t1nyeyes

@t_t1nyeyes

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

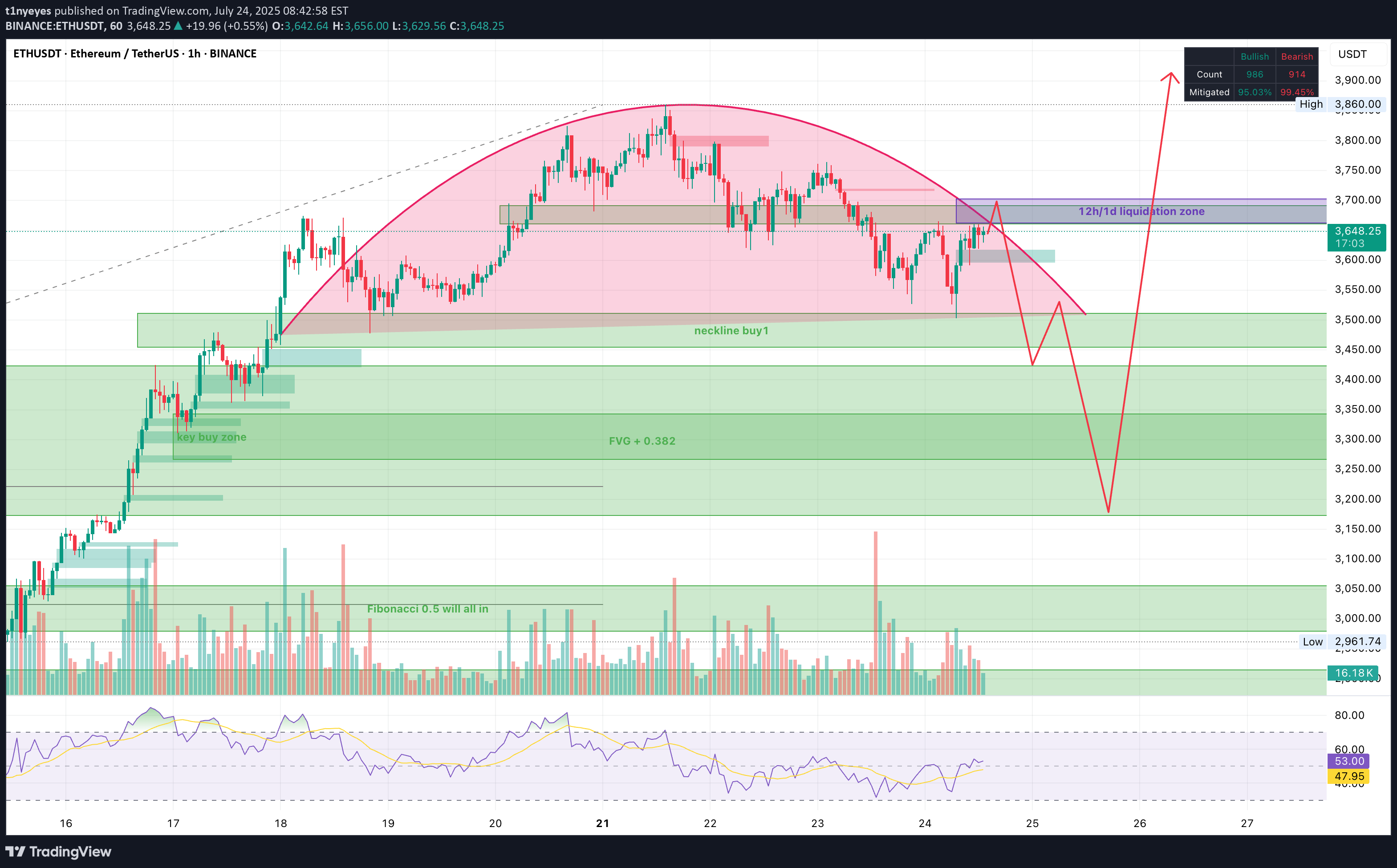

While I remain long-term bullish on ETH, I’m currently eyeing a potential short-term sweep of liquidity before continuation. Price has formed a rounded top structure and is approaching a key 12h/1d liquidation zone near 3680–3700. I expect a potential fakeout to the upside, triggering stop-losses and short liquidations, before a reversal targeting the 3500–3400 area completing the rounded top structure, which also comfortably re-tests a bunch of unmitigated bullish FVGs, and also the 0.382 level since the major rally. This is how I imagine the next leg up. 🔁 Trade Plan: small position size with 10x leverage on futures only. This is a counter-trend play against my main spot ETH position, which remains strongly bullish. 🚨 Not financial advice. Just sharing the setup I’m watching. Let’s see how it plays out.

ADAUSDT Typically this should be the first test after the broke out of bull market support band, I would expect it to be 5-10% around (at 4 h level) 20 EMA/SMA or Bollinger band MID. I will buy when 1 h RSI keeps nicely above 50 with a golden cross of stochastic RSI.

AAVEUSDT BTCUSDT.P Would like to see it gets supported in a 4 h level but the 1 h Bollinger band may support it, I have opened an initial position (buy 1) and would like to add a hedge until it reaches my buy 2.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.