دی

بانک دی

| تریدر | نوع پیام | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

saeidjkiasRank: 190 | خرید | حد سود: ۱٬۹۵۰ حد ضرر: ۶۲۰ | 10/12/2025 | |

𝐒𝒊𝒈𝒏𝒂𝒍 𝐒𝒂𝒃𝒛| سیگنال سبزRank: 934 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 4 hour ago | |

اسمارت بورسRank: 772 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 10/22/2025 | |

کانال فرمانده کریپتوRank: 587 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 10/19/2025 | |

🌱 نوسان سبز 💰Rank: 988 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 10/17/2025 |

Adjusted Price Chart of دی

سود 3 Months :

پیامهای دی

Filter

Sort messages by

Trader Type

Time Frame

🔴🔴🔴 The sixth #group_sale 🔴🔴🔴 #D (base yellow over-the-counter market) Number of sellers: 1 person Each real code: 572 million tomans Total: 572 million tomans Price: 750 (-1.70%) Power of buyer to seller: 1.19 🕘 12:25:47 🗓 08/03/1404 🆔 @SmBan 🆔 @SmBanGroup 🆔 @SmBanPVBot 👈 private channels of stock ban 🆔 @SmBanBot👈 watch bot

🔴🔴🔴 The third #group_sale 🔴🔴🔴 #D (base yellow over-the-counter market) Number of sellers: 6 people Each real code: 166 million tomans Total: 999 million tomans Price: 741 (%-2.88) Power of buyer to seller: 1.20 🕘 12:01:10 🗓 08/03/1404 🆔 @SmBan 🆔 @SmBanGroup 🆔 @SmBanPVBot 👈 private channels of stock ban 🆔 @SmBanBot👈 watch bot

پرشین سهم

Bank D medium term

𝐒𝒊𝒈𝒏𝒂𝒍 𝐒𝒂𝒃𝒛| سیگنال سبز

Update #Valraz 259 ✅ #Overseas 4960 ✅ #Bank Day is also an opportunity to enter Come on, let's go up to introduce a cool share

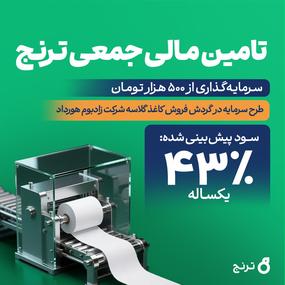

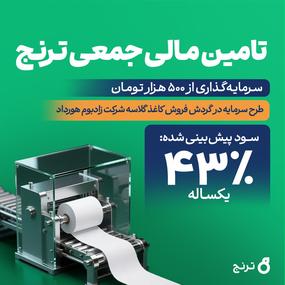

Collective financing of working capital for the sale of glossy paper by Zadboom Hordad Company 🟢 Capital required for the project: 12 billion Tomans 🟢 Predicted profit: 43% 🟢 Profit sharing: once every 3 months 🟢 Duration of planning and settlement of the principal amount: 12 months 🟢 Guarantee: Bank D's payment obligation 🟢 Name of the applicant: Zadbom Hordad Company 🟢 Agent and financial institution: Turanj Investment Consultant 🟢 with guarantee of return of capital (without profit guarantee) Start investing now 🔗 Click here to invest in this plan. 🔵 To inquire about the plan from the Iranian exchange, search for the "Tranjeboom" symbol through this link. ▫️ @ToranjCapital

Collective financing of working capital for the sale of glossy paper by Zadboom Hordad Company 🟢 Capital required for the project: 12 billion Tomans 🟢 Predicted profit: 43% 🟢 Profit sharing: once every 3 months 🟢 Duration of planning and settlement of the principal amount: 12 months 🟢 Guarantee: Bank D's payment obligation 🟢 Name of the applicant: Zadbom Hordad Company 🟢 Agent and financial institution: Turanj Investment Consultant 🟢 with guarantee of return of capital (without profit guarantee) Start investing now 🔗 Click here to invest in this plan. 🔵 To inquire about the plan from the Iranian exchange, search for the "Tranjeboom" symbol through this link. ▫️ @ToranjCapital

