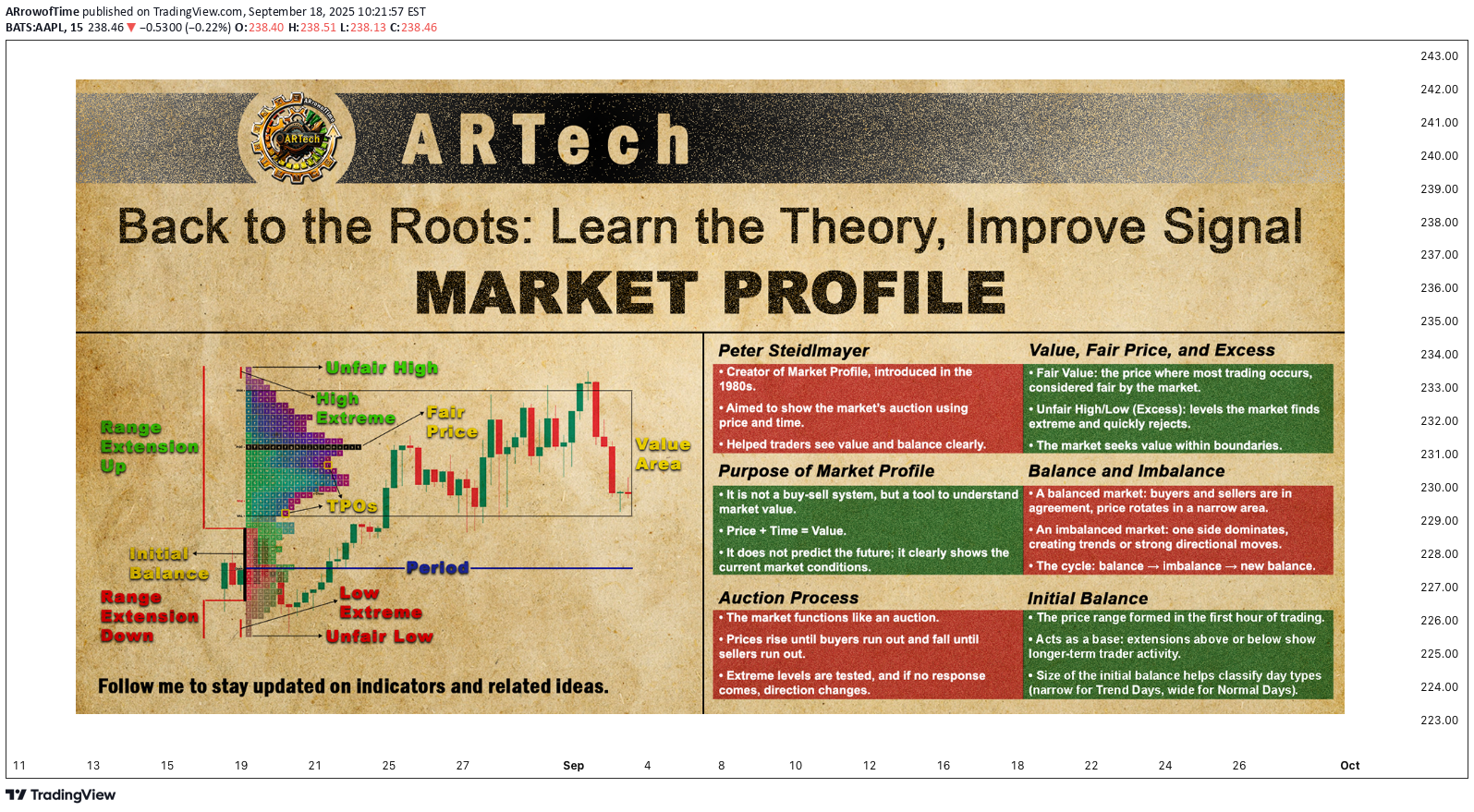

🔸🔸🔸 1 - Back to the Roots: Learn the Theory, Improve Signal 🔸🔸🔸 Becoming a successful trader starts with building a strong foundation of knowledge. This foundation comes from time spent in the markets and real experience. While the basic idea is easy to understand, actually building this solid base takes effort and patience. Trading experience, careful observation, focusing on what truly matters, and understanding basic technical principles are all key parts of this foundation. Patience and awareness also play a big role in making it stronger. Without this foundation, it’s difficult to trade well over the long term. But when you have it, you can think more clearly, make better decisions, and trust your own judgment. In today’s fast-paced markets, some traders try to skip this step, only to realize later how important it really is. The good news is, it’s never too late to start building this foundation—you just need to dedicate the time and be ready to put in the work. If you grasp the lessons from these experiences, you’ll see that they apply directly to your own journey as a trader. Along the way, you might also discover fresh insights about how markets really work today. 🔸🔸🔸 2 - Peter Steidlmayer 🔸🔸🔸 Peter Steidlmayer is the creator of Market Profile, a powerful tool that traders today often use through Market Profile analysis. What makes his idea special is that it didn’t come only from books or classrooms — it was shaped by his life experiences growing up on a ranch in California. From an early age, Peter learned important lessons about value and fairness from his father. On their family ranch, his father would only sell crops when the price was fair, aiming for a reasonable profit instead of chasing big gains. If prices were too low, he’d hold on to the grain rather than selling at a loss. When buying, whether groceries or used farm equipment, his father was careful not to overpay, always seeking a fair deal. This taught Peter that value is not just a price number — it’s a relationship between price, time, and need. Paying too much means time works against you; paying less means time is on your side. Later in college, Peter took a statistics course where he learned about the bell curve—a way to find patterns in what might look like random data. This gave him the idea that market prices also have a “fair value” area, where most trading happens, and areas away from this center that create opportunities. He combined this with the ideas of value investing from Graham and Dodd and the concept of the “minimum trend” by John Schultz, which measures the smallest meaningful price movements. By grouping these price movements, Peter saw that prices tend to cluster around a fair value zone, forming a bell curve shape. This became the foundation for Market Profile and later, Volume Profile. 🔸🔸🔸 3 - Market Profile 🔸🔸🔸 Before we dive into Market Profile, it’s important to understand Peter Steidlmayer’s journey and how he developed Market Profile. Through his research and testing different systems, Peter noticed that although some methods worked at first, none gave consistent or reliable results over time. The most important insight he gained was that all these approaches tried to predict future market prices — something he came to believe is impossible. Instead of guessing where prices might go, Peter focused on finding value , which he called fair value . The goal of Market Profile is not to provide buy or sell signals but to help traders find where the true value lies. Market Profile is a tool, not a trading system. To use it effectively, you need to understand its core principles, not just memorize fixed rules. Unlike simple buy/sell systems that stop working when market conditions change, Market Profile helps you see those changes as they happen and adapt your strategy accordingly. Remember, market decisions always require your own judgment. Market Profile cannot predict the future — no tool can — but it helps you understand what is happening right now, so you can make better trading decisions. Before we move on to interpreting Market Profile, we will first look at three key steps that will help build a clear foundation Market Profile Graph: How the profile is drawn and what it represents Market Profile on TradingView: How you can access and use this tool on TradingView Anatomy of a Market Profile: Explanation of the key components Once we cover these basics, we’ll be ready to focus on interpreting Market Profile and applying it in trading decisions. 📌 3.1 - Market Profile Graph If you understand the basic principles behind Market Profile, you will be able to recognize key patterns easily, without getting confused by changes in how they are displayed. To make this clear, I will draw the Market Profile for the trading session between 9:00 and 15:00. This will help you see how time and price interact at different levels during that trading session. 3.1.1 - Understanding the Letters in a Market Profile Chart In a Market Profile chart, each letter represents a 30-minute time period during the trading day. The sequence starts with the letter A for the first half-hour (9:00–9:30), then B for the next half-hour (9:30–10:00), and continues alphabetically until the market closes. This way, the chart shows not only which prices were traded but also exactly when they were active during the day. 3.1.2 - A Period (9:00 – 9:30) This price level is where we start placing the letter A to represent the first 30 minutes. The trading day opens at 2685, marked by an arrow on the left side of the profile. (Shape a). Shortly after the open, the price rises to 2690 (Shape b), so we place the letter A at 2690. Then, the price falls to 2680 (Shape c), and we add the letter A down to that level as well. Next, the price climbs again to 2690 before settling back to 2680 (Shape d), which becomes the final price of the first half-hour. We do not add another A where one already exists. The closing price of this period, 2680, is marked with an arrow on the right side of the profile. (Note: Price Movement Shape in the chart is drawn to illustrate how the price moved within this 30-minute period.) 