trendline2024

@t_trendline2024

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

trendline2024

trendline2024

trendline2024

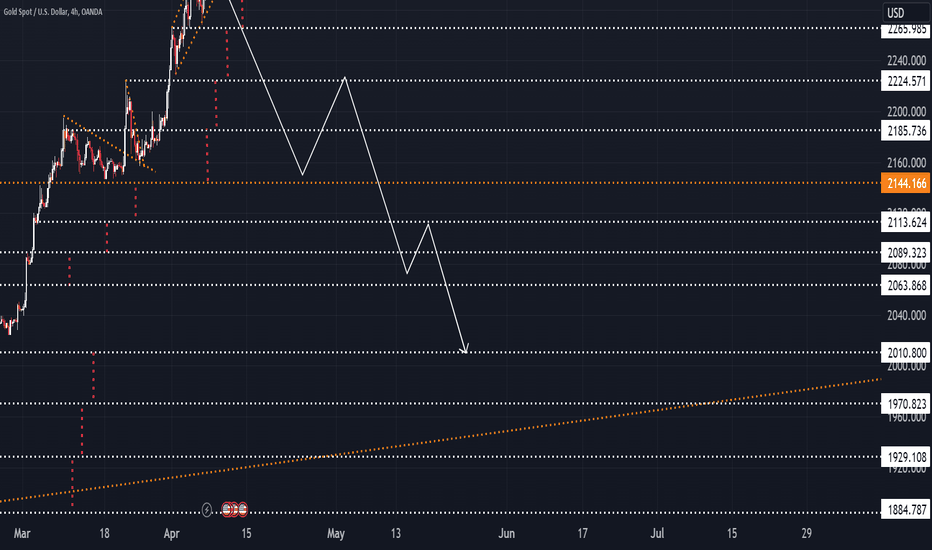

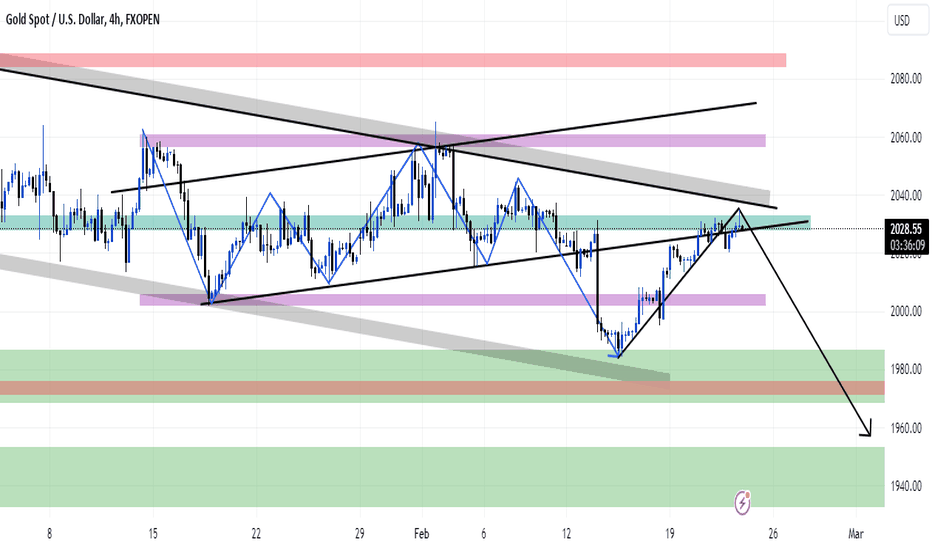

xauusd

The gold market is expected to witness a decline this week, as a result of several factors affecting the prices of the precious metal, such as the stability of global financial markets and the rise in the value of the US dollar against other currencies. In addition, global geopolitical and economic developments may play a role in moving gold prices. However, investors should closely follow market developments to make appropriate decisions based on current analyzes and forecasts.

