ساوه

سیمان ساوه

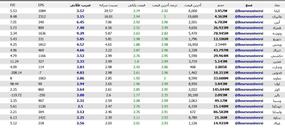

| تریدر | نوع پیام | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

واچ لیست ممتاز رایگان💚Rank: 278 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 10/21/2025 | |

تکنیکال_بورسRank: 258 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 10/20/2025 | |

سیگنال برترRank: 86 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 10/13/2025 | |

خرید | حد سود: ۹٬۹۹۹ حد ضرر: ۶٬۸۲۰ | 10/20/2025 | ||

صندوق سرمایه گذاری سهامی اهرمی نارنجRank: 415 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 9/28/2025 |

Adjusted Price Chart of ساوه

سود 3 Months :

پیامهای ساوه

Filter

Sort messages by

Trader Type

Time Frame

🏆بورس تکنیک 📉💰

// #Double_Ticket: It shows symbols that moved from negative to positive and became positive again with good ratios. #Kiana #Ghanizan #Abin #Detouzie #Khatrak #Ghchin #Kotsar #Saveh

بورس طارم

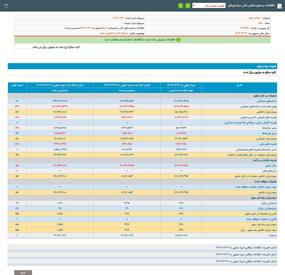

#Save 🔸 Information report and interim financial statements for 6 months ending in the fiscal year 12/29/1404 (unaudited) 6-month net profit: 1270.9 billion tomans, an increase of 56% compared to the previous year. ❇️ Accumulated profit of 1413.3 billion tomans, which increased by 50% compared to last year. Total quarterly profit: 1421 rials P/E: 6.13 Group P/E: 6.11 Number of shares: 17.18 billion Market value: 14,965 billion tomans Support your stocks by posting this report on the stock exchange channel and groups @dndir

نرم افزار تحلیل گر بورس - دایموند

#Save 🔸 Information report and interim financial statements for 6 months ending in the fiscal year 12/29/1404 (unaudited) 6-month net profit: 1270.9 billion tomans, an increase of 56% compared to the previous year. ❇️ Accumulated profit of 1413.3 billion tomans, which increased by 50% compared to last year. Total quarterly profit: 1421 rials P/E: 6.13 Group P/E: 6.11 Number of shares: 17.18 billion Market value: 14,965 billion tomans Support your stocks by posting this report on the stock exchange channel and groups @dndir

دکتر سید پرویز جلیلی: دانشگاه بورس

#Save Information and interim financial statements for the 6-month period ending on 06/31/1404 (unaudited) of Saveh Cement Company 🟠 Saveh Cement Company has recognized a profit of 740 Rials per share in the 6-month period ending on 06/31/1404, which has increased by 55% compared to the same period last year.

سیگنال و تحلیل سهام | بورسکده |

The best six-month reports Fundamental analysis center ✍️ If we do not consider the report of the steel workers, it should be said that the reports are very favorable. Let's go to the summary review of the reports of different groups... Refinement: #Shepna, considering the discount of certain food, we are confident about its profitability. #Camel was good, but it is profitable, but if it has a feed rate. #Shabandar was good. It also has a tax refund and its interest is added up to 5 times! Food: #Ghapino was the best report. The next rank was #Ghokuresh, which appeared very attractive. #Ghosino #Ghomino #Ghobshahr were also good. Cement: #Sejam and #Samtaz were great. #Saqain #Sabjno and #Sofi and #Sarod were very good. #Sefano #Saweh #Sabaqer and #Ardestan also appeared relatively well. Bank: #Vesina was great. #webmelet was very good. #Saman and #Wepost also appeared well. #Venvin average down. 🌸 Agriculture and cows and calves! #Zabina #Zafjar #Zamgsa were great. #Zadasht was also good. Medicine: #Detmad was great. #Daghazi, #Kimiatek and #Depars were very good. Miscellaneous: #Kermasha # were a great century. #Shamkam #Hafrin and #Cassava was also very good. #Fajr was also good.

بورس طارم

📈 #Saveh | Continued stable performance in six months In the six months of this year, Siman Saveh reported 1.3 percent net profit, which shows a 56% growth compared to the same period last year, and the company's performance is still stable and reliable. 📌 Considering the regular process of profitability and stability of sales, if the current conditions are maintained, the expectation of realizing about 2.8 percent profit this year was out of mind. 🧡 Value investment @eskini_vi