3.1.3 - B Period (9:30 – 10:00) The second half-hour opens at 2680, so we place the letter B—which represents this time period—at that price level. Since the first column already has the letter A, we place this B in the second column (Shape a). Then, the price drops to 2670, and we add the letter B down to this level, always filling the leftmost empty column. This period closes at 2675 (Shape b). The price falls further to 2665, which is where the second half-hour ends. The final price of this period, 2665, is marked with an arrow on the right side of the profile (Shape c). (Note: Price Movement Shape in the chart is drawn to illustrate how the price moved within this 30-minute period.) 3.1.4 - Completing the Market Profile for the Day (10:00-15:00) As the day progresses, we continue placing the letters in this way. During the third half-hour (10:00–10:30), the decline continues. The market moves between 2665 and 2620, closing this period at 2640. If we assume the drawing process is now understood from these examples, we can move to the end of the day. Throughout the session, prices move between 2695 and 2620, closing the day at 2670. At this point, we have the complete Market Profile for the day. When we compare this type of chart with a candlestick chart, we see that both show the same basic information. However, the purpose here is not to track the exact price movement, but to see the value area created during the day. By focusing on the value area, we can see how price and time interact. The more time the price spends at a certain level, the more trading volume builds there. The higher the volume, the more the market sees that price as value. Price + Time = Value 📌 3.2 - Market Profile on TradingView Before we explore the key components of a Market Profile chart, it’s important to know how to display it on TradingView. There are two main ways to do this—either by changing the chart type to TPO or by adding it through the Indicators menu. 1. Enable TPO View from Chart Type Menu Click on the Candles button at the top of your chart. Select Time Price Opportunity (TPO) from the list of chart types. 2. Add Market Profile via Indicators Click the Indicators button on the toolbar. Go to the Technicals section and scroll to Profiles. Choose Time Price Opportunity or Session Time Price Opportunity depending on whether you want the profile for the whole chart or for individual sessions. 📌 3.3 - Anatomy of a Market Profile Let’s first explore the main components of a Market Profile chart—TPOs, Initial Balance, Extremes, Range Extensions, Fair Value, Unfair High, Unfair Low, and Value Areas. In this section, we’ll not only define each of them but also show how they appear on the chart for better understanding. Key Components of a Market Profile Chart Visualizing Components on a TradingView TPO Chart 3.3.1 - Key Components of a Market Profile Chart Detailed explanations of each element that forms the structure of a Market Profile. TPOs (Time Price Opportunities) Each letter on the Market Profile chart is called a TPO (Time Price Opportunity). A TPO represents a specific price traded during a specific time period, showing both when and at what level the market was active. The sequence begins with capital letters (A, B, C, …), and once these are used up, it continues with lowercase letters (a, b, c, …) to represent later time periods. Initial Balance The Initial Balance marks the price range established during the first two letter time periods, usually represented by the letters A and B. It shows where the market first found a trading range and is often indicated on the left side of the profile with a vertical line. Note: If the letter time period is set to 15 minutes, each letter represents 15 minutes of trading, so the Initial Balance covers only the first 30 minutes in Tradingview. In TradingView, you can use the Initial Balance (IB) range feature to define the key price range at the start of the session. By default, it covers 2 letters (A and B), but if you prefer, you can adjust the range to 3, 4, 5, or more bars to suit your analysis. Extremes An extreme is the activity that occurs at the very top or bottom of a price range, represented by two or more single TPO prints standing alone. It forms when the market tests a price level, then quickly rejects it and moves away, showing that the opposite side (buyers or sellers) stepped in with strength. Extremes appear when the market rejects prices at the top or bottom of the range, leaving behind either a buying tail(single prints at the bottom) or a selling tail (single prints at the top). Visually, the value area forms the main “body” of the profile, while extremes extend outward like “tails.” Note: An extreme cannot occur in the last time period of the day, since there is no following trade to confirm rejection. Range Extension A range extension happens when the price moves beyond the initial balance (A and B TPOs). This expansion happens because longer-term traders step in with enough volume to push prices higher or lower. An upside extension signals active buyers, while a downside extension signals active sellers. Range extensions help reveal the influence of longer-term participants and provide important context about the market’s directional bias. Fair Value In a Market Profile chart, the price level with the highest number of letters (TPOs) is called the fair value. This level often corresponds to the price with the highest traded volume. If the profile shows more than one fair value level, the one closest to the midpoint of the day’s trading range is selected. Unfair High The highest price level of a distribution where trading activity is low. It represents an “unfair” or advantageous selling area because prices moved too high for buyers to remain interested. This level often marks the top of the range. Unfair Low The lowest price level of a distribution where trading activity is low. It represents an “unfair” or advantageous buying area because prices moved too low for sellers to remain interested. This level often marks the bottom of the range. Value Area The price range where most trading activity occurs, usually about 70% of TPOs. It shows where the market accepts price as fair, with buyers and sellers actively rotating around this level. Prices above the value area are advantageous for the longer-term seller; prices below it are advantageous for the longer-term buyer. The calculation process is: Start with the price level that has the highest volume. If this alone doesn’t reach 70%, compare the total volume of the one price levels above with the one price levels below. Add the larger of the one to your total. Repeat this process until you reach about 70% of the day’s total volume. 