tkolaytk

@t_tkolaytk

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

tkolaytk

Ons altında çok kısada 4138 hedefine kadar satış gelebilir mi ??

Hello friends, In my last analysis of ounce gold, I mentioned that there is a new peak unless 4265 is exceeded, and that the decline expectation is technically unlikely to come true unless it closes below 4192. With the pricing since the beginning of the week, a multiple 4h closing has occurred below 4192. In FX, the very short trend has been broken and with Pullback approval, 4138 has become a technical expectation. In the short term, a decline is not expected unless the trend starts from 3886 and closes multiple days or weeks below 4138. Personally, I opened a SELL transaction with 4206 and am waiting for 4138. My trade will remain active in FX unless I get a single day closing above 4225. Technical analysis is an expectation, it is never guaranteed to come true. Sharing is for informational purposes only without investment advice. Hello friends, my 4206 sell position, which I entered into the transaction on December 9, closed at 4228 in a single day after the FED decision on the same day, and the transaction suffered a loss with a reverse movement of 22 USD. As I mentioned in the analysis, we did not expect a decline unless we closed below 4138. With a close above 4225, our new peak expectation has technically become an expectation at the close of December 9th.

tkolaytk

اونس طلا: آیا مقاومت 4137 شکسته میشود یا سقوط در راه است؟

Hello friends, I stated that after the peak of 4385 in ounce gold, pricing was at extreme levels above 4250 and that we now expect a correction with sales at these levels. Afterwards, pricing decreased to 3886 and remained at the 3900 level support, which is 0.382 support. I suggested that the correction was completed with the support and that those who bought the correction target at 3900 were in TUT position when the price was at 4000 levels and should follow it with a cost stop. I mentioned that the sellers under 4071 are strong and they can hit him in the head as they get closer. Expectations came true until yesterday. I wish good luck to those who evaluate. At a single-day closing above 4071, pricing quickly reached 4149. In the analysis, I said that a new peak target would not be given unless a multiple close was taken above 4137. They haven't even allowed a 4H close on the 4137 resistance yet. Selling at resistance can follow the cost with a stop. The area at 3900 can take profit at a single day closing under 4071. Those who bought above 4071 should have sold at 4139. If it hasn't sold, it can continue with a cost stop. The expectation of a possible reverse flag formation in ounce gold, which was traded at 4114 as of November 11, was dashed as the support was not broken. Unless we get a single-day close below 4071, uncertainty may technically prevail under the ounce. A sell signal may appear at a close below 4071, and a Technical BUY signal may appear at a multiple close above 4137. Breaks are gambling. Technically, we are at the same levels with ounce gold, which made a pullback at 4137 on October 23, following the rising bottom trend that was broken at 4111 on October 22, and then entered the correction target. It may be safer to act according to technical closings in case of a possible similar pricing. Personally, I ended all my buy positions at 4125 and started selling with the expectation of a correction. As of today, I started selling with 4140. I will close with a loss on 2 days closing above 4137. I make an addition at a one-day closing below 4071 and take trades with the target of 4048. There is no new bottom target for ounce gold unless 4048 is broken. Technical analysis is an expectation, it is never guaranteed to come true. Sharing is for informational purposes only and never as investment advice.

tkolaytk

فشار فروش در اونس ادامه دارد؟ تحلیل تکنیکال و سطوح کلیدی قیمت!

