فولاد

فولاد مبارکه اصفهان

| تریدر | نوع پیام | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

FarhadAziRank: 397 | خرید | حد سود: ۴٬۲۰۰ حد ضرر: ۲٬۴۰۰ | 8 hour ago | |

hossein143Rank: 115 | خرید | حد سود: تعیین نشده حد ضرر: ۱٬۱۱۱ | 9/30/2025 | |

👑🦅H@rpi🦅Rank: 455 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 10/21/2025 | |

باشگاه بورسRank: 19 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 10/10/2025 | |

بورس با "نقاط جامانده"🍃🍃🍃Rank: 216 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 10/6/2025 |

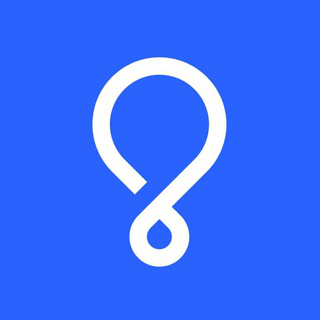

Adjusted Price Chart of فولاد

سود 3 Months :

پیامهای فولاد

Filter

Sort messages by

Trader Type

Time Frame

هم افزایان بورس تهران

#Steel According to reports, the total industry had a 31% drop in operating profit in summer compared to spring, and it had a poor performance Based on our analytical indicators, the best companies are Hormuz and Arfa. #Hormoz #Kavir #Arfa #Zob #Fajr #Cisco #Fasazan #Froud #Folad #Kaveh #Fenvard #Fajhan #Fuka #Fakhuz EcoRadar1002

ICHIOT

#Folad-3 months => The picture is clear, without description!

گاندو 𝕧𝕚𝒑

# lever 🔹 According to the replied message, a purchase offer was given in the channel 1600-1700 and now it has reached the price of 2600 (52% short-term yield without fluctuation and more yield in case of fluctuation) 🔹 It has resistance in the range of 2700-2800 and according to the picture above, in the past it had a history of fluctuating trades in the range of 2400-2500 to 2700-2800 and then moving towards a higher target. ✍ Our trading behavior is based on the behavior of the leaders, but we should also consider the possibility that the leverage and #leverages in the range below the resistance will again have an oscillatory behavior for some time. ✍ There is a possibility that levers and levers will become oscillators for a while and sell buy queues and high positives and re-buy low prices (daily and multi-day sine oscillations). ✍ Crossing the resistance of 2800 and consolidating above 2900 is important for the higher goals of leverage and #leverages. 🔹 It is emphasized that the market maker is unpredictable and the above contents are possibilities, so our criterion for decision is to check the subcategory leaders (#Famli, #Folad, #Khodro, #Shepna and #Waghdir), the boards, monitoring the cash flow and buyer power. Hamidreza Jahangirian November 2, 1404