3.3.2 - Visualizing Components on a TradingView TPO Chart Demonstration of how these components look directly on TradingView using the TPO chart. With the Expand Block feature, the Market Profile is shown as separate columns, where each letter is placed in its own block. This helps you clearly see which price levels were active in each 30-minute. Shifting the letters into the empty left column serves a special purpose. Instead of focusing on the exact price movements, this view highlights the value area created during the session. It allows traders to see where the market spent the most time and built the strongest acceptance, rather than just tracking short-term fluctuations. 🔸🔸🔸 4 - Principles of Market Profile 🔸🔸🔸 Now that we have learned how to draw the profile and the key terms used, we can move on to how to read a Market Profile chart. Market Profile is not a ready-made trading system—it is a tool designed to support your decision-making. To use it well, you need to understand the principles behind how it works. No matter how advanced a tool is, your trading decisions will always require your own judgment—Market Profile can’t replace that. It also cannot predict the future—but then again, no one can. What it does do is give you a clear picture of the current market situation. By understanding what’s happening right now, you put yourself in a stronger position to make better, more informed decisions. 📌 4.1 - The Auction Framework The Auction Framework explains how the market works like an auction, helping people buy and sell. When prices go up, more buyers are attracted, willing to pay higher prices. When prices go down, more sellers enter, ready to sell at lower prices. The market moves like an auction in two main ways: first, it pushes prices higher until there are no more buyers willing to pay more. Then, it reverses and moves down until there are no more sellers willing to sell at lower prices. In this way, the market constantly moves up and down, balancing buyers and sellers. When the upward movement ends, the downward movement begins, and this cycle keeps repeating. Looking a bit closer, the market moves in one direction and “asks” the other side (buyers or sellers) to respond. When the opposite side responds enough to stop the current move, the market changes direction. In short, the market is like a continuous auction, where prices rise and fall as buyers and sellers compete—until one side runs out of interest. 📌 4.2 - Negotiating Process When the market moves in one direction, it creates boundaries for the price range. These boundaries are called the unfair low at the bottom and the unfair high at the top. They represent price levels where the market has gone too far — these are called excesses . Once these limits are established, the market starts trading inside this range. It moves between the unfair low and unfair high to find a fair price , which we call value . In other words, the market negotiates within this range to settle on value. If you pause the market at any moment, you will notice three important points: Unfair low (the lowest excess) Unfair high (the highest excess) Value (somewhere in the middle) These three points show how buyers and sellers negotiate prices in the market. 📌 4.3 - Time Frame Markets are always shaped by two different forces: short-term traders and long-term traders. Both are active at the same time, but their goals are very different. Short-term traders are focused on “fair price” for the day. When the market opens, price moves up and down as these traders search for a balance point where both buyers and sellers agree. If the open is inside the previous day’s range, short-term activity usually dominates. They don’t wait for the perfect deal—they just need a reasonable price to complete their trades quickly, like a business traveler who buys a ticket at the going rate without shopping around. Long-term traders , on the other hand, are more strategic. They are not in a hurry to trade today. They wait for an advantageous price—something too high or too low compared to value. When they step in with enough volume, they can break the balance and extend the market range. This is how trends begin. You can think of them as a vacation traveler who has time to wait for the best discount fare. Because long-term buyers see value at low prices and long-term sellers see value at high prices, they rarely meet in the middle. Instead, the market swings: rising to create opportunity for sellers, falling to create opportunity for buyers. The result is a constant cycle: balance, imbalance, and back to balance. Day-to-day order flow is shaped by short-term traders, but big moves and directional trends come from long-term players. At the extremes—whether too high or too low—it’s always the long-term traders who take control. 📌 4.4 - Balance and Imbalanced The market helps people buy and sell by moving repeatedly between states of imbalance and balance. This happens both within a single trading session and over longer-term trends. When the market is balanced , buying and selling are roughly equal. This means the market has found an opposing force and is trading around a fair price where buyers and sellers agree. When the market is imbalanced , either buying or selling dominates. The market moves up or down directionally, searching for the opposite reaction and a fair price to trade around. In short: A balanced market has found a fair price. An imbalanced market is still looking for that fair price. This is simply another way of stating the law of supply and demand: buyers want to buy, sellers want to sell, and the market is either in balance or trying to get there. 