تحلیل تکنیکال Swissquote درباره نماد SPYX در تاریخ ۱۴۰۴/۷/۲۱

Swissquote

جنگ تجاری چین و آمریکا: آسیبهای فنی شاخص S&P 500 چقدر جدی است؟

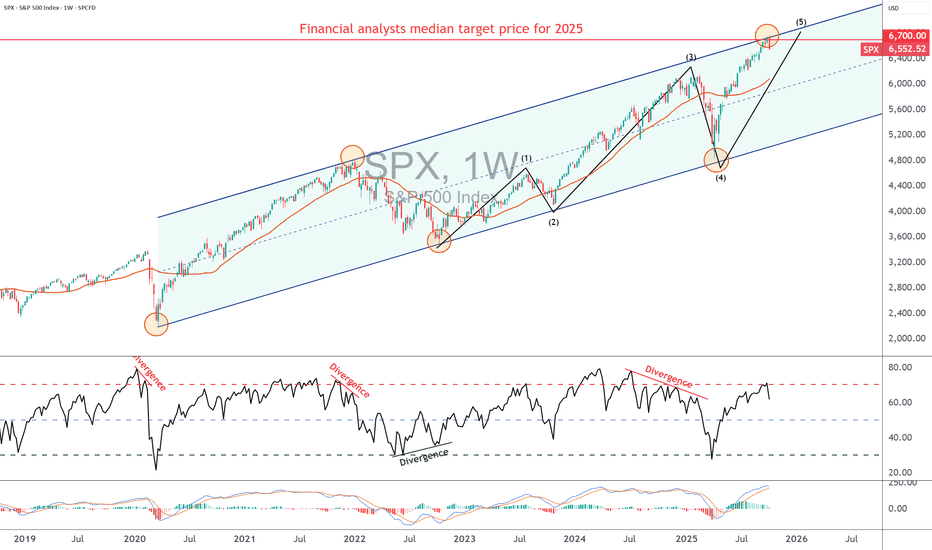

The sudden resurgence of trade tensions between the United States and China triggered a shockwave across global financial markets last Friday, hitting the S&P 500 index hard. Beijing’s announcement of new export controls on rare earths, followed by Donald Trump’s threat to double tariffs on Chinese goods to 100%, has revived the specter of a full-scale trade war. This escalation caused a sharp technical correction in the U.S. index, which just experienced its worst session in six months. Although negotiations could still lead to an agreement by the end of October between China and the U.S., investors fear a direct impact on the margins of major industrial and tech companies—already weakened by rising import costs and record-high valuations. So, what are the technical damages on the S&P 500 from this renewed trade conflict between the world’s two largest economies? 1) The S&P 500 is rejecting from the upper boundary of its long-term bullish channel During the trading session on Tuesday, September 30, I shared a technical update on the S&P 500 questioning whether an annual high had been reached. The first chart below links to that analysis: The technical damage from the sharp decline on Friday, October 10, remains limited for now, as no major support levels have been broken. However, the S&P 500 has clearly rejected from the upper boundary of the long-term bullish channel in place since 2020 — an area that could correspond to the completion of wave 5 according to Elliott Wave analysis. For the start of this week, the 50-day moving average must be closely monitored, as its breakdown last February marked the beginning of the March/April correction tied to the trade war. The chart below shows the weekly Japanese candlesticks of the S&P 500: 2) The Russell 2000 index rejects below its all-time high Looking at market breadth, another notable technical weakness appears: the bearish rejection of the Russell 2000 index below its record high of 2,460 points. A rejection under resistance is one thing, but the key now is to avoid breaking support—particularly the 2,360-point level. 3) This technical rejection occurs at very high valuation levels The current valuation of the S&P 500 is historically elevated, near levels last seen during the 2000 dot-com bubble. The Shiller P/E ratio is approaching 40, signaling a pronounced overvaluation of U.S. equities. The 12-month forward P/E exceeds 30, well above its long-term average, while the Buffett indicator (market capitalization to GDP) is above 200%, an all-time record. Such an imbalance heightens the risk of a technical correction if interest rates rise or corporate earnings weaken due to the trade war. DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.