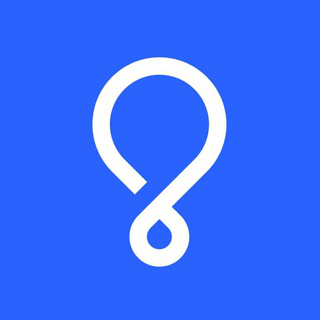

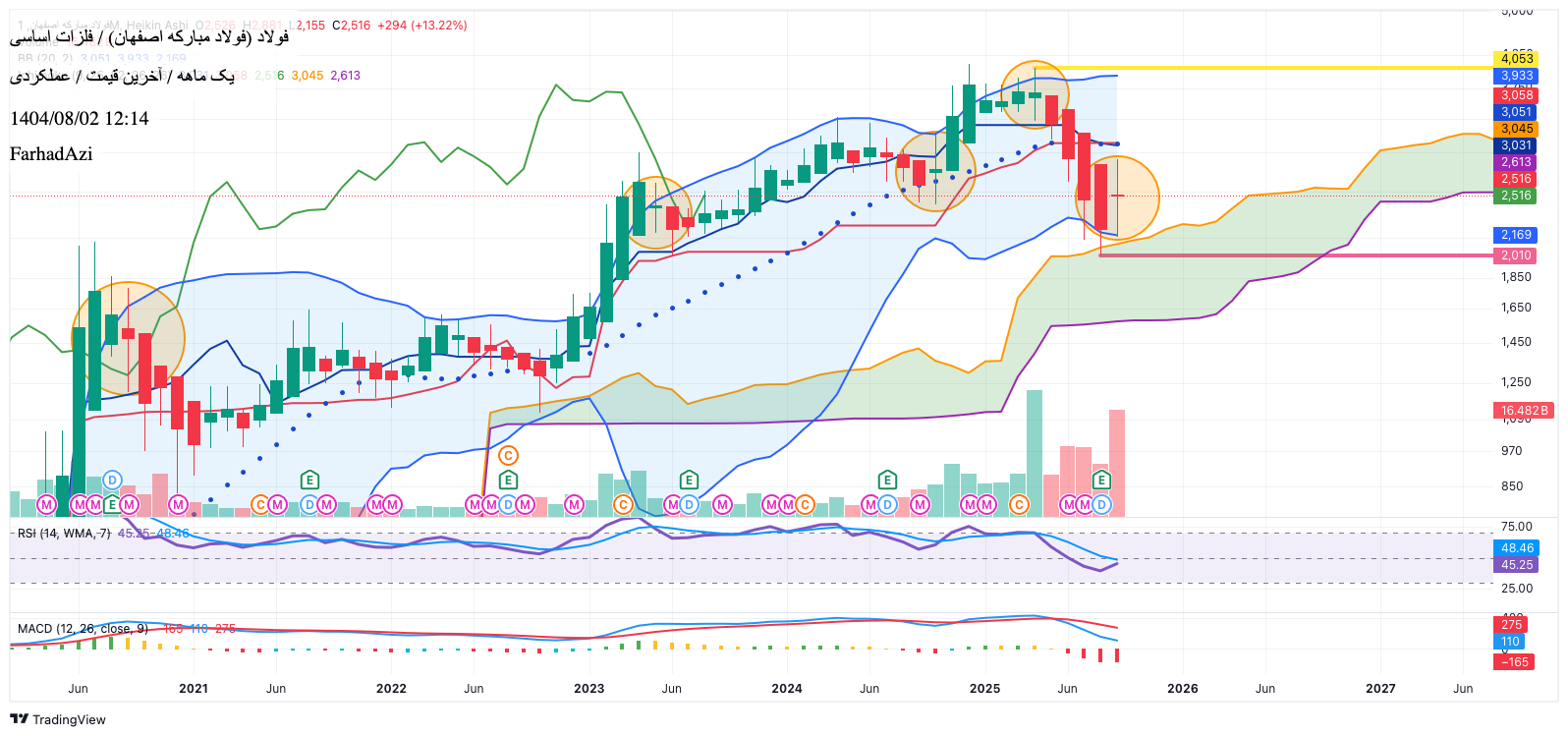

FarhadAzi

Steel weekly logarithmic chart with functional adjustment The possible route of steel in the fall of 1404 The weekly MACD has already signaled an entry and is currently indicating an upswing! In terms of weekly waves, it is currently completing microwave 3 of the current kinetic wave! Of course, the rise is definitely accompanied by fluctuations so that the growth can continue with the change of shareholders! It is written only for the exchange of opinions and should not be used as a basis for buying or selling! Your baskets are profitable! Friday, November 2, 1404