📌 4.5 - Day Timeframe Structure The idea of day structure comes from how the market looks for a fair price where both buyers and sellers are willing to trade. If a price is unfair, trading will stop there, and the market will move until balance is found. The first hour of trading sets the initial balance . This range is like the “base” of the day. A wide base is more stable, while a narrow base is weak and often leads to bigger moves later in the day. Just like the base of a lamp keeps it standing, a wide initial balance provides stability, while a narrow initial balance is easier to “knock over,” leading to bigger moves and range extensions. When longer-term traders enter, they can break this balance. If they act small, the market moves only a little. If they act strong, the market can move far and leave signs, like tails on the profile. Tails show where longer-term traders rejected extreme prices. By watching the initial balance and the activity of longer-term players, traders can recognize different day types . Each type gives clues about short-term trading opportunities and the market’s bigger direction. The main balanced types are: Normal Day Neutral Day The main imbalanced types are: Normal Variation Day Trend Day 4.5.1 - Normal Day On a Normal Day , the market is in balance and longer-term traders have little influence. The Market Profile often looks like a classic bell curve , where most trading happens around a fair central price. At the extremes, prices are rejected—buyers stop above and sellers stop below—keeping the market balanced. Key Characteristics: The key sign of a Normal Day is the initial balance (first hour’s range), which usually makes up about 85% of the entire day’s range . In other words, the first hour often defines how the rest of the day will unfold. If any range extension happens, it usually comes late in the session. Dynamics: In terms of volume, around 80% comes from short-term traders and only 20% from longer-term participants . Because long-term players are mostly inactive, the market doesn’t trend strongly and instead stays contained within the initial balance area. 4.5.2 - Neutral Day A Neutral Day occurs when both long-term buyers and sellers are active, but neither side gains control. Their efforts cancel each other out, so price extends beyond the initial balance in both directions , then returns to balance. Key Characteristics: Range extensions above and below the initial balance. Close near the middle of the day’s range. Initial balance is moderate in size —not as wide as a Normal Day, not as narrow as a Trend Day. Often shows symmetry : the upside and downside extensions are about equal. In terms of volume, around 70% comes from short-term traders and only 30% from longer-term participants . Dynamics: Uncertainty dominates. Long-term traders test prices higher and lower, but without strong follow-through, their activity neutralizes. Short-term traders make up most of the volume, keeping the market contained. This indecision often leads to repeated neutral days , as neither side has enough conviction to drive a clear trend. 4.5.3 - Normal Variation Day A Normal Variation Day happens when long-term traders play a more active role than on a Normal Day, usually making up 20–40% of the day’s activity. Key Characteristics: Their involvement leads to a clear day extension beyond the initial balance, often about twice the size of the first hour’s range. The initial balance is not as wide as on a Normal Day, making it easier to break. As the day develops, long-term traders enter with conviction and push price beyond the base (range extension). Price may extend in one direction but eventually finds a new balance area. Volume split: 60–80% short-term traders, 20–40% longer-term traders. Dynamics: Early trading looks balanced and controlled by short-term participants. Later, longer-term buyers or sellers step in more aggressively, causing the day’s range to expand. If the extension is small, their influence is limited. 4.5.4 - Trend Day A Trend Day occurs when long-term traders dominate the market, pushing it strongly in one direction. Their influence creates maximum imbalance and range extension , often lasting from the open to the close. Key Characteristics: The close is usually near the day’s high or low (about 90–95% of the time). Volume is split roughly 40% short-term traders and 60% long-term traders . The profile shape is elongated and thin , unlike the balanced bell curve of a Normal Day. Price moves in one-timeframe fashion : each period makes higher highs in an uptrend or lower lows in a downtrend, with little to no rotation. Dynamics: Trend Days often start with a narrow initial balance , quickly broken as long-term participants step in with strong conviction. The move may be triggered by news, stop orders, or a strong shift in sentiment. As the trend unfolds, new participants are drawn in, fueling continuous directional movement. There are two types: Standard Trend Day – one continuous directional move. Double-Distribution Trend Day – an initial balance and pause, followed by a second strong directional push that creates a new distribution area. 📌 4.6 – Initiative and Responsive Activity In Market Profile, it’s important to know whether longer-term traders are acting with initiative (pushing the market) or responding (reacting to prices that look too cheap or too expensive). You can figure this out by comparing the day’s action with the previous day’s value area. Responsive Activity happens when traders behave in an expected way. Buyers step in when prices drop below value (cheap). Sellers step in when prices rise above value (expensive). This behavior maintains balance and is typical in Normal or balanced days. Example: price falls below yesterday’s value area → buyers enter → responsive buying. Initiative Activity happens when traders behave in an unexpected way. Buying takes place at or above value (where you’d normally expect selling). Selling takes place at or below value (where you’d normally expect buying). This shows strong conviction and usually drives imbalance or trend. Example: price above yesterday’s value area continues to attract buyers → initiative buying. Quick Rules (relative to the previous day’s value area): Above value → Selling = responsive, Buying = initiative Below value → Buying = responsive, Selling = initiative Inside value → Both buying and selling are considered initiative , but weaker than outside activity. Why it matters Responsive action keeps the market balanced → often short-term focused. Initiative action pushes the market to new areas of value → often starts trends. In short, responsive moves are reactions to “fair or unfair” prices, while initiative moves show conviction to create new value levels. 