تحلیل تکنیکال fibcos درباره نماد NVDAX : توصیه به خرید (۱۴۰۴/۸/۴)

fibcos

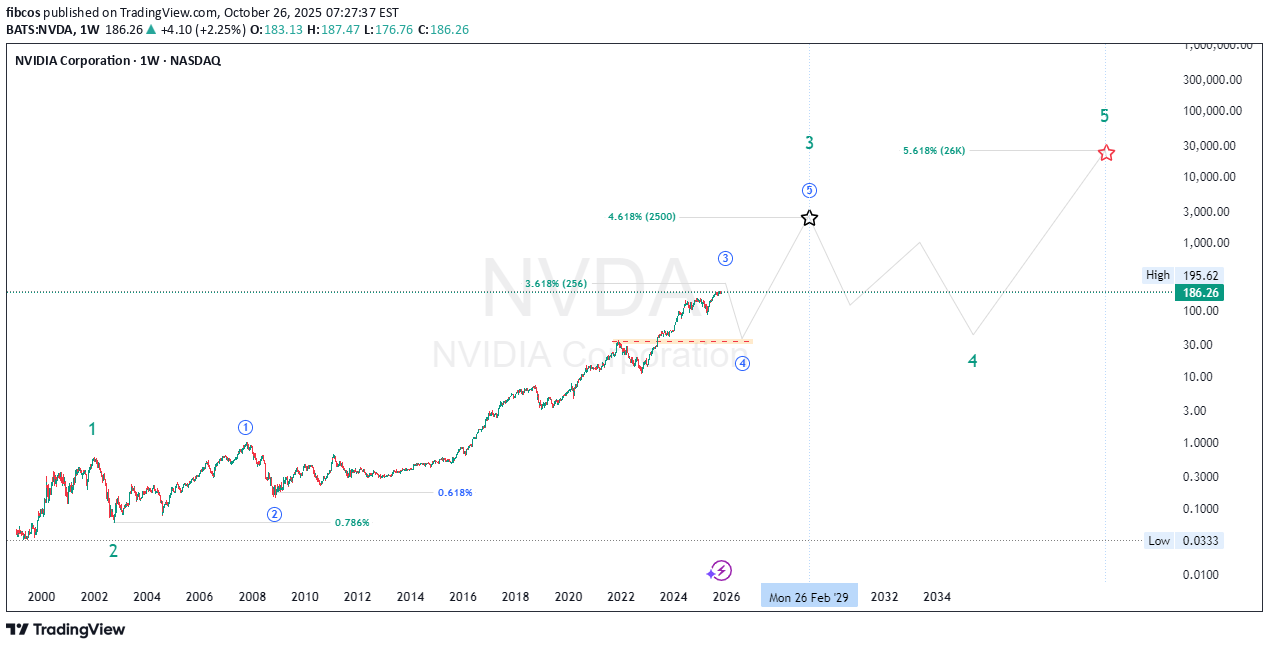

تحلیل موج الیوت: مسیر انفجاری انویدیا (NVDA) تا ۲۶,۰۰۰ دلار!