trendline2024

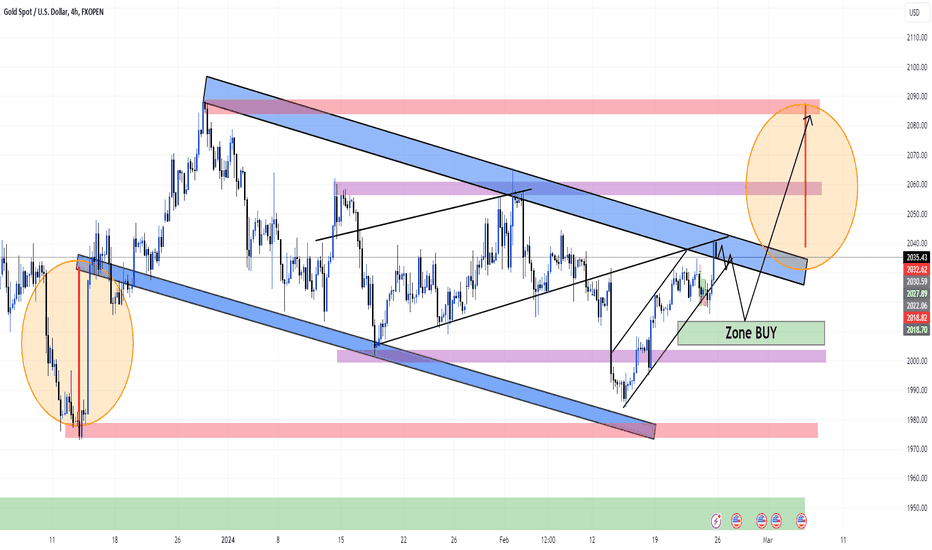

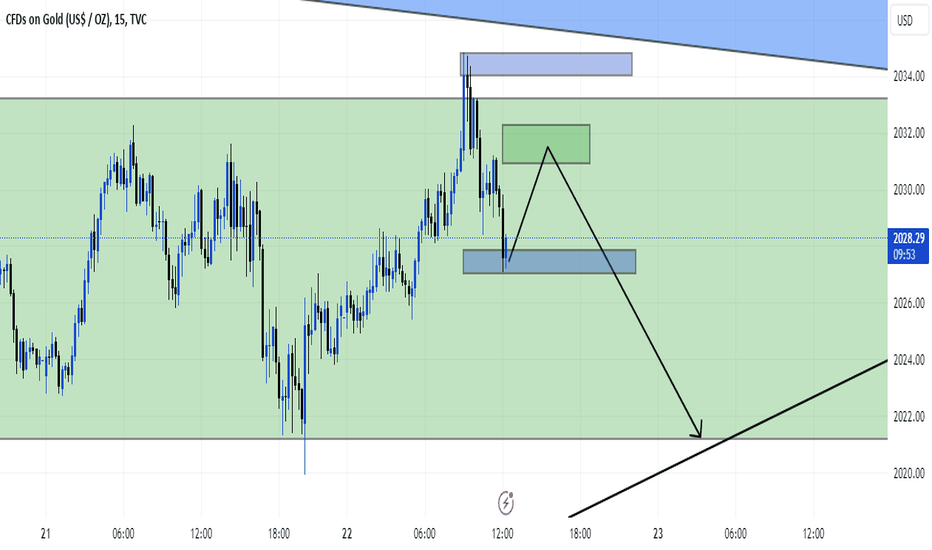

xauusd

"If the level of 1039 is broken, we may see gold at the level of 2090."

trendline2024

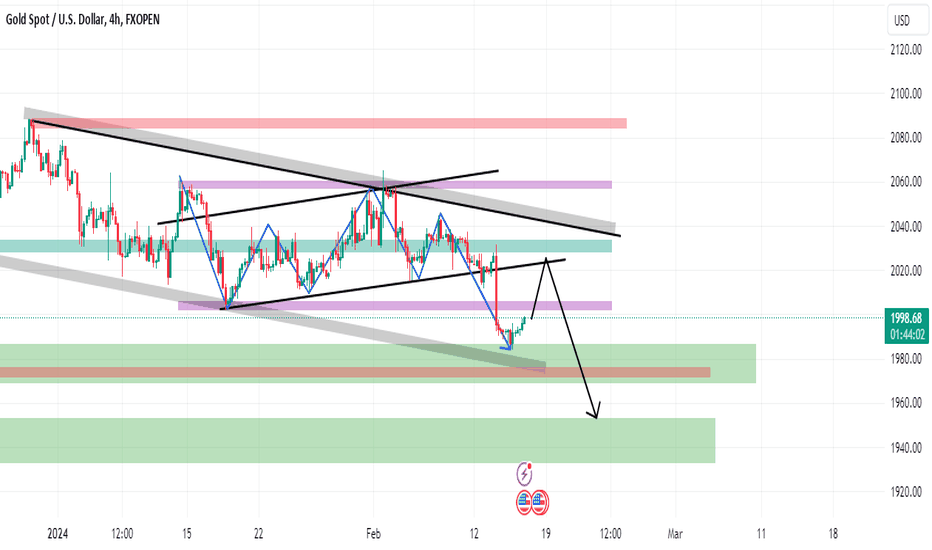

analyse xauusd

The gold market is expected to witness a decline this week, as a result of several factors affecting the prices of the precious metal, such as the stability of global financial markets and the rise in the value of the US dollar against other currencies. In addition, global geopolitical and economic developments may play a role in moving gold prices. However, investors should closely follow market developments to make appropriate decisions based on current analyzes and forecasts.