Hello friends, after the double peak in ounce gold, we were taking transactions according to the situation at the top and support points. Lastly, we followed the 3980 support. The Inverted Flag Formation, which was formed after last week's price increases in ounce gold, was formed. I said that if there is a close below 3980 and below 3905, the formation may have a very strong expectation and if there is no close, there is no expectation. I said that for those who made a pinpoint correction at 3905 and bought with 3905, they can take a profit at a single day closing under 3980 ounces or wait at cost. If 3905 goes, 3685 may be a strong expectation. For ounce gold, a new peak is not expected unless the ichimoku cloud breaks in 4h and returns to the old rising trend. As long as the level above 4137 is not exceeded today, hitting the head may continue as it rises. Unless there is a single-day closing above 4071, sellers under one ounce may be strong. Technical analysis is an expectation, it is never guaranteed to come true. Sharing is for informational purposes only and never as investment advice.

tkolaytk

اوج قیمت اونس طلا: آیا سقوط ادامه خواهد یافت؟ تحلیل تکنیکال دقیق

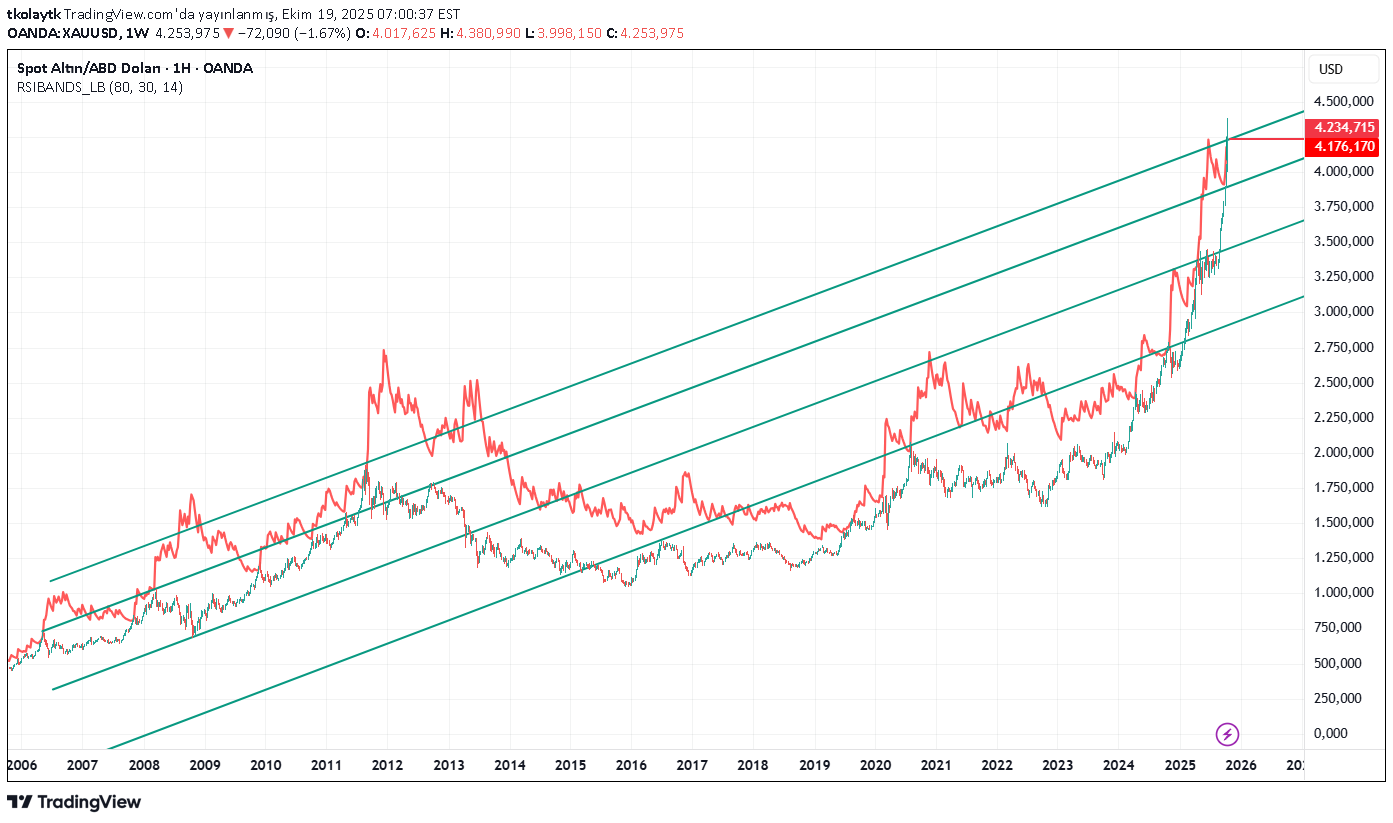

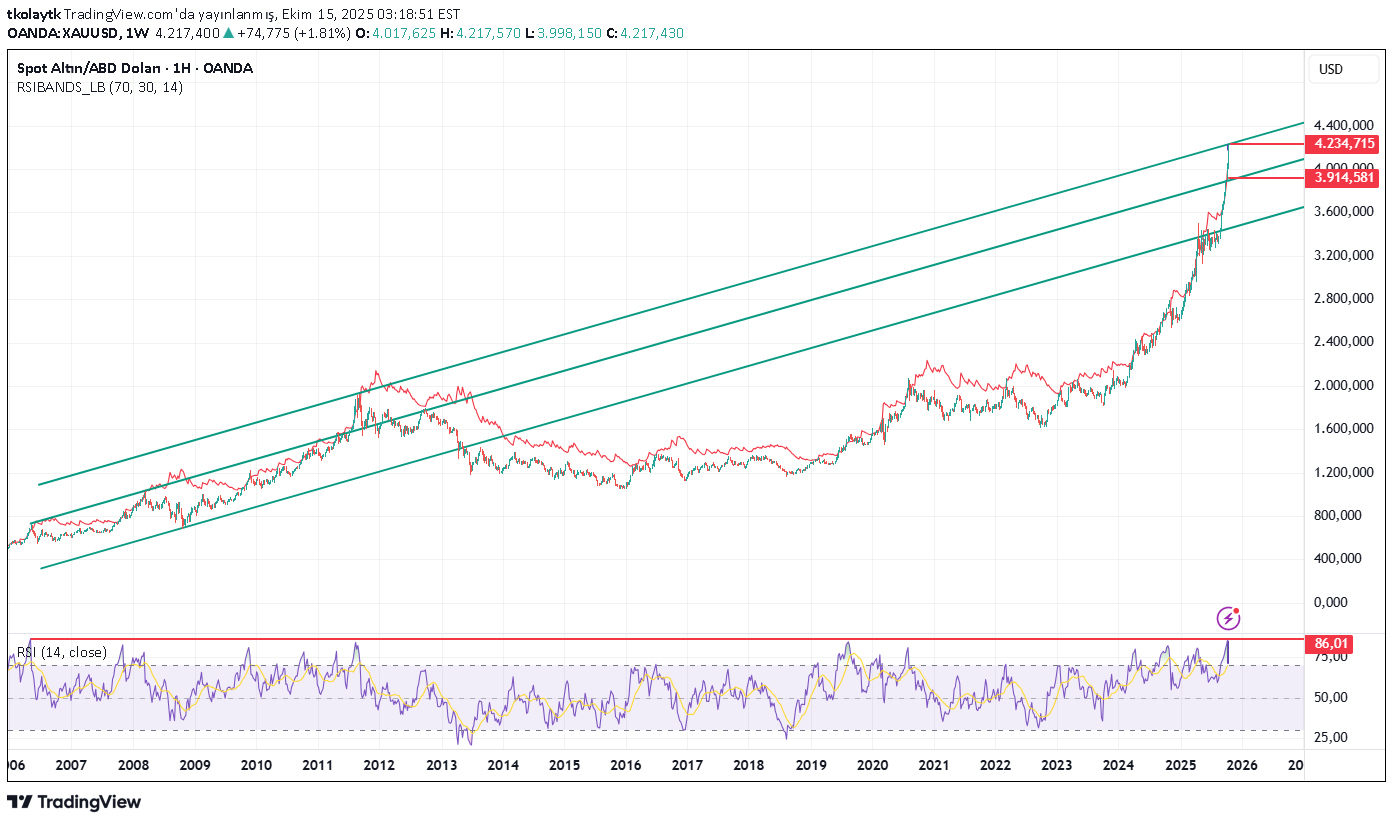

Hello friends, In the analysis I made last week, I said that if the ounce of gold is to return, it should return from the 4250 levels. For this reason, I mentioned that the RSI band is at record levels and these levels have not been exceeded before, and at the same time, a return may be seen because we may be at the peak of the price band reflection. It tested the peak with 3 percent on October 16, and fell equally sharply the next day. Afterwards, it made a double peak and again fell sharply to the bottom level of 4005. Again, in the last analysis, I said that entering into sales without a single day closing below 4204 could be risky in FX. Unless the week is closed below 4094, ounce gold is strong. I said that the signals could be strong for sales at the close of the week under 4094. On October 21, a closing level below 4204 was taken, and the target of 4094 specified in the analysis and the sale up to 4004 at the bottom, achieved a movement of approximately 163 USD technically. I wish good luck to those who evaluate. Even though the closing week was 4004, it found support at 4114 above 4094. Sales of ounce gold, which will start the last week of the month on October 27 at 4114, may be risky unless a multiple 2nd day close is taken below 4094. It is also recommended in FX that sales be close to resistance at the top. The first expectation correction target in multiple closing below 4094 in ounces may be 3976. If this expectation comes true and the support is gone, it may reach 3905. If there is a single-day closing below 3905, they can show 3695 with a possible reverse pennant flag. Under each support, another support may be a technical expectation at the close of a single day. If there is no closure, there is never expectation. The first resistance above the ounce is 4150. Unless the day closes above it, the danger of correction to 3976 may not end. Unless a multiple close is taken above 4241, the buy signal below ounces may not be triggered from a technical perspective. Technical analysis is an expectation, it is never guaranteed to come true. Sharing is for informational purposes only and never as investment advice.

tkolaytk

اونس طلا متوقف نمیشود! اگر از اینجا نه، از کجا برمیگردد؟ (تحلیل جدید)