FarhadAzi

Logarithmic monthly chart analysis with functional adjustment As I specified in the chart, whenever the Heiken Ashi monthly doji cross is crossed, we have a change in the monthly trend, so with this chart, the upward trend of steel has started, and hopefully soon it will not only hit the adjusted ceiling, but also grow more! Of course, in the regular monthly candlestick chart, RSI has given an entry signal! (The shape of the RSI changes slightly when we choose the Heiken Ashi candle!) It is written only for the exchange of opinions and should not be used as a basis for buying or selling! Your baskets are profitable! Friday, November 2, 1404

📊 Iron ore market analysis - $100 floor in danger of collapsing ➖➖➖➖➖ 💠 ➖➖➖➖➖ July 10, 2024 Source: Bloomberg Intelligence Analyst: Grant Sporre The big picture The world market of #iron_stone is standing on the threshold of one of its most sensitive psychological points: the floor of 100 dollars per ton. The combination of increased supply from mining giants and deep weakness in Chinese steel demand has made the price balance fragile and raised the possibility of a drop below this level. Supply side Increasing the exploitation capacity in key projects: ▫️ Gudaydari mine of Rio Tinto company, the second phase has begun ▫️ S11D project of Vale company, target capacity: 100 million tons BHP's Western Australian operations exceed production targets ▫️ Solving the logistics knot of the port of Punta da Madeira in Brazil 📈 The growth of the total global supply in 2024 is about +40 million tons; Most producers operate with a marginal cost of less than $65, so supply outflows at low prices are unlikely. Demand side In China, the real estate market remains stagnant and the construction sector has not yet recovered: ▫️ June crude steel production: 📉 2.1% less than the previous year ▫️ Profit margin of steel makers: negative ▫️ Construction Purchasing Managers' Index (Construction PMI): 47.3 - in contraction zone 📉 The total reduction of steel consumption is estimated to be about 10 million tons compared to 2023. Supply and demand balance 📊 Overview of the global iron ore market 🔸 Global supply: 1,589 → 1,628 million tons 🟢 (+40 increase) 🔹 China's demand: 1,102 → 1,090 million tons 🔴 (decrease -12) 🔸 Inventory of Chinese ports: 132 → 142 million tons 🟢 (+10) 🔹 Surplus of the second half of 2024: ≈22 million tons ⚠ (downward pressure on the price) Price scenarios 🟠 Basic state - failure of the psychological floor ▫️ Factors: increase in supply + weakness of Chinese steel → $90-95 range Probability: 45% 🟢 positive state - relative stability ▫️ Factors: real estate support package + reduction in carried supply → $102-115 range | Probability: 30% 🔴 Negative mode - more intense drop ▫️ Factors: Valley production boom + global recession → $85-90 range | Probability: 25% Cost curve Australia's mineral inflation has grown by +17% from 2019 to 2023. - The real floor of the market: Now it is estimated in the range of 85 to 92 dollars per ton. - High-cost producers in India, Iran and Africa were the first victims of the price drop. Market consequences - Mining giants Rio Tinto, BHP and Vale are still profitable but with lower margins. - The Baltic Dry Index (Baltic Dry Index) is likely to drop. - In the future contracts of Singapore (Singapore Futures - SGX), the probability of touching $92/ton in the fourth quarter of 2024 is more than 50%. - Long positions are risky now, unless there are signs of Chinese demand returning. 🎯 Final summary The $100 floor is no longer the fundamental wall of the market; It mostly plays the role of a mental border that collapses with the slightest drop in the profits of Chinese steelmakers. If there is no supportive news from the construction sector or financial credit in the final quarter of the year, the prices of $90 will soon be on the trading board. ━━━━━━━━━━ 📊 ━━━━━━━━━━ #Saman_Tahlil #Seng_Ahn #Bloomberg #Bloomberg_Intelligence #Commodities #BI_Strategy #Commodity_Market #Fundamental_Analysis #Supply_and_Demand #Production_Cost #Steel #China ╭━━═━⊰✦ 🪐✦⊱━═━━╮ 🚀 @samantahlil👈 Subscribe ╰━━═━⊰❖🫥❖⊱━═━━╯ 💠 In the path of analysis, awareness and transformation... 💠