فردا نیوز بورس

The names of 5 outstanding banks were announced Deputy Central Bank: 🔹 Now, apart from Aindeh Bank, we have 5 non-performing banks, Capital Bank, Di, Sepeh, Iran Zemin, and the Institute of Nations are among our non-performing banks. 🔹 Also, last year two banks, Parsian and Shahr, which were among the balanced banks for many years, became balanced banks by selling their assets. Therefore, by continuing to implement reforms in the banking system, it is possible to resolve the dissatisfaction of the banking network. 🔹 The capital adequacy of our banking system without Future Bank has increased by 3.5 times and the average gap between our banking system without Future Bank and the standards of banking regulations of the country is reduced to three percent. About 42% of the overdraft of the banking system was related to Bank Ainde and 58% was related to 28 other banks of the country. Also, about 41% of the capital imbalance of our banking system was related to the future bank. Therefore, when a bank leaves the banking network with this amount of discrepancy, the reality of the banking system becomes more accurate. In fact, with this situation, Future Bank made the banking system look unrealistically bad.

بورس نیلوفری

Future Bank's decision increased the capital adequacy of the banking network by 3.5 times / Future Bank is responsible for 42% overdraft and 41% imbalance of banking network capital. Farshad Mohammadpour; Deputy for Central Bank Regulation and Supervision: 🔹 Since the main problem of Future Bank is liquidity imbalance, it is estimated that the assets of Future Bank are not less than its liabilities. 🔹 Bank Aindeh has entered the transition process and the deposits of this bank have been determined and all have been transferred to the National Bank. 🔹 This bank has paid facilities up to about 200 thousand billion tomans, about 10 times the standard amount. 🔹 About 120 to 130 thousand billion Tomans from this facility have been given to unit owners and persons related to the projects of Future Bank, contrary to the regulations, which have been frozen in the projects and have not returned. 🔹 Assets of Ainde Bank, as one of the steps, have been transferred to the deposit guarantee fund and are under the asset management company to repay the debts of Einda Bank. 🔹 The capital adequacy of Aindeh Bank was 600% negative, and with that decision, the average capital adequacy ratio of the banking system is 3.5 times and increases from 1.36% to about 5%. 🔹 About 42% of the overdraft of the banking system was related to Bank Aindeh. Also, about 41% of the capital imbalance of our banking system was related to the future bank. 🔹 With the measures taken, the number of Natraz banks has decreased from 14 in 2019 to six Natraz banks, and with the exclusion of Aindeh Bank, they will be reduced to five Natraz banks (Kafital Bank, Bank D, Mlamil Institute, Sepeh Bank and Iran Zameen Bank). www.ibena.ir/000kVl @shastamedia

تارگت بورس

The names of 5 outstanding banks were announced Apart from Eindeh, Capital Banks, Di, Sepeh, Iran Zemin and the Nation's Institute are among the non-performing banks About 42% of the overdraft of the banking system was related to Aindeh Bank and 58% was related to 28 other banks of the country. Also, about 41% of the capital imbalance of our banking system was related to the future bank! ⭐️ @gaf_24

هم افزایان بورس تهران

The names of 5 outstanding banks were announced Deputy Central Bank: 🔹 Now, apart from Aindeh Bank, we have 5 non-performing banks, Capital Bank, Di, Sepeh, Iran Zemin, and the Institute of Nations are among our non-performing banks. 🔹 Also, last year two banks, Parsian and Shahr, which were among the balanced banks for many years, became balanced banks by selling their assets. Therefore, by continuing to implement reforms in the banking system, it is possible to resolve the dissatisfaction of the banking network. 🔹 The capital adequacy of our banking system without Future Bank has increased by 3.5 times and the average gap between our banking system without Future Bank and the standards of banking regulations of the country is reduced to three percent. About 42% of the overdraft of the banking system was related to Bank Ainde and 58% was related to 28 other banks of the country. Also, about 41% of the capital imbalance of our banking system was related to the future bank. Therefore, when a bank leaves the banking network with this amount of discrepancy, the reality of the banking system becomes more accurate. In fact, with this situation, Future Bank made the banking system look unrealistically bad. @hamafzayan_bursetehran

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.