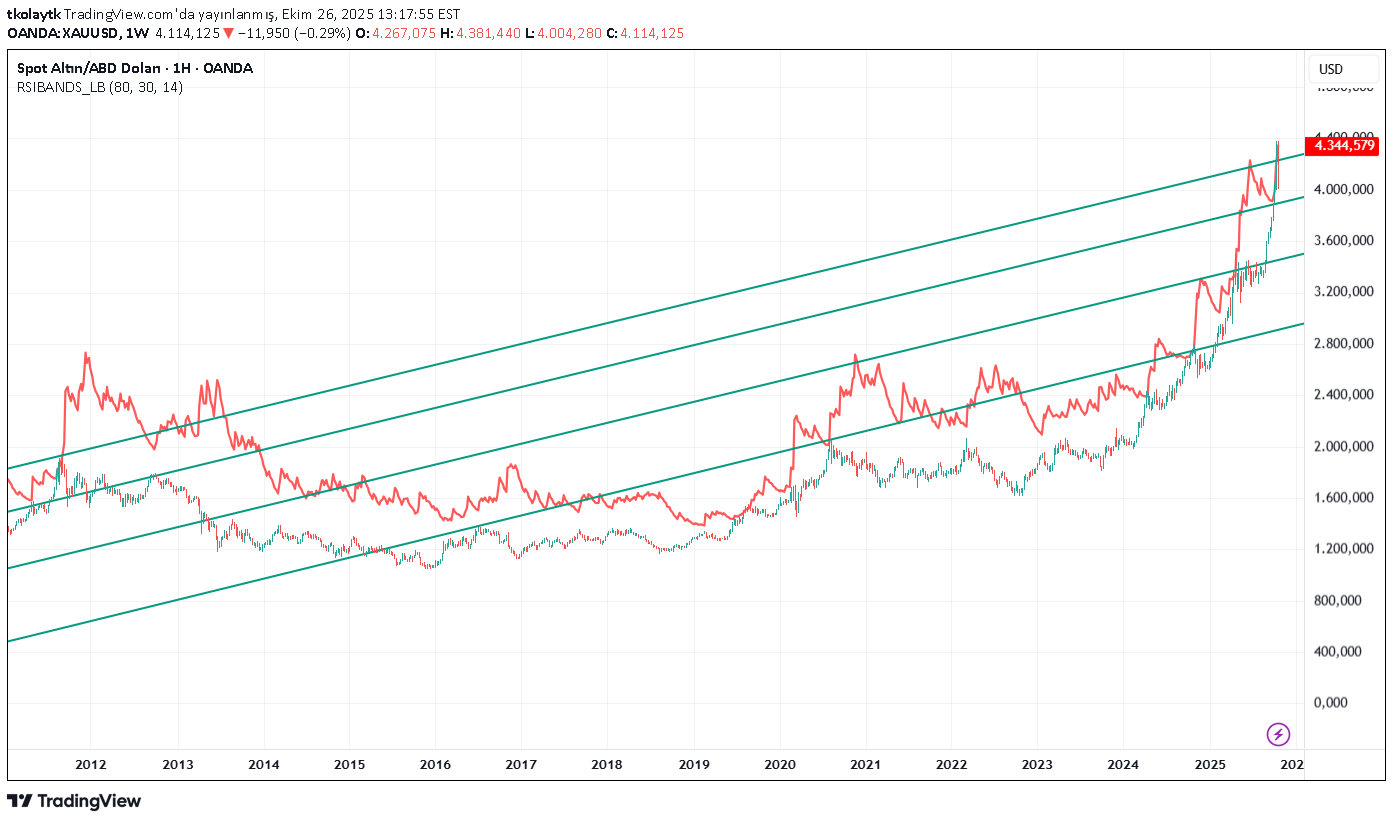

Hello friends, In the last analysis I made on Thursday last week, I mentioned that there were 3 critical resistance zones under Ounce. In the first two of these, we went from resistance to selling with the expectation that XAUUSD would return from here. In these transactions where we acted before the technique, we were reversed and made a loss. Finally, we had given the expectation that Thursday might be the last day of rise in ounce gold and that there might be a sale in ounce gold in the range of 4234-4250. Technically, we stated that it is in Tut position and there is no sell signal. On Thursday, it broke the 4250 resistance sharply with an increase of nearly 3% and rose to 4379 levels. After this top level was tested in the Asian market on Friday, the US market made a serious sale at the close of the week and 4186 was tested at the bottom in a very short time, causing a 3% decline. Ounce gold, which later tried to recover, closed the week at 4250, which is the exact resistance level. It is difficult for me to give direction without seeing the technical formation from here on out, which has fulfilled the expectations. Entering a sale without a single day closing below 4204 can be risky in FX. Unless the day closes above 4306, re-purchasing may carry the same risk. They can correct up to 4094 main support at the 2nd day close under 4204. Unless the week is closed below 4094, ounce gold is strong. Signals may be strong for selling at the close of the week below 4094. Caution should be exercised in FX gold, which moves far away from the moving averages. Technical analysis is an expectation, it is never guaranteed to come true. Sharing is for informational purposes only and never as investment advice.

tkolaytk

طلای اونس: آیا این صعود افسارگسیخته متوقف میشود؟ تحلیل تکنیکال و سطوح کلیدی!