🔸🔸🔸 5 - Strategy 🔸🔸🔸 Trading is never about finding a magic formula—it’s about reading the market and making decisions with context. Market Profile doesn’t give you fixed answers like “buy here, sell there.” Instead, it provides market-generated information that helps you recognize when conditions are shifting and when an opportunity has a higher probability of success. Just like in teaching, if someone only looks for answers without understanding the reasoning, they miss the bigger lesson. In trading, the same is true: rules without context are dangerous. Market Profile teaches us how to think about the market, not just follow signals blindly. That said, there are special situations in Market Profile where the structure itself points to a high-confidence setup. These are not guarantees, but they often create trades that “almost have to be taken,” provided the overall market context supports them. Below are a few of the special strategies I’ll cover in detail. The goal is not to memorize fixed rules but to understand the logic behind them. By learning the reasoning, you’ll see why these setups matter and how to use them in practice with your Market Profile indicator. 3-1 Days Neutral-Extreme Days Spike 📌 5.1 - 3-1 Days Among the special setups in Market Profile, the 3-1 Day is one of the most well-known. It signals a strong conviction from longer-term traders and often leads to reliable follow-through the next session. Below is a practical, step-by-step guide you can follow when you spot a potential 3-1 Day. I give rules for identification, entry options (conservative → aggressive), stops, targets, trade management and failure signals. Keep it mechanical but always use judgement. What is a 3-1 Day A 3-1 Day occurs when three things line up in the same direction: an initiative tail (single-print tail showing rejection at an extreme), range extension beyond the Initial Balance, and TPO distribution that favors the same direction. When they align, longer-term players are showing conviction and follow-through is likely. Step 1 - Identify & confirm the 3 signals Confirm all three before trusting the set-up: Initiative tail • Look for single-print tail(s) at an extreme (top for selling tail, bottom for buying tail). • The tail must be initiative, not just reactive — ideally it sits outside or within prior day value area and is followed by continued action in the same direction. • A tail is valid only if price is rejected in at least one subsequent time period (i.e., it’s confirmed). Range extension • Price extends beyond the Initial Balance (A+B hour). • The extension should be clear (not just a one-tick TPO). On many 3-1 examples extension is large and directional. TPO count / profile bias • The profile shows more TPOs on the extension side. • TPOs favor the trend (more time/acceptance on the extension side). Step 2 — Decide entry approaches Conservative (recommended) • Wait for the next day open to be within or better than the previous day’s value area (statistically highly probable after a 3-1). • If next-day open confirms (opens in the trend direction or inside value but not against you), enter with a defined stop just beyond the tail/extreme. • Advantage: extra confirmation, lower chance of false continuation. Standard intraday (balanced) • Enter after the tail + extension + TPO bias are visible and price pulls back to a logical support/resistance area: • Buy: pullback into single-print area / inside single prints or into the upper edge of the prior value area. • Sell: mirrored logic for downside. • Place stop just beyond the tail extreme (a few ticks/pips beyond the single prints), or a tight structural stop below/above the retest. Aggressive • Enter as soon as price breaks out of the initial balance and shows range extension. • Because this approach carries more risk of a false breakout, you should use the smallest position size and the tightest stop. If the breakout continues, you capture the move early and maximize reward. If it fails, your loss is limited because of the tight stop and small size. 📌 5.2 - Neutral-Extreme Day A Neutral-Extreme Day starts as a neutral day (range extensions both above and below the Initial Balance) but closes near one extreme . That close signals a short-term “victor” among longer-term participants and gives a high-probability bias into the next session. Neutral-Extreme Days are powerful because they combine both-sided testing (neutrality) with a clear winning side at the close. That winner often carries conviction into the next session — but always use proper stops and watch for early failure signs. Treat the setup as a probability edge, not a certainty. Step 1 - Identify the Neutral-Extreme Day Confirm the day was neutral : range extensions occurred both above and below the IB during the session. Check the close : it is near the day’s high (neutral→high close) or near the day’s low (neutral→low close). Note: The close near an extreme indicates one side “won” the day and increased conviction. Step 2 - Decide entry approaches Conservative (recommended) • Wait for the next days' open. • If price of following days' opens above the Neutral Day’s Value Area and the Neutral Day closed near the high => Long below the Neutral Day’s Value Area and the Neutral Day closed near the low => Short • Place stop just beyond the opposite edge of the previous day’s VA or slightly beyond today’s extreme. Standard intraday (balanced) • Wait for the next day’s first 30–90 minutes • If price above the Neutral Day’s VA(or below the Neutral Day’s VA for short) • Enter during the next day when early initiative activity confirms continuation • Place stop just beyond the opposite edge of the Neutral day’s VA Aggressive • Enter at close of the Neutral-Extreme day, expecting continuation • Use small size and a tight stop because overnight/new-session risk exists. Example - 1 Example - 2 📌 5.3 - Spike A spike is a fast, a few time periods move away from Value Area of trading session. Because it happens near the close, the market has not had time to “prove” the new levels (Price + Time = Value). The next session’s open and early activity tell you whether the spike will be accepted (continuation) or rejected (reversion). 