Summary: “Elliott Waves, Fibonacci, and Smart Money align perfectly — NVIDIA’s long-term chart points to an AI-powered Supercycle with massive upside." 💎📊 🚀 NVDA | The Supercycle of the AI Era! 💚 🌀 Elliott Wave Supercycle Breakdown NVIDIA’s price action over the past two decades is a textbook example of a multi-decade Elliott Wave Supercycle — where technical , fundamentals , and Smart Money flows perfectly align to form a once-in-a-generation structure 🌎 Let’s break it down step-by-step 👇 Super Cycle Wave (1) — launched in the early 2000s, marking NVDA’s first growth phase during the birth of consumer GPUs 🎮. Super Cycle Wave (2) — deep correction into 2002, retracing a 0.786 Fibonacci, cleansing early euphoria and creating the foundation for institutional accumulation 💼. Then began the Super Cycle Wave (3) — the most powerful phase of all. Within it, we have distinct macro sub-waves: 1️⃣ Macro Wave (1) — ended in 2007 , aligning with the first institutional wave of adoption. 2️⃣ Macro Wave (2) — retraced 0.618 in 2008 , coinciding with the global financial crisis (perfect Smart Money shakeout). 3️⃣ Macro Wave (3) — the current dominant leg, fueled by exponential AI and data center growth . It’s extending toward the 3.618 Fibonacci extension (~$256) , confirming wave strength and institutional conviction. 4️⃣ Macro Wave (4) — expected between 2026–2027, likely retracing 0.236–0.382, a natural cooling period before the next breakout. 5️⃣ Macro Wave (5) — projected to rally toward 4.618 extension (~$2,500) , completing Super Cycle Wave (3) near 2029 🏁 From there, a larger Super Cycle Wave (4) correction could unfold before the final parabolic Super Cycle Wave (5) run to the 5.618 Fibonacci extension (~$26,000) — the climax of NVDA’s decades-long AI expansion super-trend 🌕 💰 Smart Money Concept (SMC) Perspective The chart structure clearly shows Smart Money accumulation patterns in every correction phase: Re-accumulation ranges appeared at every 0.618 retracement level 📊 Liquidity grabs below previous swing lows before strong impulsive moves ⚡ Fair Value Gaps (FVGs) filled during corrections, creating perfect liquidity imbalances that institutional players exploit Currently, NVDA trades near a premium zone of Macro Wave (3), but Smart Money will likely reaccumulate during the upcoming Macro Wave (4) discount phase (2026–2027). Expect Order Block re-tests and liquidity sweeps around discounted Fibonacci retracement zones (0.236–0.382) before the next major rally 📉➡️📈 📈 Price Action Structure NVDA’s macro structure remains strongly bullish: The multi-decade trend has respected every higher high and higher low sequence since 2008. Each impulse is followed by a healthy re-accumulation range, never breaking long-term structure. Expect distribution near the $250–$300 (split-adjusted) region as Wave (3) matures, followed by a macro correction that offers generational entries for long-term investors 🧠 🔢 Fibonacci Confluence & Technical Harmony Fibonacci has been the invisible hand guiding NVDA’s growth 👇 0.786 retracement (2002) → deep liquidity reset 0.618 retracement (2008) → institutional re-entry 3.618 extension (256) → current macro resistance target 4.618 extension (2500) → Super Cycle Wave (3) final target 5.618 extension (26K) → ultimate Super Cycle Wave (5) projection Each impulse and retracement aligns perfectly with Fibonacci’s geometric rhythm , proving the power of confluence between time, price, and sentiment. 🧠 Fundamentals — The Energy Behind the Waves Behind the technicals lies unmatched fundamental growth : 💾 AI & Data Centers: NVIDIA is the core infrastructure for modern AI compute and cloud training workloads. 🧩 CUDA Ecosystem: A software moat that ties developers and enterprises directly to NVIDIA’s architecture. 🌐 Omniverse & Robotics: Positioning NVDA as a leader in 3D simulation, robotics, and digital twins — future trillion-dollar markets. ⚙️ Strategic Partnerships: Expanding across hyperscalers, automotives, and enterprise AI. Each innovation wave fuels a new Elliott Wave impulse , with the AI revolution now driving the strongest macro leg in NVDA’s history. ⚡ Macro Outlook & Timeline ✅ Now (2025): Completing Macro Wave (3) of Super Cycle (3) → heading toward $256 target ⚠️ 2026–2027: Macro Wave (4) correction to 0.236–0.382 (Smart Money entry) 🚀 2028–2029: Macro Wave (5) push → Super Cycle (3) peak near $2,500 🌊 2030–2032: Super Cycle (4) correction — consolidation phase 💎 2035–2040+: Super Cycle (5) → ultimate 5.618 target near $26K 💬 Final Thoughts "Every correction is a setup for the next expansion. Smart Money buys fear — not euphoria." NVIDIA is the heartbeat of the AI revolution , the core of data-driven computing , and a living Fibonacci sequence in motion. As long as fundamentals stay aligned with the wave rhythm, NVDA’s Supercycle will continue to redefine what’s possible in long-term growth. 🌌 #NVDA #ElliottWaveAnalysis #SmartMoneyConcept #PriceActionTrading #FibonacciMagic #AIRevolution #StockMarket #Investing #TradingViewCommunity #TechSupercycle #NVDAtoTheMoon #LongTermInvesting 💬 Traders, analysts, and wave watchers — your insights matter! Have you spotted NVDA’s next move? Drop your Elliott Wave counts, confirmations, or constructive critiques below 👇 Let’s discuss NVIDIA’s structural evolution, AI-driven Supercycle, and long-term growth potential together 🚀💚 Every comment adds perspective — let’s decode this massive wave as a community! 🌊📈 — Team FIBCOS ⚡💎NVDA may present a compelling buying opportunity, as our outlook suggests the upside target of 256 has not yet been fully realized. However, ensure that risk is managed effectively at all times.