Hello friends, In the analysis I made yesterday, I mentioned that ounce gold was at very overbought levels on a monthly and weekly basis. I have shared from a technical perspective that this rise, which is technically very different from the old customary pricing movements and which we have difficulty in understanding, could end at 4250 levels. I had attempted a sell transaction in the 4235-4250 range, expecting that there was no sell signal under the ounce, but I was wondering if it would turn from resistance here. I closed my purchase transactions with 4215 for all maturities. Unfortunately, the third attempt we made due to resistance resulted in damage. Following the technique usually pays off. The result is obvious. Technically, RSI is trying levels that have not been tried in the recent past and pricing is above 4250, which is the possible trend clone target. The TUT situation continues for those holding less than one ounce, which is far away from the moving average. If the week close remains above 4250, it is hoped that the rise in ounce gold will continue. Technical analysis is an expectation, it is never guaranteed to come true. Sharing is for informational purposes only and never as investment advice.

tkolaytk

آیا پایان صعود افسانهای اونس طلا فرا رسیده است؟ (تحلیل تکنیکال و سطوح حیاتی)

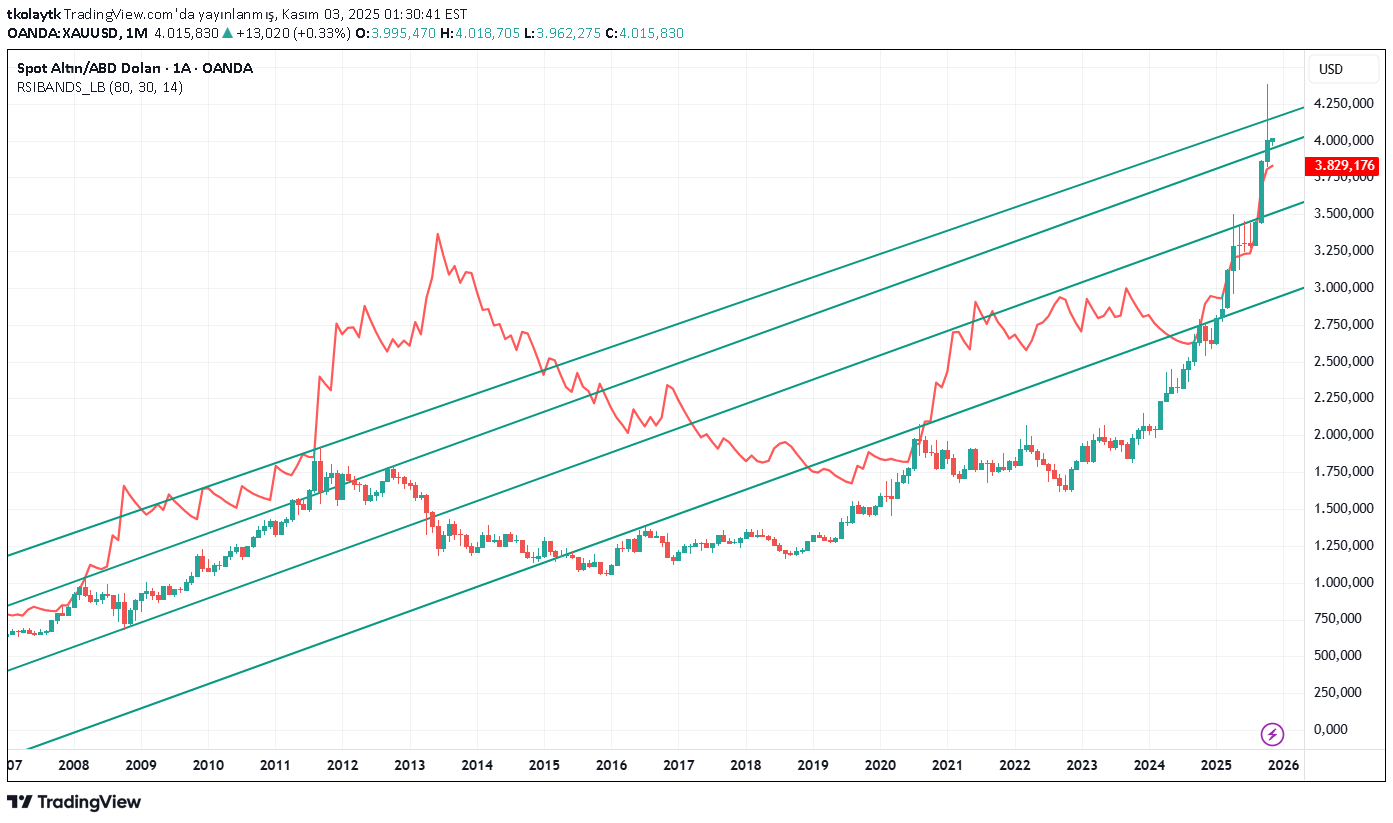

Hello friends, with the rapid increase in ounce gold in the last two months, the increase in the last year has exceeded 100%. In my technical analysis, we set new peak targets after the 3450 resistance was overcome. I said that at these peak targets of 3750 and 3880, sales are not technically possible, but it can be tried for those with solid margins who want to enter into risky transactions to see if they will return. In both transactions I personally entered, we recorded losses at the end of the day. I stated that the target per ounce was 4100 as of the beginning of October. As of October 15, ounce gold is priced at $4210, above the target. The rapid and uncorrected rise in fundamental and technical terms has created uneasiness about entering the transaction. Technically, a critical threshold has once again been reached in ounce gold, which provided serious gains during a period that many analysts had difficulty making sense of. As of October 15, technically, ounce gold is priced close to the 4235 resistance. This level is even above the highest levels in the benchmark values in the long term. RSI band is preparing for a 3-week stay at 3914 after a long time. Again, technically it is very close to contacting the trend resistances passing through 700, 1050 and 1975 historical peaks. Trend and RSI band harmony is clearly visible in the chart. In other words, roughly 4250 levels may now be the last historical peak prices under ounces. Technically, this perspective is expectation. There is never a guarantee that it will happen. Because it is difficult to analyze this rise as it is something we are not used to before. If it will return, we