1 - How to identify a spike A spike starts with the period that breaks out of the day’s value area (the breakout period). The spike range is from the breakout period’s extreme to the day’s extreme in the spike direction. It is typically a quick, directional move in the last few time periods of the session. 2 - Acceptance vs Rejection - what to watch for next day Because the move happened late, you must wait until the next trading day to judge follow-through. Early next-day activity shows whether value forms at the spike levels (acceptance) or not (rejection). Accepted spike (continuation): Next day opens beyond the spike (above a buying spike, below a selling spike), or Next day opens inside the spike and then builds value there (TPOs/volume accumulate inside the spike). Both cases mean the market accepts the new levels and continuation in the spike direction is likely. Rejected spike (failure): Next day opens opposite the spike (below a buying spike or above a selling spike) and moves away. This indicates the probe failed and price will likely move back toward prior value. 3 - Spike Reference Points Openings within the spike: If next day opens inside the spike range → day is likely to balance around the spike. Expect two-timeframe rotational trade (sideways activity) within or near the spike. Treat the spike as a short-term new base : use the spike range (top-to-bottom of spike) as an estimate for that day’s range potential. Openings outside the spike: Open above a buying spike: very bullish - initiative buyers in control. Trade idea: look to buy near the top of the spike (spike top becomes support). Caution: if price later auctions back into the spike and breaks the spike top, the support may fail quickly. Open below a selling spike: very bearish — initiative sellers in control. Trade idea: look to short near the bottom of the spike (spike bottom becomes resistance). Open above a selling spike (rejecting the spike): bullish day-timeframe signal, often leads to rotations supported by the spike top as support. Open below a buying spike (rejecting the spike): bearish. 4 - Decide entry approaches Conservative (recommended) • Wait for next-day open and confirmation (open beyond spike or open inside then build value inside spike). • Enter on a pullback toward the spike extreme (top for long, bottom for short). • Place stop just beyond the opposite spike extreme. Standard intraday (balanced) • Enter at the open if it is above/below the spike in the spike direction. • Use tight size and tight stop (higher risk / higher reward). Aggressive • Enter when early session shows initiative in spike direction (strong TPO/volume buildup). • Stop under/above the spike extreme or an early structural swing. 🔸🔸🔸 6 - Conclusion 🔸🔸🔸 Becoming a proficient trader is much like designing with wood. At first, you study the fundamentals—understanding different types of wood, their strengths, how they react under load, and how joints transfer forces. Then you begin by following standard rules and templates, carefully measuring and cutting according to the book. Along the way, the tools you use—whether it’s a simple saw or advanced CNC machines—shape the quality of your work. Without the right tools, even solid knowledge can fall short. With practice, however, you learn not only how to apply the theory but also how to make the most of your tools, combining both into a process that feels natural and efficient. Eventually, you stop focusing on each detail step by step and instead feel how to create a structure that is both strong and elegant. Trading develops in the same way—starting from theory, moving through repetition, and finally reaching intuitive proficiency. Success in trading is not about memorizing every pattern but about combining three essential elements: Theory + Your Judgment + Tools = Results . Theory provides the foundation, judgment comes from experience and self-awareness, and tools like TradingView allow you to test, visualize, and refine your edge. Together, these elements build the confidence to act decisively in live markets. The strategies we explored—such as 3-1 Days, Neutral-Extreme Days, and Spikes —are valuable examples of how Market Profile structure can highlight high-probability opportunities. But now that you understand how profiles are built and the principles behind them, you are equipped to create and test your own strategies. Developing a personal approach not only strengthens your decision-making, it also raises your confidence level—one of the most important skills a trader can have. In the end, Market Profile is not about rigid answers but about learning to think in market terms. Once theory and experience merge into intuition, opportunity becomes something you recognize instinctively—just as a fluent speaker understands meaning without translation. That is the essence of proficiency: not just knowing the rules, but mastering the ability to trade with clarity and conviction. 🔸🔸🔸 7 – Resources 🔸🔸🔸 If you’d like to deepen your knowledge of Market Profile and its applications, the following books are highly recommended: A Six-Part Study Guide to Market Profile – CBOT A clear and structured guide that introduces Market Profile theory step by step, making it accessible for both beginners and intermediate traders. Steidlmayer on Markets: Trading with Market Profile – J. Peter Steidlmayer, Steven B. Hawkins Written by the creator of Market Profile, this book lays out the foundational concepts and demonstrates how profiles reveal the auction process behind price movement. Markets in Profile: Profiting from the Auction Process – James F. Dalton, Eric T. Jones, Robert B. Dalton A modern exploration of how the auction process applies to today’s markets, combining Market Profile concepts with behavioral finance and practical strategy. Mind Over Markets: Power Trading with Market Generated Information – James F. Dalton, Eric T. Jones, Robert B. Dalton Considered a classic, this book provides a comprehensive framework for understanding and applying Market Profile. It bridges theory with practical trading insights, making it a must-read for serious traders.

