syedshanifahmed

@t_syedshanifahmed

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

syedshanifahmed

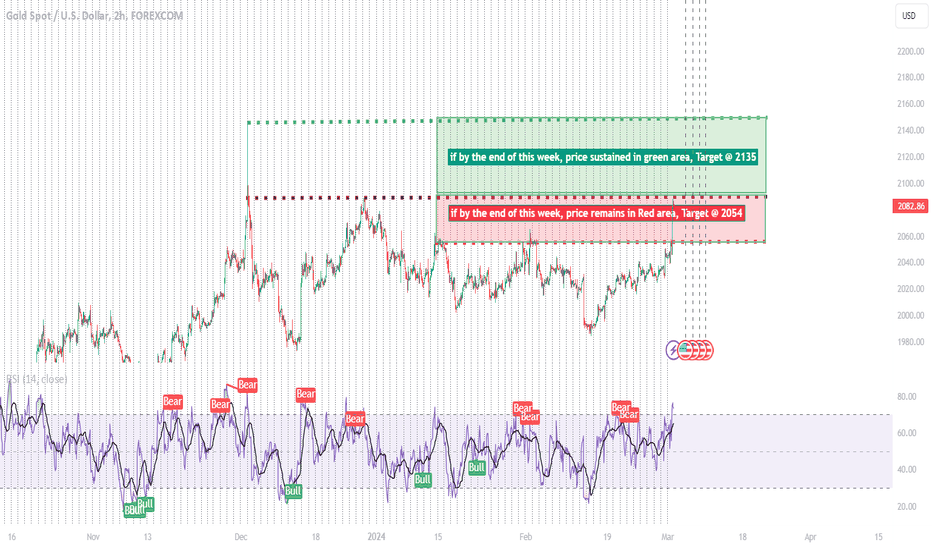

Our system is currently generating mixed signals in the short term, creating a situation where we are inclined to maintain a long-term position. However, the decision on our stance for the upcoming weekend remains pending, and we are deliberating whether to align with bullish or bearish market sentiments.

syedshanifahmed

The current sentiment for gold trading,shows a predominance of short positions over long positions, with 75% of traders holding short positions and 25% holding long positions in XAUUSD. This suggests a bearish sentiment among Forex traders regarding the future price of gold. Indicate uncertainty or a balanced view among traders regarding gold's price direction in the near term. Moreover, highlighting that bullish sentiment during a bull market is natural, while bearish sentiment during a bull market represents a contrarian opportunity to buy. Current sentiment in gold is bearish, which, during a long-term bull market, could be seen as a contrarian signal to be long on gold.Unemployment claims, while there are positive signs such as a decrease in initial claims and continued weeks claimed, the stability of the unemployment rate and an increase in the number of individuals claiming benefits in state programs could be areas of concern, gauge the Buyers to get more benefits in comming week... Welcome Bulls, Good Bye to Bears...