say from here, if it goes over, we set another peak with a new target price above. Personally, I am waiting to enter the reverse trade at 4235-4250 levels. All my buy transactions ended with 4215. I can start buying again after 2 days of closing above 4250. Unless there is a close, I am waiting for an opportunity for a reverse transaction. Unless there are multiple closes below 3914 per ounce, gold may remain strong. In a very short time, we will be observing the technical candle movements for the first signal. Incompatibility started to be seen in FX. Technical analysis is an expectation, it is never guaranteed to come true. Sharing is for informational purposes only and never as investment advice.

tkolaytk

تحلیل تکنیکال اونس طلا: آیا اصلاح قیمتی در راه است؟ (بررسی کندلهای جدید)

Hi friends, under the ounce of 20 August 3300 starting as the rise, first 3895 today with 3897 summit. With the exceeding of the 3435 resistance, we may have reached the level of procurement under ounce of which our technical expectation is over 3578 over 3744. Even though technically sold technically, we said that a possible red candle burned and correct after the reversal of 3675, which may have a level of correction for risk, but our expectation did not occur. Technically, the latest closing candles in ounce of gold as of October 2 took the appearance of pin Bar (candle in which the price is strong resistance) and doji (equal candle of buyers and sellers). If the red burns when the October 3 candle burns and the day or week is closed, we can say that a correct correction may start under ounce. Ones Gold is strong over 3750. Unless the closing under this level is taken, the expectations that will fall and crash can be technically difficult. At the 2nd day closing below 3750, a correction decrease to 3674, that is, the resistance zone it breaks, may occur. If there is no closing, there is no expectation. Unless the closing of 3895 weeks is taken, purchasing from these levels can now be technically risky. It is seen that we are in the excessive purchase zone in the indicator values. Multiple of a possible 3903 under ounce may be able to expect a powerful technical expectation with 4100 levels at the 2nd day closing. If there is no closing, there is no expectation. Under the ounce of October 3 candles can say clearly about us in terms of direction. Teknik Teknik says wait for the transaction. Personally, the resistances experienced at 3895 levels under ounce is that the top price is seen under ounce of ounce, which increased by 20 %. The band resistance may have worked. I personally entered the rather risk sales transaction from 3856 on the condition of being stopped at a single day closing over 3883. Technically under 3834 multi -hour closes without taking the process of FX is not technically recommended. Technical analysis is expectation, there is never a guarantee of realization. Sharing is for information purposes without investment advice.

tkolaytk

Ons altında Tamam mı? Devam mı ?