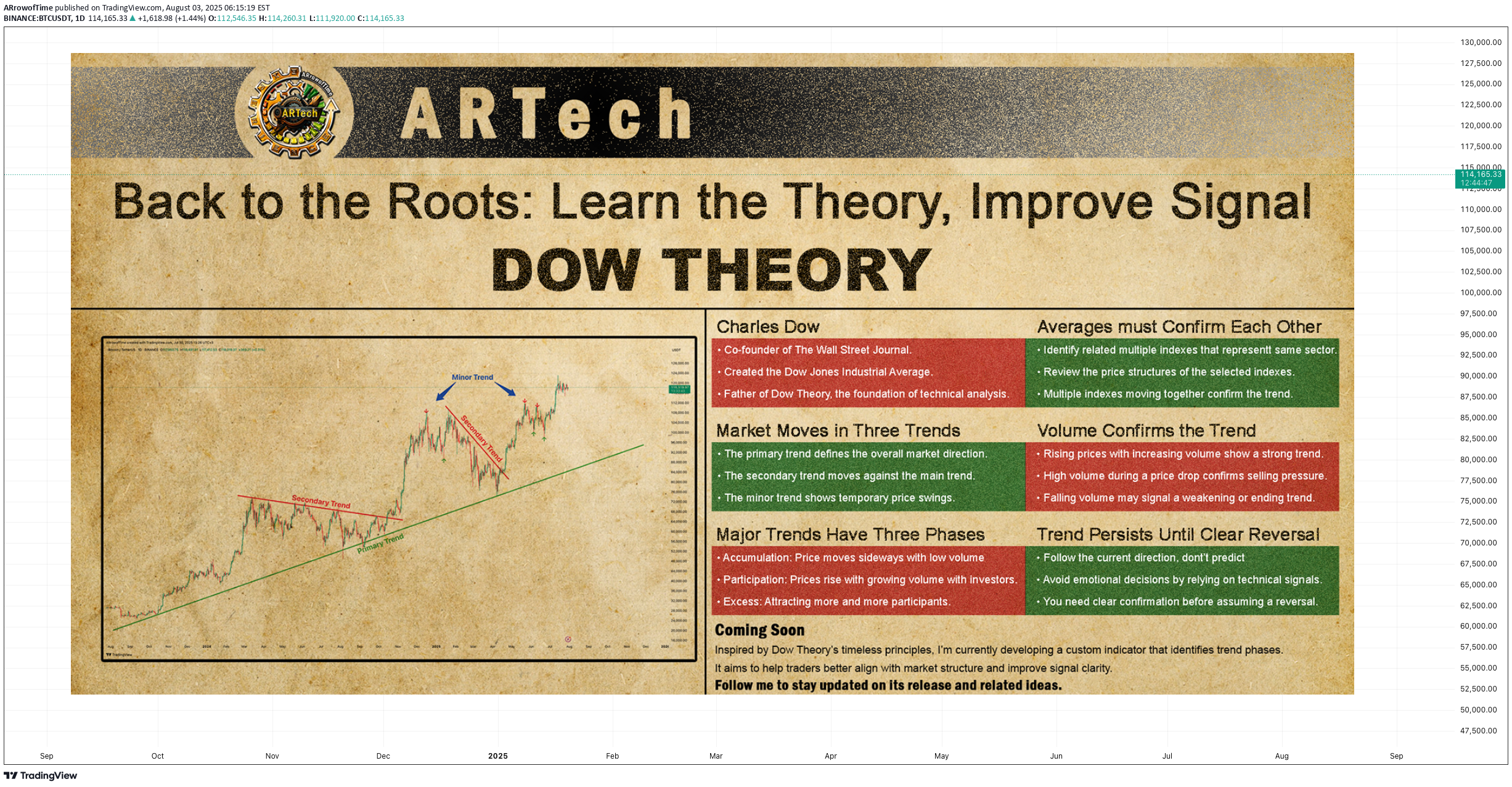

Back to the Roots: Learn the Theory, Improve Signal Charles Dow Before we explore Dow Theory, let’s take a moment to understand who Charles Dow was — and why his ideas still matter today. Charles Dow wasn’t a financial expert. He was a journalist with a sharp eye for market behavior. In the late 1800s, he began to write about how prices move, how trends form, and what they might mean. His goal was simple: to bring structure and logic to the chaotic world of stock prices. More importantly, he believed that markets move in trends , and that these trends reflect the collective psychology of all investors. This basic idea became the starting point of technical analysis . Dow created one of the first stock indexes, which helped investors see the bigger picture instead of focusing only on individual stocks. He also promoted transparency in financial data — long before it was required by law. In 1889, Dow co-founded The Wall Street Journal, a newspaper that became the voice of financial markets. Through its pages, he published his observations on price behavior, setting the foundation for what would later be known as Dow Theory . Dow Theory At the heart of Dow Theory lies a simple but powerful idea: The market discounts everything. This means that all known information — earnings reports, interest rates, economic events, political changes, and even future expectations — is already reflected in the price. Price is not random. It is the result of collective investor behavior based on all available knowledge. Charles Dow didn’t write this exact sentence, but his work clearly reflected this belief. He trusted that by analyzing price movements alone, one could understand the overall direction of the market — because price already includes all the important signals. Dow and later analysts outlined a set of guiding principles. These are now known as the Six Core Principles of Dow Theory , and they continue to serve as a foundation for modern technical analysis. The market discounts everything The market moves in three trends Major trends have three phases Averages must confirm each other Volume confirms the trend A trend stays in place until it clearly reverses 🔸🔸🔸 The Market Moves in Three Trends 🔸🔸🔸 According to Dow Theory, market movements are not random. Prices move in three different dimensions and time frames: the primary trend , the secondary trend , and the minor (short-term) trend. These three types of movement often occur at the same time. It is very important for an investor to distinguish between them. The primary trend shows the general direction of the market and can last for months or even years. It’s the major upward or downward movement. The secondary trend refers to corrections or pullbacks that move in the opposite direction of the primary trend. The minor trend typically consists of daily or weekly fluctuations and is often considered market “noise.” These short-term movements can occur in the same or opposite direction of the primary trend and may last from a few hours to two or three weeks. Dow Theory emphasizes that understanding this three-layered structure can protect investors from many mistakes. The theory not only classifies trends but also offers valuable lessons about investor behavior. It especially highlights the importance of three key principles: Don’t go against the main trend Short-term moves can easily confuse traders. Trading against the primary trend often leads to losses. That is why it is crucial to identify the main trend and follow it. Diversify your exposure In Dow’s time, technology wasn’t as advanced as it is today, but he still followed multiple indexes (like industrials and transport) to reduce risk. The same principle applies today: investors shouldn’t rely on a single asset — diversification remains a critical part of managing risk. Define your holding period before entering a trade Each type of trend comes with a different time expectation. The holding period you choose will play a key role in shaping your trading strategy and aligning it with your financial goals. Instead of debating how long each type of trend should last, it’s more important to define your intended holding period before entering a position. Your answer to the question “Which holding period suits me?” reflects not only your trading style and lifestyle, but also determines which chart timeframes and indicator timeframes you should use. 🔸🔸🔸 Major Trends Have Three Phases 🔸🔸🔸 According to Dow Theory, major (primary) trends consist of three phases. This structure reflects how investor psychology changes over time and how those emotions are reflected in price action. Regardless of whether the trend is bullish or bearish, each major trend includes these three stages: Accumulation Phase The first stage of a bull market often looks like a small bounce during a bear trend. Most people still feel negative about the market. They are afraid to buy again after losing money. Trading volume is low, and prices move in a narrow range. The market stops making new lows, but investors are still unsure. Many have left the market or are very careful now. The price action becomes slow and sideways. It feels boring. But during this quiet time, smart investors slowly start buying. This is how a new trend begins — silently and with doubt. However, there is no clear signal that a bull market has started. Buying now carries two big risks. First, the market may still go lower. Second, even if a bull trend is coming, no one knows when it will start. How long can you wait while the market does nothing? Holding positions in a flat market has costs — financial, emotional, and missed opportunities elsewhere. That’s why this phase is difficult for most traders to handle. Public Participation Phase The market begins to recover, and the broader investor base starts to notice positive