بورس نیلوفری

The best six-month reports ✍️ If we do not consider the report of the steel workers, it must be said that the reports are very favorable. Let's go to the summary review of the reports of different groups... Refinement: #Shepna, considering the discount of certain feed, we are comfortable with its profitability. #Camel was good, but it is profitable, but if it has a feed rate. #Shabandar was good. It also has a tax refund and its interest is added up to 5 times! Food: #Ghapino was the best report. The next rank was #Ghokuresh, which appeared very attractive. #Ghosino #Ghomino #Ghobshahr were also good. Cement: #Sejam and #Samtaz were great. #Saqain #Sabjno and #Sofi and #Sarod were very good. #Sefano #Saweh #Sabaqer and #Ardestan also appeared relatively well. Bank: #Vesina was great. #webmelet was very good. #Saman and #Wepost also appeared well. #Venvin average down. 🌸 Agriculture and cows and calves! #Zabina #Zafjar #Zamgsa were great. #Zadasht was also good. Medicine: #Detmad was great. #Daghazi, #Kimiatek and #Depars were very good. Miscellaneous: #Kermasha # were a great century. #Shamkam #Hafrin and #Cassava was also very good. #Fajr was also good. ❤️ Fundamental analysis center @tahlil_center 💠

💎 رضا(حاجیان)بورس 💎

The best six-month reports If we do not consider the report of the steel workers, it should be said that the reports are very favorable. Let's go to the summary review of the reports of different groups... Refinement: #Shepna, considering the discount of certain feed, we are comfortable with its profitability. #Camel was good, but it is profitable, but if it has a feed rate. #Shabandar was good. It also has a tax refund and its interest is added up to 5 times! Food: #Ghapino was the best report. The next rank was #Ghokuresh, which appeared very attractive. #Ghosino #Ghomino #Ghobshahr were also good. Cement: #Sejam and #Samtaz were great. #Saqain #Sabjno and #Sofi and #Sarod were very good. #Sefano #Saweh #Sabaqer and #Ardestan also appeared relatively well. Banking: #Vesina was great. #webmelet was very good. #Saman and #Wepost also appeared well. #Venvin average down. Agriculture and cows and calves! #Zabina #Zafjar #Zamgsa were great. #Zadasht was also good. Medicine: #Detmad was great. #Daghazi, #Kimiatek and #Depars were very good. Miscellaneous: #Kermasha # were a great century. #Shamkam #Hafrin and #Cassava was also very good. #Fajr was also good. / @rezaboors

#Save Explanations regarding information and #financial_statements published by #Saweh Cement Company Regarding the notice published with follow-up number 1420475 on 07/30/1404, the reasons for the change in operational and net profit and (loss) are presented to your service in the attached description. Returning to the letter number dated about the summons 07-30-1404 17:48:26 (1424448) ➖➖➖➖⬇️⬇️⬇️⬇️ @codal360_ir

⚙️ Expert analysis of the 6-month performance of "#Saveh" - 56% growth in net profit while keeping the profit margin at high levels ➖➖➖➖➖ 💠 ➖➖➖➖➖ Saveh Cement Company (#Saveh) recorded a strong performance in the cement industry during the 6-month period ending on 06/31/1404 with a 60% increase in #operating_income and a 56% increase in #net_profit. Keeping the gross profit margin at 54% and the net profit margin at 46% indicates the ability to control costs and maintain favorable sales rates; However, compared to the previous season, there is a slight drop in percentages. 📊 Key financial data (million Rials): 🔹 Operating revenues: 27,748,935 (+60%) — growth due to increased domestic and export sales volumes, along with higher sales rates. 🔹 Cost of revenues: 12,683,515 (+64%) — controlled growth of production cost affected by the increase in the price of energy and raw materials. 🔹 Gross profit: 15,065,420 (+56%) — Relative stability in operating profit margin given inflationary conditions. Selling, administrative and general (SG&A) expenses: 1,237,103 (+81%) — internal cost pressures related to transportation and administrative services. Financial expenses: 166,218 (+68%) — increase due to greater use of bank facilities for investment. 🔹 Other non-operating income: 797,897 (0%) — fixed share of total income; No significant change. Net profit: 12,709,395 (+56%) — the result of a combination of sales growth and maintaining a controlled cost structure. 🟢✔️ Profit per share (EPS): 740 Rials (+55%) ➕ Strengthening the stock position for long-term investors. 🔹 Gross profit margin: 54% (previous season 56% | change -4%) 🔹 Net profit margin: 46% (previous season 47% | Change -2%) 📈 Interpretive analysis The steady trend and high profit margin shows #Saveh's privileged position in the domestic and export cement market. The growth of SG&A and finance costs needs to be carefully monitored so that it does not negatively affect future profitability. Production cost control is still considered the strength of the company. 🎯 Summary and perspective Due to the continuation of domestic demand and the improving conditions of cement export, Saweh is able to maintain the current level of profitability. Focusing on reducing overhead costs can bring profit margins back to the previous quarter's levels. ⚖️ ━━━━━━━━━━ 📊 ━━━━━━━━━━ #SAVEH #Saman_analysis #quarterly_report #fundamental_analysis #cement_industry #EPS #profitability #profit_margin #operating_income #financial_statement #stock_market_analysis #capital_market ╭━━═━⊰✦ 🪐✦⊱━═━━╮ 🚀 @samantahlil👈 Subscribe ╰━━═━⊰❖🫥❖⊱━═━━╯ 💠 In the path of analysis, awareness and transformation... 💠

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.