Hi friends, after the rapid rise in the short term under ounce; I mentioned that it can be opened up to 3744 over 3578. At the top of the ounce of 3675 at the top of the rise in the decreased speed of the horizontal pricing began to be seen. The support levels that occur below ounces after yesterday's 3675 peak price are below. Being careful under ounce at the excessive level of purchase can chase closing and process accordingly. At the closing of yesterday, the daily candle was reverse hammer. This candle can often be a signal of what direction the trend can be. After this candle, red candles may now indicate that sales can come, and the green candle on the needle may indicate the continuation of the trend. As of September 10, 17:00, our candle is in green but under the needle. At the end of the day you need to look at the candle again. Technically, it may be necessary to process the needle from the needle for sale in FX or wait for a single day closing below 3626. For the purchase, today's candle should be green and it may make sense to enter the process after the needle is overcome. With the closing under 3589, withdrawals under ounce may be accepted as correction. As it remains below 3662, correction expectations may increase. Purchases can be risky unless they are overcome. Personally, unless you get a single 4H closing over 3675, I think it would be reasonable to correct these levels this time. Technical says wait in two directions, but risk areas move before the technique and take profit and harm. As of 3654 and 17:20, I have taken Sell transactions. The 3744 level I mentioned in the previous analysis may be strong expectation at a single day closing over 3675. Technical analysis is expectation, there is never a guarantee of realization. Sharing is for information purposes without investment advice.

tkolaytk

Ons altında rüzgar sert esti!Peki yükseliş devam edebilecek mi?

Hi friends, from the end of July at the end of July, we have been caught by the opportunities in FX. As we approached the resistance of 3402, which he had repeatedly tried many times under ounce, we were hitting his head after the rising trend was broken and the appearance of the rising trend. 27 In my analysis in August; I said that over 3361 ounce of gold is optimistic, the mid -band resistance over 3390, which is over 3390, can be the target of the band hill at the closing of 2 days. Sell transactions under ounce without closing below 3382 are extremely risky, but I have said that the risk lovers can take and have been processed in person because they had previously eaten sales from these levels before. However, the ounce of gold weeks on 3390 and burned a strong Al signal and has not been able to stay over 3400 before a single day, this time, multiple days and one week closing and personally damaged damage. As of September 1, the Asian market, which had a limited withdrawal in the night session, increased over 1 %within 1 hour and reached up to 3489. Technically, the expectation was realized up to the point of firing band. Technically, ounce of gold, which has a strong Al and a strong Al and is close to the Channel Hill and is close to the April 2025 summit. If you say whether to buy goods from here or if you say it would be technically correct, friends will take over 3500 multiple closings without seeing it without seeing it, it may be more risk -free purchase from support levels, and from these levels, it can be an extremely risky but more sensitive process. Technically, profit sales can come with RSI in over -purchase. It can come from the peak band resistance. I said it might come from extremely swollen indicators, and personally, I entered the cell with 3479. In eleven operations, we entered the technique in contradiction and damaged it. This time the situation is the same. If you say that 3500 cannot be overcome, the technique looks here at 2 directions. The margin is solid, the weak traces. Let's be careful under ounce that makes pulsing on the rising trend resistance for the second time. If he's up to hard. Below is 3450 support. 3402 expectations may occur at the closing of a single day. The target price is shared with purchase analysis at multiple closing over 3500. If there is no closing, there is no expectation. Technical analysis is expectation, there is never a guarantee of realization. Sharing is for information purposes without investment advice.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.