changes. News improves, technical indicators give bullish signals. Prices rise, and trading volume increases. This is usually the strongest part of the trend. At this stage, more disciplined and research-driven investors — who follow the market closely — start buying in. They see confirmation in both price action and economic data. Their confidence supports the trend, and momentum grows. The market attracts more attention. Confidence replaces fear. Many investors who stayed out during the earlier phase now feel safer to enter. Joining the market during this phase is important. The trend is already underway, but there’s still room to grow. Risk is lower than in the early phase, and potential rewards are still high. For many investors, this is the best time to take a position. Excess Phase The market enters a phase of excessive optimism. Prices have been rising for a long time, attracting more and more participants. However, during this stage, institutional investors and professional traders who entered earlier begin to gradually take profits. Although prices remain high, momentum weakens, and the rate of increase slows down. Looking at the volume profile, prices may reach new highs but often without volume support. Technical indicators frequently show bearish divergences. These conditions generate early technical signals that the primary trend may be coming to an end. 🔸🔸🔸 Averages must Confirm Each Other 🔸🔸🔸 According to Dow Theory, a market trend is considered valid only when different indexes move in the same direction. The term “average” here refers to an index or the general direction of a price series. This principle is used to assess whether a price movement is supported by broad market participation. A single index reaching a new high or low is not enough. For a real and sustainable trend to be confirmed, related indexes are expected to show similar movement and generate signals in the same direction. If this confirmation is missing, the current move may be considered weak or temporary. How to Analyze It: Identify related indexes Choose multiple indexes that represent the same market, sector, or economic domain. Compare trend direction Review the price structures of the selected indexes. Are they all showing similar patterns? Did the new highs or lows form around the same time? Look for confirmation If multiple indexes form new structures in the same direction (e.g., all make new highs in an uptrend), this increases the validity of the trend.If only one index is moving while others are not participating, confirmation is lacking. Be cautious without confirmation When confirmation is missing, trading strategies should be more conservative, or additional signals should be awaited before taking action. 🔸🔸🔸 Volume Confirms the Trend 🔸🔸🔸 According to Dow Theory, the validity of a market trend depends not only on price movement but also on trading volume. For a trend to be considered strong and sustainable, price action should be supported by volume. Why Is Volume Important? In a rising market, increasing volume is expected. This indicates growing investor interest and broader participation in the trend. In a falling market, if the decline happens with high volume, it suggests serious selling pressure and strengthens the trend. Declining volume may signal a loss of momentum and suggest that the current trend is weakening or nearing its end. How to Analyze It: Observe the relationship between price and volume: Price rising + volume increasing → Strong trend Price rising + volume decreasing → Lack of confirmation; caution is advised Check volume during breakouts: If resistance or highs are broken with strong volume → Reliable signal If breakouts happen on low volume → May indicate a false move (fakeout) 🔸🔸🔸 A Trend Persists Until a Clear Reversal Occurs 🔸🔸🔸 This core principle of Dow Theory is at the heart of all trend-following strategies. It states that once a price begins moving in a certain direction, the trend is assumed to continue — until there is clear and technically confirmed evidence that it has ended. Why Is This Principle Important? Follow, don’t predict Instead of guessing what the market will do next, traders stay with the current direction. Reduces emotional decisions Trades are based on technical signals, not assumptions like “the price is too high, it must fall.” A weak trend is not the same as a reversal Not every pullback means the trend is over. You need clear confirmation before assuming a reversal — such as a breakdown, volume shift, momentum loss, or structural change. How to Apply It First, identify the trend direction clearly, and trade in that direction. Pullbacks are seen as normal movements within the trend — not as reversals. Even when signs of a reversal appear, wait for confirmation before acting. Confirmation signals may include: Failure to form new highs or lows A break of previous support or resistance Sudden drop in volume or volume rising in the opposite direction Weakness or divergence in momentum indicators Strategic Benefit This principle is especially useful in trend-following strategies. It helps avoid premature exits and allows traders to stay in profitable trends longer. By focusing on technical confirmation instead of speculation or panic, it encourages disciplined and systematic decision-making.

سلب مسئولیت

هر محتوا و مطالب مندرج در سایت و کانالهای رسمی ارتباطی سهمتو، جمعبندی نظرات و تحلیلهای شخصی و غیر تعهد آور بوده و هیچگونه توصیهای مبنی بر خرید، فروش، ورود و یا خروج از بازارهای مالی نمی باشد. همچنین کلیه اخبار و تحلیلهای مندرج در سایت و کانالها، صرفا بازنشر اطلاعات از منابع رسمی و غیر رسمی داخلی و خارجی است و بدیهی است استفاده کنندگان محتوای مذکور، مسئول پیگیری و حصول اطمینان از اصالت و درستی مطالب هستند. از این رو ضمن سلب مسئولیت اعلام میدارد مسئولیت هرنوع تصمیم گیری و اقدام و سود و زیان احتمالی در بازار سرمایه و ارز دیجیتال، با شخص معامله گر است.