بورس طارم

💎 The best in the market 📅 Update 13:40 30/7/1404 The greatest power of real buyers: #Hamon #Pirouz #Polad #Pertosa #Falezfarabi #Tkardan #Kiana #Khalij #Petrofars #Tabarak 🔸 The most inflow of real money: #WebMalt #Kermasha #Fazar #Parsan #Khodro #Vesapa #Kegel #Folad #Totoshe #Shiraz 🔹 The most inflow of salary money: #Gohar #Tala #Vpasar #Dara_Ikm #Famli #Buali #Bepas #Kardan #Midko #Aasas 🔸 The strongest shopping queues: #Kramasha #Votjarat #Shakbir #Dara_Ikm #Btrans #Zamgsa #Ranfur #Ghkuresh #Zbina #Palaish 🔹 The strongest sales queues: #Thaman #Khfula #Shafan #Haghar #Qazvin #Hafari #Thtusa #Fazar #Mamsani #Habandar 🔸 The largest traded volume in proportion to the number of shares of the company: #ابتکار #غنوش #حرهشا #برتوسا #تروت_ساز #جوانه_ککک #دارا_یکم #تخت_غاز #عرش #refining Stocks with a tick pattern: #WebMalt #Barket #Dadam #Balbar #Ghpak #Shabhern #Bepoya #Datmad #Totoshe #Desanko Stocks with a clock pattern: #Wati #Khazin #Metal #Qahkamt #Qashed #Vanfait #Ranfur #Wafari #Bakam #Chekarn 🔻 The full output of all filters is available in the section of the robot's table reading filters. 🆔 FindChartBot 📡 FindChart

فردا نیوز بورس

⭕️ Foulad Mubarake's explanations about the reasons for the drop in profit 1- 5% drop in sales volume and lack of significant growth in sales rates, which only resulted in a 6% growth in operating income compared to the same period last year. 2- The increase in the cost of financing due to the growth of interest rates as well as the purchase of Opal, which has imposed a heavy financial burden on the company. 3- The removal of Saba region (Saba steel producer of hot coils and until the end of 1403 was practically part of Mobarake steel factory) from the financial statements of #Steel and presenting reports as a separate company, which has caused a drop in some of the company's profitability indicators in the report. #Kadal

فردا نیوز بورس

"Steel" melted in the summer heat 🔹Mobarake Steel Company of Isfahan has not performed very well this year and in the report ending in September of this year, it has only realized a profit of 30.1 hemti, which is a 45% drop compared to the same period last year!! 🔺 #Folad did not perform well in the summer and realized only a profit of 13.9 hemti, which is a 49% drop compared to last year. 🔺Of course, due to the sharp drop in global rates, the lack of product competition in the commodity exchange, and the sharp growth of energy carriers, we did not expect very good reports. #Kadal

UT TRADER

#Folad Yeha (1) 6-month performance report ➖#Fuka Sod [34 MT]: drop-91% ➖# Fajr Sud [465 M.T]: down-12% ➖#Fepenta profit [10 m.t.]: down-67% ➖#Fespa profit [116 MT]: down-62% ➖ #Fuleh Profit [134 MT]: 10% growth ➖# Profit technology [377 m.t.]: 187% growth ➖# Fasazan profit [190 m.t.]: 110% growth ➖ #Fros loss [-20 m.t.]: growth-192% loss ➖ #Froj loss [-200 m.t.]: growth-179% loss ➖#Decreasing profit [153 m.t.]: 91% growth ➖#Frosil profit [2 MT]: drop-83% ➖#Folay Sood [46 MT]: 22% growth ➖ #Fanfat loss [-23%]: growth -14% loss ➖# Fafza profit [50 m.t.]: 34% growth ➖ #Famak profit [2 m.t.]: 118% growth @ut_trader

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.