trendline2024

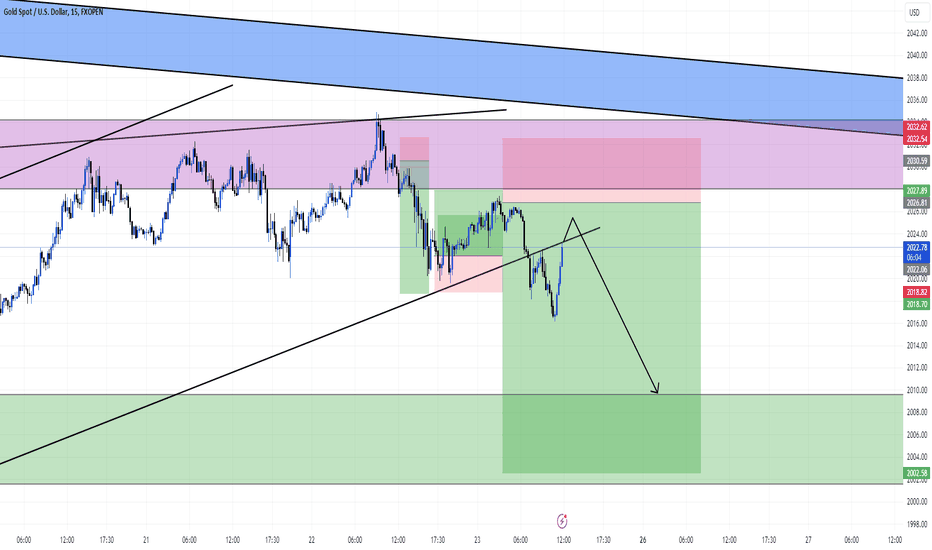

analyse xauusd

The gold market is expected to witness a decline this week, as a result of several factors affecting the prices of the precious metal, such as the stability of global financial markets and the rise in the value of the US dollar against other currencies. In addition, global geopolitical and economic developments may play a role in moving gold prices. However, investors should closely follow market developments to make appropriate decisions based on current analyzes and forecasts.

trendline2024

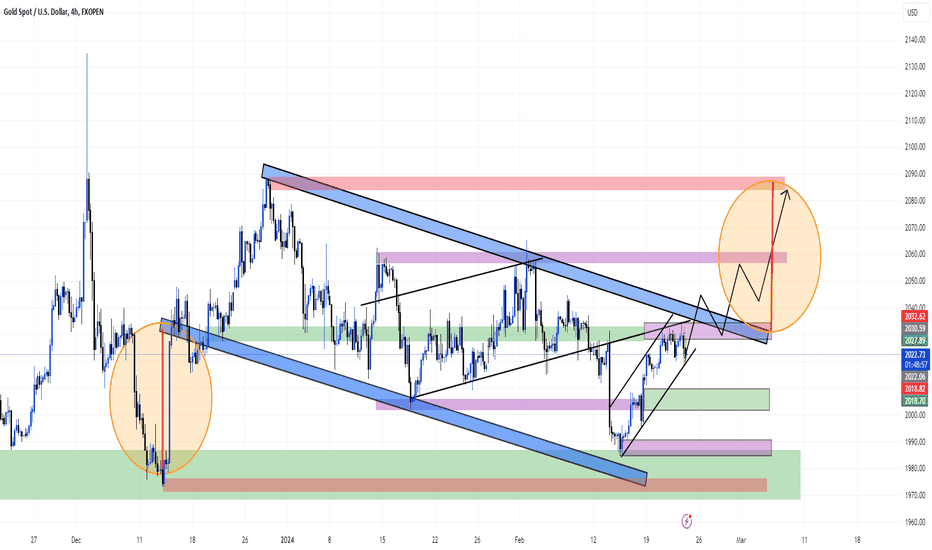

xauusd Gold

The gold market is expected to witness a decline this week, as a result of several factors affecting the prices of the precious metal, such as the stability of global financial markets and the rise in the value of the US dollar against other currencies. In addition, global geopolitical and economic developments may play a role in moving gold prices. However, investors should closely follow market developments to make appropriate decisions based on current analyzes and forecasts.

trendline2024

analyse xauusd (gold)

The gold market is expected to witness a decline this week, as a result of several factors affecting the prices of the precious metal, such as the stability of global financial markets and the rise in the value of the US dollar against other currencies. In addition, global geopolitical and economic developments may play a role in moving gold prices. However, investors should closely follow market developments to make appropriate decisions based on current analyzes and forecasts.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.