syedshanifahmed

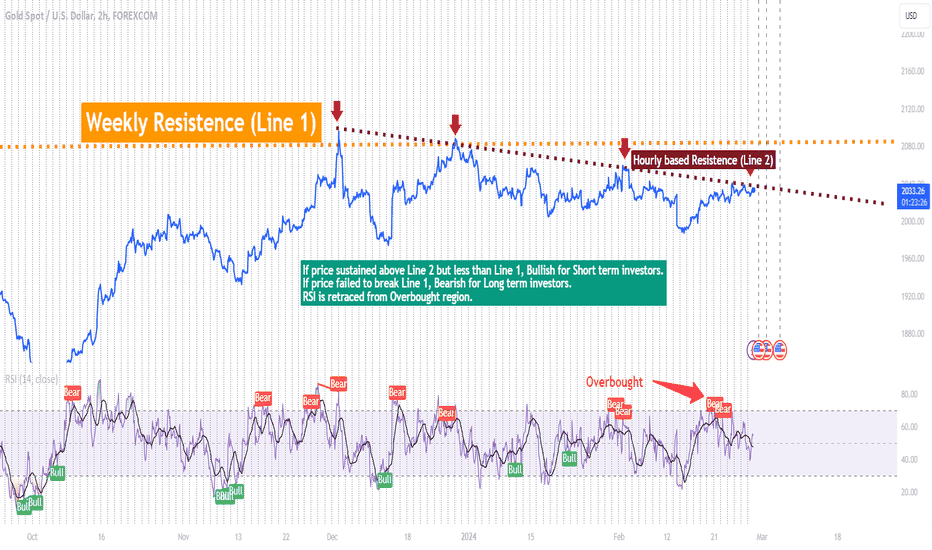

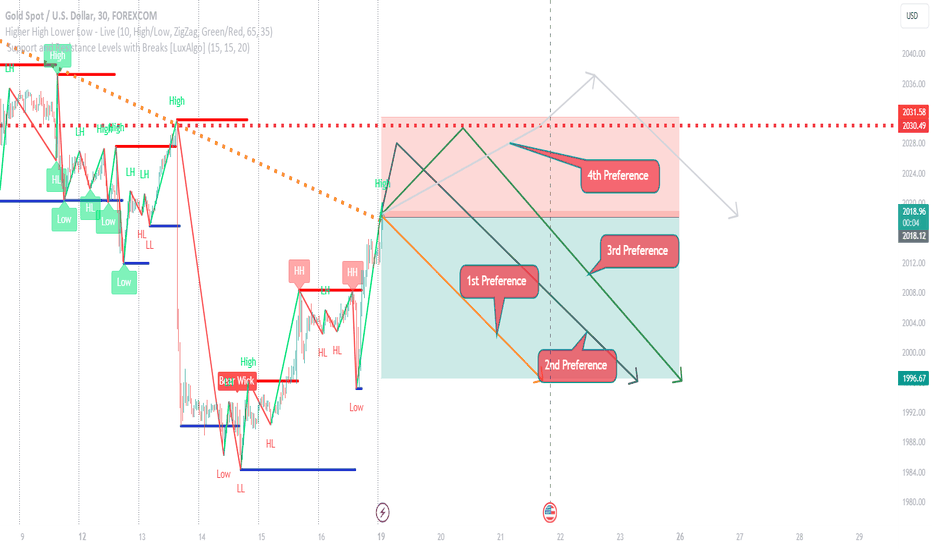

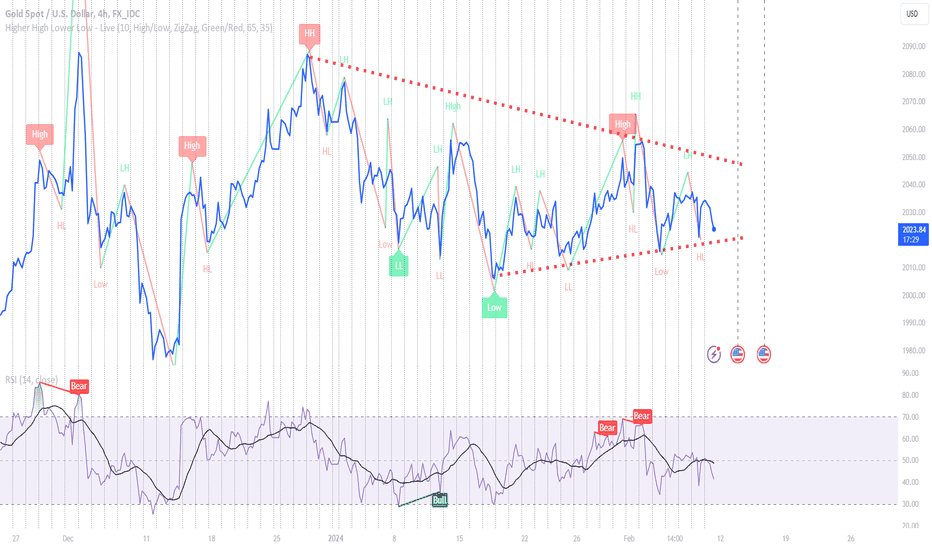

Gold continues to exhibit a bearish trend in the short and mid-term timeframes while maintaining a neutral stance in the long term. The Dow Theory is continuing its trajectory. Relative Strength Index (RSI) readings indicate overbought conditions in the short and mid periods. Bearish sentiment prevails in the market. Bearish Engulfing encountered on 1H & 4H. Dollar on other end shows more Hawkish tune last week than expected. Our recommendation entails identifying four trading opportunities suitable for scalpers and day traders, emphasizing a bearish outlook.Preference 3 & 4 exhibits more strength...Comming Economic events, US Unemployment Claims,Manufacturing & Service sector reports followed by FOMC minutes... expected more hawkish tune from Dollar...The FOMC minutes discussions and decisions regarding monetary policy, financial markets, and the economic outlook. Here’s a concise moral: Adaptability and Caution in Monetary Policy Amidst Economic Uncertainty: The Federal Reserve's discussions and actions as captured in the minutes emphasize a strategic approach to managing monetary policy in a period marked by economic growth, easing inflation, but still elevated above the target. The Fed's decisions reflect a balance between fostering economic resilience and remaining vigilant against inflationary pressures. The commitment to keeping the federal funds rate steady, alongside a readiness to adjust policy as new data comes in, underscores a prudent stance in navigating economic uncertainties. This cautious yet flexible approach aims to ensure a sustainable path toward achieving its dual mandate of maximum employment and price stability, while also being prepared to address risks that could impede these goals. This takeaway encapsulates the essence of the discussions and the Fed's policy stance, highlighting the importance of adaptability and careful monitoring in the face of economic uncertainties and evolving conditions.The current sentiment for gold trading, as indicated by Forex sentiment data on Myfxbook, shows a predominance of short positions over long positions, with 67% of traders holding short positions and 33% holding long positions in XAUUSD. This suggests a bearish sentiment among Forex traders regarding the future price of gold. On the other hand, IG Client Sentiment data suggests a mixed sentiment among traders, without specific percentages provided in the data I accessed. This mixed sentiment could indicate uncertainty or a balanced view among traders regarding gold's price direction in the near term. Moreover, an analysis from Gold Eagle discusses the importance of contrarian views in trading, highlighting that bullish sentiment during a bull market is natural, while bearish sentiment during a bull market represents a contrarian opportunity to buy. The article also notes that the Commitments of Traders (COT) data is a reliable sentiment source, offering insights into the positions of commercial and speculative traders. The analysis suggests that the current sentiment in gold is bearish, which, during a long-term bull market, could be seen as a contrarian signal to be long on gold. These mixed views underscore the complexity of market sentiment analysis and the importance of considering multiple data sources and perspectives when evaluating trading opportunities in the gold market.

syedshanifahmed

we put sell stop @2010 after reach towards LastKiss @ 2020...@2010@1998

syedshanifahmed

Instrument : XAUUSD Time Frame :4Hours Trend :Bearish Go for short... Caution: Comming events US Core retail sales... Opinion: Fundamentals would gauge the Bearish trend...TP @1995

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.